April 26, 2024 12:08 GMT

Fund Flows

CREDIT MACRO

- Total flows were relatively mute for week ending Wednesday (echoing ETFs); small outflows from US Govvies offset by mortgage & muni inflows. $IG & €HY only sectors to face outflows in credit with inflows into €IG, £IG & $HY were mild.

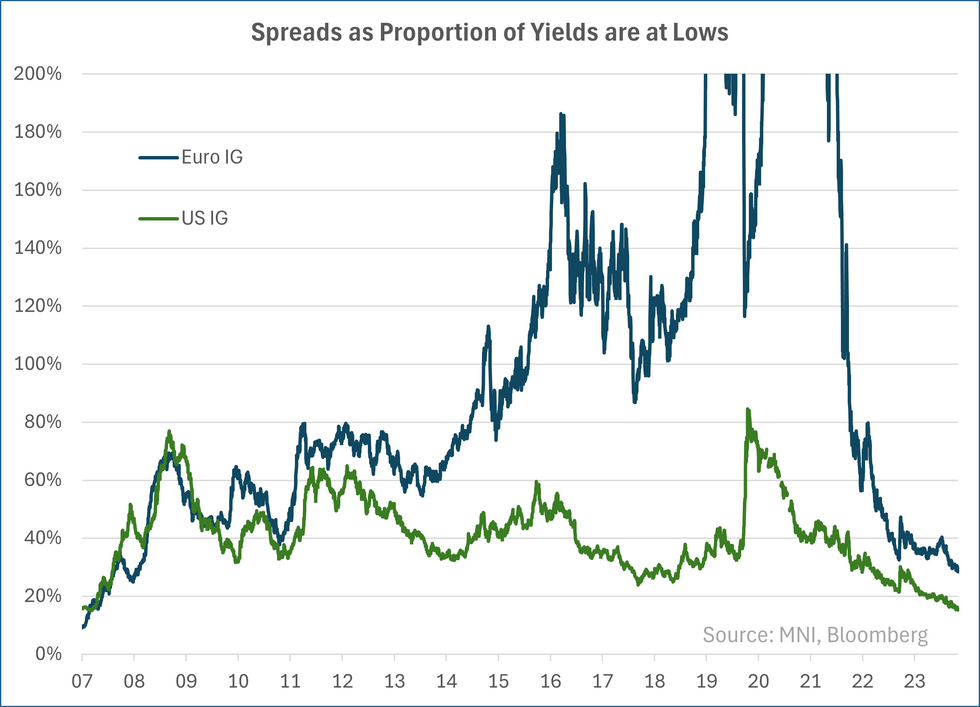

- Yesterday's firm US data pushed rates up +6bps with strong pass through to bunds. As mentioned in last 2 weekly's we've seen yields fail to support credit inflows & its not hard to see why - spreads as % of yields have sunk particularly in $IG (below).

- Its had little impact in secondary for now on a seasonally slow supply month. Books in primary have been well covered and we've seen NIC's come in from earlier this month.

- Earnings not flashing concern either (yet), €IG & $IG equity baskets up ~+1% this week - echoed in spreads that are ~3bps tighter across both regions.

155 words