-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

GLOBAL MORNING BRIEFING: All eyes on US inflation

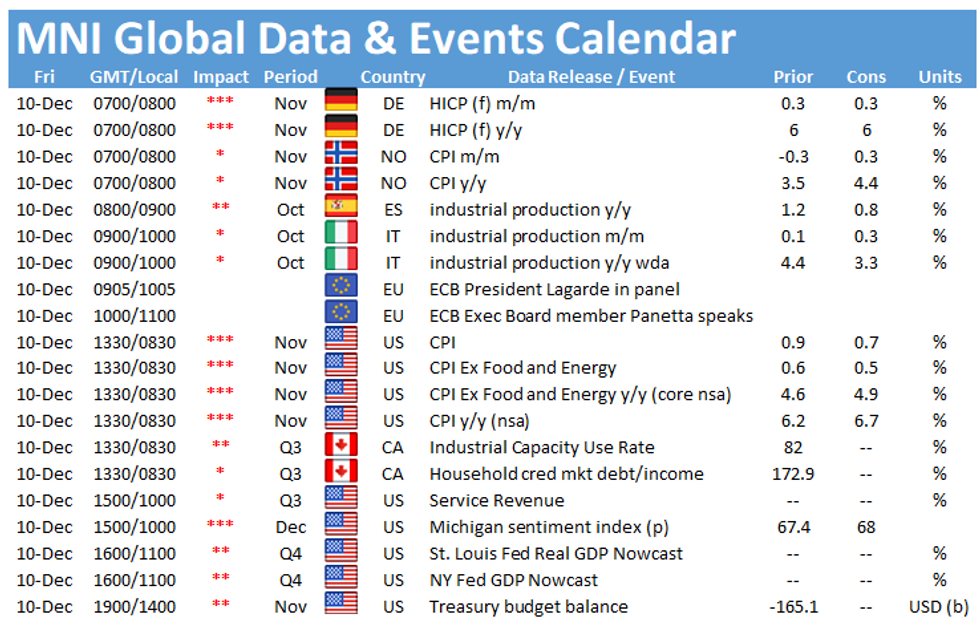

All eyes will be on US inflation data this afternoon, as markets watch for signals for a faster taper and an estimated timeframe for the first hike.

UK data: monthly GDP / Services / IP / Trade / Construction (0700 GMT)

Analysts predict October’s monthly GDP to dampen to 0.6% to 0.4% m/m. Industrial production is likely to point towards slight recoveries in October, expected to come in at 0.1% m/m, up from -0.4% in September, however annual IP is predicted to be lower at 2.2% compared to 2.9% in October 2020. Manufacturing is expected to follow a similar trajectory, up to 0.2% m/m in October from -0.1% m/m in September, but with the annual measure at 1.6% y/y for this October compared to 2.8% y/y in October 2020.

Construction and Services are also projected to slow, with construction dropping considerably to 0.2% m/m in October, from 1.3% m/m in September, with annual rates dropping to 5.4% from 7.5% in October last year.

German CPI continues to grow (0700 GMT)

Final German headline inflation data for November is projected to equal the flash values of -0.2% m/m and 5.2% y/y for November, compared to 4.5% y/y in October. Energy price inflation continues to be the main culprit, with energy costs expected to have inflated by 22.1% y/y for November. It is worth noting that base effects may exaggerate this data.

Norway CPI follows suit (0700 GMT)

Analysts predict Norway’s November headline inflation to come in at 0.3% m/m and 4.6% y/y, compared to 3.5% y/y in October, beating the September 5-year high of 4.1% y/y as housing, energy and transport costs continue to push prices upwards, despite core inflation following a downward trajectory since August 2020.

Spanish and Italian IP (0800 / 0900 GMT)

Spanish industrial production is projected to have eased to 0.9% y/y in October, down from 1.2% y/y in September, whilst monthly IP looks set to remain steady around the 0.3% mark.

Italian IP is expected to also have slowed in the annual readings, to a milder 3.3% y/y in October, from the previous reading of 4.4% y/y, while the monthly rate increased slightly to 0.3% m/m this October from 0.1% m/m in September.

US inflation pushing towards 7% (1330 GMT)

This afternoon all eyes will be on US inflation data. Monthly headline inflation is projected to dampen slightly to 0.7% for November, from 0.9% in October. Annual headline inflation predictions are at 6.8% y/y for November, up from 6.2% y/y in October, with the Bloomberg consensus pricing more upside risks. Core CPI is expected to follow suit, predicted to come in at 4.9% y/y, compared to 4.6% y/y in October. The tight labour market and high inflation expectations represent a green light for the Fed to accelerate tapering faster to finish in March, with markets pricing a hike shortly after. The surge in energy prices, supply chain bottlenecks and major labour supply shortages remain the key contributors, however the spread of the omicron variant will provide considerable downside growth risks for the upcoming Winter months.

Image source: U.S. Bureau of Labor Statistics

Central bank speakers on Friday include ECB President Christine Lagarde and Executive Board member Fabio Panetta.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.