-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Countdown To Biden Inauguration

US TSY SUMMARY: Ylds Higher Even As Political Risk Remains

Generally muted start to the week: no data Monday, limited early volumes w/Japan out for extended weekend-holiday.

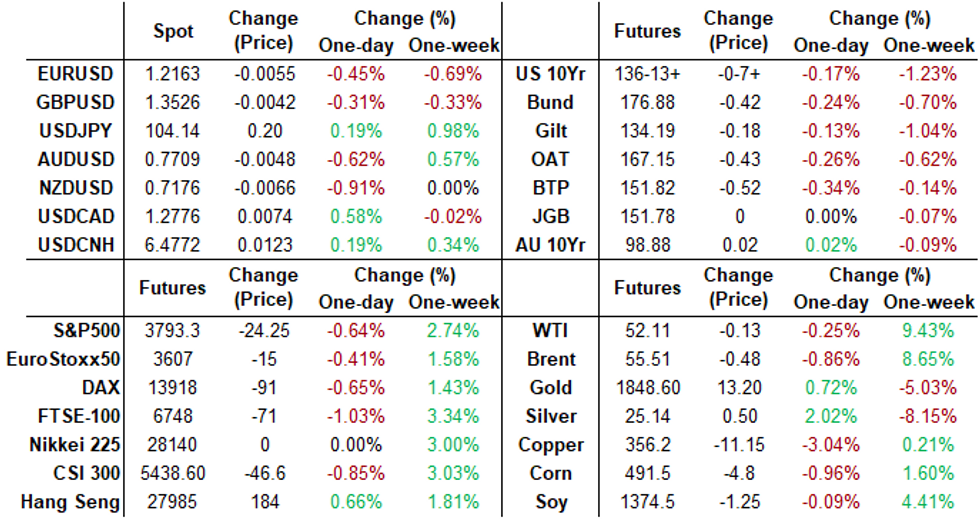

- Tsy futures managed to rack up decent totals by the closing bell, however, TYH1>1.33M futures, as ylds continued to climb (10YY 1.1358% marks March 2020 level) while equities receded as well: ESH1 -23.0 in late trade.

- Headline focus on political risk: "HOUSE TO VOTE TUESDAY ON URGING PENCE TO BACK TRUMP'S REMOVAL" Bbg, after impeachment vote failed to reach unanimous consent Monday. Out late: FBI WARNS OF PLANS FOR ARMED PROTESTS AT 50 STATE CAPITALS:" AP

- Fed speak weighed on equities: Atl Fed Bostic comment that mkts "need to understand Fed policy is open to change" DJ.

- Small tail: US Tsy $58B 3Y Note auction (91282CBE0) drew 0.234% high yield (0.211% last month) vs. 0.230% WI, on a bid/cover 2.52 vs. 2.28 previous.

- Indirects drew 52.20% vs. 49.25% prior, directs 14.57% vs. 15.87% prior, dealers w/ 33.23% vs. 34.88% prior.

- The 2-Yr yield is up 1.2bps at 0.1449%, 5-Yr is up 1.5bps at 0.4978%, 10-Yr is up 1.9bps at 1.1341%, and 30-Yr is up 0.6bps at 1.8797%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00013 at 0.08688% (+0.00912 net last wk)

- 1 Month -0.00038 to 0.12600 (-0.01750 net last wk)

- 3 Month +0.00012 to 0.22450% (-0.01405 net last wk)

- 6 Month +0.00375 to 0.25025% (-0.01113 net last wk)

- 1 Year -0.00275 to 0.32688% (-0.01225 net last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $55B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $154B

- Secured Overnight Financing Rate (SOFR): 0.09%, $992B

- Broad General Collateral Rate (BGCR): 0.07%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $340B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- TIPS 1Y-7.5Y, $2.401B accepted vs. $9.476B submission

- Next scheduled purchases:

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +15,000 Blue Mar 88/90/91 put trees, 0.0

