-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: On Back Foot Ahead Biden Conference

US TSY SUMMARY

Tsys sold-off, extended session lows early in the second half after some 11,400 FVH Block sales waved off interested buyers. Levels bottomed out over last hour but are looking to extend yet again in the minutes after the bell.

- Early chop -- Tsys moved off lows following lower than expected weekly claims (965k vs. 786 est) -- reversed gains just after the equity open (eminis dipped as well), no obvious driver at the time, but headline risk always a factor: tentative Biden presser at 1915ET to discuss fiscal package among other topics; $2T chatter.

- Biden will "deliver remarks on the public health and economic crises in Wilmington, Delaware. He will outline his vaccination and economic rescue legislative package to fund vaccinations and provide immediate, direct relief to working families and communities bearing the brunt of this crisis and call on both parties in Congress to move his proposals quickly."

Meanwhile, sovereigns debt issuance kept supply rolling as domestic names sidelined into earnings cycle. The 2-Yr yield is up 0.2bps at 0.145%, 5-Yr is up 1.5bps at 0.4836%, 10-Yr is up 4.6bps at 1.1292%, and 30-Yr is up 6bps at 1.8755%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00075 at 0.08675% (+0.00000/wk)

- 1 Month -0.00075 to 0.12650% (+0.00012/wk)

- 3 Month -0.01562 to 0.22563% (+0.00125/wk)

- 6 Month +0.00025 to 0.24788% (+0.00138/wk)

- 1 Year +0.00062 to 0.32625% (-0.00338/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $167B

- Secured Overnight Financing Rate (SOFR): 0.08%, $911B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $330B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 20Y-30Y, $1.732B accepted vs. $3.752B submission

- Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +100,000 Blue Mar 88 puts, 1.5 on screen, open interest 212,346 coming into the session -- adding to tighter policy insurance for early 2024.

- +20,000 Green Jun 93/95 put spds 0.5 over 97 calls vs. 99.605/0.30%

- 5,000 Red Jun 93/96/97 broken call flys

- -5,000 Blue Jun 91/93 put spds, 11.75

- +40,000 (block/screen/pit) Green Mar 96/97 risk reversals, 1.5 puts over

- Overnight trade

- +15,990 Green Mar 96/97 risk reversals, 1.5 puts over

- 3,000 short Jun 96/97 2x1 put spds

- 4,000 Apr 99.812/99.87 call spds

- 2,000 short Jun 97 calls, 0.5

- 2,000 Green Jun 96 calls

- 1,500 Blue Mar 91/95 call spds

Treasury Options:

- +13,500 FVH 125.75 calls, 11, 20.5k total/day

- over +15,000 TYH 137 calls, 27, 26.9k on day

- 5,900 USG 166.5/171 call over risk reversals, 1 net

- 3,500 FVH 125.75 calls, 11, 20.5k total/day

- over 15,000 TYH 137 calls, 27, 26.9k on day

- +2,500 USG 169 puts, 47-48

- 3,000 TYG 137.5 calls, 2

- Overnight trade

- 15,000 TYH 135/136 put spds, 11

- 6,000 TYG 137 calls, 6-10

EGBs-GILTS CASH CLOSE: Italy Spreads Widen On Political Risk

Wider periphery spreads and stronger core FI were the themes of Thursday's session.

- Italian spreads ended wider on continued political uncertainty, with PM Conte set to address parliament (time/date TBD).

- The cash trading day ended with news of deepening lockdowns: France set to extend an 1800CET curfew across the country, with Bild reporting Germany's Merkel seeking to toughen lockdowns nationwide including school closures and potentially curfews. Little impact though as core FI had already rallied most of the day.

