-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessHigher U.S. Tsy Yields Support USD/JPY, Kuroda Deems Recent FX Intervention Appropriate

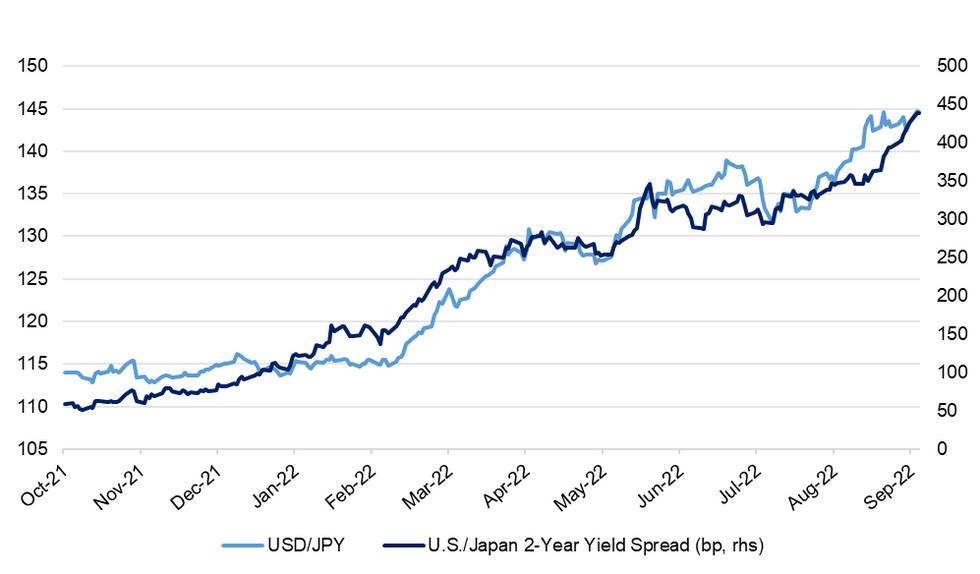

Spot USD/JPY ground higher Monday as U.S. Tsy yields rallied across the curve, with hawkish Fedspeak crossing the wires and all eyes on turbulence in UK financial markets.

- The rapid widening in U.S./Japan yield differentials continued as the latest signals reaffirmed expectations of further Fed/BoJ policy divergence. 2-Year spread grew 12.6bp to 11-year wides, while 10-Year gap rose 22.5bp to 10-year wides. Fed speakers kept beating the hawkish drum, while the BoJ boosted its regular bond purchases as its chief reiterated that powerful monetary easing is here to stay.

- BoJ Gov Kuroda also said the FX intervention last week was appropriate as a means to curb yen volatility and did not contradict the BoJ's policy stance. The Nikkei reported that Japan spent ~Y3tn on its intervention, citing estimates by market participants.

- USD/JPY risk reversals were heavy, moving out of sync with the spot rate. One-month option skews fell to its lowest point since early Jul, while one-year tenor printed worst levels in several weeks.

- Spot USD/JPY last trades at Y144.58, down 18 pips on the day. Bears would be pleased by a move through Sep 22 low of Y140.36, while bulls look for gains towards Sep 22 high/2.764 proj of the Aug 2 - 8 - 11 price swing at Y145.90/146.03.

- With Japan's final machine tool orders unlikely to cause much stir today, focus turns to Friday's data dump, which will include updates on unemployment, retail sales & flash industrial output.

Fig. 1: USD/JPY vs. U.S./Japan 2-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.