-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

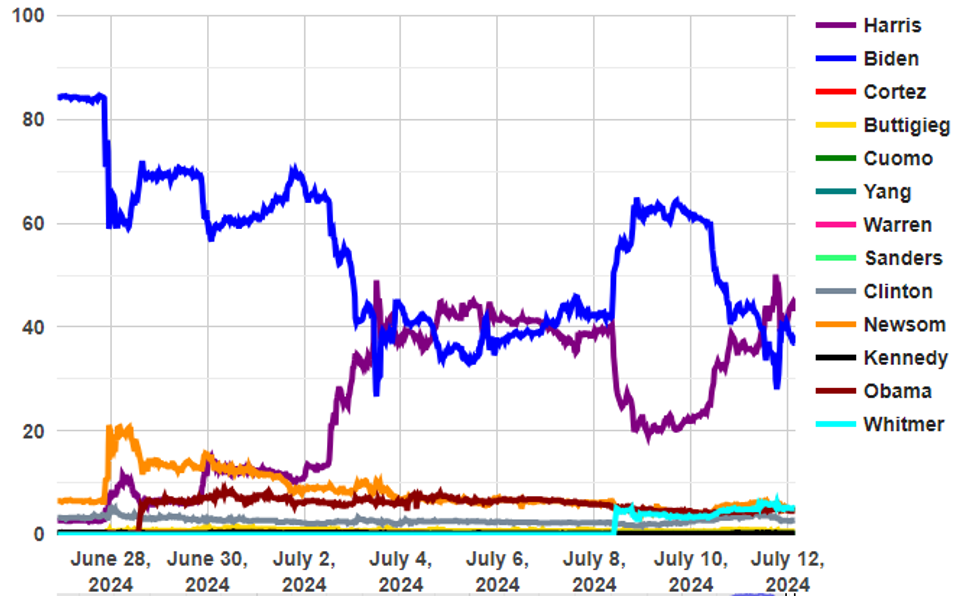

Free AccessHarris Overtakes Biden Again In Dem Nom Betting After Pres' Gaffes

Vice President Kamala Harris has once again overtaken President Joe Biden in political betting markets with regards to who will be the Democratic party's presidential nominee come November. Earlier in the morning we noted the impact of Biden's latest verbal gaffes on the broader presidential betting markets (see 'US: Presidential Odds Volatile As Biden Gives Press Conference', 0248BST). The latest figures from Election Betting Odds, which collates data from Predictit, Polymarket, Smarkets and Betfair, gives Harris a 43.3% implied probability of becoming the Democratic party nominee, up 7.3% to 24 hours ago.

- Biden is afforded a 37.1% implied probability of taking part in the presidential election, down 6.5% in a day. Michigan Governor Gretchen Whitmer (D) has taken over third place, with a 5.0% implied probability, coming in just ahead of California Governor Gavin Newsom (D) on 4.9%.

Source: electionbettingodds.com

Source: electionbettingodds.com

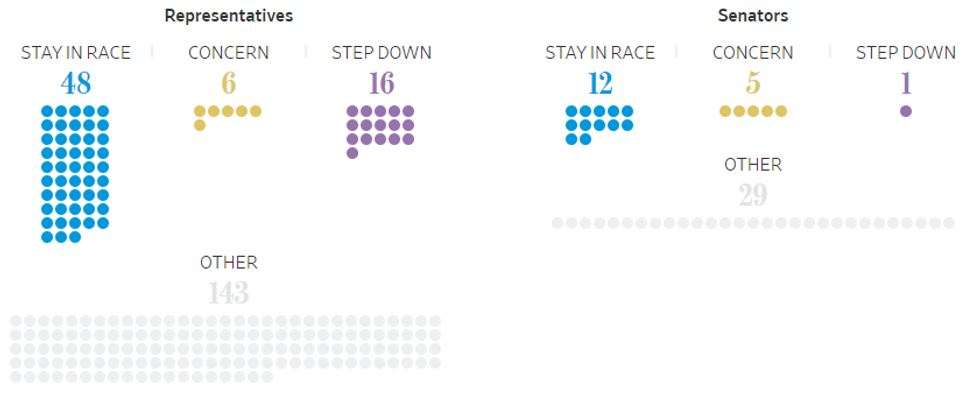

- Immediately following the NATO-closing presser, three more Democratic reps. - Jim Himes (CT), Scott Peters (CA) and Eric Sorensen (IL) - calledon Biden to withdraw from the race. This raises the number of congressmen calling for Biden to quit to 16 as well as one Dem senator, Vermont's Peter Welch.

- This number would appear to be smaller than the 'half dozen' Dems willing to go public with calls for Biden to resign speculated upon by Politico on 11 July (see 'US: House Dems "Prepare To Break With Biden If he Tanks NATO Presser", Politico', 1813BST 11 Jul).

Source: WSJ

Source: WSJ

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.