-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: SLR Extension Debate

US TYS SUMMARY: Post-CPI Chop; SLR Extension Debate

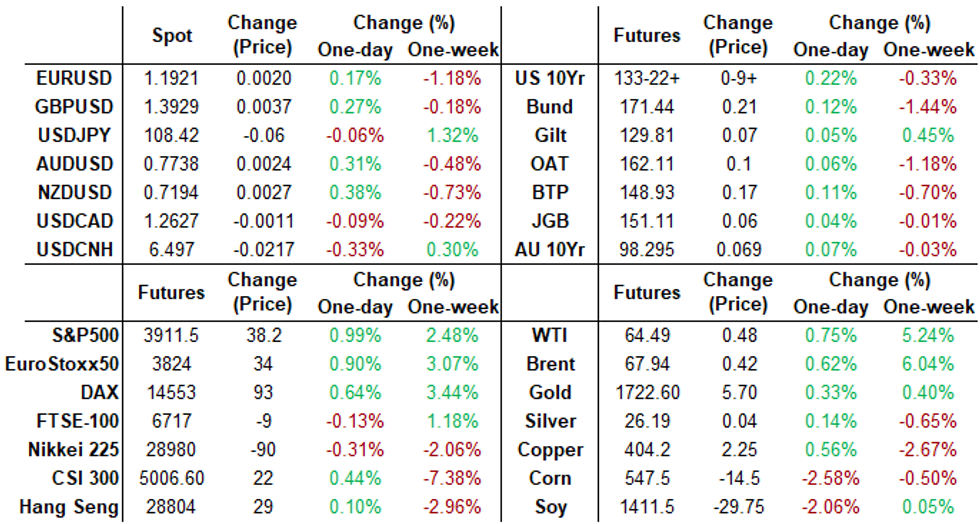

Choppy first half, Tsy futures see-sawed following CPI: Core +0.1015% M/M unrounded, so firmly bottom of 0.1-0.3% expected range and 0.2% median. Mainly due to drop in core goods prices, -0.2% M/M, lowest since May 2020. Core services were +0.2%, highest since Nov 2020.- Decent early two-way as Tsys drew fast$ selling on bounce, while buyers reloaded. Appr 95,000 TYM traded in the five minutes after the CPI data release, from 132-08 to -13.5, 132-11.5 high volume price.

- Another day closer to SLR deadline on March 31, participants still expect extension. Buy the rumor, sell the fact.

- Rates extended top end of range ahead the $38B 10Y note auction re-open, sold off briefly after small tail: drawing 1.523% high yield (1.155% last month) vs. 1.520% WI; 2.37 bid/cover (2.37 previous).

- After some chunky flatteners Blocked in prior session, steepeners gained momentum: On the heels of lar +18,934 TYM blocked 132-11, second leg showed up: -4,638 WNM at 187-16 -- post-time bid at 0935:37ET. Appears to be steepener, $1.6M dv01.

- Option flow continued to revolve around puts with some notable consolidation: -20,500 TYK 128/131.5 put spds, 35-33 (unwind, paper +30k 45-47 Monday).

- The 2-Yr yield is down 0.6bps at 0.1548%, 5-Yr is down 1.3bps at 0.7923%, 10-Yr is down 0.3bps at 1.523%, and 30-Yr is up 1.4bps at 2.2479%

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N +0.00012 at 0.07725% (-0.00038/wk)

- 1 Month -0.00125 to 0.10588% (+0.00263/wk)

- 3 Month +0.00688 to 0.18413% (-0.00125/wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00413 to 0.19363% (-0.00225/wk)

- 1 Year -0.00100 to 0.27863% (+0.00088/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $219B

- Secured Overnight Financing Rate (SOFR): 0.02%, $914B

- Broad General Collateral Rate (BGCR): 0.01%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $341B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $5.821B submission

- Thu 3/11 1500ET Next scheduled release schedule

OVERNIGHT REPO: Repo Specials Continue

Overnight repo at special across the curve. Current levels:

T-Bills: 1M 0.0203%, 3M 0.0330%, 6M 0.0456%; Tsy General O/N Coll. 0.04%

| Duration | Current | Old Issue |

| 2Y | 0.03% | 0.03% |

| 3Y | -0.26% | 0.03% |

| 5Y | -0.14% | -0.06% |

| 7Y | -0.08% | +0.03% |

| 10Y | -2.75% | -0.07% |

| 30Y | -0.14% | 0.00% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 10,000 short Sep 95/96/97 put flys, 3.0

