-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI MARKET ANALYSIS: PBoC's Targeted Actions Match Targeted Rhetoric

The past few weeks have heralded a turn for the PBoC in terms of its day-to-day liquidity provisions (see MNI Analysis: Noise From The Chinese Money Markets for further colour on developments around the end of January), with everyday monetary policy becoming more prudent, in line with the central bank's well-versed rhetoric.

As a reminder, the Bank's recently released Q420 monetary policy report reiterated that it will maintain prudent monetary policy settings, making flexible and precise adjustments, while avoiding sharp changes to ensure a balance between the economic recovery and risk prevention i.e. keeping an eye on broader based leverage and/or the formation of bubbles. The Bank stressed that its liquidity operations must be accurate and effective in order to maintain sufficient liquidity without flooding the market. Many suggested that the report underscored the idea that the PBoC will continue to take incremental steps away from its post-COVID monetary settings.

Still, as we have highlighted previously, we would suggest that incremental tightening as opposed to normalisation is more of the issue for money markets to contend with here.

The marginal demand for physical cash ahead of the Lunar New Year break (which got underway today) was seemingly more limited than usual given the COVID related travel restrictions in place in China at present. This allowed the central bank to be more hands off in terms of its regular open market operations, often disappointing broader market expectations in terms of liquidity provisions, whether that was via smaller than expected net injections or even net drains of liquidity. Also of note, the central bank didn't deem it necessary to employ an early MLF injection to meet liquidity needs ahead of the Lunar New Year.

The PBoC's adoption of a more laissez-faire approach on that front, combined with several record daily levels of net capital outflows from the mainland via the southbound leg of the Hong Kong-China Stock Connect scheme and income tax payments provided a tightening impetus.

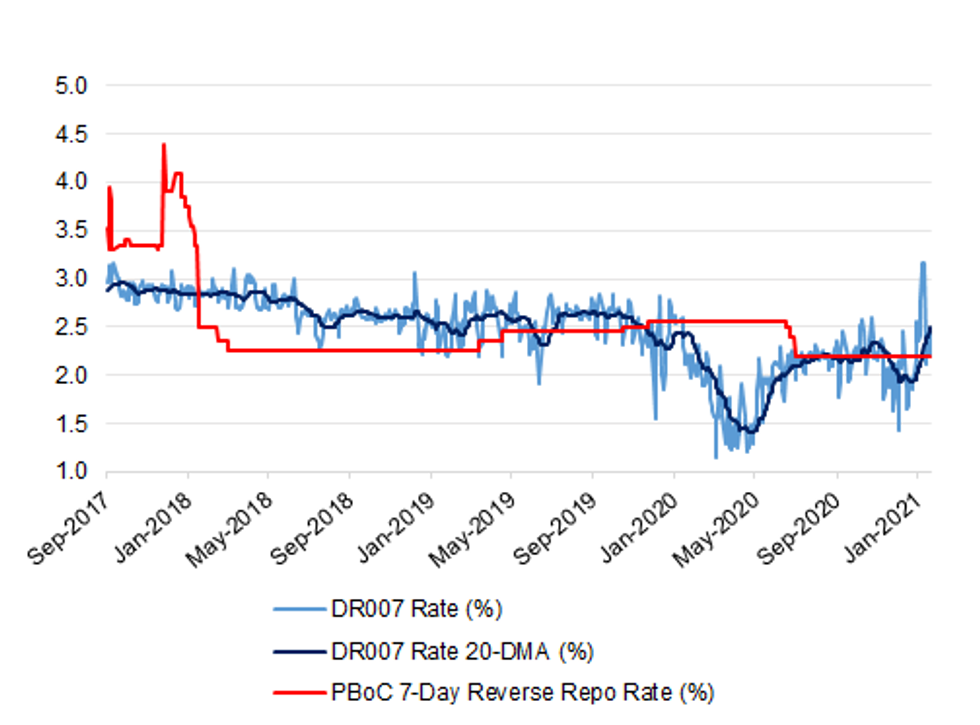

What was the ultimate net impact? Very little in the grand scheme of things, outside of some intraday volatility in short-end rates, with the focal point there proving to be overnight repo rates. The 20-day moving average of the weighted DR007 rate (the 7-day repurchase rate for depositary institutions) moved higher, but this shouldn't be seen as an issue as intraday movements in that benchmark have partially retraced, anchoring to the interest rate applied to the PBoC's 7-day reverse repo operations, in line with the central bank's aim. It is also worth highlighting that the metric came off of a low base, with the 20-DMA of the measure operating below the PBoC's 7-day reverse repo rate for the bulk of the last year or so (the aim of this was to facilitate the post-COVID recovery and ease concerns surrounding bond defaults in H220).

Fig. 1: Weighted DR007 Rate Vs. PBoC 7-Day Reverse Repo Rate

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Looking ahead, we should expect the PBoC to maintain ample liquidity as it continues to promote the deleveraging of the broader economy, while confronting well-documented risks, which include, but are not limited to: potential equity and property market bubbles, non-performing loans, corporate bond defaults (including those at SoEs) and shadow banking usage.

The powers that be are more than aware of the need for a gradual weaning off of the plentiful liquidity backdrop that many investors have become accustomed to, while they will still want to provide underlying support for the real economy, which includes maintaining fertile ground for the central policy of dual-circulation.

The latest instance of reassuring tones came via Tuesday's edition of the state-run Shanghai Securities News, which highlighted the need for the PBoC to ensure interbank liquidity after the Lunar New Year holiday period as a slew of business debts, monetary instruments and bonds mature in March and April.

We would suggest that the PBoC is likely to continue to deploy marginal liquidity injections to counter any meaningful deviations between the DR007 rate and the interest rate that it applies to 7-day reverse repos, while gradually withdrawing longer term liquidity provisions that it deems excess to requirements. Bigger picture, it would seem that any lingering chances of a cut to the broad or targeted reserve requirement ratios have receded further, with policymakers apparently content with China's economic trajectory at present.To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.