-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessHomebuilding Activity Transitioning From Plateau To Pullback

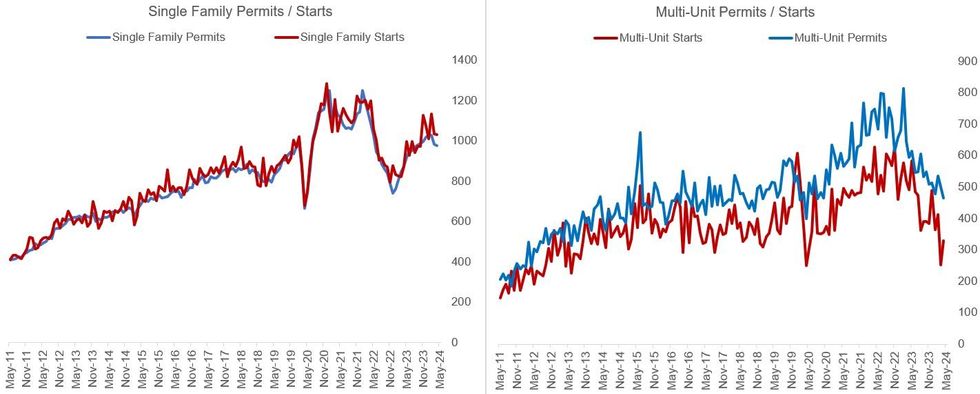

April's New Residential Construction report came in on the weak side, with building permits and housing starts missing expectations - suggesting residential building activity is transitioning from an extended plateau to an outright pullback as Fed tightening takes effect with a lag.

- Housing starts printed 1,360k (SA ann.), well below the 1,421k expected and a meek rebound versus 1,287k prior which was a downward revision from 1,321k. Permits dipped rather than rise as expected, when accounting for revisions: the 1,440k was below 1,480k expected, and vs 1,485k prior (revised up from 1,458k). This was the weakest figure since January 2023.

- Multi-unit housing starts (eg apartment buildings) were the bright spot of the release, bouncing back to 329k from March's 252k which had been the 2nd lowest print in a decade - but the outlook here remains weak, with the 464k multi-unit permits the lowest since October 2020.

- Single family starts and permits pulled back by 4k (to 1,031k) and 8k (to 976k), respectively, but these have effectively gone sideways since late 2023.

- While completions remain strong, the total number of units currently under construction fell to 1,616k (682k single family, 934k multi-unit) - the lowest number since February 2022.

- With permits beginning to slip, a pullback in construction from multi-decade highs set in late 2022 to below the 1,600k mark looks likely in the coming months.

- For the Fed, this will be doubly encouraging: recent reports provide some evidence that higher interest rates (including via higher mortgage rates) are feeding into economic activity with a lag, while the large number of housing units still in the pipeline should help contribute to disinflation.

- This release includes revisions for the three series going back as far as 2017 (for permits SA), with all SA series revised back to January 2019, but the changes do not alter the overall picture.

Source: Census Bureau, MNI

Source: Census Bureau, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.