-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMacro Impact Of Debt Limit Bill Looks Modest (2/2)

Overall, the macro impact from the debt limit bill looks limited, apart from relieving uncertainty over the prospect of a near-term US debt default.

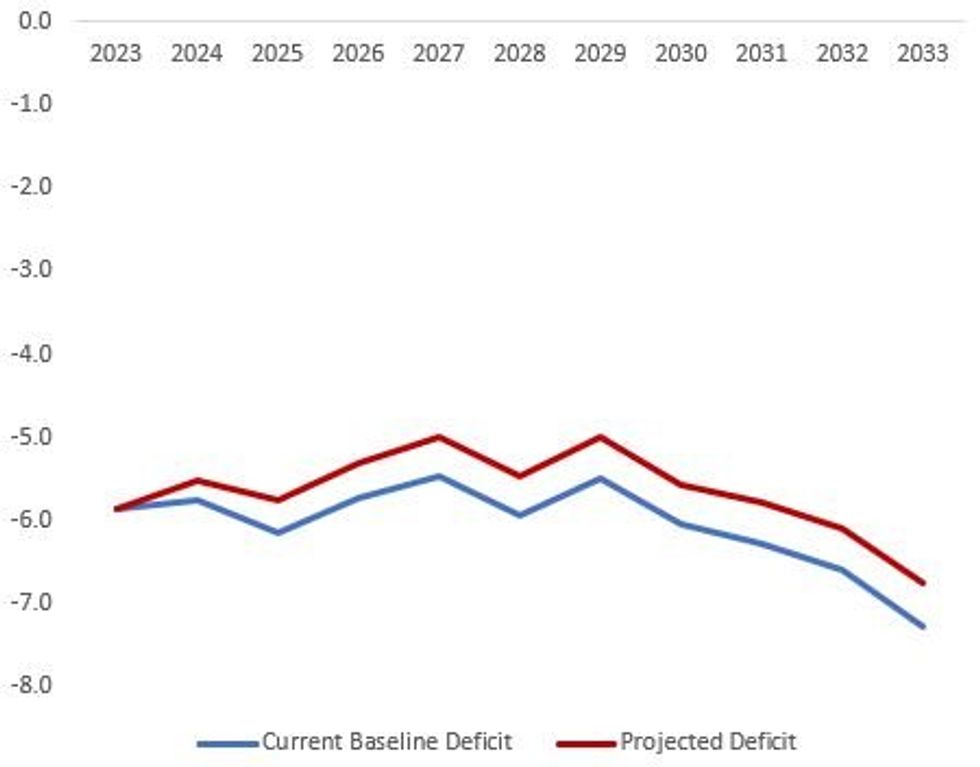

- The GDP equivalent deficit reduction in 2024 will be on the order of 0.2-0.3% of GDP lower vs baseline, growing slightly over the next decade in part due to lower implied debt servicing costs - see chart.

- To put that in context - over a decade, the cumulative deficit reduction in nominal dollars of $1.5T compares to nominal cumulative GDP projected at $332T, so about 0.45% GDP, and the 2023 deficit estimated at 5.9% of GDP.

- Another basis of comparison is the 2011 debt limit agreement which reduced deficits by $2T - that led to a projected 0.7% of GDP deficit reduction in 2012.

- They key macro impact of the deal in the short term is likely to come from the deal's cementing the end of federal student loan forbearance by Aug 30. This has no impact on the fiscal deficit projections because it had already been assumed by the CBO, and student debt relief had probably been likely to end by the fall anyway.

- But the end of forbearance will drag on consumer spending via a reduction in disposable personal income by a mostly high-spending-propensity demographic. There could be a sudden impact as well in September as debt repayments start back up (we've seen estimates of the average monthly forbearance at $250-400 per month per impacted borrower).

- For example: JPM estimates the spending reduction impact at 0.1% of GDP, though GDP could be hit at 0.25-0.5% quarterly annualized in a short period of time.

Annual Deficits As % of GDPSource: CBO, MNI

Annual Deficits As % of GDPSource: CBO, MNI

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.