-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Counterintuitive

US TSY SUMMARY: Good Data, Positive For Rates?

Tsy trading mostly higher, 10Y back to steady after the bell. Tsys sold off post minutes, back near post 20Y AND pre-early session data levels. After trading lower on better than expected data (aside from revisions, and taking yesterday's move into account) it appears sentiment is back to "good data is bad" as it lowers probability of $1.X trillion fiscal stimulus on the margins.- Quick takeaways, Fed remains accommodative as some see near term downside risks eco-outlook and conditions, Covid-19 metrics remain "important". Upside risks, fiscal policy could be more robust, financial market utilities could display greater propensity toward higher spending.

- Treasuries gap lower after WEAK US Tsy $27B 20Y bond auction (912810SW9) draws 1.920% vs. 1.897% WI, bid/cover 2.15% (2.28% previous).

- Choppy day for Tsy yld curves, mildly flatter after bear steepening Tue. Heavy session volumes in 2s-10s March/June rolls ahead Feb 26 first notice: TUH/TUM w/82k, FVH/FVM w/99k, TYH/TYM w/67k.

- TYH1 hit resistance: 135-30.5H (+5.5) just below initial resistance of 136-01, Jan 12 low -- trend remains down.

- The 2-Yr yield is down 1.2bps at 0.1069%, 5-Yr is down 1.4bps at 0.5593%, 10-Yr is down 2.2bps at 1.2922%, and 30-Yr is down 3.1bps at 2.0608%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00087 at 0.08063% (+0.00100/wk)

- 1 Month +0.00275 to 0.11100% (+0.00362/wk)

- 3 Month -0.00725 to 0.18138% (-0.01237/wk) ** New Record Low (prior: 0.18863% on 2/16/21)

- 6 Month -0.00488 to 0.19775% (-0.00300/wk)

- 1 Year -0.00650 to 0.29613% (-0.00362/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $65B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $201B

- Secured Overnight Financing Rate (SOFR): 0.06%, $934B

- Broad General Collateral Rate (BGCR): 0.04%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $337B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.241B submission

- Next scheduled purchases:

- Thu 2/18 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 2/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- -10,000 short Apr/short Jun 88 strip, 17.0 cr

- +10,000 Blue Dec 92 calls, 5.5

- -7,500 long Green Mar 96/97 call spds, 8.5, desks say rolling strikes down

- +2,500 Green Jun 99.5/99.56/99.62/99.75 broken call condors, .25 legs

- Block, 10,000 Blue Jun 93 calls 1.5 vs. 98.885/0.10%

- +3,000 Blue Apr 91/92/93 call flys, 1.25

- Overnight trade

- +35,000 Jun 99.87/99.937 1x2 call spds, 0.5

- 9,600 Mar 99.87 calls, 0.25

- +14,000 (10k blocked) Jun 99.87/100.0 1x2 call spds, 0.75

- +11,000 Blue Apr 91/92/93 call flys, 1.5

- 6,500 Green Apr 99.437 puts

- 2,500 Blue Mar 99.25/99.37 call spds

Treasury Options:

- +7,600 TYH 133 puts, 30-32, total volume 10.5k

- Update +28,000 TYM 132 puts, 20

- 2,000 TYH 135.75/136 put spds, 10

- Update, +10,000 TYJ 133 puts, 14-16

- Overnight trade

- -25,000 TYJ 138 calls, 2

- +11,000 TYJ 133/134.5 put spds, 26-30

- -5,000 FVH 125.5/125.75 put spds, 14

- -4,500 FVJ 124.75/125.25 put spds, 14

- +2,000 FVM 124/124.25/125 put trees w/1,000 FVM 122/123.25 put strip, 11 db

- +3,300 FVM 123.5 puts, 9

BONDS: EGBs-GILTS CASH CLOSE: Core Selloff Pauses; BTPs Fade

In direct contrast with Tuesday, Wednesday saw Gilt and Bund yields close at/near session lows, with global safe havens in favor as equities retreated and the US dollar strengthened. The German and UK curves bull flattened. Against that backdrop, BTP spreads headed to widest levels to Bunds in four sessions.

