-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ECB Preview – October 2020: Ahead of Events, Or At Their Mercy?

- The ECB must decide whether to wait until the December meeting to get over the hump of upcoming event risks and ascertain the impact of the recent tightening of social restrictions, or act now to ward off intensifying headwinds to the fragile recovery.

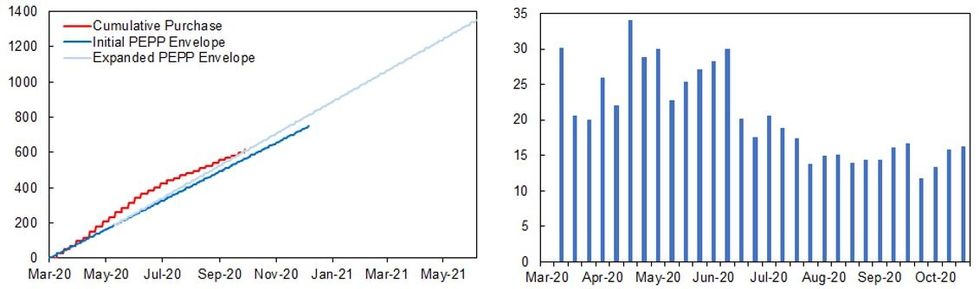

- On balance, the ECB is likely to hold fire for now and instead pave the way for further easing in December when there will be more clarity on economic conditions and risk outcomes. The considerable amount of capacity left in the expanded PEPP envelope further strengthens this baseline scenario.

- Nonetheless, the risk of further policy easing in October is non-negligible The coronavirus crisis is moving faster than policymakers are able to divine the associated economic impacts, elevated uncertainty risks becoming self-fulfilling and the inflation path is under grave threat.

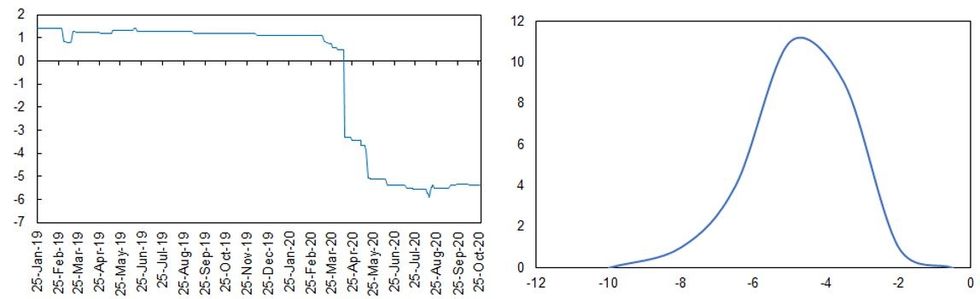

Aside from the difficulties of getting an accurate read on economic conditions - particularly since the recent rapid tightening of social restrictions will be felt immediately but only show up in the economic data with a lag – the list of risk events that is clouding the economic outlook are considerable. The outcome of the US election, the prospect of a post-Brexit trade deal, the scale and impact of a second coronavirus wave and 2021 budget plans provide plenty for the ECB to chew over, and further suggests that the GC will hold fire until December when there is greater visibility on these issues.

Fig 1. Bloomberg Consensus Eurozone Q4 GDP Forecast, % Y/Y (History, LHS / Distribution, RHS)

Source: MNI/Bloomberg

Nonetheless, there is still a non-negligible risk of policy action at the October meeting. The coronavirus crisis is a fast-moving headwind for the economy and policymakers do not have the luxury of time in assessing its impact on the economy. However, we do know from the experience during the first wave that lockdown measures can paralyse whole industries and have a devasting impact on economic activity. Although policymakers are now opting for more localised restrictions, rather than blanket national shutdowns, any tightening of the pandemic measures will significantly dampen economic activity and undermine the ECB's baseline forecast. The uncertainty itself risks becoming self-fulfilling if the threat of lockdowns further restrains consumer and investment spending. As such, waiting until December before adjusting the policy stance again is not without risk.

Fig 2. PEPP Purchases, EURbn (Cumulative, LHS / Weekly, RHS)

Source: MNI/Bloomberg

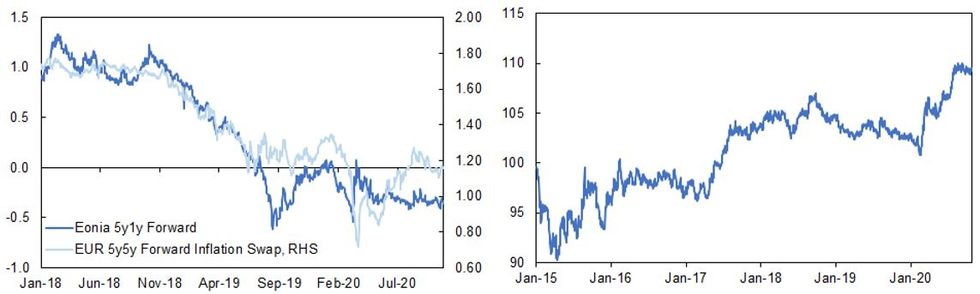

The current inflation path is also a serious concern. Although the Governing Council acknowledge that inflation will remain in negative territory in the coming months as a result of the contraction in economic output, the previous decline in energy prices and temporary VAT cuts in Germany, most still expect inflationary pressure to build as the economy rebounds (nonetheless, the official forecast pegs inflation below target over the medium-term). However, the enormous uncertainty around the economic trajectory, the mounting risks to the recovery in the face of tightening social restrictions and the risk of inflation expectations becoming unanchored pose severe risks to the baseline. Some members of the GC, including Lagarde, have pointed to global supply chain restructuring as a possible inflation-positive development. While the services sector has adjusted quickly to the pandemic and the digitalisation shift has accelerated, onshoring production and restructuring industrial supply chains will take much longer.

On the assumption that the ECB remains cautious of further easing just now, a policy shift at the December meeting becomes more likely. The ECB has repeatedly articulated the primacy of the PEPP facility in combating the economic impacts of the pandemic, and this is likely to be the first port of call for a new easing package. A EUR250-500bn expansion to the PEPP envelope, an extension of the purchasing programme until end-2021, an extension of the reinvestment window and additional TLTROs on easier terms, are the most likely policy levers that the ECB would choose to pull. Although further deposit rate cuts remain in the toolkit (internal research at the ECB suggests that policy rates are still some way off the reversal rate), there appears to be little appetite for further cuts just yet.

Fig 3. Eonia 5y1y Forward & EUR5y5y Forward Inflation Swap (RHS) and EUR Effective ER

Source: MNI/Blomberg

Finally, it should be noted in the context of currency appreciation concerns at the September meeting that the GC has since become more vocal in addressing the issue of euro strength. While the technocratic stalwarts at the ECB continue to stress that the exchange rate is an input to the reaction function and not a policy target, others have more explicitly linked recent weak inflation (in part) to exchange rate developments. It seems more likely that the path of the euro matters more than its trading level (a notion that has been expressed by members of the GC), with sharp sustained appreciation likely to cause the most concern. With that in mind, the loss of momentum in the euro since the summer will provide some relief and significantly lowers the probability of a policy response.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.