-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

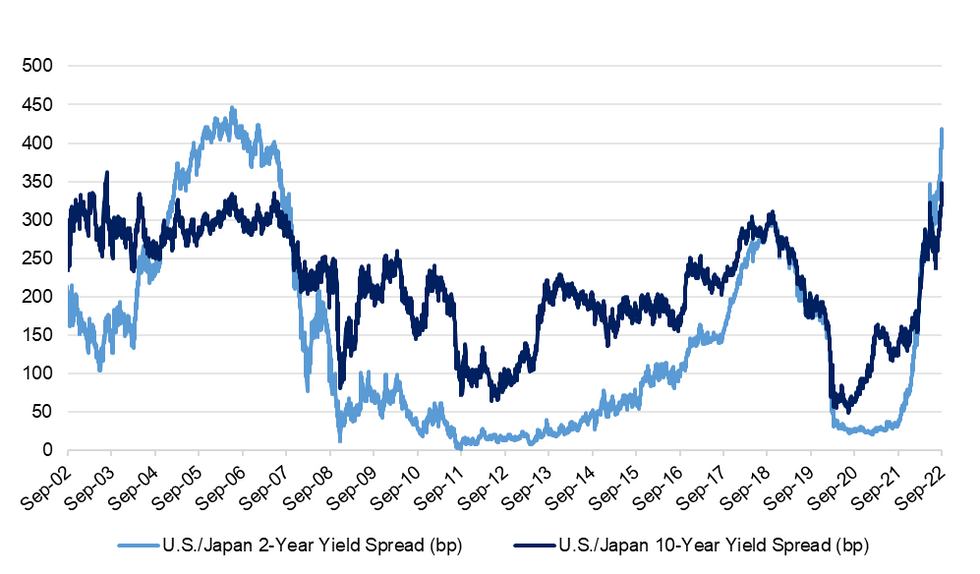

FX Intervention Props Up Yen But U.S./Japan Yield Differentials Grow Wider

Japanese officials threw a lifeline to the beleaguered yen Thursday, intervening to prop up domestic currency for the first time since 1998. The intervention was confirmed as USD/JPY approached Y146.00 after the BoJ kept its ultra-loose monetary policy settings unchanged.

- The BoJ's decision triggered some JPY volatility as prior comments from FX authorities pointed to heightened intervention risk. Spot USD/JPY kept climbing as Gov Kuroda reaffirmed the Bank's easing bias and signalled intention to stick with the current forward guidance for the next 2-3 years.

- Kuroda's presser was followed by a confirmation that officials were purchasing the yen to curb speculative one-sided moves. Japan's $1.17tn stockpile of FX reserves and a reverse repo agreement with the Fed provides potent ammunition to keep slowing yen decline.

- Still, there seems to be a consensus that the intervention is not enough to permanently reverse the depreciation trend, as the fundamental forces behind yen weakness remain in operation. The SNB's rate hike left the BoJ as the only central bank in the world with negative interest rates amidst the global wave of aggressive monetary tightening.

- On that note, Thursday saw U.S./Japan yield differentials widen by notable margins. 2-Year gap rose 8.5bp to 418bp, most since 2006; 10-Year spread grew 20.6bp to 348bp, most since 2002.

- Spot USD/JPY last trades flat at Y142.40. The round figure of Y140.00 and the 50-DMA at Y138.12 provide the initial layers of support. Bullish focus is on yesterday's peak/2.764 proj of the Aug 2 - 8 - 11 price swing at Y145.90/146.03.

- Japanese financial markets are closed today.

Fig. 1: U.S./Japan 2-Year vs. 10-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.