- +105,000 Blue Mar 88 puts, 2.5

- Block, +40,000 Green Jun 93/95/96 put trees, 1.5 vs. 99.58/0.06% at 0958:07ET

- -20,000 Green Jun 87/91/95 put flys, 4.5

- Block, +10,000 Blue Jun 88/96 put over risk reversals, 5.5 at 0922:17ET

- Block +10,000 Blue Mar 90/96 put over risk reversals, 3.0 at 0918:05ET

- Overnight trade

- Block 2,500 Green Dec 91/95 7x4 put spds vs. Green Dec 96 calls (x4), 22.0 net

- +11,000 short Jun 97/-Green Jun 96 call spds, 0.5cr/Green Jun over

- +6,500 Blue Feb 92 straddles, 15.5-16.0

- +4,000 Blue Feb 92/93 2x1 put spds, 0.5

- +2,000 Blue Feb 91/92/93 2x3x1 put flys, 0.0

- Block, +10,000 short May 96/97/98 2x3x1 put flys, 5.0 at 0636:44ET

- Block, -10,000 Green Jun 87/91/95 put flys, 4.5 vs 99.58/0.23% at 0634:22ET

- +5,000 FVG 125.75/126/126.25 call trees, 2

- 5,000 FVG 125.75/126/126.25 call trees, 2

- 6,400 wk3 TY 137.25/137.75 1x2 call spds, 1

- +5,000 USH 172/174 call spds, 16

- -16,000 TYH 135/136 put spds, 15

- 7,300 TYJ 138/138.5 call spds, 4/64

- 2,000 TYG 135/136 put spds, 7

- +2,000 TYG 137/137.5 1x2 call spds, 2

- -1,500 TYH 135/137.5 strangles, 28

- >6,500 TYH 136.5 puts, 36

- +1,000 FVH 124.75/125/125.25 put trees , 0.0

- Overnight trade

- 12,000 TYG 136 puts, 7-8

- 10,500 TYG 136.5 puts, 16-19

- +7,400 TYG 137.5 calls, 5 vs. 136-24/0.08%

- 7,800 TYG 138 calls, 2

- +5,000 TYG 135.5/136.5 put spds, 4

- +4,000 TYG 136.5 puts, 16 vs. 136-21.5/0.42%

EGBs-GILTS CASH CLOSE: Bear Steepening Dies Risk-Off Mood

The German and UK curves bear steepened Monday despite a general risk-off environment (equities lower, BTP spreads wider). Largely following moves in USTs and little in the way of key triggers in Europe.

- BoE's Tenreyro spoke explicitly on applicability of -ve rates in the UK. Arguably increasingly relevant given PM Johnson's comment that more COVID lockdown measures could be put in place, weakening the economy (Chancellor Sunak had little detail on potential relief).

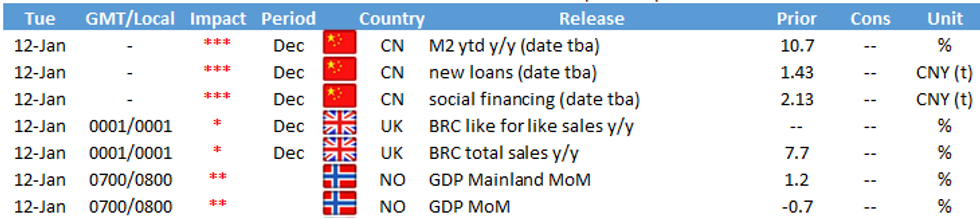

- No key data today, and the supply slate consisted of EFSF syndication of dual 10-/30-Yr tranches. Tuesday sees a very heavy slate, with Netherlands, UK, Austria, Germany all coming to market and likely Belgium 10-Yr syndication as well. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.2bps at -0.699%, 5-Yr is up 1.4bps at -0.716%, 10-Yr is up 2.3bps at -0.496%, and 30-Yr is up 3.6bps at -0.09%.

- UK: The 2-Yr yield is up 1.1bps at -0.117%, 5-Yr is up 1.2bps at -0.032%, 10-Yr is up 2.1bps at 0.309%, and 30-Yr is up 3.3bps at 0.903%.

