-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Heavy Ahead Next Week's FOMC

US TYS SUMMARY: Tsys Have That Heavy Feeling, FOMC Next Week

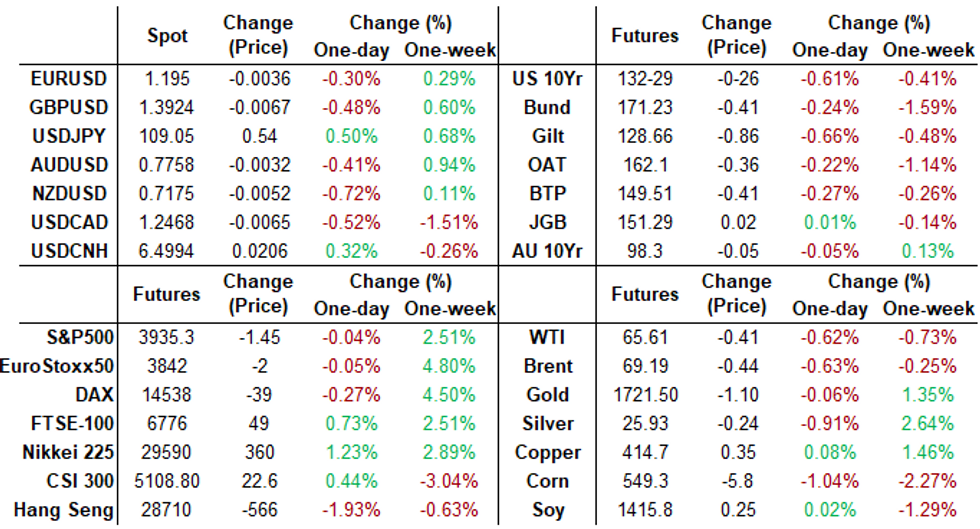

Tsys traded broadly weaker/near lows late Friday, yields making new one-year highs, steeper yield curves climbing back to near 7 year highs tapped Feb 25. Much of the initial choppy sell-off occurred overnight as Tsys followed Bunds lead lower for second day, US$ strength persisted. Focus on next week's FOMC and BoE policy announcements.- Not much of a react to PPI, more or less in-line with expectations (FINAL DEMAND PPI +0.5%, EX FOOD, ENERGY +0.2%). Tsy futures holding to relative narrow range -- near lows over last four hours. Moderate buying in 10s-30s was short lived.

- Lack of clarity adding to pressure in rates: another day closer to Supplementary leverage ratio (SLR) exemption expiration on Wed, Mar 31, and still no word from Fed gov's over extending (widely expected) or letting it expire -- necessitating banks to scale back their deposits, reserves, and Tsy holdings.

- Decent option trade, put buys/heading rate hikes in late '22 through '23 continue; vol sale on range: Block, -40,000 short Sep 96/97 strangles, 12.0 vs. 99.67, -5.6k more/screen. Salient Tsy option highlight: +32,000 TYM 129/130/131/132 put condors 12 on screen.

- The 2-Yr yield is up 1bps at 0.149%, 5-Yr is up 5.9bps at 0.8449%, 10-Yr is up 9.7bps at 1.6335%, and 30-Yr is up 10.6bps at 2.4005%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N +0.00000 at 0.07813% (+0.00050/wk)

- 1 Month +0.00013 to 0.10613% (+0.00288/wk)

- 3 Month +0.00562 to 0.18950% (+0.00412/wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00125 to 0.19400% (-0.00188/wk)

- 1 Year +0.00088 to 0.27813% (+0.00038/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $67B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $216B

- Secured Overnight Financing Rate (SOFR): 0.01%, $884B

- Broad General Collateral Rate (BGCR): 0.01%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $32,234B submission

- Next scheduled purchases

- Mon 3/15 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 3/16 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 3/17 No buy operation due to FOMC

- Thu 3/18 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/19 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +3,000 Blue May 82/85 2x1 put spds, 0.0

