-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Iron Ore Imports To Remain Positive In 2025

MNI BRIEF: China To Boost Long-term Funds For Equity Market

MNI BRIEF: China To Maintian Communication With U.S. - MOFA

Heterogeneous National Trends Could Complicate Inflation Outlook (4/4)

May's inflation readings will give the ECB plenty to talk about at next week's meeting. For a start, even with the lower-than-expected the inflation forecasts will likely have to be raised, at least for the near-term (the March forecasts estimated Q2 headline averaging 6.0% in Q2, but has averaged 6.5% in April-May).

- But May's readings also reminded that inflation dynamics aren't uniform across the euro area. French HICP came in lower than survey (6.0% vs 6.4% expected), as did Germany's (6.3% vs 6.7%), Spain's (2.9% vs 3.3%), and Portugal's (5.4% vs 6.0%); whereas Italy's beat (8.1% vs 7.5%), as did the Netherlands (6.8% vs 6.1%).

- Rabobank sees the shift in inflation pressures from headline to core complicating the outlook as these dynamics will play out differently in each member state. For the countries that saw higher than expected May readings, Rabobank points out the Italian divergence on inflation vs progress elsewhere in the eurozone was mainly down to energy: up 11.9% Y/Y in May, vs -1.7% Y/Y in the euro area – potentially due to price controls last May that boosted the Y/Y impact. Meanwhile in the Netherlands, notably in month-on-month terms, “practically everything” but energy became more expensive with the Y/Y rate has mainly moved in the opposite direction vs eurozone likely due to base effect in energy.

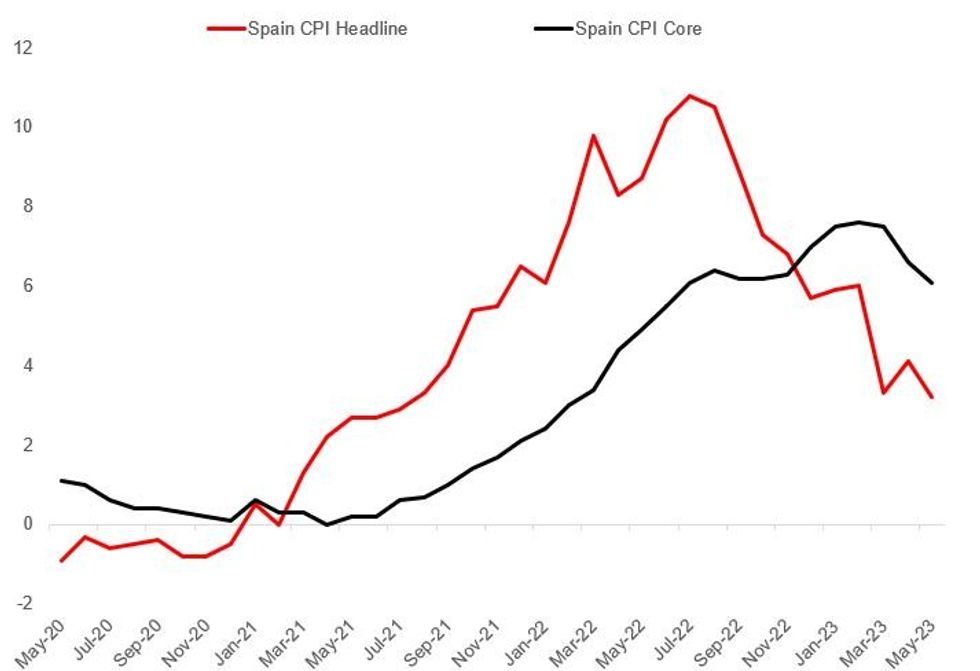

- These dynamics could shift: in Spain, lower energy prices have pushed down headline but not core (see chart), but this isn’t the case in Italy – Spanish inflation is set to rise going forward, with Italian inflation declining toward year-end. Rabobank: “With inflation at current levels, the current restrictive policy stance makes sense for every member state. But as average Eurozone inflation falls closer to target, structural differences in inflation matter a lot more and the ECB’s one-size-fits-all policy becomes a poorer fit for those countries with a vastly different inflation trend. This not only a risk, but it is actually quite likely that the inflation differential will remain substantial."

- Several dynamics will be at play for core CPI: Rabobank notes that Belgian wages are automatically indexed to inflation; unemployment is different across different countries (eg slack Greece vs tight Netherlands), meaning different wage / core dynamics, and large output gap differences (Netherlands very tight in this regard); energy passthrough is larger in some countries and will take longer to work themselves through. For example, Baltic countries saw the highest energy inflation and passthrough is still going to prop up core in Estonia, Lithuania, and Slovakia.

Source: BBG, MNI

Source: BBG, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.