- Italian BTP spread up 1bps at 106bps / Spain down 0.6bps at 55.4bps

EUROPE OPTIONS: Summary

- Large Sterling Ratio Spds

- DUG1112.30/112.20ps, sold at 3.5 in 2.5k

- RXG1 178/176.50/175p fly, sold at 48.5 in 1.5k

- RXG1 178.00/177.00/176.00 put fly sold at 33 in 1.5k

- RXG1 176.50/175.5/175.00p fly, sold at 9.5 in 1.5k

- ERM1 100.75c, sold at 0.5 in 17k

- LM1 100.00/12/25c ladder, bought for 2.5 in 2k

- LM1 100.12/100.25cs x4 vs 100p, bought for 4.75 in 20k x 5k

- LH1100.00/10025/100.50c flfy vs LM1 100.12/100.37/100.62c fly, sold the March at 0.25 in 2.5k

- LZ1 100.375/100.50/100.625 c1x3x2 bought for 0.25 in 10k

- 2LH1 99.875/99.75 put spread bought for 2.5 in 3.6k

- 3LZ1 99.75/99.875/100.00 c fly, bought for 2 in 40k

FOREX: FOREX: Greenback Bounce Fades Ahead Close

The dollar strengthened throughout the Asia-Pac and European session Monday, with profit-taking and short-covering likely responsible. This price action partially reversed into the US close, with EUR/USD recovering off the earlier lows of 1.2132 and USD/JPY failing to make headway above 104.40.

- Nonetheless, the dollar still rose against most others, while commodity-tied currencies including NOK and CAD slipped.

- Data points and notable speakers were few and far between, leaving currencies to follow the macro picture - namely a modest pullback in equities away from all-time highs and the incoming White House team upon Biden's inauguration on January 20th.

- Focus Tuesday turns to Fed speakers, with Brainard, George and Rosengren due, as well as BoE's Broadbent and ECB's de Cos.

FX OPTIONS: Expiries for Jan 12 NY Cut 1000ET (Source DTCC)

- EUR/USD: Jan19 $1.2000(E1.0bln), $1.2190-1.2200(E4.0bln-EUR puts), $1.2300(E1.4bln)

- USD/JPY: Jan13 Y103.00($1.4bln), Y104.00-15($1.3bln)

- EUR/GBP: Jan15 0.8650(E1.5bln)

PIPELINE: American Honda Launched; T-Mobile Upsized

- Date $MM Issuer (Priced *, Launch #)

- 01/11 $3B T-Mobile 5NC2 2.375%, 8NC3 2.75%, 10NC5 3.0%

- 01/11 $1..75B #American Honda $900M 3.5Y fix +35, #300M 3.5Y FRN L+35, $550M10Y +70

- 01/11 $1.5B *Korean Development Bank $700M 3Y5M +25, $500M 5.5Y +35, $300M 10Y +52

- 01/11 $1.5B #Simon Property $800M 7Y +95, $700M 10Y +110

- 01/11 $1.25B #Deutsche Bank 11NC10 +260

- 01/11 $900M #NY Life Global 5Y +37

- 01/11 $800M #Berry Global 3Y +77

- 01/11 $Benchmark KFW 5Y +5a

- 01/11 $Benchmark MuniFin 5Y +10a

- 01/11 $Benchmark CADES 10Y +26a

- 01/11 $Benchmark ABC NY 3Y +110a, 5Y +120a

EQUITIES: Stocks Open Modest Gap With All-Time Highs

Equities traded lower Monday, but only marginally so - opening a gap with the all-time highs posted on Friday. Price action was muted with volumes below average, with no major range-breaks or challenges of key support. In the US, real estate and utilities names led declines, while energy and healthcare were among the only sectors in the green.

- Going forward, US earnings take focus, with big banks unofficially kicking off proceedings on Friday as Wells Fargo, Citigroup and JPMorgan all report.

COMMODITIES: Mixed Session, Early Oil Weakness Pared

A vague sense of risk-off led global equities lower on Monday, in likely profit-taking after a strong start to 2021. Resulting USD strength has weighed on the broader commodity complex, leading to underperformance in oil and industrial metals. Brent crude futures traded lower by around 0.4%, but recovered into the Late US session.- Precious metals have stabilised after last week's weakness, but not before spot gold showed again below the 200-dma at $1839.79. A solid break and close below this support would be bearish, opening levels not seen since early December.

- On commodities, Goldman Sachs this morning wrote that they see a circa 10% return in the S&P GSCI index over the next 12 months, although markets are likely to consolidate in the near-term given the magnitude of the recent rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.