-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Fragmentation Risks Have Dialed Down On Multiple Fronts #1

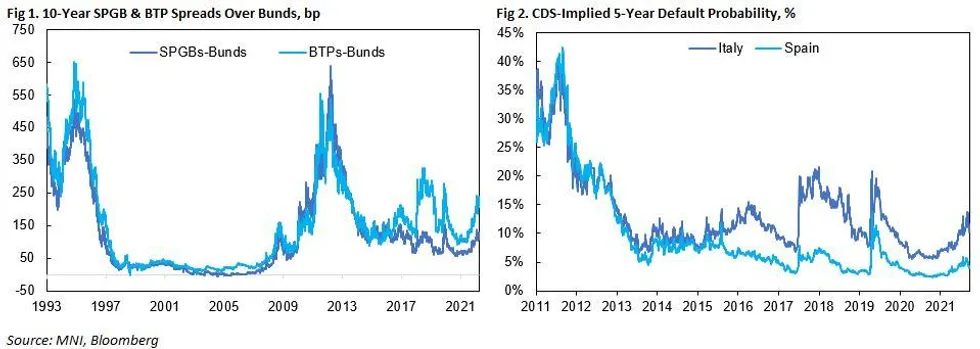

As long as the Eurozone lacks the fully fledged architecture of a single currency area - notably full banking union (including mutualised deposit insurance) and a centralised fiscal authority (with permanent risk-sharing and cross-border fiscal transfers) - fragmentation risks will never be fully eradicated. However, the ECB's ever expanding toolkit and frequent policy innovations have mitigated short-term pressures. In the following charts we present evidence of a containment of fragmentation risks on multiple fronts since the sovereign debt crisis.

- Most references to fragmentation refer explicitly to the bond market which has provided the most visible signs of stress between the core and periphery. On this front, the current situation is a world away from the sovereign debt crisis and notably less stressed than when the Italian government squared off against Brussels in 2018 over the proposed expansionary fiscal budget.

- While uncertainty over how and when the ECB will activate the Transmission Protection Instrument may partly explain why periphery-core spreads remain elevated, the mere existence of the tool has arguably prevented spreads widening further. As we suggested in our review of the July ECB meeting "the ECB now has a tool unlimited in size, that it can use with complete discretion, with activation criteria that are deliberately vague, and everybody around the table supports it".

- Following in the footsteps of the TLTROs, OMT, APP and PEPP, the TPI marks the latest evolution of the ECB's toolkit which has anchored spreads since the sovereign debt crisis.

- The relative improvement in risk premia over the past decade is also reflected in CDS prices and implied default probabilities. In Fig 2, we provide estimates of the 5-year implied default probability under the assumption of a 40% recovery rate and near-zero risk-free rate. As the chart shows, implied default probabilities are a fraction of what they were at the height of the debt crisis.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.