-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

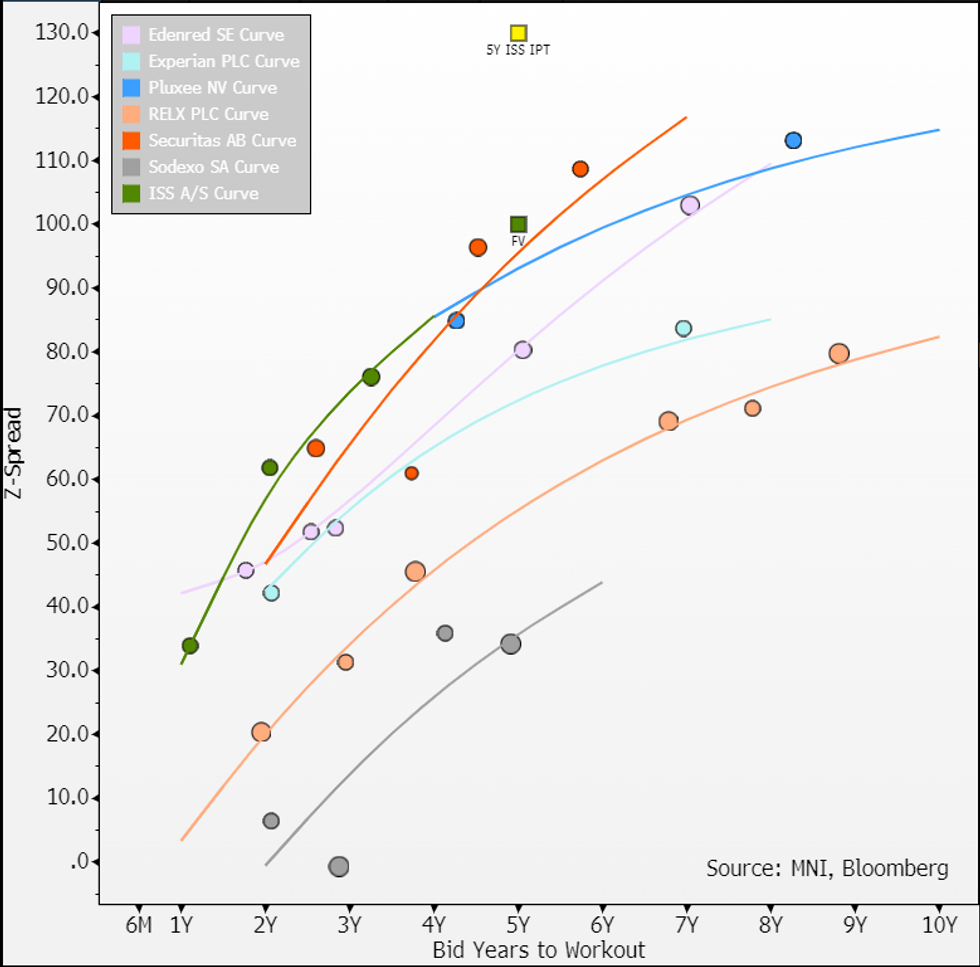

ISS Global (Baa3 S, BBB S) 5Y FV

€500m 5Y IPT MS+130a vs. FV +100.

**IPT coming tight to FV (-30). For equal carry Securitas (NR/BBB) also coming off a S&P upgrade and/or Pluxee (NR/BBB+) are alternatives (at FV). Screen cheap on ISS 26s & Pluxee 28s still stand.

- Not much new for us in the roadshow, summary for investors new to name; services co with main exposure in cleaning (42%) and rest split between technical services, food & other. Its Europe heavy (70%), contract renewal risk seems skewed to 2025 (30%), '27 (21%) & '28+ (26%). Capital allocation policies are clear (2-2.5x leverage target, 20-40% dividends from net profit, open to M&A, excess to buybacks) as are targeted headline metrics (4-6% organic growth, operating margin >5%, cash conversion on op. profit >60%).

- Key points from us previously; growth this year price driven as it exits unprofitable contracts, S&P ratings have headroom with top-end equity return assumptions, next earnings (1H in August) will show step up in leverage on FCF/WC seasonality, some issues with its biggest customer Deutsche Telekom on what it says are services unpaid for & expects DKK600m (€80m) cash from it next yr, FCF guidance next year at >DKK1.8b (>€241m) with shareholder returns at DKK1.4b (€188m) netting most of that.

- On FV, our closet comp is Sodexo but curve not a useful curve for RV (well tight on CSPP/French co). Securitas (NR/BBB) offers different services to business but has a very similar scale/near term growth. Higher margin leaves ~€150m more FCF/yr & runs similar S&P adj. leverage (mid to high 2xs by year end expected from both, Securitas targets <3x net).

- Given similarities, Securitas shorter March 29s at Z+96 are a floor for our FV, we spread a small +4bps for 3m term premium which leaves FV +7bps above interpolated Pluxee curve. Re the sector as a whole, pickup here from brewers while equal rated retailers still trade north (see new Pandora 30s) - latter seems fair given near-term outlook.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.