-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: ECB Policy Focus After BOC Tapers QE

US TSY SUMMARY: Waiting for US Data and ECB Policy Annc

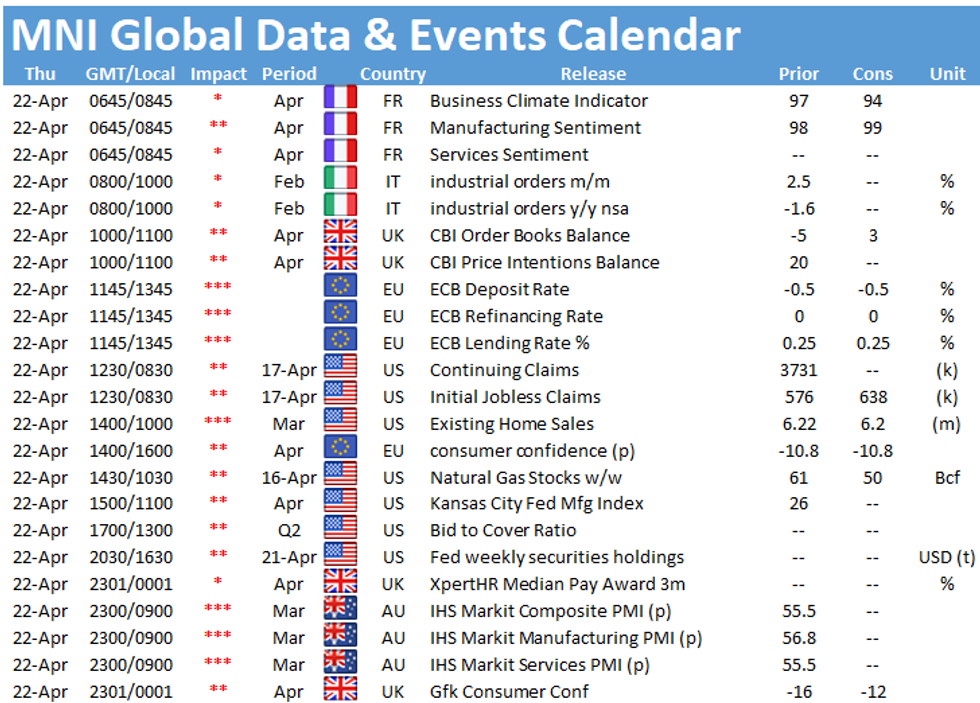

Tsys see-sawed in a narrow range Wednesday, trading steady to marginally mixed by the close on the third consecutive session of no economic data to draw guidance from.- Bonds had pared gains following the decent $24B 20Y Bond auction re-open (2.144% high yld (2.290% last month) vs. 2.150% WI) as flow turned two-way, modest positioning ahead return of economic data Thursday (weekly claims, leading index, existing home sales). Focus also turns to ECB policy annc after Bank of Canada held rates steady but tapered QE by CAD1B to CAD3B. (Spurious headline prior to official release clearly said NO change to weekly bond buying causing some volatility in CAD).

- Near another $10B in high-grade corporate supply priced in day, $38B total in first half of the week largely supra-sovereign.

- Lead quarterly Eurodollar futures traded higher after 3M LIBOR dropped to new record low: -0.01087 to 0.17288% (-0.01537/wk) compares to prior record Low of 0.17525% on 2/19/21.

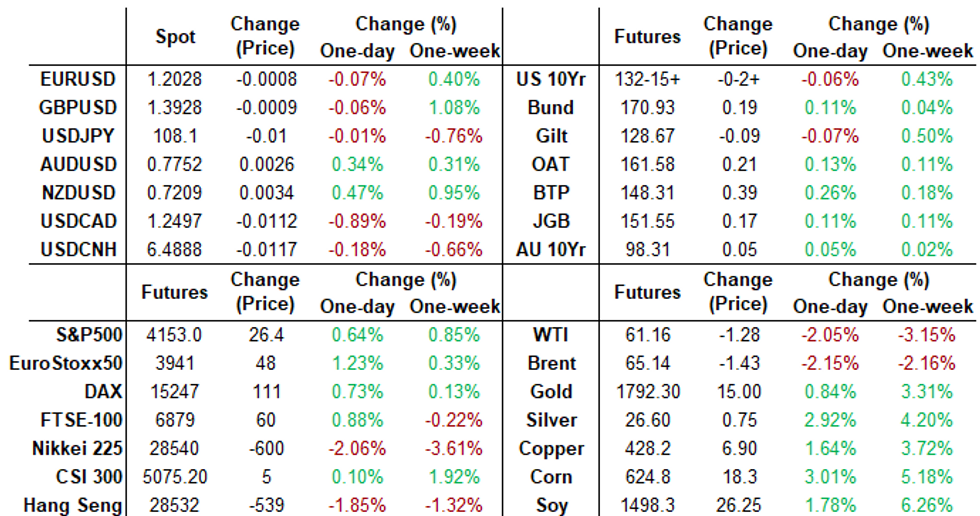

- The 2-Yr yield is down 0.2bps at 0.1472%, 5-Yr is up 0.7bps at 0.7985%, 10-Yr is up 0.4bps at 1.5626%, and 30-Yr is up 1.2bps at 2.2634%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00075 at 0.07213% (-0.00063/wk)

