-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net injects CNY90 Bln via OMO Thursday

MNI: PBOC Sets Yuan Parity Higher At 7.1740 Thurs; -0.77% Y/Y

SK Telecom (SKM, A3/A-/A-) in quantum computing partnership

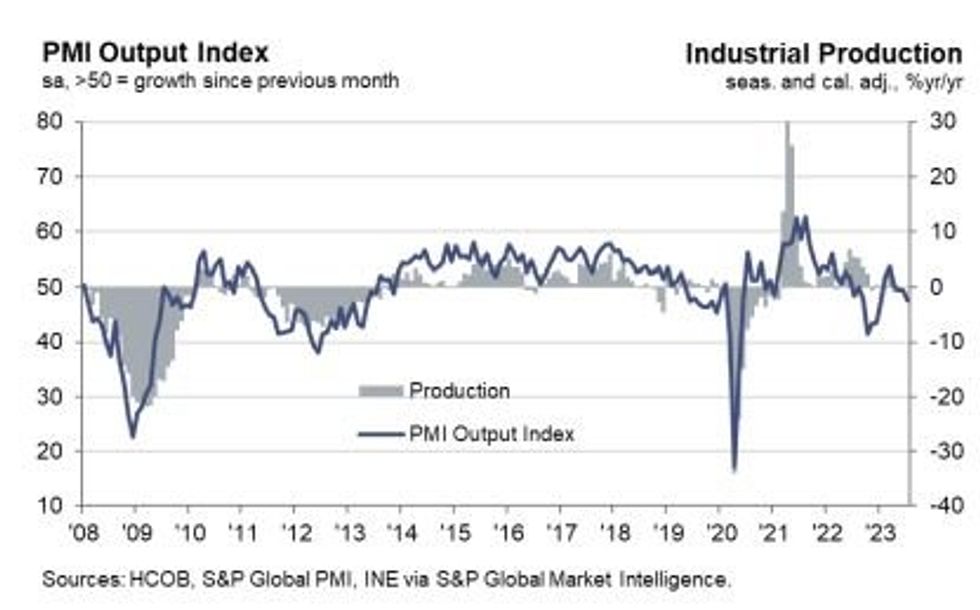

July PMI Shows Weak Demand And Disinflation Amid Manufacturing Slump

SPAIN JUL MANUF PMI 47.8 (FCST 48.3); JUN 48.0

- Spanish July manufacturing PMI came in on the weak side of expectations at 47.8, unexpectedly decelerating from 48.0 in June and undershooting the 48.3 consensus.

- This was the 4th consecutive monthly reading below the 50.0 level demarcating contraction from expansion, and overall the report provides further evidence of disinflationary impulses from the Eurozone goods / manufacturing sector.

- As with the German and French PMI flash figures, weakness in manufacturing demand was evident in Spain's report from HCOB/S&P Global, with "sharper reductions in both output and new orders" (including a "more severe deceleration in foreign market demand") resulting in "paring back input buying at a quicker rate and lowering workforce numbers again".

- Inventories contracted at an accelerated rate (in line with weak demand), with manufacturers running down backlogs. Delivery times have normalized vs stretched pandemic levels.

- The disinflationary implications were evident: input prices fell at the fastest pace since June 2009, while output charges declined at the strongest rate in just over 3 years as "muted customer demand imparted further downward pressure on prices".

- While there was a "positive outlook" for future output, the "degree of confidence remained historically subdued and only modest overall".

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.