- Update, +15,000 Blue Apr 82 puts, 3.5

- 2,000 long Green Jun 87/90/93 put trees

- +2,500 Red Dec'22 through Green Sep'23 87 put strips, 61.5

- 3,400 Blue Apr 92 calls, 0.5 earlier

- +1,500 Blue Sep 80/88 put over risk reversals, 1.5

- Overnight trade

- 8,800 short Dec 98 calls

- +5,000 Blue Dec 85/87 call spd 2.0 over Blue Dec 77 puts

- 13,000 short Jul 96/97 call spds vs. short Sep 98 calls (hearing put spd and calls bought)

- 3,000 short Aug 95/96/97 put flys, 3.0

- +3,000 short Aug 99.18/99.31/99.56 put flys, 2.0

- 2,000 Jun 99.75/99.81 1x2 put spds

- -3,000 Blue Mar 86/90 put spds 22.0-21.5

- +4,000 TYJ 134 calls, 5

- 3,500 TYM 131 puts, 38

- 7,200 TYK 130.5 puts, 21

- Update, -20,500 TYK 128/131.5 put spds, 35-33 (unwind, paper +30k 45-47 Monday)

- Update, just over10,000 TYM 129 puts, 24-23

- 5,800 TYM 131 puts, 50

- +2,000 TYJ 131.5 puts, 24 pre-data

- 2,000 FVM 121.5/123/124 broken put fly, 5.5

- Overnight trade

- +2,500 TYJ 133/133.5/134 call flys, 4

- 3,000 TYK 135 calls, 6

- 2,000 FVJ 124.5 calls, 4.5

- Block +9,375 TYJ 130 puts, 6

- Block, -1,875 TYJ 134 puts, 142

BONDS/EGBs-GILTS CASH CLOSE: Awaiting Lagarde

Bund and Gilt yields fell Wednesday, with mixed moves (UK short-end outperformed, whereas it was the opposite in Germany). Periphery spreads a little tighter.

- Little newsflow driving the market, with more attention on US CPI data (which came in on the soft side, boosting global core FI), and the ECB decision and Pres Lagarde's press conf on Thursday.

- In data, French IP came in stronger than expected; bond supply came from UK (Linker, GBP800mn), Germany (Bobl, EUR3.2595bn allotted), Portugal (OTs, EUR1.25bn), with Latvia selling E1.25bn in 10-yr bonds via syndication.

- Late in the session, the EU sent an RfP for further SURE issuance.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.682%, 5-Yr is down 0.7bps at -0.616%, 10-Yr is down 1.2bps at -0.313%, and 30-Yr is down 2.1bps at 0.184%.

- UK: The 2-Yr yield is down 1.8bps at 0.066%, 5-Yr is down 1.4bps at 0.319%, 10-Yr is down 1.3bps at 0.714%, and 30-Yr is down 1.3bps at 1.229%.

- Italian BTP spread down 0.5bps at 98.8bps /Spanish spread up 0.1bps at 66.5bps

OPTIONS/EUROPE SUMMARY: Euribor Plays

Wednesday's options flow included:

- RXJ1 170/168ps, was bought for 27 in 2k

- RXK1 174/176/178c fly, bought for 13.5 in 2k

- RXK1 174/176/178 call fly sold at 13.5 in 1.5k

- RXM1 172.5/173 call spread bought for 18 in 2.3k

- OEM1 134.75/134.50ps, bought for 8.5 in 1k

- DUM1 112/111.90ps, bought for 2.5 in 2.5k

- 0RU1 100.50/100.37ps 1x2, bought the 1 for half in 3k total

- 2RU1 100.375/100.25 put spread v 0RU1 100.50/100.375 put spread, buys the green for 0.5 in 12k

- 3RU1 100.25/100.125 put spread v 0RU1 100.50/100.375 put spread, buys the blue for 1.25 in 1k

- 3LM1 99.37/99.12ps, sold at 10 in 4k

- 3LU1 99.00/98.62ps 1x1.5, bought for 5.25 in 8k

FOREX: JPY Downtrend Pauses as Markets Ponders Two-Way Risk for Yields

- JPY bounced well off the overnight lows, dragging USD/JPY further off the week's best levels of 109.23 as Bloomberg reported that the Bank of Japan were said to be seeking a freer rein over bond yield fluctuations as part of their policy review. This re-introduction of two-way risk to Japanese bond markets underpinned the drop in USD/JPY, but a slip through 108.27 is needed to halt current bullish momentum.

- The greenback traded mixed, trading largely inside recent ranges against most others in G10. EUR/USD shrugged off sourced reports that the ECB see only a fleeting bounceback in inflation as part of their forecasts due for release Thursday.

- NOK was among the best performers, with CHF and CAD trading poorly. The Bank of Canada stood pat on policy but reaffirmed the pace of their asset purchase program against outside expectations of a taper.

