-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMarketable Borrowing Preview: Q4 Ests Set To Be Lowered (1/3)

Treasury's quarterly refunding process begins Monday with the announcement of marketable borrowing requirements (scheduled for 1500ET release). On Tuesday, MNI will publish our full preview of Wednesday's refunding announcement, which will include expectations for Tsy issuance sizes. In the meantime, today's release will provide a guide to how much bigger those auctions might be.

- We go through the arithmetic on the expectations below, but to summarize: if we get marketable borrowing estimates meaningfully above $800B for each quarter, and/or $1.5T for both quarters combined, that will probably be considered hawkish.

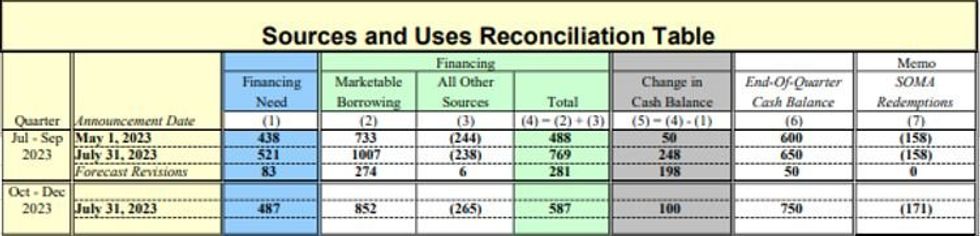

The general expectation is that the Oct-Dec borrowing requirements are expected to be similar and if not, revised downward from August's refunding announcement expectations (see table below). Some expect the higher-than-anticipated tax take in October - which was due to delayed tax payments for some states due to weather-related incidents - and other idiosyncratic factors such as the resumption of student loan payments, to mean a lower financing requirement for the current quarter, having increased the financing requirement for the Jul-Sep quarter. A higher-than-forecast for End-Sep TGA cash levels also implies a lower financing requirement.

- However, Jan-Mar borrowing estimates will be published for the first time, and there is significant disagreement over what Treasury will guide.

- Overall the projected borrowing requirements are expected to set up another "gradual" increase in Treasury auction sizes in the coming quarters, with the upcoming round similar to August's upsizing.

To recap the numbers from the last announcement on Jul 31 (ahead of the Aug 2 refunding) (link here): Treasury announced it expected to borrow $1.007T in the Jul-Sep quarter with an end-Sept cash balance of $650B; and $852B in Oct-Dec with an end-Dec cash balance of $750B.

- The Jul-Sep estimate was $274B higher than had been foreseen in the previous quarter, owing to the debt limit-depleted cash balance to start the quarter ($148B lower than had been anticipated), higher projected end-Sept end-quarter cash balance (by $50B), and lower fiscal revenue/ higher outlay expectations ($83B impact).

- The $1T figure was well above analyst estimates of roughly $800B and triggered a hawkish reaction.

Source: Treasury's Jul 31 Statement

Source: Treasury's Jul 31 Statement

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.