- Pre-open, UK CPI pushed higher in January and came in above expectations.

- Germany sold 30Yr Bund (E1.2bn allotted) at a positive yield for the first time since June; UK sold EGB2.5bn of Jul-35 Gilt. Toward the end of the session, BOE's Ramsden noted the BOE has room to increase QE further.

- Thursday's data fairly thin, including Eurozone consumer confidence. Meanwhile, the ECB publishes its policy meeting account, while BOE's Saunders speaks on a webinar. Spain and France hold auctions.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.8bps at -0.698%, 5-Yr is down 1.6bps at -0.65%, 10-Yr is down 2bps at -0.368%, and 30-Yr is down 2.6bps at 0.137%.

- UK: The 2-Yr yield is down 0.7bps at -0.044%, 5-Yr is down 2bps at 0.107%, 10-Yr is down 4.9bps at 0.572%, and 30-Yr is down 6.9bps at 1.154%.

- Italian BTP spread up 3.4bps at 95.4bps / Spanish spread up 1.4bps at 65.6bps

OPTIONS EUROPE SUMMARY: Sterling Downside

Wednesday's options flow included:

- OEH1 135/134.75/134.50p fly sold at 3 in ~6k

- RXH1 176c, bought for 2 in 7.5k

- RXH1 173.50p, bought for 3 in 5k

- RXJ1 173.5c, bought for 30 in 12.75k

- RXJ1 172.0 vs RXM1 170.5 diagonal p, sold April at 18 in 1k

- RXM1 172/169.5ps 1x2, bought for 36 in 1.5k

- ERZ1 100.25/100.00ps, bought for 0.5 in 5k

- 3RM1 100p, bought for 1 in 5k

- LZ1 100/99.87/99.75p fly 1x3x2 vs LM1 100/99.87/99.75p fly 1x3x2, bot Dec for -1 in 30k

- 3LM1 99.62/50/37/25p condor, sold at 4 in 3k

- 3LM1 99.25/99.00ps vs 99.75c, bought ps for 0.25 in 4.8k

- 3LZ1 99.00/98.625 put spread with 98.875/98.50 put spread, pays up to 9.75 in 5k (v 99.37)

FOREX: Sagging Sentiment Sees USD/JPY Sink Off 2021 Highs

JPY traded well, prompting USD/JPY to edge lower for the first session in five as the equity rally stalled and stock markets edged lower. Crosses including EUR/JPY and AUD/JPY saw decent momentum unwinds, but there are few signs yet of a meaningful bearish reversal.

- A combination of firm US retail sales and bearish technical signals sent EUR/USD to the lowest levels of the week. Bears watch Tuesday's candle pattern for confirmation of a bearish shooting star which, if confirmed could open declines toward the 100-dma, which crossed at 1.2000 Wednesday.

- Elsewhere, commodity-tied currencies slipped, with the NOK underperforming all others in G10 as oil prices were bumped lower. The WSJ reported that Saudi Arabia are to notify OPEC that they will reverse recent oil output cuts as soon as April given the recent recovery in prices. USD/NOK rallied smartly before stalling ahead of the 8.5604 50-dma.

