-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN

EXECUTIVE SUMMARY:

- MNI DECEMBER FED PREVIEW: REASONS TO WAIT

- CONGRESS REACHES OMNIBUS SPENDING BILL DEAL (BBG)

- MNI EXCLUSIVES ON U.S. FISCAL TALKS AND BREXIT NEGOTIATIONS

- TENSIONS SIMMERING ONCE AGAIN BETWEEN INDIA AND CHINA IN HIMALAYAS

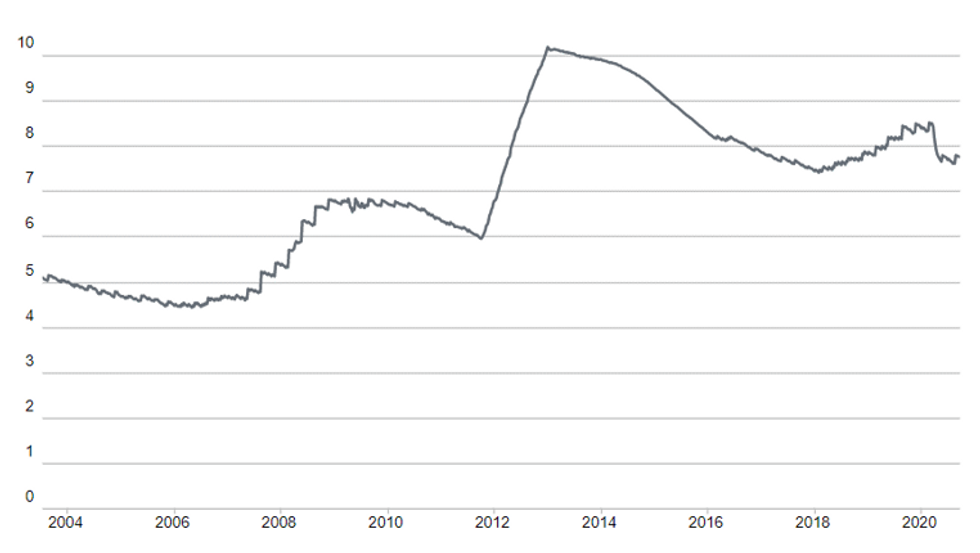

Fig. 1: Will The Fed Extend Portfolio Duration? (Weighted Avg Maturity of Tsy holdings, in Years)

NY Fed

NY Fed

FED (MNI): The FOMC is likely to adopt new guidance on asset purchases at the December FOMC, but will fall short ofadjusting its purchase program in either scope or size, preferring to wait for further clarity over the outlook before taking such a step.

While an increase in the weighted average maturity of the Fed's asset purchases is not the consensus outcome from this meeting, it is expected by some market participants - setting up the potential for a mildly hawkish disappointment on Wednesday.

FOR FULL PDF PREVIEW USE THE FOLLOWING LINK:

https://roar-assets-auto.rbl.ms/documents/7672/Fed...

U.S. FISCAL: Bloomberg reports citing congressional aides that lawmakers have reached a compromise on a funding provision for Veterans Affairs, unlocking a deal to an overall omnibus spending bill agreement.

* Fairly minimal market reaction to this news - it is yet to be officiallyagreed and even if it were, there has been broad expectation that a dealwould finally be reached, averting a government shutdown on Dec 18.* That said, if agreed, it would remove a negative tail risk from the near-termoutlook. But focus is still on the COVID bipartisan stimulus package -with which the omnibus was due to be paired - with details expected to be unveiled at 1600ET.

MNI EXCLUSIVE: MNI speaks to former officials about the odds of a fiscal deal and the benefits of acting this week, on MNI Policy Main Wire and email now.

MNI EXCLUSIVE: MNI sources latest on the Brexit talks - On MNI Policy MainWire now, for more details please contact sales@marketnews.com

TECH: According to an Axios Tweet: The FTC will announce it's launching a new inquiry into the privacy and datacollection practices of major tech firms including Amazon, TikTok owner ByteDance, Twitter, YouTube and Facebook as well as its subsidiary WhatsApp.

INDIA-CHINA: Following a border skirmish that say Sino-Indian tensions in the Himalayas peak in the summer, the Chief of India's Defence Staff General Bipin Rawat has stated that there is 'development work' being carried out by the People's Liberation Army (the Chinese army, PLA) in Tibet, close to the contested border (the line of actual control, LAC) with India. Rawat said: "We are in a standoff situation in Ladakh and based on that thereis some development activity which has been ongoing in Tibet AutonomousRegion of China. Every nation will continue to prepare for ensuring its security based on their strategic interest" Speaking to a domestic audience on Monday, Indian Defence Minister RajnathSingh stated that China's "unprovoked aggression" in both the Himalayas and the wider Indo-Pacific region risked regional instability.

