-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

JGB Curve Still Steep Vs. Major Peers

{wo} BONDS: JGB Curve Still Steep Vs. Major Peers

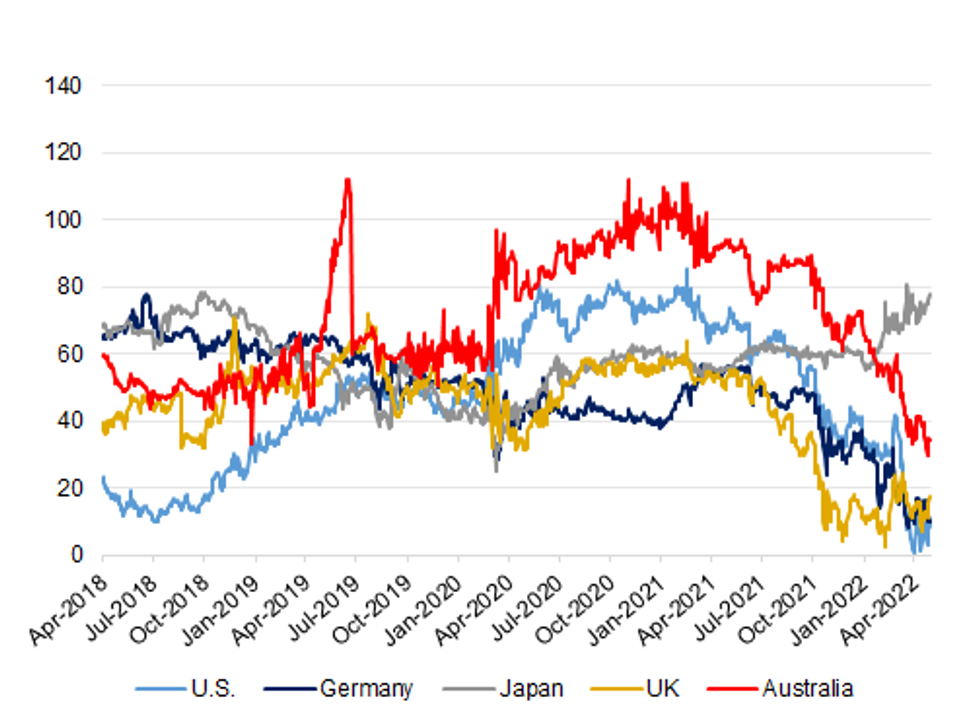

The JGB curve continues to offer by far the steepest 10-/30-Year slope when compared to a group of its major global fixed income peers (namely the U.S., UK, Germany & Australia).

- Wider core fixed income markets have been subjected to the hawkish repricing of the major global central banks in recent months (excluding the BoJ), pressuring the short end of the previously flagged global core FI curves (excluding Japan), while growth and recession fears are also playing into the broader flattening dynamic. Granted, the U.S. curve operates a little off cycle flats with the FOMC pushing back against some of the more hawkish market expectations re: tightening, while flow specific matters may have also played into Tsy curve dynamics in recent weeks.

- Conversely, the BoJ’s continued commitment to its 10-Year JGB yield target band of -/+0.25%, which has been backed up by action in recent months, coupled with the combination of a relative lack of BoJ control in the longer end of the JGB curve and the wider bearish impulse observed in the core global FI space, has allowed the JGB curve to steepen.

- This dynamic, alongside the wider vol. observed in global financial markets, jumping FX-hedging costs (magnified by the well-documented run of JPY weakness observed in recent weeks), inflationary threat and questions re: the required level of wider central bank tightening is seemingly keeping Japanese investors away from offshore fixed income markets. Indeed, Japanese participants have net sold foreign paper during 11 of the latest 13 weeks observable via the Japanese weekly international security flow data (with the two weeks that didn’t see net selling flows only seeing Y10.5 and Y18.0bn of net purchases), net selling ~Y7.1tn of foreign paper in that time. More granularly, there have been some suggestions that Japanese investors have been showing interest in European paper in recent weeks, while shedding exposure to U.S. Tsys.

- Note that this general dynamic when it comes to asset allocation e.g. some hesitance surrounding/shedding of U.S. Tsys, eying European bonds and diversifying in to credit markets were all factors alluded to in the recent semi-annual investment interviews released by Japanese life insurers. As was the potential for a more pronounced home bias to develop.

Fig. 1: Major 10-/30-Year Government Bond Yield Curves (bp)

Source: MNI Market News/Bloomberg

Source: MNI Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.