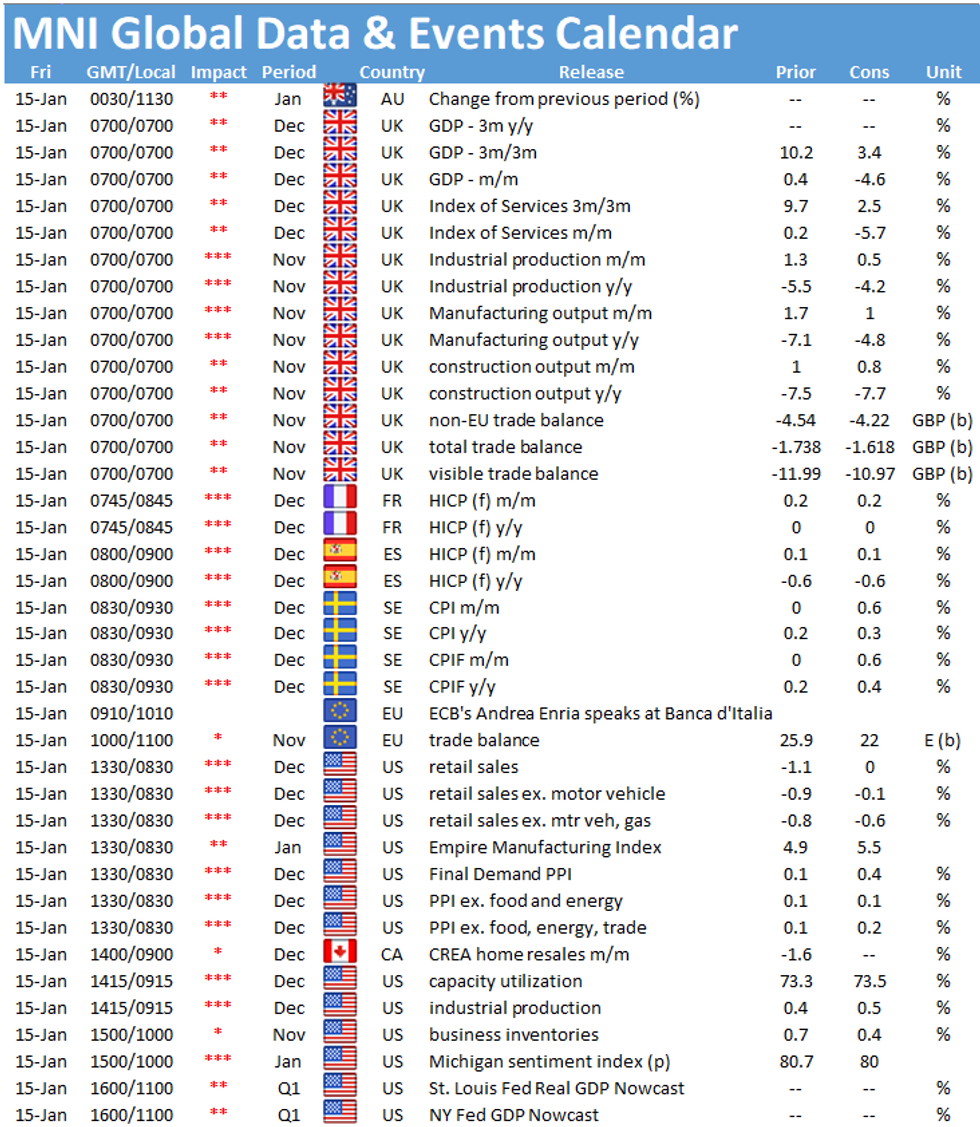

- Friday sees UK GDP data and some final Dec Eurozone nat'l CPIs, but no supply.

- Closing levels:

- Germany: The 2-Yr yield is down 2.2bps at -0.727%, 5-Yr is down 3.5bps at -0.74%, 10-Yr is down 2.8bps at -0.55%, and 30-Yr is down 2.4bps at -0.146%.

UK: The 2-Yr yield is down 1.2bps at -0.12%, 5-Yr is down 1.5bps at -0.026%, - UK: The 2-Yr yield is down 1.2bps at -0.12%, 5-Yr is down 1.5bps at -0.026%,10-Yr is down 1.6bps at 0.291%, and 30-Yr is down 1.3bps at 0.865%.

- Italian BTP spread up 7.1bps at 119.3bps / Spanish up 2bps at 61.1bps

EUROPE OPTIONS: Summary, Plenty Of Sterling Midcurves Again

- Thursday's options flow included:

- RXH1 177.50/176.00/174.50p fly 1x3x2 put fly, sold at 9.5 in 1.5k. (Closing)

- RXH1 176/179 RR, bought for 8.5 in 5k vs RXG1 176p, sold at 5 in 5k (package trades at 3.5)

- DUG1 112.30/20/00p fly, sold at 3 in 2k

- ERZ2 101c, bought for 1.75 in 10k

- LM1 100.00/100.12cs x4 vs LM1 100p, bought for 4.5 in 20k x 5k (ref 100.035, 100%)

- LU1 100.12/100.25/100.37c fly vs 99.87p, bought for 0.75 in 10k

- LZ1 100.12/100.25cs vs 99.87p, bought for 1.25 in 15k

- 0LH1 100.12/100/99.87p fly 1x3x2 sold at 1 in 10k

- 0LM1 100.00/99.75ps, bought for 9 in 20k (ref 99.955, -45 del)

- 0LU1 99.87/99.75ps 1x2, bought for half in 13.5k

- 0LZ1 100.00/99.75ps 1x4, bought the 4 for 5 in 5k

- 2LU1 99.75/99.50 put spread + 99.625/99.375 put spread (v 99.85) bought for up to 9.5 in 20k all day

