-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Global Equities Take a Hit

US TSY SUMMARY: Risk-Appetite Cools

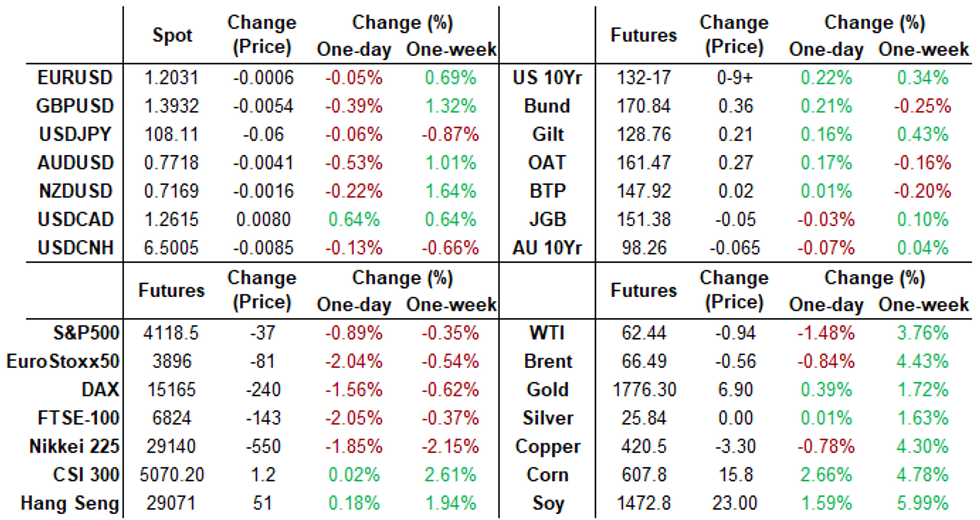

Risk appetite cooled Tuesday, 30Y bonds staging an early rally with stocks broadly weaker: SPUs followed weaker global stocks: Estoxx as the index fell blow Friday's lows, Japan's NIKKEI settled down a whopping 584.99 pts or -1.97% at 29100.38.- While some sources cited ongoing pandemic related concerns (Japan looking to call a state of emergency earlier, growing concerns in India w/PM Modi addressing the nation) and growing US/Russia tensions over troop build-up near Ukraine border -- others simply cited various technicals: sellers emerge every time SPUs climb 16% over 200DMA; or following a pattern of better selling in the second half of the month, every month since the beginning of the year.

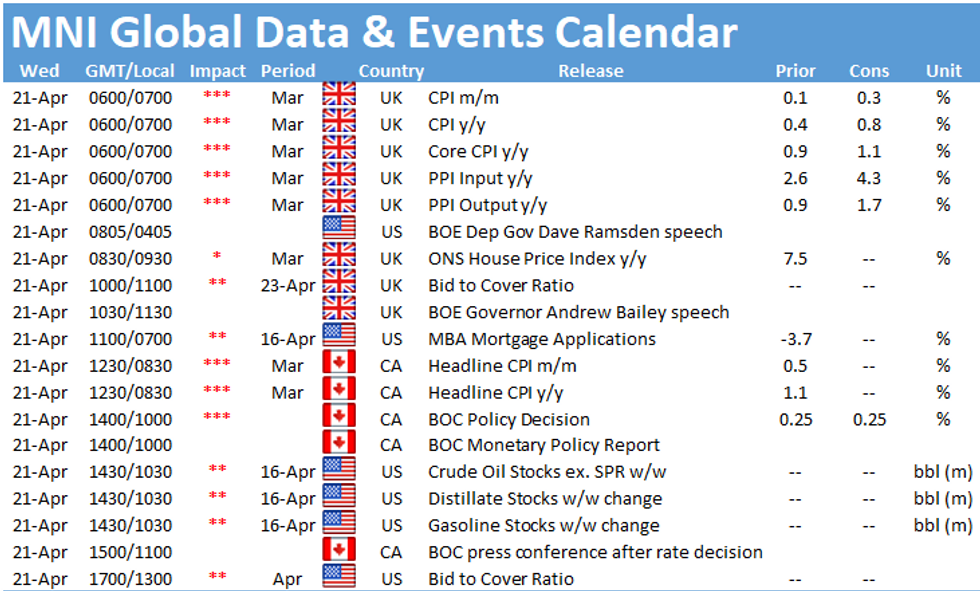

- Whatever the reason, US markets had another day of no economic data to trade off of -- and more of the same Wednesday. Data resumes Thursday w/weekly claims. Otherwise, focus is on Bank of Canada policy announcement Wednesday (includes Monetary Policy Report) and ECB decision Thursday.