U.K.-E.U.: Journalist at Belgium's Knack magazine tweets: "Breaking: This afternoon leaders of EPP, S&D, Renew and Greens in European Parliament have agreed on not ratifying any brexit deal in 2020. According to @ph_lamberts (Greens) there are 2 options for EP: short period of no-deal or technical prolongation of transition period. As I understand, 'prolongation TP' would take place by signing new agreement for a period of five or six weeks. 'When there is an agreement, atmosphere on both sides will be constructive and UK Government will be pleased to do so', Lamberts says."* As noted in bullet earlier today (see 1027GMT bullet), the European Councillegal service has said the decision of whether to provisionally apply atreaty before ratification belongs to the Council (the leaders of the member states), not the European Parliament.* Should a deal be reached this could create some difficulty between Counciland Commission (in favour of getting deal in place ASAP) and the Parliament (which wants its say on any deal).

DATA:

No overnight data of note.

SNAPSHOT: Equities Fade In U.S. Afternoon

Below gives key levels of markets in afternoon NY trade:

- DJIA down 157.42 points (-0.52%) at 29888.95

- S&P E-Mini Future down 11.5 points (-0.31%) at 3642

- Nasdaq up 56.5 points (0.5%) at 12434.38

- US 10-Yr yield is down 0.3 bps at 0.8931%

- US Mar 10-Yr futures (TY) are down 1.5/32 at 138-1.5

- EURUSD up 0.003 (0.25%) at 1.2154

- USDJPY up 0.02 (0.02%) at 103.74

- WTI Crude Oil (front-month) up $0.41 (0.88%) at $46.98

- Gold is down $12.15 (-0.66%) at $1827.69

Prior European bourses closing levels:

- EuroStoxx 50 up 18.12 points (0.52%) at 3526.55

- FTSE 100 down 14.92 points (-0.23%) at 6565.58

- German DAX up 108.86 points (0.83%) at 13270.16

- French CAC 40 up 20.29 points (0.37%) at 5566.44

US TSYS SUMMARY: Recovery From Session Lows, Awaiting Fiscal News

With no data or speakers and few macro events of note, Monday's session had a placeholder feel to it, with the Fed decision Wednesday lying in wait.

- Equities rose after the opening bell and fell continually afterwards, and parallel to this, Treasuries recovered from session lows, and curves came off steepest levels.

- The 2-Yr yield is unchanged at 0.115%, 5-Yr is down 0.6bps at 0.3591%, 10-Yr is down 0.3bps at 0.8931%, and 30-Yr is up 0.6bps at 1.6329%. Mar 10-Yr futures (TY) down 1.5/32 at 138-01.5 (L: 137-23 / H: 138-04).

- Volumes barely set to crack the 1mn for TYs though.

- We continue to await progress on the fiscal front. Though Bloomberg cited congressional aides as saying an omnibus spending bill is close to being agreed, this did not move the market at all, with most/all continuing to await further details on COVID stimulus negotiations.

- MNI's just published our December FOMC preview - let us know if you haven't received it.

- A little more data coming Tuesday, with industrial production the highlight.

USD LIBOR FIX

US00O/N 0.08250 -0.00075

US0001W 0.09825 -0.00113

US0001M 0.15313 -0.00550

US0003M 0.21925 0.00275

US0006M 0.24713 -0.00162

US0012M 0.33488 -0.00100

New York Fed EFFR for prior session (rate, chg from prev day)

- Daily Effective Fed Funds Rate: 0.09%, no change, volume: $51B

- Daily Overnight Bank Funding Rate: 0.08%, no change, volume: $155B

REPO REFERENCE RATES (rate, change from prev. day, volume):

- Secured Overnight Financing Rate (SOFR): 0.08%, no change, $885B

- Broad General Collateral Rate (BGCR): 0.06%, no change, $357B

- Tri-Party General Collateral Rate (TGCR): 0.06%, no change, $338B

NY Fed Operational Purchase

Fed buys $1.732bn of 20-30Y Tsys, of $3.92bn submitted.

Next operations (2x Tuesday):

- Tue 12/15: 2.25-4.5Y, ~$8.825bn

- Tue 12/15: 7-20Y, ~$3.625bn (1100-1120ET)

FOREX: CAD Reverses Course on Oil Drop

After a decent start to the week, WTI and Brent futures reversed into the NYMEX close, undermining early CAD strength and pressuring the currency to the bottom end of the G10 table. Weight went through in WTI and Brent crude futures following OPEC's outlook update in which they see daily global fuel demand dropping by around 1mln barrels per day across the first quarter of next year.

GBP was among the strongest currencies Monday, as markets welcomed the decision to extend trade deal negotiations as a sign that middle ground can be met before the end of the transition period on Dec31. Betting markets now see a trade deal as the odds-on outcome.

