-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS: Subdued Rate Rally Ahead Impeach Vote

US TSY SUMMARY

Rates as well as equities chopped higher Wednesday as the House most certainly will vote to impeach Pres Trump a second time in his term Wednesday. House members kicked off the debate in the morning should have vote count before 1700ET.

- Otherwise somber session as markets absorbed several Fed speaker comments on economy/outlook: Fed Gov Brainard expects Fed to keep buying assets current pace of $120B/m "for some time"; Fed VC Clarida commitment to 2% avg inflation, predicting rate normalization could be slower if survey measures of inflation expectations are low relative to pre-pandemic times.

- Tsys gained after Italy headline: "ITALY MINISTERS QUIT COALITION, PUTTING PREMIER CONTE AT RISK" -bbg amid robust volumes and wo-way trade w/better buying ahead House impeachment vote.

- Already on session highs -- Tsys surge after strong US Tsy $24B 30Y bond auction re-open (912810SS8) yielded 1.825% (1.665% last month) vs. 1.832% WI; w/ 2.47 bid/cover (2.480 prior).

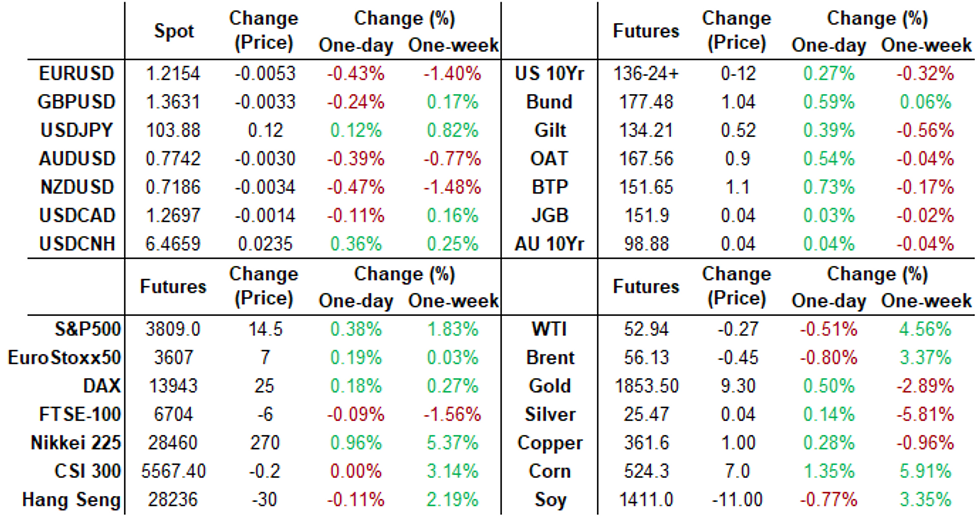

- The 2-Yr yield is up 0bps at 0.145%, 5-Yr is down 2.4bps at 0.4755%, 10-Yr is down 4.1bps at 1.0883%, and 30-Yr is down 5.4bps at 1.8183%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00012 at 0.08600% (-0.00075/wk)

- 1 Month -0.00075 to 0.12650% (+0.00012/wk)

- 3 Month +0.00750 to 0.24125% (+0.01687/wk)

- 6 Month +0.00025 to 0.24788% (+0.00138/wk)

- 1 Year +0.00062 to 0.32625% (-0.00338/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $143B

- Secured Overnight Financing Rate (SOFR): 0.08%, $918B

- Broad General Collateral Rate (BGCR): 0.06%, $356B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $334B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 7Y-20Y, $3.601B accepted vs. $10.924B submission

- Next scheduled purchases:

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +5,000 Green Sep 86/91 2x1 put spds, 2.5

