-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

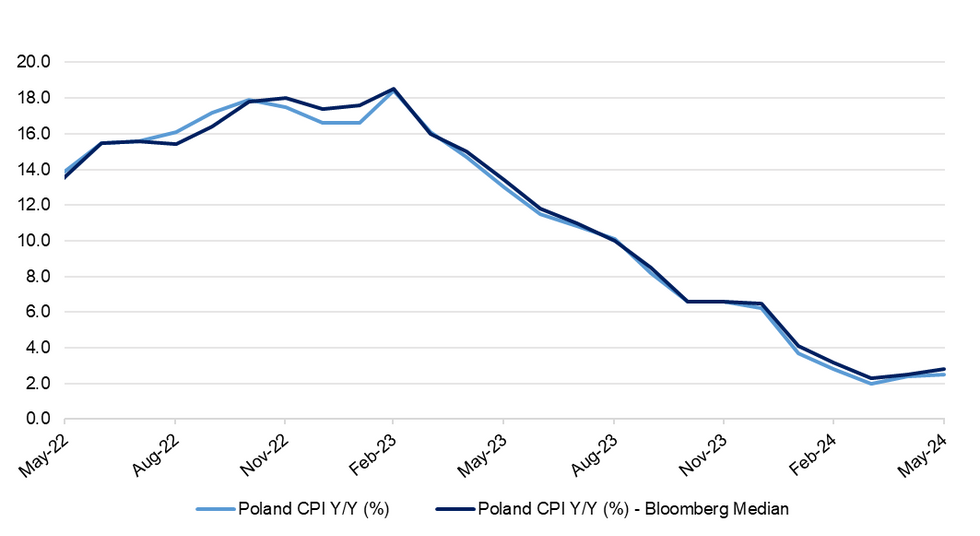

Headline Inflation Prints Below Expectations, Core Seen Around +3.8-3.9% Y/Y

Preliminary data showed that Poland's headline inflation undershot expectations in May, printing at +2.5% Y/Y (i.e. right at the NBP's point-target). Consensus was looking for an acceleration to +2.8% from +2.4% registered in April. On a sequential basis, prices ticked higher by just 0.1% M/M versus +0.5% expected and +1.1% in April.

- ING call the price increase in May "symbolic," noting that small declines in fuel and heat prices were coupled with a very small rise in the costs of food. Per their calculations, core inflation may have fallen to around +3.8-3.9% Y/Y. They note that a slightly slower sequential core inflation (+0.2% M/M) is typical for May. They maintain their call for stable rates through the rest of 2024 as the economy is rebounding.

- mBank estimate that core inflation fell further to +3.8% Y/Y from +4.1%, while noting that it is difficult to say how the reaction in food prices to recent VAT adjustments played out before the publication of detailed data.

- Pekao suggest that core inflation fell to +3.9% Y/Y, adding that forecasts suggesting that headline inflation could end the year at +6-7% Y/Y are "going through a difficult time."

- PKO write that prices rose 0.1% M/M mostly on the back of an increase in food prices, which was largely neutralised by cheaper fuel and heat.

- The Polish Economic Institute write that core inflation likely fell to around +3.8% Y/Y. They note that food prices ticked higher by a small margin, despite a higher VAT rate. They believe that June will be the last month with inflation within the NBP's target. CPI may accelerate to +4.0-4.5% Y/Y in July due to the adjustments to energy price caps. A rebound in core inflation cannot be ruled out due to wage pressures. The Institute warn that 2H2024 will also bring higher inflation.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.