- 3LZ1 99.00/98.50 put spread bought for 1.75 in 4k all day

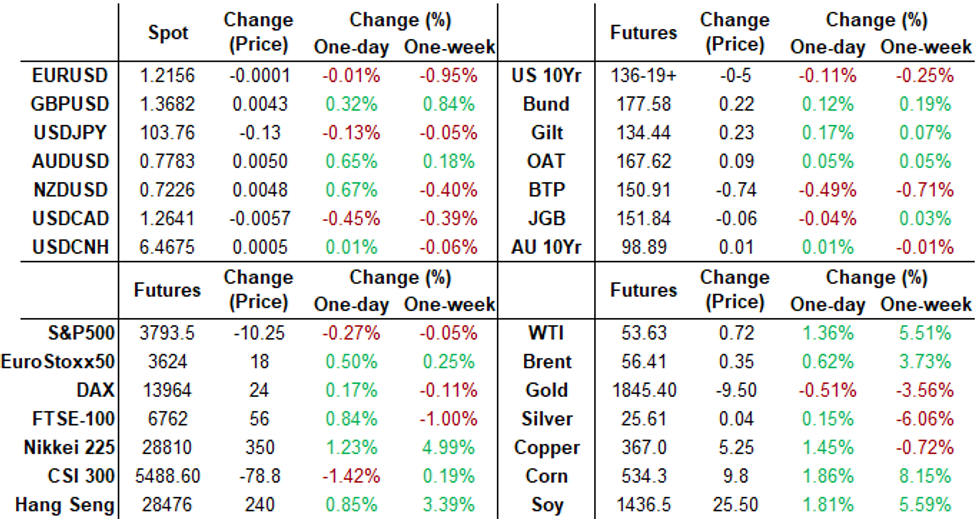

FOREX: Greenback Gives Back Stimulus Inspired Gains

After a firm start to the session, the USD was sold into the NY close as markets look ahead to an event from the Biden-Harris transition team, at which the President-Elect is expected to outline his economic plan for when he enters office. Reports of a stimulus package that could amount to as much as $2trl helped boost the USD initially, but selling pressure knocked the greenback as stocks advanced.

- Elsewhere, the single currency traded poorly, with the EUR slipping as Italian politics begins to take focus. Following the withdrawal of Matteo Renzi's ministers from the governing coalition, Italian PM Conte faces a stark set of choices to continue governing, including a snap general election.

- UK industrial and manufacturing production, US PPI and retail sales data as well as the prelim Uni. of Michigan sentiment release are the highlights Friday. A number of ECB speakers are due, with Stournaras, Visco, Makhlouf among those due.

FX OPTIONS: Expiries for Jan 15 NY Cut 1000ET (Source DTCC)

- EUR/USD: Jan19 $1.2000(E1.1bln), $1.2190-1.2210(E4.7bln-EUR puts), $1.2250(E1.2bln-EUR puts), $1.2300(E1.4bln-EUR puts), $1.2350-55(E1.1bln-EUR puts); Jan21 $1.2000(E1.35bln); Jan22 $1.2275(E1.95bln)

- USD/JPY: Jan15 Y104.00-05($1.1bln), Y104.80-00($1.4bln); Jan19 Y103.00($1.4bln); Jan21 Y103.65-75($1.1bln)

- EUR/GBP: Jan15 0.8650(E1.5bln)

- AUD/USD: Jan19 $0.7450(A$1.2bln), $0.7700(A$1.2bln); Jan25 $0.7550(A$2.8bln), $0.7650(A$1.4bln)

- USD/CAD: Jan21 C$1.2715($1.8bln-USD puts)

- USD/CNY: Jan20 Cny6.50($1.4bln)

PIPELINE: Supra-Sovereign Outpace Domestics

- Date $MM Issuer (Priced *, Launch #)

- 01/14 $3.25B Oman $500M 2025 Tap 4.45%, $1.75B 10Y 6.25%, $1B 30Y 7.25%

- 01/14 $2.5B #Pioneer Natural $750M 3NC1 +55, $750M 5Y +65, $1B 10Y +105

- 01/14 $1.25B #Nationwide Building Society 3Y +37

- 01/14 $1B *EIB 5Y FRN SOFR+20

- 01/14 $500M #American Assets Trust 10Y +237.5

- 01/14 $500M #Public Storage WNG 5Y +43

- On tap for Friday:

- 01/15 $Benchmark Nederlandse Waterschapsbank (NWB) 2Y +4a

EQUITIES: Stocks Solid Ahead Biden Event

Stock markets started the session well, with the S&P 500 opening higher as traders looked ahead to the Biden-Harris transition team event, in which the President-elect is expected to outline stimulus plans amounting to as much as $2trl. These gains faded somewhat into the close, but downside still seems limited ahead of the Jan 20th inauguration.

- Energy and industrials outperformed from the off, with communication services and consumer staples the weakest sectors in the S&P500.

- European markets rallied smartly, with most indices adding 0.3-0.7%, although Italy lagged as domestic political pressure kept a lid on the index.

COMMODITIES: Rangebound Oil As Rally Peters Out

The firm rally in WTI and Brent crude futures cooled Thursday, pulling slightly off the cycle highs printed earlier in the week on likely profit-taking, mirroring the moves in equities. Spot gold initially traded softer early Thursday, but this reversed ahead of the close as USD strength dissipated, helping gold rise back above the 200-dma. A further rally and close above the $1865.69 50-dma is now needed to solidify any move higher.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.