-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Powell Liftoff Remains Outcome Based

US TSY SUMMARY: Powell, Second Verse Same as the First

Rates trade weaker after the bell, well off lows to near middle of the session range, perhaps ironically as equities trimmed gains under heavier late session selling. Futures held mildly weaker levels in shorts to intermediates post-Import/export index data.

- Data was not expected to be a market mover, however, focus on headline risk over Fed-speak: vaccine-centric with safety of other jab-makers evaluated after J&J blood clot news Tue; geopolitical on Russia/US tensions related to former's troop buildup on Ukraine border.

- Several Fed speakers on day included Chairman Powell: No market reaction to Fed Chair's comments during Washington Economic Club virtual event, Tsys holding near recent lows, yld curves steeper. Economy at a bit of inflection point, going into period of faster growth and higher job creation; risk to improvement -- spike in virus mutations. Too much focus on dot plot and not enough outcome based. Three outcomes / goals need to be met: labor market recovery, inflation stable at 2% (not temporary), moving above 2%. Late Fed VC Clarida: "policy will not tighten solely because the unemployment rate has fallen below any particular econometric estimate of its long-run natural level."

- The 2-Yr yield is up 0.2bps at 0.161%, 5-Yr is up 2.1bps at 0.8564%, 10-Yr is up 2bps at 1.6341%, and 30-Yr is up 2.9bps at 2.3232%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00112 at 0.07363% (-0.00112/wk)

- 1 Month +0.00100 to 0.11563% (+0.00438/wk)

- 3 Month -0.00012 to 0.18363% (-0.00388/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00012 to 0.21938% (+0.00900/wk)

- 1 Year -0.00100 to 0.28675% (+0.00100/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $67B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $242B

- Secured Overnight Financing Rate (SOFR): 0.01%, $894B

- Broad General Collateral Rate (BGCR): 0.01%, $379B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $354B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, appr $12.801B accepted vs. $46.828B submission

- Next scheduled purchases:

- Thu 4/15 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/16 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Mon 4/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 4/20 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Steady-On Specials

Largely steady in special territory; Bills unchanged. Current levels:

T-Bills: 1M 0.0051%, 3M 0.0152%, 6M 0.0355%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | 0.00% | 0.00% |

| 3Y | -0.15% | -0.19% |

| 5Y | -0.12% | -0.11% |

| 7Y | 0.00% | -0.07% |

| 10Y | -0.20% | -0.11% |

| 30Y | -0.19% | -0.06% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, +10,000 long Green Mar 90/93 1x2 call spds, 1.5

- -3,000 Red Mar 97/98 1x3 call spds, 1.0 3-leg over

- +2,500 Red Mar 85 puts, 8.0

- +12,000 short Jun 98 calls, 0.25

- Overnight trade

- 5,000 Red Jun 90/92 put spds

- +2,300 Green Dec 88 straddles, 49.0

- total -44,000 (28.3k Blocked) short Dec 93/96 put spds w/ 97/98 call spds, 8.0 total

- 11,000 short Dec 91/93/96 put flys

- more short Dec 96 puts outright from 14-14.5 pushes volume in strike near 88,000

- 1,500 Green Jul 83/86/88 put flys

- 1,500 TYM 132.5 calls, 27

- Update, over 10,000 wk5 TY 130.5/131 put spds, 8

- 1,900 FVM 120.5/121/122.5/123 put condors, 5

- -1.500 FVM 122.25/124.5 strangles, 9.5

- -2,500 TYM 132 straddles 132-131

- +5,000 TYU 128.5 puts, 45-47

- +4,500 wk5 TY 131.5 puts, 19

- -4,000 TYM 131/133 strangles, 44

- Overnight trade

- 2,500 TYM 131/133 put over risk reversals, 7

- +28,000 FVM 125 calls, 2.5

- Block, +5,000 FVM 123.75/124.25 2x3 call spds, 22.0

- Block, +10,000 TYM 130.5/133 put over risk reversals, 12 net ongoing position build

- 7,000 TYK 131.5 puts, 11

- 5,000 TYK 133 calls, 3

- 5,000 TYK 132.5/133.25 2x3 call spds

EGBs-GILTS CASH CLOSE: Bear Steepening

A strong start gave way to sizeable weakness for Bunds and Gilts, with yields testing their highest levels since March in a bear steepening move Weds afternoon.

