-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI ASIA MARKETS ANALYSIS - Can't Bully Senate For Stimulus

US TSY SUMMARY

Rates finishing higher after a weaker start, modest risk-on unwind tone for the last full trade session of 2020.

- Late stimulus headlines lending to risk-off move: Sen majority leader McConnell "SENATE WON'T BE `BULLIED' INTO MORE AID CHECKS; WON'T BREAK UP THREE TRUMP DEMANDS."

- Futures bounce back to steady/mixed levels midmorning, volume spike in TYH1 over 38,000 on move from 137-28 to -30.5 pushing TYH1 volume up to 285k at the time (635k late). Not data related (PMI better than expected at 59.5 vs. 56.0 est) and unlikely related to confirmation that "huge swaths of England moving to tier 4, lockdown. Bid more likely month/year end allocations again -- similar gap trade on volume spike same time Tuesday.

- Couple large block buys in March Ultra-bonds contributed to second half rally: +4,655 WNH1 212-11 through 212-02 offer and +2,470 WNH1 at 212-28 through 212-21 offer.

- The 2-Yr yield is unchanged at 0.125%, 5-Yr is down 1bps at 0.3687%, 10-Yr is down 1.3bps at 0.9231%, and 30-Yr is down 1.6bps at 1.6589%.

MONTH-END EXTENSIONS: Updated Bloomberg-Barclays US Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2019. TIPS -0.03Y; Govt inflation-linked, -0.04. Note MBS extension climbs to 0.14Y from 0.09 in preliminary.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.09 | 0.07 |

| Agencies | 0.08 | 0.06 | 0.09 |

| Credit | 0.07 | 0.09 | 0.07 |

| Govt/Credit | 0.07 | 0.09 | 0.07 |

| MBS | 0.14 | 0.05 | 0.09 |

| Aggregate | 0.08 | 0.08 | 0.06 |

| Long Gov/Cr | 0.07 | 0.09 | 0.06 |

| Iterm Credit | 0.05 | 0.08 | 0.06 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.08 | 0.06 |

| High Yield | 0.08 | 0.08 | 0.09 |

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00175 at 0.08563% (+0.00463/wk)

- 1 Month -0.00275 to 0.14400% (-0.00113/wk)

- 3 Month -0.01638 to 0.23750% (-0.00263/wk)

- 6 Month +0.00237 to 0.25950% (-0.00713/wk)

- 1 Year +0.00113 to 0.34238% (+0.00200/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $69B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $154B

- Secured Overnight Financing Rate (SOFR): 0.10%, $945B

- Broad General Collateral Rate (BGCR): 0.08%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $325B

- (rate, volume levels reflect prior session)

Updated NY Fed operational purchase schedule, $40.2B from 1/04-1/14

- Mon 1/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 1/05 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 1/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options

- +2,500 Blue Jun 90/92/93 broken put trees, 1.25

- +5,000 Mar/Jun 99.75/99.812 1x2 call spd strip, 4.25

- +2,500 Blue Apr/Blue Jun 93 straddle spds, 6.0

- +11,200 Blue Mar 92 puts, 3.0

- -1,250 Mar 96/97 2x1 put spds, 0.0

- +5,000 TYG 137/139 put over risk reversals, 2

- 1,500 TYG 137.75/138.5 1x3 call spds, 3 net 3-legs over

- 1,500 TYH 136.5/TYG 137 put spds,

- +1,700 USH 177 calls, 41

- -1,600 FVH 126 puts, 13

- +1,00 FVH 125.75 calls, 31.5-32.5

- -1,000 TYH 138.5 calls, 26

- +2,500 wk3 TY 136.75/137.5 2x1 put spds, 6

EGBs-GILTS: Summary

Waiting for Tiers and School Clarity in the UK. With a lack of liquidity we have had an up and down day, but at the time of writing are almost exactly where we started after a sell-off this morning.- The UK House of Commons has approved the Brexit deal today by a large margin. The vast majority of opposition MPs have voted in favour of the deal on the premise that any deal is better than no deal and there is of course no time to renegotiate anything at such a late stage.

- Attention now turns to the new Covid-19 tiers (which Health Secretary Matt Hancock is due to release shortly) and the announcement of whether the plan for schools to go back for the new term will change. The previous plan was for primary schools to return as normal on 4 January with pupils in exam years in secondary schools back the same day but with other year groups in secondary schools starting a week later.

- More of the UK was confirmed to be entering tier 4 lockdown from midnight. Now over 75% of the English population will be in tier 4 with the vast majority of the rest in tier 3. No areas will be in tier 2 and only the Isle of Scilly will be in tier 1. Secondary school openings have been pushed back a further week too (so most pupils will now start their term 2 weeks late). Primary schools will close across much of London and the parts of the South East that are worst affected with school closures reviewed at least every 2 weeks.