- +8,000 long Green Mar 92/97 put spds, 18.0

- -2,000 Green Sep 90 straddles, 40.5

- +30,000 short Dec 93 puts, 9.5

- Block, -40,000 short Sep 96/97 strangles, 12.0 vs. 99.67, -5.6k more/screen

- Block, 16,500 Blue Mar 90 puts, 26.5

- +10,000 short Dec 93/95 put spds 0.5 over Blue Dec 77/78 put spds

- +10,000 short Sep 93/96 2x1 put spds, 0.5

- +3,000 short Dec 92 puts, 7.0

- Overnight trade

- +10,000 short Sep 90/92/95 put flys, 1.5

- 2,650 Jun 99.81/99.87/99.93 call flys

- Block, +25,000 Blue Dec 72/77 put spds, 8.0

- Block, +14,000 Blue Apr 90 calls, 1.5 vs. 98.58/0.09%

- 5,000 Green Dec 87 puts, 20.0

- +5,000 Blue Jun 83/86 2x1 put spds

- 5,000 Blue Mar 88 puts,

- -7,000 TYJ 131.5/132 put spds 15

- over 10,000 TYJ 131.25/132 call spds, 3

- 5,000 TYK 133/134 1x2 call spds, 4

- 4,000 TYK 134/135 call spds, 7

- +32,000 TYM 129/130/131/132 put condors 12 on screen

- Overnight trade

- Block, 10,000 TYK 130/133.5 combo, 0.0

- Block 5,000 TYK 131.5 puts, 37

- 3,500 USJ 155/156 put spds, 19

EGBs-GILTS CASH CLOSE: Bunds Fail To Hold Onto Initial ECB Rally

European core FI curves ended the week steeper, notably Bunds which failed to hold onto Thursday's post-ECB decision rally.

- Friday's weakness was largely a result of some push-back among ECB policymakers in the 24 hours since the decision (pointing out that they are merely accelerating and not increasing the total volume of PEPP), and a sell-off in US Tsys.

- Periphery spreads finished mixed, with Italy a little tighter despite news of broader lockdowns and wider fiscal deficits coming.

- Gilts underperfomed. Earlier, Jan UK GDP was contractionary but less so than expected.

- The Europe focus next week is on the Bank of England meeting, which comes a day after the global focal point of the Federal Reserve decision.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.4bps at -0.687%, 5-Yr is up 1.3bps at -0.619%, 10-Yr is up 2.8bps at -0.306%, and 30-Yr is up 4bps at 0.221%.

- UK: The 2-Yr yield is up 1.9bps at 0.099%, 5-Yr is up 5.4bps at 0.381%, 10-Yr is up 8.7bps at 0.822%, and 30-Yr is up 9.2bps at 1.352%.

- Italian BTP spread down 0.6bps at 92.9bps/ Spanish up 0.5bps at 63.5bps

OPTION/EUROPE SUMMARY: Largely Downside

Friday's options flow included:

- RXJ1 171.50p, bought for 59 in 2.5k

- RXJ1 171.50^, sold at 118 in 2.5k

- RXM1 167/166ps, bought for 8 in 7k

- OEJ1 134.50/134.25ps, bought for 2.5 in 1k

- OEJ1 135/25/50c ladder, bought for 8 in 1k

- OEM1 134.5/134/133.75p fly, bought for 7.5 in 1k

- DUM1 112.20/30cs vs 112.00/111.90ps, bought the cs for flat in 2.5k

- 0RZ1 100p with 2RZ1 99.75p strip, bought for 3 in 3k

- 3RM1100.25/100.37/100.50c ladder, was sold at 5 in 3k

- 2LM1 99.37/99.12ps, bought for 4.5 in 15k

- 2LZ1 99.37/99.12ps 1x2, bought the 2 for 2.75 in 6.5k

- 3LM1 99.00/98.75ps 1x2, bought for 3 in 5k

FOREX: USD/CAD Downtrend Resumes

- CAD outstripped all others Friday, with USD/CAD resuming the 2021 downtrend on the break below 1.2468. CAD strength followed a stellar Canadian jobs report for February, in which Canada added over 3 times as many jobs as forecast, with a decent bounce across both full and part-time positions. This saw the unemployment rate shed a whole 1.2ppts to new pandemic-era lows.

- Persistent USD strength was evident throughout Asia-Pac and European hours as US yields rallied and the Treasury Curve steepened. This saw the USD Index bounce off the weekly post-ECB lows before price action faltered into the US close, with the greenback rolling off the day's best levels ahead of the close.

- SEK, NZD and GBP were among the poorest performers Friday, CAD, USD and NOK the strongest.

