-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessLooking At The Setup Into CPI

U.S. CPI provides the immediate event risk for broader markets.

- A downside surprise would likely provide a more notable market reaction than an upside surprise given the well-documented fear re: inflationary pressure. For deeper insight surrounding the release please see our full preview.

- U.S. Tsy market positioning also points to the potential for a greater market reaction if the CPI data disappoints.

- The latest J.P.Morgan Tsy client survey revealed a slight moderation in overall net shorts (from the recent multi-year extremes) in the week ending 7 Feb, even as global core FI markets sold off on the back of hawkish turns from the BoE & ECB, in addition to a firmer than expected NFP report. The short covering theme seemingly carried through Wednesday’s 10-Year Tsy supply, which was very well received. Still, net shorts remain stretched in a historical sense.

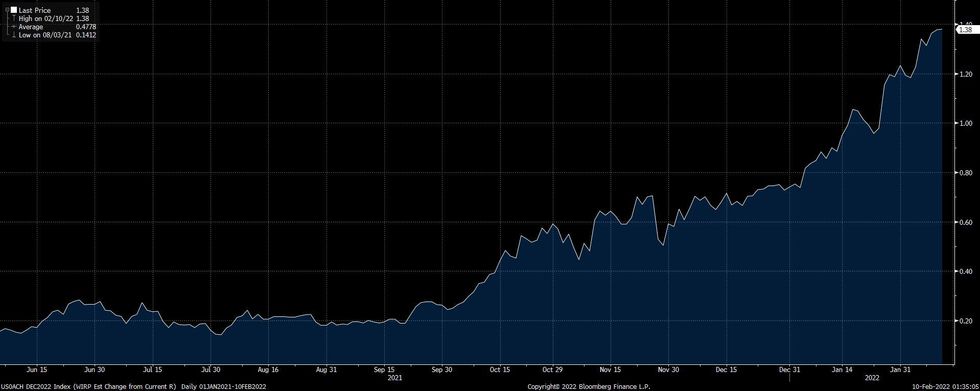

- A quick reminder that there has been a swift repricing of Fed hike expectations in recent months after the Fed’s late ’21 pivot and persistent upside inflationary pressure.

- OIS markets currently price ~32bp of tightening for the March FOMC (recent Fedspeak has downplayed the odds of a 50bp hike at that meeting, although some regional Fed Presidents have noted that a 50bp rate hike could be on the table further down the line, inflation-dependent), with a cumulative ~138bp of tightening i.e. ~5.5x 25bp rate hikes, priced by the end of the year.

- Bank of America probably have the most aggressive sell-side view on the matter, looking for 7 hikes during ’22.

- The sell-side and market views are much more aggressive than the Fed’s base case. The latest Fed dot plot (produced in Dec ’21) revealed median expectations of 3 hikes in calendar ’22, although some of those that fell in line with the Fed median have outlined hawkish risks to their views in recent weeks.

Fig. 1: FOMC Dec ‘22 Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

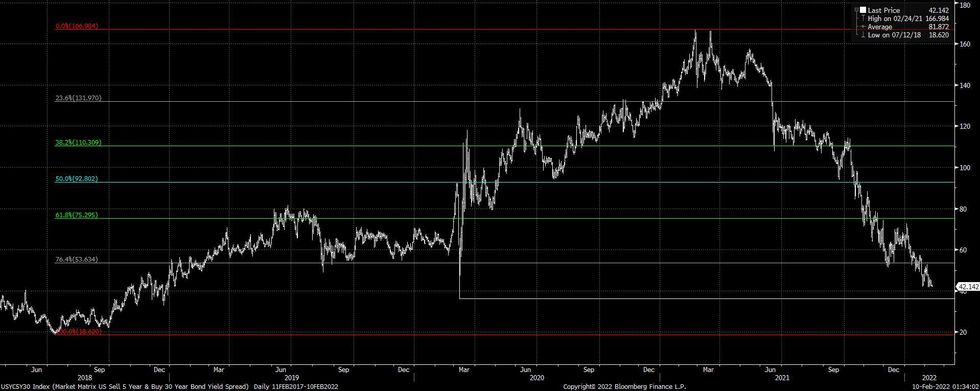

- Zooming out, the 5-/30-Year yield spread operates just above the recent flats. An upside surprise in the CPI release may open the way towards the ’20 COVID vol flats (36.3bp). Through there, the ’18 flats sit nearly 25bp below current levels.

- 2.00% in 10-Year Tsy yields presents the obvious psychological hurdle in benchmark outright yields in the case of a fresh leg lower in the broader Tsy market. 10s currently yield ~1.93%, operating a touch shy of their recent ~1.97% peak. Note that 10s haven’t traded above 2.00% in yield terms since Aug ’19.

Fig. 2: U.S. 5-/30-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.