-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

GLOBAL MORNING BRIEFING

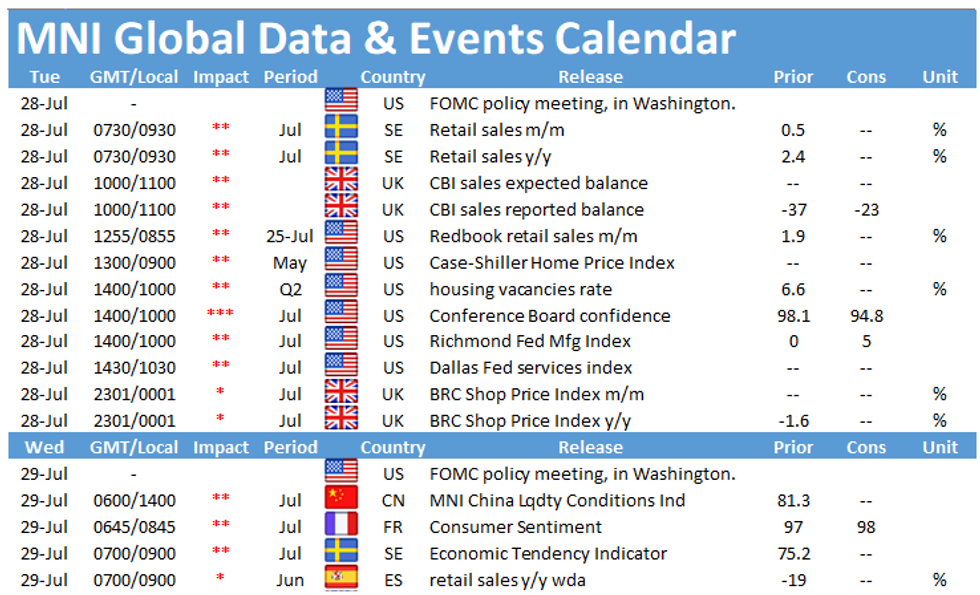

Tuesday's data calendar throws up another quiet session before picking up Thursday and Friday. In Europe, the release of the UK CBI distributive trades survey at 1100BST is worth noting, while in the US the highlight of the day is the publication of consumer confidence and the Richmond Fed survey, both at 1500BST.

CBI sales forecast to improve further

CBI reported sales are projected to increase further to -23 in July after coming in at -37 in June. This would mark the third successive increase, but it would still be a reading well below pre-crisis levels. Orders placed upon suppliers improved somewhat in June, but they remain deeply negative. The recent reopening of the hospitality sector is likely to provide a boost to retail sales and should bode well with footfall on high streets. However, consumer confidence only recovers slowly as people fear rising unemployment due to the end of the furlough scheme in autumn but also the threat of a second wave persists and keeps consumers cautious.

US consumer confidence seen declining

The conference board consumer conference index rose in June to 98.1 following an almost unchanged reading of 85.9 in May. Both the present situations index and the Expectations index increased in June, but remain below pre-crisis levels. The survey noted that the reopening of the economy as well as an improvement in unemployment benefits led June's uptick. However, markets expect consumer confidence to tick down slightly in July to 94.5 as Covid-19 cases continue to rise in the US and consumers are concerned about leaving their homes.

Richmond Fed manufacturing index seen higher

The composite index increased markedly in June to 0 after recording -27 in May, showing the highest level since March and the second successive increase. Markets are looking for another uptick in July to 5 which would be the highest level since January. Similar survey evidence is in line with market forecasts. The recently released flash IHS manufacturing PMI edged up to a six-month high and shifted back into expansion. Meanwhile, the Kansas City Fed manufacturing index rose to 3 July, up from 1 in the previous month.

Tuesday's highlight in terms of events is the FOMC's policy meeting in Washington. However, the minutes will be published on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.