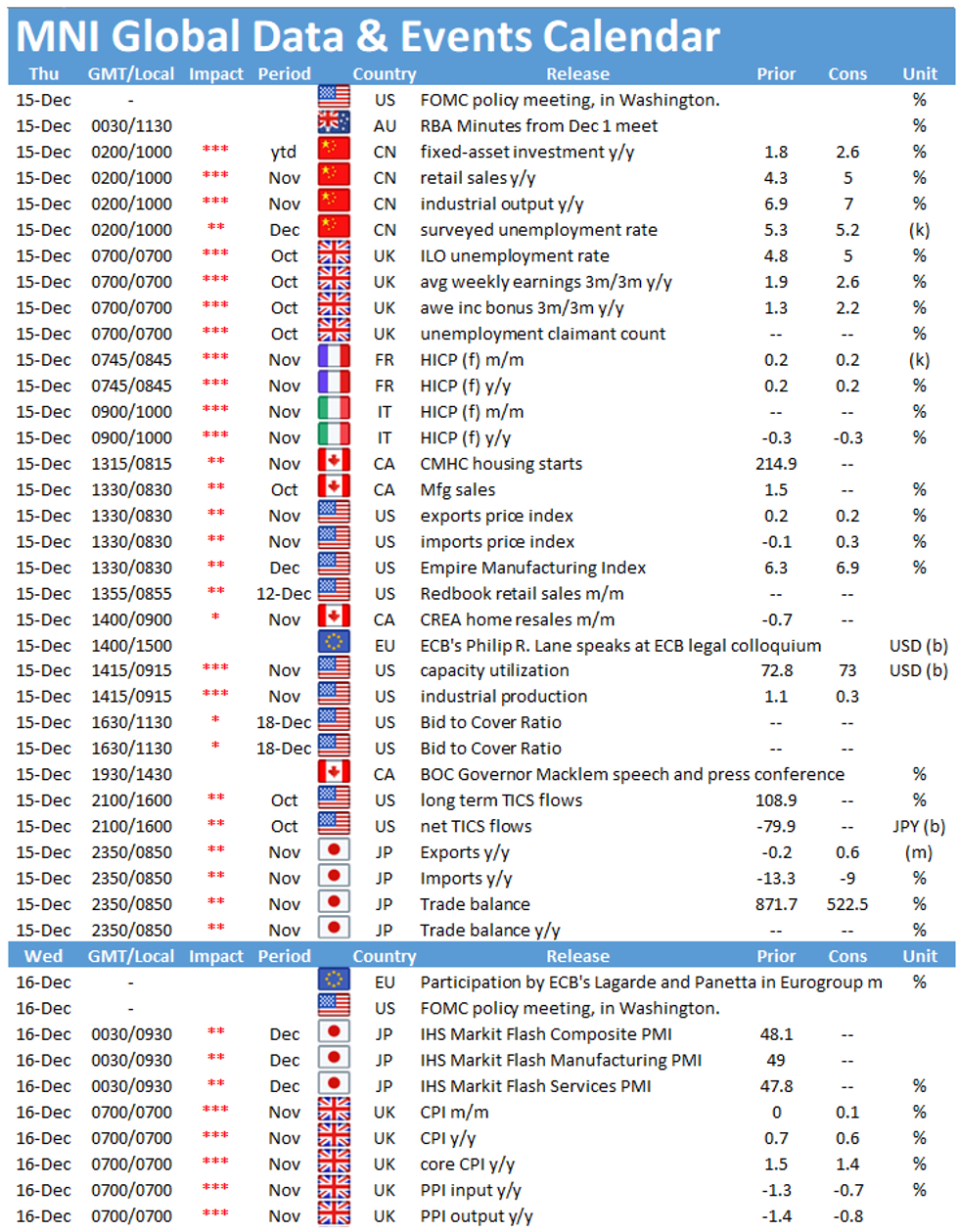

Chinese industrial production & retail sales data are due Tuesday as well as the UK jobs numbers for November. US import/export price indices and industrial production numbers also cross.

EGBs-GILTS CASH CLOSE: Renewed Brexit Optimism Sinks Gilts

Gilts sold off on yet another Brexit deal deadline extension (reversing Friday's pessimism to some degree), though yields fell from session highs, while EGBs largely saw range trading Friday.

- The UK and German curves bear steepened, while periphery spreads tightened.

- After little data today, Tuesday kicks off with UK labor market data. ECB's Rehn speaks in the morning, but all attention is on Brexit and Thursday's BoE decision.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.2bps at -0.771%, 5-Yr is up 1.4bps at -0.798%, 10-Yr is up 1.6bps at -0.62%, and 30-Yr is up 2.7bps at -0.212%.

- UK: The 2-Yr yield is up 2.3bps at -0.089%, 5-Yr is up 3.4bps at -0.061%, 10-Yr is up 5bps at 0.222%, and 30-Yr is up 4.9bps at 0.762%.

- Italian BTP spread down 3.3bps at 116.1bps

- Spanish bond spread down 1.5bps at 62.3bps/Portuguese down 1.7bps at 58.1bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.