- No overt catalyst though, with most of the week's (large) supply already having seemed to have been absorbed, and only some facets of a risk-on move (equities mixed, USD weaker). Periphery spreads mixed but basically steady.

- The E.U. confirmed details on issuance for the E800bn NextGenEU programme, with auctions and syndications due to start in the summer. Afternoon comments by ECB Lagarde had little impact.

- Slovakia held a 15-Yr syndication, raising E1.5bn; Germany held 30-Yr Bund sale and UK a 30-Yr linker auction. Ireland announced a 20-Yr Mandate.

- Thursday sees some final March CPI data, but no scheduled speakers or bond auctions.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.4bps at -0.688%, 5-Yr is up 2.8bps at -0.603%, 10-Yr is up 3.4bps at -0.258%, and 30-Yr is up 3.1bps at 0.295%.

- UK: The 2-Yr yield is up 1.2bps at 0.061%, 5-Yr is up 1.1bps at 0.367%, 10-Yr is up 2.5bps at 0.804%, and 30-Yr is up 3.8bps at 1.345%.

- Italian BTP spread up 1bps at 105.1bps / Spanish down 0.5bps at 67.4bps

OPTIONS/EUROPE SUMMARY: Plenty Of Mid Structures, No Particular Theme

Wednesday's options flow included:

- 0RZ1 100.625/100.50 1x2 put spread, sells the 1 at 1 in 4k

- 0RZ1 100.50/100.375 put spread bought for 3.25 in 7k

- ERZ2 100.50^ v 0.5x100.25 put, sold at 21.25 in 3k all day

- 3RM1 100.125/100.00 put spread sold at 1 in 10k

- 3RM1 100.125/100.00 put spread bought for 1.25 in 5k

- 3RZ1 100.00/99.875 put spread vs 100.50/100.625 call spread, buys the p/s for 1 in 4k on the day