EUROPE OPTIONS: Summary

- HUGE Bund Put spread.. But looks like could be a massive miss block:

- RXG1 177/176ps, trades at 23.5 in 100k, done versus futures, 17k RXH1 at 177.68

- ERU1 100.75c vs ERH1 100.75c x2, bought te Sep for 0.5 in 2.5k (2.5k x 5k)

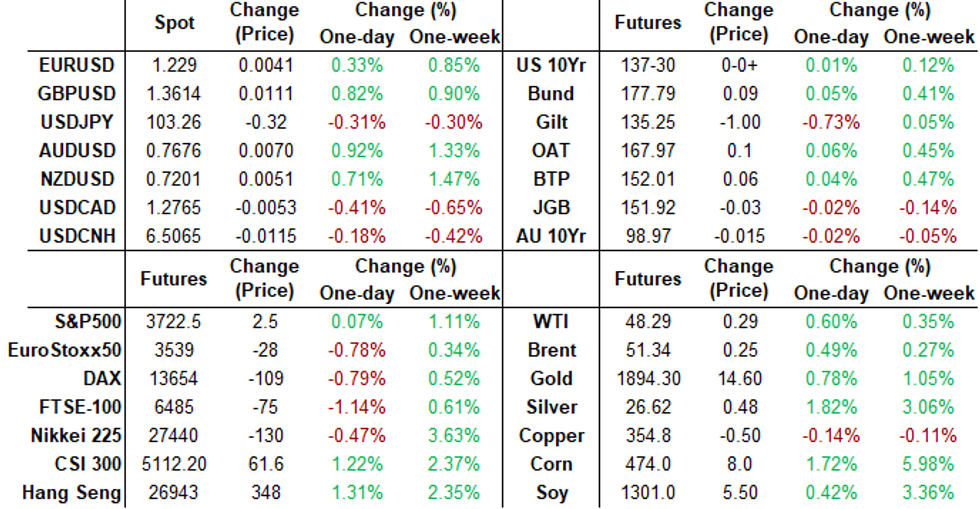

FOREX: US$ On Backfoot

EURUSD tested immediate resistance at 1.2305 1.764 proj of Nov 4 - 9 rally from the Nov 11 low. Some broader base buying went through around 14.00GMT/09.00ET

- The pair has since reversed on ECB Rehn: "We monitor exchange rate developments very closely and we will continue to do so in the future"

- EURUSD is now at 1.2287 at the time of typing.

- Focus this afternoon was on the UK, with Boris winning the first parliament vote on the Brexit deal.

- Matt Hancock stated that stated that the Midlands North East and areas of the North West and the South East have been moved to the highest tier

- Cable has been unaffected with pair trading around 1.3610, on the weaker dollar

FX OPTIONS: Expiries for Dec 31 NY Cut at 1000ET (Source DTCC)

- EUR/USD: $1.2077(E497mln)

- EUR/USD: Jan06 $1.2300(E1bln-EUR puts); Jan07 $1.2155(E1.3bln-EUR puts); Jan11 $1.2295-1.2300(E2.2bln-EUR puts), $1.2310-15(E1.1bln-EUR puts)

- USD/JPY: Jan06 Y104.00($1.1bln); Jan07 Y104.00($1.2bln)

- EUR/GBP: Jan07 Gbp0.8800(E1.1bln-EUR puts)

- AUD/NZD: Jan05 N$1.0485(A$960mln-AUD puts)

EQUITIES: Summary: US Indexes Higher But Paring Gains

US equities higher in late trade but paring gains since midmorning. Asian bourses mixed, European bourses weaker.

- Japan's NIKKEI down 123.98 pts or -0.45% at 27444.17 and the TOPIX down 14.5 pts or -0.8% at 1804.68

- China's SHANGHAI closed up 35.417 pts or +1.05% at 3414.453 and the HANG SENG ended 578.62 pts higher or +2.18% at 27147.11

- The German Dax down 42.6 pts or -0.31% at 13718.78, FTSE 100 down 46.83 pts or -0.71% at 6555.82, CAC 40 down 12.38 pts or -0.22% at 5599.41 and Euro Stoxx 50 down 9.78 pts or -0.27% at 3571.59.

- Dow Jones mini up 53 pts or +0.18% at 30290, S&P 500 mini up 1.75 pts or +0.05% at 3721.75, NASDAQ mini down 3.75 pts or -0.03% at 12836.5.

COMMODITIES: Metals Remain Strong

Gold and Platinum lead metals charge to higher levels again:

- WTI Crude up $0.29 or +0.6% at $48.28

- Natural Gas down $0.01 or -0.53% at $2.432

- Gold spot up $11.92 or +0.63% at $1889.92

- Copper down $0.8 or -0.23% at $354.75

- Silver up $0.25 or +0.94% at $26.451

- Platinum up $16.61 or +1.58% at $1069.35

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.