-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGov't To Raise Def Spending & Signs Deal w/US In Effort To Boost Support

The Swedish gov't has stated its desire to significantly boost defence spending, and has signed a deal on military cooperation with the United States as it seeks to revive its flagging support levels. Earlier in December, Defence Minister Pål Jonson stated that the gov't intends to increase defence spending by 28% to bring the country up to the military spending target for NATO member states of 2% of GDP.

- The defence bill for 2024 envisages a SEK27bn (USD2.4bn) increase in military spending, and is seen as a key plank in Stockholm's attempts to prove its military credentials as it continues to push for NATO membership.

- The gov't has also signed adefence co-operation agreementwith the United States that will allow US access to military bases across the country. Jonson argued the deal, similar to the one that neighbouring Finland and Denmark have also recently signed with the US, “will create better conditions for Sweden to be able to receive support from the United States in the event of a war or crisis.”

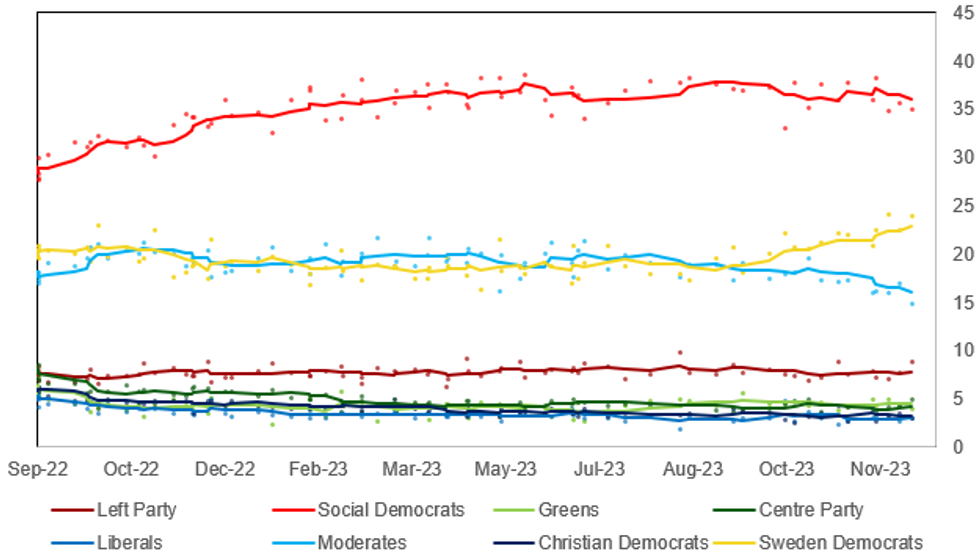

- Efforts to talk tough on security come as the Moderates, and their partners in the minority governing coalition, the Liberals and the Christian Democrats, trail the right-wing nationalist Sweden Democrats in opinion polling.

- Although the Sweden Democrats prop up the minority coalition from outside gov't, the sustained increase in support for the party - driven by concerns about immigration and widespread gang violence - will unnerve the governing parties as SD support could be withdrawn at any time.

Chart 1. General Election Opinion Polling, % and 5-Poll Moving Average

Source: Sentio, Kantar, Novus, Demoskop, Ipsos, Sifo, SCB, Indikator, Verian, MNI

Source: Sentio, Kantar, Novus, Demoskop, Ipsos, Sifo, SCB, Indikator, Verian, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.