- 0LZ1 99.875/100.00/100.125/100.25 1x1x0.5x0.5 call condor sold at 1 in 7k

- 0LZ1 99.625^ v 99.50 put sold at 16.75 in 5k

- 0LZ1 99.75/99.875/100.125 c1x3x2 - buys the wings, receiving 0.25 in 5k

- 2LZ1 99.25 put (v 99.33) sold at 3k in 15

FOREX: Commodity-Tied Currencies On Top as Oil Markets Break Out

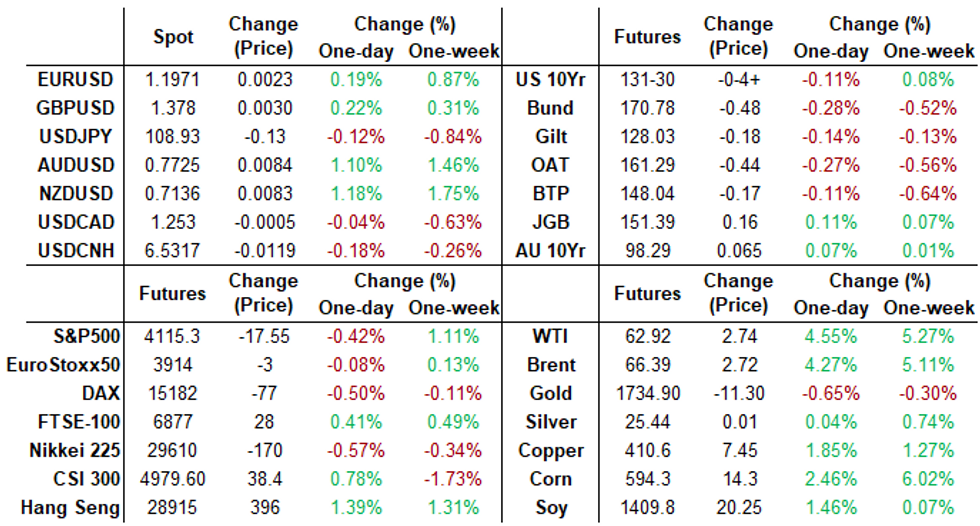

- Powell's end-of-session speech did little to turnaround the weaker greenback Wednesday as surging equity markets and still-low Treasury yields helped pressure the USD Index to new April lows. The 50-dma undercuts as support for the index, today crossing at 91.602.

- Building on a strong start, AUD and NZD rose further into the US close as commodity markets surged to outperform all others, with AUD/USD cracking near-term resistance to trade at the best levels since mid-March. Bulls need to build a base above the 50-dma to extend the recovery, with the key bull trigger now seen at March's 0.7849.

- A stellar session for WTI and Brent crude futures helped these currencies, alongside CAD, outperform, as a considerably larger draw on inventories than expected in the weekly DoE inventories helped fuel gains.

- USD and CHF were the weakest Wednesday, with AUD, NZD well ahead of the rest of G10.

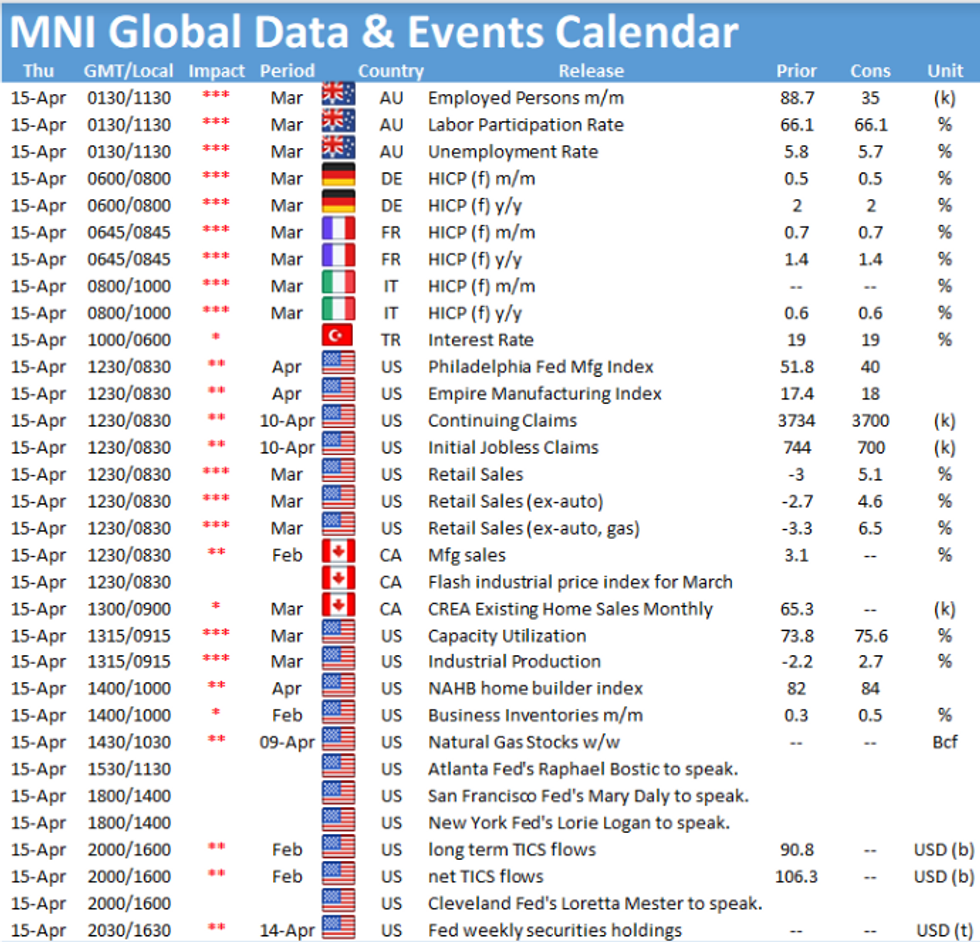

- Focus Thursday remains on US earnings season, with the Australian jobs report, weekly US jobless claims, industrial production and retail sales data as well as rate decisions from the the Turkish and South Korean central banks.