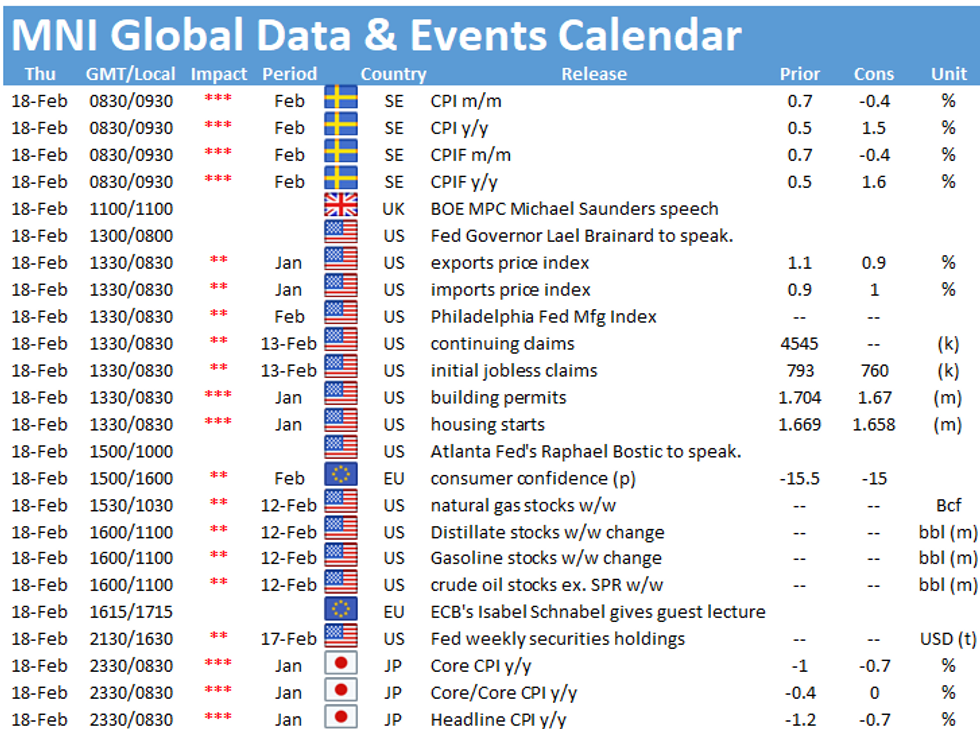

- Focus Thursday turns to weekly US jobless claims and housing starts/building permits, Australia's January jobs report and rate decisions from the Turkish and Indonesian central banks.

FX OPTIONS: Expiries for Feb18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E527mln), $1.1895-05(E859mln), $1.1940-41(E663mln), $1.2000-10(E1.8bln), $1.2050(E642mln), $1.2100(E1.3bln), $1.2125-35(E831mln), $1.2200(E1.5bln)

- USD/JPY: Y104.50-70($826mln), Y104.95-00(E596mln), Y105.95-00($900mln), Y107.75($1bln)

- AUD/USD: $0.7400(A$1.2bln), $0.7555-75(A$1.3mln), $0.7700-10(A$649mln)

- AUD/NZD: N$1.0820-30(A$769mln)

- USD/CNY: Cny6.35($1.8bln), Cny6.45($1.1bln), Cny6.50($1.25bln)

PIPELINE: Rabobank, NextEra Launched, Ontario Expected Thu

- Date $MM Issuer (Priced *, Launch #)

- 02/17 $1.65B #NextEra Energy Capital 2NC.5 FRN 3M LIBOR +27

- 02/17 $1B #Rabobank 6NC5 +55

- Rolled to Thursday:

- 02/18 $Benchmark Prov of Ontario 10Y +27a

EQUITIES: Rare Down Day for Stocks, But No Reversal Yet

Global equities traded lower Wednesday, in a rare down day for US and European indices. The S&P 500 traded lower from the open as futures opened a decent gap with the all time highs posted during Tuesday's Asia-Pac session.

- Catalysts and headline news-flow were thin on the ground with the Senate and House of Representatives on recess, and a much firmer-than-expected retail sales release did little to shift prices in either direction.

- Tech names underperformed, with the tech sector prompting some underperformance in the NASDAQ, while energy and utilities were the sole sectors to post gains.

COMMODITIES: Oil Rally Tempered as Saudi Arabia Consider Reversal of Output Cuts

Strength in WTI and Brent crude futures continued early Wednesday, with production interruptions in the southern US states and surging energy demand to combat inclement weather keeping prices elevated.

- This pattern persisted into early NY hours before the publication of a WSJ report citing Saudi Arabia advisers as saying the Kingdom will reverse a recent big production cut, after OPEC+ stated they would curb output by 1mln bpd earlier in the year.

- Brent crude futures slipped back below $63.50/bbl in response before stabilising. Similar price action was noted in WTI crude futures, with prices edging below $60/bbl before rebounding into the close.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.