-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessIntervention Guessing Game Goes On As Off'ls Lean Towards Volatility Management

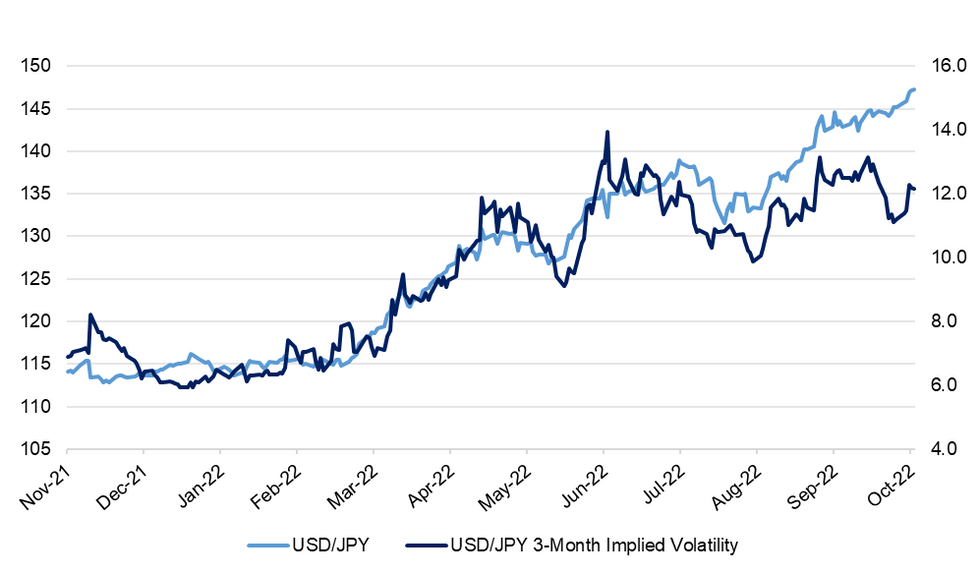

Above-forecast U.S. CPI print catalysed another upswing in USD/JPY, sending the pair to a 30-year high Thursday. The rate topped out at Y147.67, just above key resistance from the 1998 high located at Y147.66. The subsequent sharp pullback inspired speculation re: potential intervention.

- The BoJ's commitment to its ultra-loose policy settings maintained upward pressure on USD/JPY after PM Kishida and BoJ Gov Kuroda both expressed unwavering support for the current monetary policy course this week.

- U.S./Japan yield spreads rose post-U.S. CPI, with 10-year differential expanding 5.3bp on the day. 2-year gap widened 16.8bp to top 450bp for the first time since late 2000.

- The reassessment of intervention risks helped remove a key obstacle to further USD/JPY gains as FinMin Suzuki clarified that officials were focusing on volatility rather than specific levels of the exchange rate.

- Suzuki's comments may have helped USD/JPY rally through the levels that historically triggered interventions to prop up the yen last month (Y145.90) and in 1998 (147.66). USD/JPY implied volatilities ore comfortably off recent cyclical highs, with one-week tenor last at 12.0%.

- Still, the prompt reversal of the post-CPI move inspired chatter of potential intervention, as officials may have judged that renewed gains were too sharp. For the record, MoF officials keep rattling the intervention sabre, while flagging the option of conducting a covert intervention.

- Spot USD/JPY last +15 pips at Y147.28. Clearance of Y147.67 would draw bullish attention to the round figure of Y150.00. Bears look for a pullback towards Sep 22 low of Y140.36, a key layer of support.

Fig. 1: USD/JPY vs. USD/JPY 3-Month Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.