- Another decent round of corporate issuance, near $17B generated hedging flow; FI markets a little gun-shy ahead Wednesday's $24B 20Y Bill auction re-open that has managed to push markets around last two auctions as performance varied.

- The 2-Yr yield is down 0.6bps at 0.1512%, 5-Yr is down 3.4bps at 0.7952%, 10-Yr is down 4.4bps at 1.5607%, and 30-Yr is down 3.9bps at 2.2573%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N +0.00013 at 0.07288% (+0.00013/wk)

- 1 Month -0.00625 to 0.10750% (-0.00838/wk)

- 3 Month -0.00225 to 0.18375% (-0.00450/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00088 to 0.22263% (-0.00100/wk)

- 1 Year +0.00025 to 0.28700% (-0.00538/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $65B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.01%, $919B

- Broad General Collateral Rate (BGCR): 0.01%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, appr $1.732B accepted vs. $4.793B submission

- Next scheduled purchases:

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Steady-On Specials

Holding steady, Bills unchanged. Current levels:

T-Bills: 1M 0.0051%, 3M 0.0152%, 6M 0.0355%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | -0.01% | -0.01% |

| 3Y | 0.00% | -0.08% |

| 5Y | -0.13% | -0.09% |

| 7Y | -0.01% | -0.08% |

| 10Y | -0.09% | -0.09% |

| 30Y | -0.04% | -0.04% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Blue Jun 90 calls, 4.0

- +15,000 Mar 100.12 calls, 0.5

- +6,000 Green Jun 92/93 strangles, 13.0

- +5,000 Blue Mar 77/82 put spds, 17.5 vs. 98.28/0.18%

- +5,000 Blue Jun 83/86 2x1 put spds, 3.0

- +2,500 Green May 95/96 call spds, 1.0

- +2,000 Red Sep 92/97 call over risk reversals, 2.0

- +5,000 Red Dec 95/96 put spds, 2.0 over 98 calls vs. 99.565/0.26%

- Overnight trade

- Block, +5,000 Blue Sep 80/81/83 put flys, 5.0

- +3,000 TYM 131.5 puts, 23 vs. 132-19/0.29%

- -5,000 TUM 110.37 calls 3.5

- -2,800 USM 161 calls, 45

- +6,000 wk5 TY 132.5/133/133.5 1x1x2 call trees, 3

- over 12,500 TYK 132.5 calls, 8-9

- -2,000 TYM 131.5 puts, 6-6.5

- -1,500 TYM 132 puts, 43

- +1,500 TYM 131 puts, 20

- -1,000 TYU 127/135.5 strangles, 49

- 1,000 USM 158 calls, 132

- 1,000 USK 160 calls

EGB/Gilt Summary: Underpinned during the afternoon session

Core Govies remain supported this afternoon, after taking their cue from the Risk Off price action.

- Move in Equities was seen as corrective, rather than any new news impact. German stays bull flatter, but well within April's ranges.

- In options space, downside structure play continue to dominate ahead of the awaited ECB meeting on Thursday

- Semi core have under performed somewhat, translating in wider peripheral spreads.

- Greece and Portugal trades at 1.7bp and 1.3bps wider respectively against the German 10yr

- Bund futures are up 0.07 today at 170.55 with 10y Bund yields down -0.6bp at -0.241%

- Schatz yields down -0.5bp at -0.692%

- BTP futures are down -0.07 today at 147.83 with 10y yields up 0.2bp at 0.792% and 2y yields up 0.1bp at -0.348%.

- OAT futures are up 0.03 today at 161.23 with 10y yields down -0.5bp at 0.096% and 2y yields up 0.3bp at -0.653%..

FOREX: USD Spared Another Day of Losses Despite Further Curve Flattening

- Somewhat bucking the recent trend, the USD Index was spared further losses Tuesday as profit-taking and position squaring in the likes of EUR/USD and GBP/USD worked in favour of the index. This came despite persistent flattening the US yield curve, having taken the lead from a pullback in the US stock market.

- Further support for the greenback came as the latest polling in Germany suggested Merkel's CDU/CSU bloc has fallen behind the Greens. The headline prompted some selling pressure in the single currency, pressuring EUR/USD to the day's lowest levels, although support at the 1.20 remained intact.

