-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessLockdown Extended, Gov't To Announce Economic Relief Package

Spot USD/MYR reopened in close proximity to pre-weekend levels, ignoring latest developments surrounding Malaysia's lockdown measures, and last trades at MYR4.1565, virtually unchanged on the day.

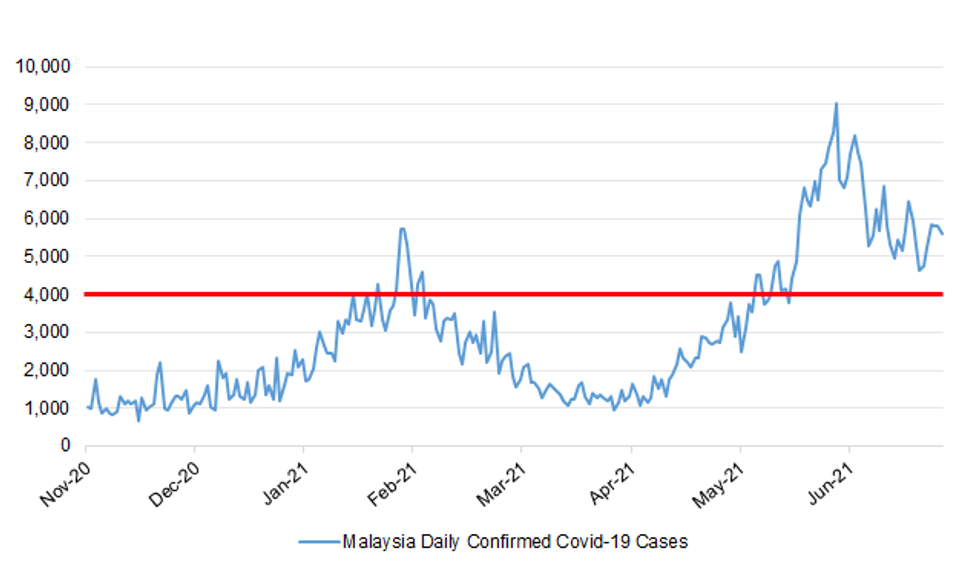

- PM Muhyiddin announced an extension of the nationwide lockdown until the daily Covid-19 case count falls below 4,000. A relaxation of a rule on eateries' operating hours, announced later by Defence Min Ismail Sabri, is unlikely to mitigate the impact of the extension of broader curbs. The gov't is expected to announce a fresh economic relief package today or on Tuesday, according to Muhyiddin. Separately, FinMin Zafrul wrote in a Facebook post over the weekend that the gov't will unveil assistance on loan moratorium soon.

- Ismail Sabri clarified that interstate and interdistrict travel will remain banned in Phase 2 of the National Recovery Plan. He also provided a list of business activities which will be allowed in Phase 2, which includes haircuts, car washing as well as manufacturing a number of goods.

- On the political front, speakers of both houses expressed the view that the parliament could reopen in a hybrid mode as soon as in late August.

- Malaysia's MITI will release the latest trade data today, with BBG consensus seeing trade surplus at +MYR20.70bn. Looking further afield, Markit M'fing PMI hits the wires on Thursday.

- Bears look for a move through last Friday's low of MYR4.1423, which would expose Jun 18 low of MYR4.1360. Bulls look for a clearance of Jun 24 multi-month high of MYR4.1710, before targeting Nov 4, 2020 high of MYR4.1745.

The red line represents the target for proceeding to Phase 2 of the National Recovery Plan.Source: MNI - Market News/Bloomberg

The red line represents the target for proceeding to Phase 2 of the National Recovery Plan.Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.