- 1 Month +0.00275 to 0.11025% (-0.00563/wk)

- 3 Month -0.01087 to 0.17288% (-0.01537/wk) ** New record vs. 0.17525% on 2/19/21)

- 6 Month -0.00613 to 0.21650% (-0.00713/wk)

- 1 Year -0.00475 to 0.28225% (-0.01013/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.01%, $896B

- Broad General Collateral Rate (BGCR): 0.01%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, appr $6.001B accepted vs. $18.560B submission

- Next scheduled purchases:

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Steady-On, 1M Bill Go Negative

Holding steady, Bills unchanged. Current levels:

T-Bills: 1M -0.0025%, 3M 0.0152%, 6M 0.0304%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | -0.01% | -0.01% |

| 3Y | 0.00% | -0.06% |

| 5Y | -0.10% | -0.07% |

| 7Y | -0.01% | -0.06% |

| 10Y | -0.08% | -0.08% |

| 30Y | -0.04% | -0.04% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- -5,000 short Dec 93 puts, 5.5 vs. 99.585/0.20%

- +25,000 short Sep 92/93 put spds, 0.5 in late trade

- Block, +14,000 Blue May 82/85 2x1 put spds, 2.0 net at 1050:28ET

- +14,000 Blue Sep 80/90 put over risk reversal, 1.0 net db vs. 98.545/0.40%

- -5,000 Green Sep 92/93 call spds 0.5 over 90/91 put spds

- +5,000 Green Dec 93/95 1x2 call spds,

- +10,000 Mar 100.12 calls, 0.5, ongoing buyer of negative rate hedge up to +32k since Monday. Offer reloads on over 130k. Traders remind one acct back in December bought appr 50,000 Mar 100.5 calls at 0.5 as well.

- Overnight trade

- 4,000 Dec 96/97 put spds

- 3,000 Green May 99.18/99.25/99.37 call trees

- 1,500 Green May 99.06/99.18/99.31 put flys

- 1,600 Blue Jun 85/88 put over risk reversals

- +5,000 TYK 313.5/132 put spds, 3 vs. 132-16/0.10%

- +1,500 TYK 312.5 calls, 16

- Overnight trade

- 25,500 (10k Blocked) TYM 133.5 calls, 20-24

- 7,500 TYK 132 puts, 5

- 5,600 TYK 131.5 puts, 2

- 4,400 TYM 130.5 puts, 11

- 1,000 TYM 131 straddles, 163

- 3,700 FVM 122.5/123/123.75 broken put flys

EGBs-GILTS CASH CLOSE: BTPs Gain Ground On German Court Ruling

Core FI gained a bit of ground Thursday, with BTPs outperforming on the periphery. The Bund and Gilt curves saw very modest steepening, in Germany's case off the bull variety.

- Highlight of the session was the German federal court ruling paving the way for Germany to ratify the EU recovery fund; with that (modest) uncertainty out of the way, BTP spreads compressed.

- Germany allotted E3.42bn of 10-yr Bund; UK GBP2.50bn of Jul-35 Gilt.

- Otherwise, with little in the way of impactful speakers/data during the session (UK Mar inflation was broadly in line with expectations), attention was more on ECB tomorrow.

- MNI ran an exclusive this afternoon citing sources saying there are deep differences on the Governing Council over the strength of the eurozone recovery and thus the future of stimulus.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.3bps at -0.696%, 5-Yr is down 0.2bps at -0.607%, 10-Yr is unchanged at -0.262%, and 30-Yr is unchanged at 0.281%.

- UK: The 2-Yr yield is unchanged at 0.038%, 5-Yr is up 0.2bps at 0.316%, 10-Yr is up 0.9bps at 0.74%, and 30-Yr is up 2bps at 1.285%.

- Italian BTP spread down 2.6bps at 101.5bps / Spanish down 1.2bps at 65.4bps

OPTIONS/EUROPE SUMMARY: Profit-Taking On Bearish BTPs

Wednesday's options flow included:

- IKM1 147.00/145.00 put spread vs 151.00/153.00 call spread sold at 23 / 24 in 10k. Market sources report this is closing position - looking back, this was bought previously (+p/s) for 2 in 3.3k on Mar 30 and added to at -1 in 5.8k on Apr 7.