- BLOCK, 10,000 Blue Mar 90/96 put over risk reversals, 2.5 at 1010:19ET

- -5,000 Blue Mar 88/93 put spds, 13.0

- -5,000 Blue Jun 95 calls, 2.0

- Overnight trade

- Block, 10,000 long Green Jun 95 calls, 16.5

- +20,000 Jun 98 calls, 0.75

- +10,000 Jun 98/100 call spds, 0.5

- 5,000 Jun 99.812/99.87 1x2 call spds

- +2,000 Red Jun22 96/97 2x1 put spds, 0.5

- +3,000 USH 161/165 put spds, 22

- +3,000 TYH 139 calls, 3

- -3,000 FVH 126 calls, 4.5-4.0

- 2,200 TYH 136.5 puts, 34

- +9,500 TYH 134 puts 4 over TYG 135 puts

- -2,500 TYH 135.5./137.5 put over risk reversals, 5

- -2,000 TYG 136.5 puts, 18

- -1,500 FVH 135.75 straddles, 31.5

- Overnight trade

- 5,000 TYH 135 puts, 13

- +6,000 wk3 TY 137 calls, 3

- +3,000 TYG 135.5/136 put spds, 5

- 2,000 TYG 135.75/136/136.5 2x3x1 put flys

- +4,000 FVH 125.5/125.75/126 call trees, 4.0

EGBs-GILTS CASH CLOSE: Conte Rescues BTPs

Bunds and Gilts performed strongly for most of the session with bull flattening, and BTPs caught up as political risk reduced somewhat.

- BTPs rallied with 10-Yr spreads vs Bunds dropping 3.5bps when PM Conte said he's working on a new coalition pact that would last until the end of the legislature - easing fears of an imminent gov't collapse. This left spreads flat after earlier widening.

- As cash close arrived, coalition partner Renzi was due to give a press conference, w Conte due to speak in the evening.

- Thurs to be a quieter day for supply (Weds saw Spain selling E10bn in new Obli, Germany/Portugal/UK sales too) with just Italy selling 3-/7-/30-Yr BTP. ECB publishes accounts of December meeting. No data of note.

- Closing Yields / 10-Yr Periphery Spreads:

- Germany: The 2-Yr yield is down 1.4bps at -0.705%, 5-Yr is down 1.7bps at -0.705%, 10-Yr is down 5.4bps at -0.522%, and 30-Yr is down 5.7bps at -0.122%.

- UK: The 2-Yr yield is down 3.1bps at -0.108%, 5-Yr is down 2.3bps at -0.011%, 10-Yr is down 4.5bps at 0.307%, and 30-Yr is down 5bps at 0.878%.

- Italian BTP spread up 0.4bps at 112.2bps / Spain up 1.3bps at 59.1bps

EUROPE OPTIONS: Summary

All About The Midcurves. Wednesday's options flow included:

- RXG1 177/176ps 1x2 sold at 20 in 1k

- RXH1 179c, sold at 16 down to 15 in 5k

- RXH1 178/179cs, bought for 22 in 1k (ref 176.94)

- RXH1 176/175ps bought for 23 in 1.2k

- OEH1 135.25c sold at 11.0/11.5 in 15k all day

- OEG1 137.25 call sold at 5 in 2.5k v DUG1 112.30 call bought for 1.5 in 10k

- 3RU1 100.625 calls bought for 2 in 4k (v 100.375)

- 3RU1 100.50+100.625 (v 100.125+100.00) combo strip, sells the calls at 1 in .5k total; note 7.5k also sold at 0.75

- LH1 100c, bought for 2.5 in 4k

- LM1 100.125/100.375 call spread bought for 2.5 in 6.4k

- LU1 100p, sold at 5.5 in 3k

- 2LU1 99.625 put vs 0LU1 99.75 put bought for 1.5 in 8k

- 3LH1 99.625/99.50 put spread v 2LH1 99.75 puts, buys the blue for 0.25 in 8k

- 3LM1 99.50/99.25ps vs 2LM1 99.62p, bought the blue for 0.75 in 8k

FOREX: EUR Recovers Italy-Inspired Losses Pre-Close

The single currency tumbled just after the London close as wires confirmed that Italy's Renzi was pulling ministers from the governing coalition, raising the risk of early elections in the country. EUR/USD slipped to touch 1.2140 in the immediate response, before recovering off the lows as Renzi stated he doesn't believe there will be new elections as a result.

- The greenback clawed back some of the recently lost ground, but the USD index made no sincere attempt on the Tuesday highs. December CPI data was ineffectual, with inflation all inline with expectations.

- Markets responded to the Riksbank's decision to start a transition to a fully financed FX reserve resulted in broad-based SEK weakness, prompting a EUR/SEK rally up to the 50-dma at 10.1645.