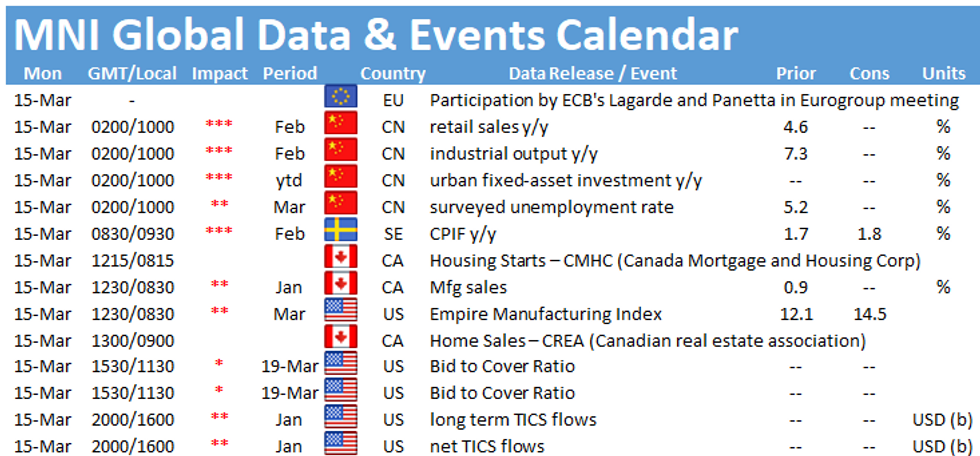

- Focus for the coming week rests on a frenetic five days for central banks. Rate decisions are due from the US, UK, Norway, Japan, Russia, Turkey, Brazil and Indonesia among others.

- On the data front, the Australian jobs report, Japanese CPI and US retail sales are all due.

FX OPTIONS: Expiries for Mar15 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.00($550mln)

- AUD/USD: $0.7780-90(A$655mln)

- USD/CNY: Cny6.47($1.35bln-USD puts)

PIPELINE: $25B Verizon Deal Outpaced Thu's 30Y Bond Auction

Thursday highlight: Huge $25B 9pt issue from Verizon, $1B more than the US Tsy bond auction and oversubscribed too. Issue size at low end of estimate, appeared some prop/fast$ accounts had anticipated larger issuance and had sold along with hedges -- contributed to the bounce in Tsys after the 30Y Bond R/O auction tailed slightly. Verizon still holds record of largest debt launch ever at $49B total in August 2013. Sole issuer for Friday:

- 03/12 $1.1B #Bell Canada $600M 3Y +45, $500M 30Y +127

- Date $MM Issuer (Priced *, Launch #)

- 03/11 $1.75B *Verizon 3Y +45, $750M 3Y FRN SOFR+50

- 03/11 $2.75B *Verizon 5Y 70, $750M FRN SOFR+79

- 03/11 $3B *Verizon 7Y +90

- 03/11 $4.25B *Verizon 10Y +107

- 03/11 $3.75B *Verizon 20Y +120

- 03/11 $4.5B *Verizon 30Y +130

- 03/11 $3.5B *Verizon 40Y +145

EQUITIES: Mixed Session For Stocks, Bluechips Higher, Tech Lags

- The to-and-fro of cyclical vs. value stocks this week extended Friday, as tech lagged and bluechip companies outperformed. This resulted in further strength for the Dow Jones, which hit a new alltime high. The largest contributors to the rally were Boeing and bank stocks, who rallied on the steeper US Treasury curve.

- Having neared the record highs Thursday, the e-mini S&P retreated as markets were unsettled by bond market weakness, keeping prices well within the Thursday range. This keeps the technical picture unchanged.

- Across Europe, stocks finished mixed as UK, Spanish indices posted gains (0.4%, 0.6% respectively) while Germany's DAX lagged, closing lower by 0.5% or so.

COMMODITIES: Precious Metals Track US Dollar, Subdued Friday For Crude Futures

- Precious metals lost ground early Friday as the US Dollar appreciated with US yields marching higher. The sell-off was short-lived as the US Dollar momentum faded. Spot gold rebounded and trades broadly flat on the session as we approach the close. Silver had been the real laggard during European hours, however, recovered half of the day's range to post ~1% losses.

- Subdued price action in oil markets to finish the week. WTI futures consolidated Thursday's gains around the $66 mark, exhibiting marginal losses for the week (~1%) despite the volatile price action.

- Bitcoin caps off a stellar week, gaining around 15% to trade just below $58,000, in close proximity to the all-time highs of $58,350.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.