- DUM1 112.00 put bought for 1.5 in 10k

- RXM1 169.5/167.5ps 1x2, bought for 22 in 2k

- RXM1 170.50/169.50 ps vs RXK1 171.00/170.00 ps, +Jun/-May for 2 / 2.5 (vs 170.88)

- 2RZ1 100.37^, bought for 21 in 1k

- 2RU1 100.37/100.25ps vs 100.50c, bought the ps for 0.25 in 4k

- 3RZ1 100.12/100/99.87/99.75p condor trades 2 in 1.5k

- 3RZ1 100.37/100.50cs, trades 2 in 1k

- 0LZ1 99.625/99.50 ps bought for 3.5 in 4k

- 0LZ1 99.875 call + 0LH2 99.875 call bought for 8.25 in 15k (v 99.605 and 99.67)

- 2LU1 99.75/99.50/99.25p fly sold at 8.75 in 12.5k

- 2LU199.25/99.37/99.50c fly, bought for 2 in 10.65k

- 2LU1 99.12/99.00ps, bought for 1.5 in 2k

- 2LK1 99.50/99.375 put spread bought for up to 2.25 in 5k

FOREX: CAD Shoots Higher After BoC Head Fake

- A wild ride for CAD, as erroneous reports circulated pre-BoC decision that the Bank had decided to maintain the pace of their QE purchase programme, which prompted a notable rally in USD/CAD before the decision itself confirmed otherwise.

- The BoC tapered their bond purchase programme for the second time, pressuring USD/CAD through the week's lows and toward the mid-March low and bear trigger of 1.2365.

- After early signs that US yields were recovering after the flattening pressure Tuesday, the greenback initially rallied during the European morning before yields returned lower, dragging the USD in tandem, which fell closer to the bottom of the G10 leaderboard.

- CHF, GBP and USD traded poorly, CAD AUD and NZD were the more solid currencies Wednesday.

- Focus Thursday turns to the ECB rate decision, with markets watching closely for any hints on the future of the APP and, in particular, the pace of future bond purchases.

- Weekly US jobless claims and existing home sales data also cross. ECB's Lagarde conducts her usual post-decision press conference, but other than that there are no major central bank speakers.

FX OPTIONS: Expiries for Apr22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1792-00(E1bln), $1.1900-10(E1.3bln), $1.1975-87(E923mln), $1.2045-50(E557mln)

- USD/JPY: Y108.00-05($1.5bln), Y108.30-40($2.4bln-USD puts), Y108.50-55($505mln), Y109.00($693mln), Y109.90-110.00($1.1bln)

- EUR/GBP: Gbp0.8550(E580mln)

- NZD/USD: $0.7060(N$917mln-NZD puts), $0.7090(N$942mln-NZD puts)

- AUD/USD: $0.7750(A$565mln)

PIPELINE: Coca-Cola, Glencore, P&G Launched

- $9.7B To price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 04/21 $2B #Coca-Cola Eur Ptnrs $850M 2Y +40, $650M 3Y +50, $500M 5.75Y +73

- 04/21 $2B *International Development Assn (IDA) 5Y +4

- 04/21 $2B #P&G $1B 5Y +20, $1B 10Y +42

- 04/21 $1.7B #Glencore Funding $600M 5Y +85, $600M 10Y +130, $500M 30Y +160

- 04/21 $1B *Kommunivest (Koomins) 3Y +0

- 04/21 $500M *Kommunalbanken Norway (KBN) 2Y SOFR+16

- 04/21 $500M Western Southern Life Ins 40Y +150

- 04/21 $Benchmark Malaysia sukuk 10Y +50, 30Y +80

- 04/21 $Benchmark Equate Petrochem 7Y +150a

EQUITIES: Stocks Bounce Smartly, Trims Gap with All TIme Highs

- US equity markets returned to winning ways Wednesday, erasing the bulk of the week's losses and trimming the gap with all time highs posted Friday to just 30 points. Sharp gains in materials names underpinned the index rally, with industrials and energy also trading well. Utilities and communication services were the sole sectors to trade in the red.

- Better trading the Dow Jones, NASDAQ and S&P 500 worked against the recent rally in the VIX, which shed over 2 points from the mid-week high.

- Cruiselines and economic re-opening firms retraced Monday/Tuesday weakness, with Norwegian and Carnival among the biggest gainers on the S&P500. Netflix was comfortably the poorest performer, slipping close to 7% after an unexpected slowing in the rise of subscriber numbers.

COMMODITIES: Oil Prices Slide On Global Demand Concerns, Inventory Climb

- Crude benchmarks slipped after an increase in U.S. crude inventories compounded anxieties surrounding the demand outlook.

- Prices slipped by around 2% on Wednesday, dragged down by surging coronavirus cases across major energy importers India and Japan. With India being a large, high growth market for oil case spikes may pose a challenge for demand in the short term.

- Additional downward pressure became evident after the EIA released their data indicating stockpiles rose by 594,000 barrels to 493 million barrels, the first rise in four weeks. Supplies were about 1% higher than the five-year average for this time of year. A week ago, inventories fell by 5.9 million barrels.

- Prices appear to be on the defensive following last week's breakout. Analysts have noted the technical focus on the 21-day MAs at $64.25 in Brent and $60.80 in WTI.

- A sharp reversal lower in the dollar index during the US session provided a supportive environment for metals to extend recent gains:

- Spot Gold – 1793 (+0.8%)

- Spot Silver – 26.50 (+2.5%)

- Copper Futures (HGA) – 428.50 (+1.56%)

- The yellow metal recently cleared resistance at $1758.8, Apr 8 high and is trading above the 50-day EMA. Furthermore, the break higher last week confirmed a double bottom reversal that had formed since the Mar 8 low. Attention now turns to $1805.7, Feb 25 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.