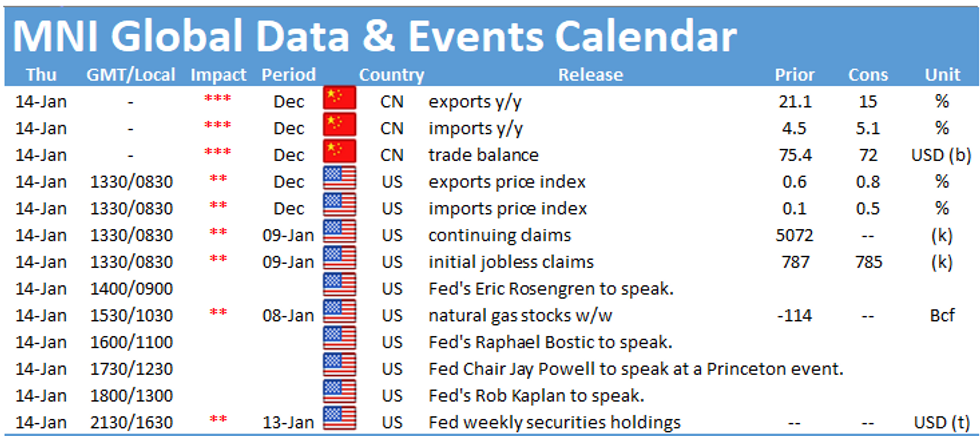

- Focus Thursday turns to Chinese trade balance, US weekly jobless claims and further Fed speakers including Rosengren, Bostic Powell and Kaplan.

FX OPTIONS: Expiries for Jan 13 NY Cut 1000ET (Source DTCC)

- EUR/USD: Jan15 $1.2135-50(E1.2bln); Jan19 $1.2000(E1.1bln), $1.2190-1.2210(E4.7bln-EUR puts), $1.2250(E1.2bln-EUR puts), $1.2300(E1.4bln-EUR puts), $1.2350-55(E1.1bln-EUR puts); Jan21 $1.2000(E1.35bln); Jan22 $1.2275(E1.95bln)

- USD/JPY: Jan15 Y104.00-05($1.0bln), Y104.80-00($1.4bln); Jan19 Y103.00($1.4bln)

- EUR/GBP: Jan15 0.8650(E1.5bln)

- AUD/USD: Jan19 $0.7450(A$1.2bln), $0.7700(A$1.2bln); Jan25 $0.7550(A$2.8bln), $0.7650(A$1.4bln)

- USD/CAD: Jan21 C$1.2715($1.8bln)

- USD/CNY: Jan20 Cny6.50($1.3bln)

PIPELINE: Royal Bank Of Canada 4-Tranche Launched Late

- Date $MM Issuer (Priced *, Launch #)

- 01/13 $3.25B #Royal Bank of Canada $1B 3Y +22, $700M 3Y FRN SOFR+30, $1.25B 5Y +42, $300M 5Y FRN SOFR+52.5

- 01/13 $3.5B *Ontario 5Y +17

- 01/13 $2.5B #SK Hynix $500M 3Y +85, $1B 5Y +105, $1B 10Y +140

- 01/13 $2.5B #Dominican Republic $1B tap 10Y 3.875%, $1.5B 20Y 5.3%

- 01/13 $1.6B #Nippon Life 30NC10 2.75%

- 01/13 $1.5B *Japan Bank Int Cooperation (JBIC) 10y +25

- 01/13 $1.5B #Avalon Holdings $750M each 5Y +190, 7Y +215

- 01/13 $1.25B #Nordic Inv Bank 5Y +3

- On tap for Thursday:

- 01/14 $1B EIB 5Y FRN SOFR+22a

EQUITIES: S&P500 Resumes Grind Higher

After muted trade across Asia-Pac and European sessions, US markets followed suit Wednesday, resuming their grind higher amid thin price action. This narrowed the gap with, but failed to break, the alltime highs printed on Jan 8 at 3,826.69.

- Utilities and real estate outperformed in the US, with tech no far behind. Materials and industrials were the laggards.

- Focus remains on the looming beginning of quarterly earnings season, with Wells Fargo, JPMorgan and Citigroup all reporting before the end of the week.

COMMODITIES: Oil Slips Despite Larger Than Expected Stockpile Draw

While both WTI and Brent crude futures hit new cycle highs in the Wednesday session, gains were erased into the close as markets took profits following the weekly DoE report. Despite the headline reading showing a draw in reserves of over 3mln bbls, a sizeable build in both gasoline and distillate inventories countered, sending oil uncharacteristically lower.

- Gold and silver were little changed as a muted session for equities provided little direction for precious metals. Spot gold remains pinned between 50- and 200-dmas at $1,866.91 and $1,841.78 respectively.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.