-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI Analysis: What Now For Japanese Investors Looking Offshore

Japanese investors have been net buyers of foreign bonds for 5 consecutive weeks (based on data from the Japanese Ministry of Finance). While the weekly purchase sizes have not been particularly large in outright terms, the direction of net flows is at least consistent. Japanese investors have also been net sellers of foreign equities in 4 of those 5 weeks, pointing to the potential for at least a degree of maintenance re: target asset weights within portfolios among the data.

Still, even when we adjust for sales of foreign equities, Japanese investors have allotted a net ~Y2.4tn to foreign assets over the aforementioned 5 weeks (per the MoF data), all of which has flowed into bonds.

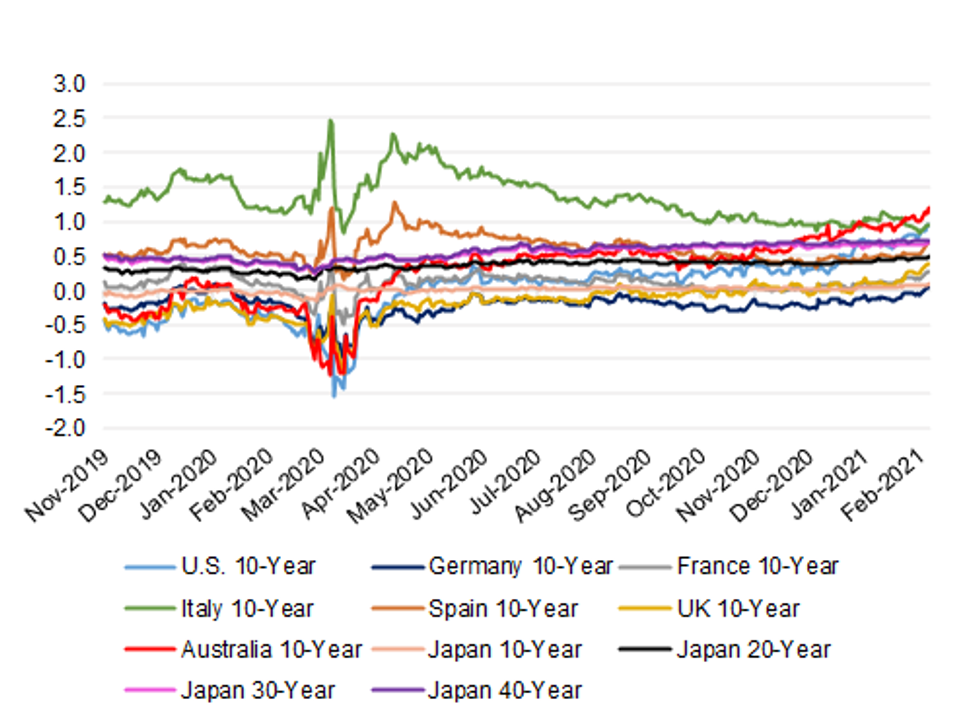

A quick look at the FX-hedged yield backdrop for Japanese investors shows that the ECB/Draghi inspired decreditisation of BTPs and recent run of momentum behind the reflation trade leaves Australian 10-Year government bonds as a particularly attractive investment vehicle for Japanese investors.

The same holds true in FX-unhedged terms, which is particularly important given that the sell-side points to widespread FX-unhedged positioning out of Japan when it comes to Australian assets.

Fig. 1: 3-Month Annualised Rolling FX-Hedged Yields From the Perspective Of A Japanese Investor

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

| FX-Hedged Yield (%) | Conventional Yield (%) | |

|---|---|---|

| U.S. 10-Year | 0.9362 | 1.3006 |

| German 10-Year | 0.0380 | -0.3490 |

| France 10-Year | 0.2693 | -0.1180 |

| Italy 10-Year | 0.9573 | 0.5720 |

| Spain 10-Year | 0.6802 | 0.2930 |

| UK 10-Year | 0.3910 | 0.6210 |

| Australia 10-Year | 1.2123 | 1.4080 |

| Japan 10-Year | 0.0950 | |

| Japan 20-Year | 0.4900 | |

| Japan 30-Year | 0.6860 | |

| Japan 40-Year | 0.7270 |

On that note, the AUD/JPY uptrend in play since March '20 will be providing a layer of insulation to any FX-unhedged Japanese investments in Australia, although the recent outright cheapening and potential for the reflation trade mantra to extend may have some looking to the exits, and limit further offshore bond investments to portfolio adjustments, at least in the immediate term. The reflation-based trade mantra may also limit any Japanese flows into the broader international credit space.

In terms of confirmed flows, 2020's record annual round of net investment from Japanese investors into Australian fixed income assets is well documented, although net purchases tapered off towards the end of the calendar year, while Japanese net investments into Italian and French fixed income ticked higher in December.

Japan's balance of payments data will come under scrutiny over the coming months, as participants will want to see if the Japanese investor base has contributed to the latest round of tightening of Italian BTPs against their European counterparts.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.