- Lastly, commodity-tied currencies had the wind taken from their sails Tuesday, with a sharp drop in oil prices knocking both NOK and CAD into the close. The advancement of a bill in the Judiciary Committee that would open OPEC to lawsuit pressure from US lawmakers weighed on sentiment.

- Focus Wednesday turns to Australian retail sales, UK inflation data for March, Canadian CPI and the Bank of Canada rate decision. There are a number of BoE speakers on tap, with BoE's Bailey and Ramsden due to speak.

FX OPTIONS: Expiries for Apr21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-05(E942mln), $1.1920-40(E922mln)

- GBP/USD: $1.3700(Gbp582mln), $1.3800(Gbp638mln)

- AUD/USD: $0.7740-50(A$1.1bln-AUD puts)

- USD/CNY: Cny6.55($541mln)

PIPELINE: $16.88B To Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 04/20 $4B *EIB 3Y -3

- 04/20 $3.5B #Taiwan Semiconductor Mfg (TSMC) $1.1B 5Y +50, $900M 7Y +55, $1.5B 10Y +70

- 04/20 $1.75B #FedEx $1B 10Y +87.5, $750M 20Y +112.5

- 04/20 $1.5B #New Development Bank (NDB) 5Y +25

- 04/20 $1.5B #Abu Dhabi National Energy (TAQA) 7Y +80, 30Y 3.4%

- 04/20 $580M *Japan Int Cooperation Agcy 10Y +30

- 04/20 $500M *Korea Hydro & Nuclear Power 5Y +57.5

- 04/20 $1B #PNC Financial 11NC10 +75

- 04/20 $1.75B #FedEx $1B 10Y +87.5, $750M 20Y +112.5

- 04/20 $800M #New York Life $400M each: 3Y +25, 3Y FRN SOFR+31

- Expected over next few days:

- 04/21 $1B Kommunivest (Koomins) 3Y +2a

- 04/21 $Benchmark Kommunalbanken Norway (KBN) 2Y SOFR

- 04/21 $Benchmark International Development Assn (IDA) 5Y +5a

- 04/26 $Benchmark Tokyo Metropolitan, investor calls re: 3-10Y

EQUITIES: Stocks Slip Sharply, Europe Down over 2%

- All three major US indices opened lower Tuesday and held the losses into the close, helping relieve some of the technically overbought conditions at the tail-end of last week. The RSI retreated back into normal territory Tuesday, after flashing overbought as of Friday's rally.

- Equity markets in Europe traded softer at the NY crossover, but additional weight went through following the sharp downtick in oil prices.

- News that the House Judiciary Committee had advanced a bill that would allow for collusion lawsuits aimed at OPEC sent prices lower Tuesday, undercutting the energy sector both on the continent and stateside. As such, European markets took another leg lower ahead of the close to finish with losses of over 2% in most markets.

- The VIX continue to enjoy a late April recovery, rallying to near 20 points Tuesday as the pullback from all time highs buoys the index.

COMMODITIES: Oil Retreats Amid Sliding Equity Indices/OPEC Antitrust Probe

- Initial strength in crude benchmarks reversed on Tuesday as equity indices suffered from souring risk sentiment. WTI futures gave up 1.5% while Brent also encountered 1.1% losses.

- Weakness in European equities at the NY crossover was weighing on crude futures but the move was exacerbated by OPEC headlines circulating on social media.

- It appears the US House Judiciary Committee have passed a bill opening OPEC to Antitrust lawsuits over production costs, the so-called 'NOPEC Act'. Still uncertain the extent to which the legislation would be considered by the full chamber at this stage, however this helped fuel the next leg lower in risk across financial markets.

- That being said, the market has recently broken out and this still appears to be a retest of a major breakout with WTI futures maintaining a bullish technical tone following last week's breach of $62.27, Mar 30 high. Firm support is found at $61.36, the 20-day EMA.

- Copper had a similarly volatile Tuesday, with futures initially approaching fresh nine-year highs at 430.35 before a sharp 2% reversal. With the US dollar posting it's first rise in seven trading days, the renewed copper rally came to a halt. Additional headlines weighed on the base metal: Smelters in China, the largest user of the metal, recommended limiting new capacity and using more scrap to help meet climate goals.

- Precious metals took a backseat with spot gold 0.4% in the green, despite the stronger dollar and silver broadly unchanged.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.