-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY13.8 Bln via OMO Monday

MNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

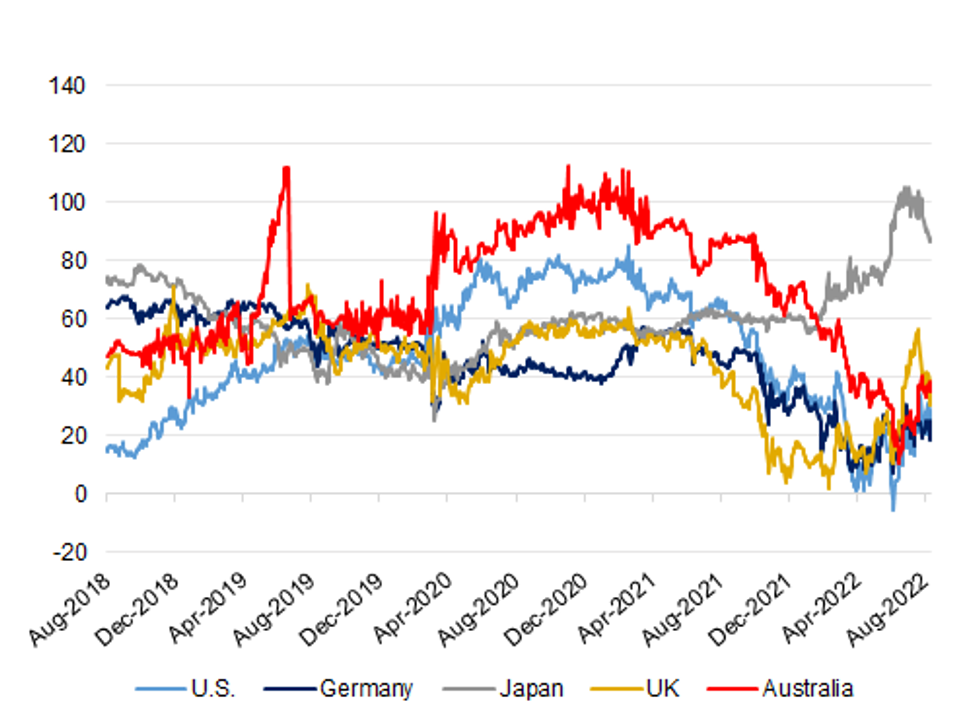

Longer JGB Curve Flattening An Outlier Since Mid-June

A quick eyeball of the 10-/30-Year yield spreads across some of the major core global FI markets shows that the Japanese 10-/30-Year yield spread has moved away from cycle steeps registered in mid-June, with the rest of the 10-/30-Year yield spreads that we have chosen (U.S., German, UK and Australian) all operating off of their cycle flats, albeit with the UK variant pulling flatter in recent sessions owing to increased stagflationary worry and a related uptick in BoE tightening premium priced into money markets. What are the driving factors for the JGB curve?:

- Increased recession worry centred on the U.S. & Europe, driving yields lower, but the flattening impulse hasn’t been observed in the remaining core FI global markets over the horizon in question, so there must be something else at play.

- Mid-June saw the challenge and ultimately successful defence of the BoJ’s existing YCC parameters with the subsequent insistence that the Bank remains on hold until meaningful underlying inflationary pressures emerge (with a formal easing bias maintained). Foreign investors were the key party in the challenge with subsequent data revealing notable short selling of JGBs by that particular cohort ahead of the Bank’s June meeting as speculation surrounding the potential for a hawkish move stepped up, followed by short covering in the weeks that have followed. The fact that the BoJ has less relative control beyond the 10-Year point of the curve allowed the test of the BoJ to be amplified by a steepening of the curve, with flows in swaps also noted at the time of the challenge. The recent short covering could have aided the flattening in question.

- Another idiosyncratic factor has been the willingness of domestic life insurers to deploy capital in the longer end of the JGB curve (as alluded to in their semi-annual investment interviews), with pension funds and lifers shedding a record amount of foreign bonds in the month of July (per JSDA data), as Japan experienced deployed a record stretch of weekly net sales of foreign paper, owing to market volatility and elevated FX-hedging costs. That trend has started to turn recently, with Japan registering purchases of foreign bonds in each of the last 4 weeks (albeit in relatively limited terms when compared to the net sales that came before).

- The previous steepness of the curve, in both a domestic and international sense, added to aforementioned demand from the domestic lifer and pension community, who have likely been the min driver of the recent curve flattening.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.