FX OPTIONS: Expiries for Apr15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-65(E1.2bln), $1.1895-1.1900(E2.3bln, E1.85bln EUR puts), $1.1970-75(E1.2bln-EUR puts)

- USD/JPY: Y105.90-106.00($1.1bln), Y109.00-10($1.7bln-USD puts), Y109.15-25($975mln), Y109.40-50($715mln), Y110.00($691mln), Y110.50-60($1.3bln-USD puts)

- AUD/USD: $0.7700(A$543mln), $0.7750-75(A$1.1bln-AUD puts)

- AUD/NZD: N$1.0850(A$668mln)

- USD/CAD: C$1.2645-50($765mln), C$1.2680($837mln)

PIPELINE: Still Waiting for UAL Launch

- Date $MM Issuer (Priced *, Launch #)

- 04/14 $1B #Quebec 10Y +29

- 04/14 $2B #Public Storage (3Y fix dropped) $700M 3NC1 FRN SOFR+47, $650M 7Y +55, $650M 10Y +70

- 04/14 $4B United Airlines $25B 5Y 4.375%, $2B 8Y 4.625% ($1.5B moved to term loan after initial total topped $5.5B)

- 04/14 $1.9B #Bank of Nova Scotia $1.25B 3Y +38, $650M 3Y FRN SOFR+44.5

- 04/14 $1.2B #Viterra Finance $600M 5Y +120, $600M 10Y +160

- 04/14 $500M *Kommunalbanken (KBN) WNG 3.5Y +2

- 04/14 $500M #Shinhan Bank 5.5Y +65

EQUITIES: Stocks Hit New Highs on Earnings

- The S&P 500 again hit all time highs Wednesday, showing briefly above the 4,150 mark for cash indices. In futures space, the Dow Jones outperformed while the tech-led NASDAQ sagged, the only major index to trade lower headed into the cash close.

- Earnings were generally received favourably, with both Goldman Sachs and Wells Fargo trading with gains of as much as 5.5% following their respective reports.

- This helped buoy the financials sector close to the top of the pile Wednesday, outstripped only by the energy sector, which surged on a long-awaited breakout in oil prices after a lengthy period of rangebound trade.

- Earnings due Thursday include Bank of America, Blackrock, Citigroup and Charles Schwab, among others.

COMMODITIES: Oil Benchmarks Set To Confirm Break Above Short-Term Ranges

- Brent and WTI Crude Prices gained over 5% on Wednesday, active contracts strengthening to $66.75 and $63.25 respectively. Benchmarks are set to break out of most recent tight ranges, posting the highest closes since March 17th.

- Prices extended gains as weekly EIA data showed a much larger-than-forecast, 5.9M barrel drop in US crude-oil inventories. Additionally, the rally was bolstered after the monthly IEA report released forecasts of a significant rise in global oil demand in the second half of the year.

- WTI crude futures face next resistance at the March 18 high of 64.88 ahead of the key bull trigger above at 67.70 - the Mar 8 high.

- Despite the softer dollar, gold fell on Wednesday as an uptick in U.S. Treasury yields weighed on bullion's appeal. Spot gold dropped around 0.5% to $1736. Spot silver consolidated yesterday's gains and was broadly unchanged on the session.

- Copper prices firmed 2.5% as Goldman Sachs released a note doubling down on their bullish outlook for the base metal. Analysts raised 12-month target to $11,000 and projects prices will hit $15,000 by 2025 as the global green-energy transition propels demand for the metal used in power grids, wind turbines and electric vehicles.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.