-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessWeak Demand Weighs On Manufacturers, But Waning Prices May Bring Relief

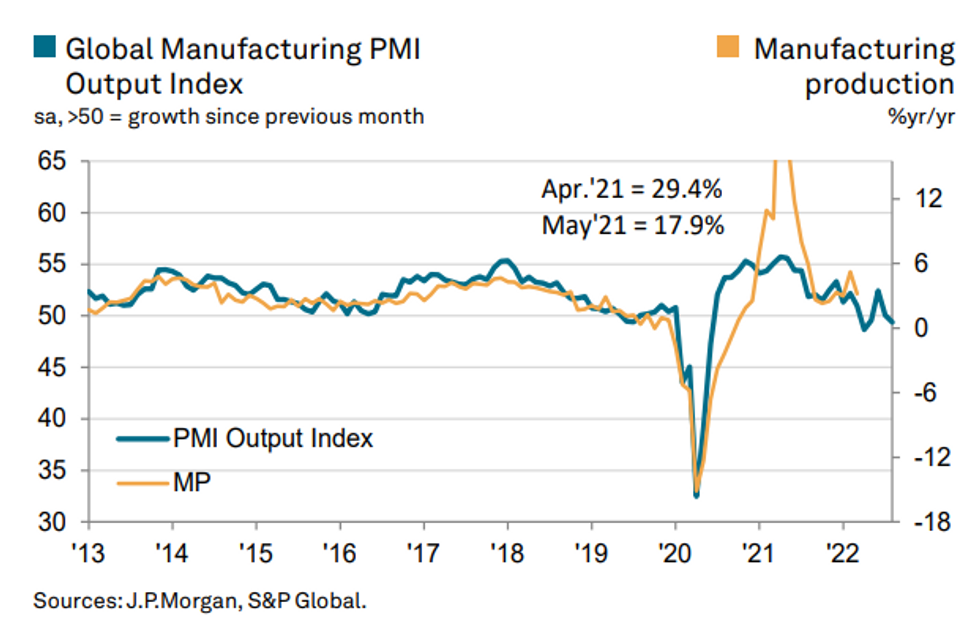

Several themes emerge from August's Global PMI data - and point to a weak near-term outlook for manufacturers, but some light at the end of the tunnel if and when inflationary pressures ease.

- Firms are pricing in slow demand into the year end as global inflationary pressures chip at consumer spending. New orders saw a sharp fall due to waning demand across the Eurozone, UK, US and Japan, whilst remaining robust in Australia.

- This will continue to weigh on overall output. Eurozone manufacturing output is already falling at the fastest pace since mid-2020, adding to recessionary fears.

- Cooling inflationary pressures across the surveys imply that August CPI data could show prices growth slowing, after several countries posted another round of surprisingly hot prints in July. This effect appears more delayed for Australia, where output costs are yet to ease.

- Optimism is improving (albeit still low) in the Eurozone, though have fallen further in the UK. Improvements in the Eurozone were largely underpinned by slowing prices which were expected to bolster future consumer purchasing power. However, energy prices and gas scarcity as a result of the Ukraine war remain of key concern (particularly in the EU).

- Australian manufacturing remains robust with new orders and production continuing to grow, albeit at a softer pace. The August ISM US PMI out Thursday - which was met with a hawkish market reaction - highlighted an expansion in new orders. But in this regard, the ISM PMI wasn't in line with the S&P PMI, which recorded falling orders.

Source: JPM, S&P

Source: JPM, S&P

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.