-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

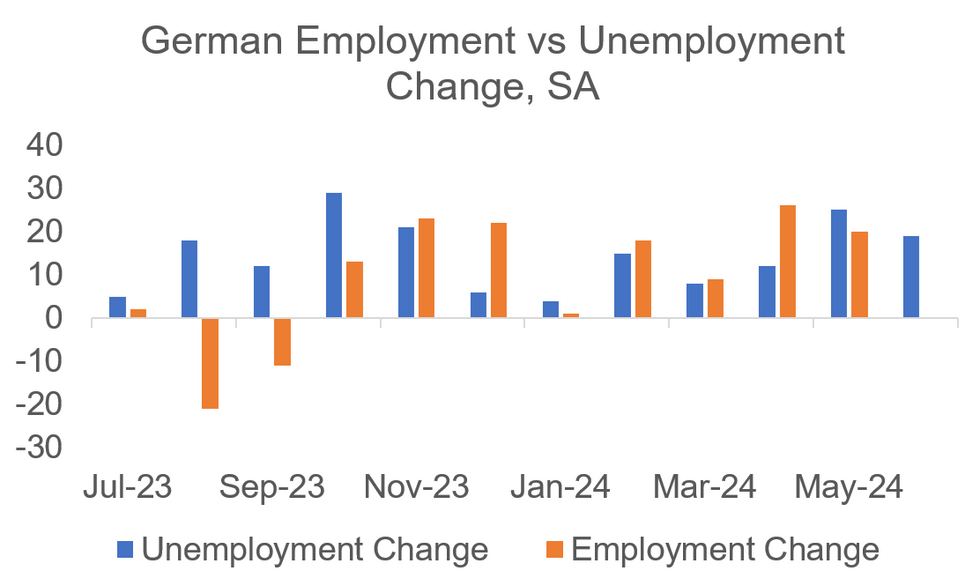

Labour Market Data Continues To Signal Ongoing Softening

The latest German labour market data has been slightly on the weaker side overall, with rising unemployment and underemployment as well as a fall in labour demand, offset somewhat by a marginal rise in employment.

- Unemployment rose more than expected in June, by 19k (vs 15k cons) but less than in May (25k) on a seasonally-adjusted basis. This nudged the SA unemployment rate up to 6.0% (vs 5.9% cons and prior).

- Employment rose by 20k in May (latest month for which data is available; vs 26k Apr) in a further extension of all-time levels on a seasonally-adjusted basis. Employment gains since the beginning of 2024 continue to be solely driven by part-time employment, according to the German employment agency.

- The expected number of employees impacted by Kurzarbeit (which has to be reported in advance by companies and can be interpreted as an early indicator for future use of state benefits) remained relatively steady in June vs May according to the employment agency (42k June 1-24). Underemployment excl. Kurzarbeit meanwhile continued its slight uptrend on a SA basis, printing 16k higher (around +0.5% M/M vs +0.4% prior).

- Labour demand, reflected by the agency's seasonally-adjusted job index "BA-X", declined by 2 points to 109 in June (-10p vs June 2023; all-time high of 138p in May 2022; the index is normalised to 2015=100 and reflects vacancy levels and activity).

- Looking ahead, forecasts and sentiment indicators suggest that the German labour market will continue to soften slightly. The unemployment rate is expected to increase to up to 6.1% in the coming quarters according to MNI's collation of sellside consensus and the IFO Employment Barometer has printed in contractionary territory for 14 consecutive months.

MNI, Destatis, Bloomberg

MNI, Destatis, Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.