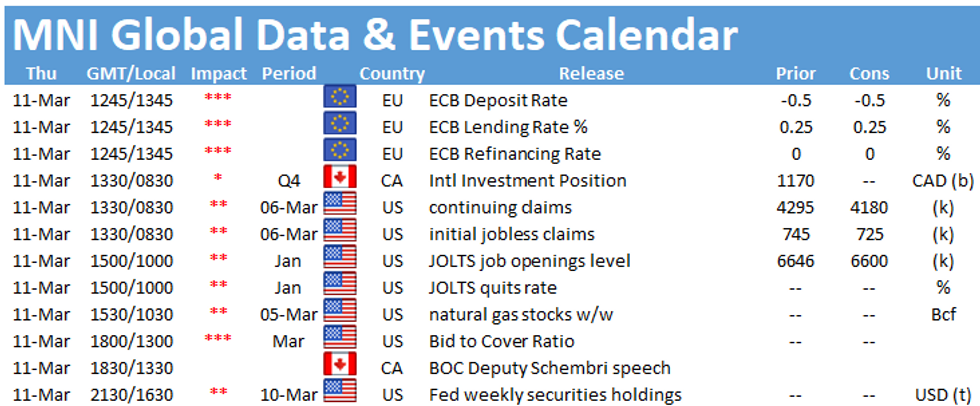

- Focus Thursday rests on the ECB. The bank are seen keeping policy unchanged, but plenty of focus rests on the governing council's explanation for the slowing in their asset purchase program in recent weeks. US weekly jobless claims are also on the docket.

FX OPTIONS: Expiries for Mar11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.2bln), $1.1900-15(E1.7bln), $1.1995-00(E630mln)

- USD/JPY: Y107.75($1.7bln), Y108.50($1.0bln)

- AUD/USD: $0.7600(A$1.7bln), $0.7720-25(A$777mln), $0.8000(A$1.8bln)

- AUD/NZD: N$1.0730(A$2.2bln-AUD puts)

- USD/CAD: C$1.2600-05($514mln), C$1.2770($860mln)

- USD/CNY: Cny6.4900($868mln)

PIPELINE: Upsized $6.5B United Airlines Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/10 $6.5B #American Airlines, $3.5B 5NC 5.5%, $3B 8NC 5.75%

- 03/10 $500M *IADB 7Y FRN SOFR+27a

- On tap for Friday:

- 03/12 $800M Pitney Bowes 6NC3, 8NC3

- However, Verizon debt something to be alert for as they still hold the record for largest multi-tranche jumbo issuance w/ $49B back in August 2013.

- In 2020, Verizon only issued a total of $15.5B:

- November 2020 $12B *Verizon 5pt: $2B 5Y +40, $2.25B +10Y +85, $3B 20Y +115, $2.75B 30Y +115, $2B 40Y +130

- March 2020 $3.5B Verizon 3pt: $750M 7Y +215, $1.5B 10Y +225, $1.25B 30Y +250.

EQUITIES: Bluechips Outperform Tech as Dow Hits Another High

- Despite a shaky start Wednesday, equity markets shrugged off early weakness to make decent progress. Bluechip stocks traded well, with the Dow Jones Industrial Average notching up gains of over 1% thanks to rallies in Boeing, Goldman Sachs and Honeywell shares.

- The tech-led NASDAQ traded more poorly, as tech names consolidated. Tech was also the sole sector in the red across the S&P500 as names including Apple, Micron Tech and Western Union slipped.

- Across Europe, Eurozone markets were uniformly higher, with France's CAC-40 outperforming to trade with gains of over 1%, while the UK's FTSE-100 was a laggard, softer on GBP strength against both USD and EUR.

- The VIX was subdued given the general strength in US equity indices, falling below 23 points and further below the 2021 average.

COMMODITIES: Weaker US Dollar Keeps Precious Metals Underpinned

- Lower US Yields throughout the US session placed the dollar on the backfoot for the second consecutive session. This prompted precious metals to further their recovery, looking to close at their best levels of the day.

- A choppy session for oil prices as markets digested another round of DoE inventory data, heavily affected by the Southern Freeze. Once again, a sizeable build in inventories - likely on refining infrastructure still playing catch-up. The market focused on the draw in gasoline inventories of near 12mln bbls vs. Exp. 2.5mln. WTI and Brent Futures ending in marginal positive territory.

- WTI Crude +0.83% at $64.49

- Natural Gas +1.28% at $2.697

- Gold spot +0.55% at $1725.74

- Copper +0.75% at $403.85

- Silver up +0.82% at $26.1586

- Platinum +2.64% at $1204.44

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.