-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI ASIA MARKETS ANALYSIS: May the Fourth Be With You

US TSY SUMMARY: General Risk-On, May the Fourth Be With You!

Generally a risk-on trade Thursday, rates/equities weaker/stronger but off lower/higher bounds by the bell. In other words, markets fairly subdued in the session after the FOMC left rates and bond buying steady (if I had a dollar for every time I heard "no time to taper" I could go to the movies).

- Speaking of the movies, in another hopeful sign the pandemic is loosening it's grip: Lowe's to Hire 50,000 Staff, Sets Hiring Event for May 4, Bbg. Elsewhere, France hopes to reopen in phases starting May 3, Germany looking to ease restrictions for the vaccinated, while NY Mayor De Blasio marked July 1 on calendar for NY reopening (NY schools at 100% in the fall).

- Rates hit session lows around 1000ET, S&P eminis made new all-time highs (4210.0). From that point through the Tsy close, Tsys weaker but at top end of session range, markets scaled back respective moves, eminis just over 4200.0.

- Despite decent overall volumes (TYM1 >1.4M) desks did not report much conviction in the second half reversal, some repositioning, month-end flow, muted deal-tied hedging. Note, next Tsy quarterly refunding annc next week Wed at 0830ET -- expected to remain on par w/prior quarter likely due to uncertainty over large-scale infrastructure spending and whether the debt ceiling will be reinstated July 31.

- The 2-Yr yield is unchanged at 0.1641%, 5-Yr is up 1.4bps at 0.8652%, 10-Yr is up 2.9bps at 1.6379%, and 30-Yr is up 1.9bps at 2.3082%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00038 at 0.07275% (-0.00062/wk)

- 1 Month -0.00312 to 0.11013% (-0.00088/wk)

- 3 Month -0.00987 to 0.17563% (-0.00575/wk) ** (Record Low 0.17288% on 4/22/21)

- 6 Month +0.00038 to 0.20638% (+0.00225/wk)

- 1 Year -0.00237 to 0.28138% (+0.00050/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $67B

- Daily Overnight Bank Funding Rate: 0.05%, volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.01%, $847B

- Broad General Collateral Rate (BGCR): 0.01%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $354B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.197B submission

- Next scheduled purchases:

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

US TSYS/OVERNIGHT REPO

Holding steady, 5s, 10s and 30s lead specials. Bills reverse Monday bounce, current levels:

T-Bills: 1M 0.0025%, 3M 0.0076%, 6M 0.0279%; Tsy General O/N Coll. 0.00%

| Duration | Current | Old Issue |

| 2Y | -0.04% | -0.02% |

| 3Y | -0.01% | -0.08% |

| 5Y | -0.11% | -0.03% |

| 7Y | -0.03% | -0.05% |

| 10Y | -0.10% | -0.09% |

| 30Y | -0.09% | -0.06% |

MONTH-END EXTENSION ESTS: UPDATED Barclays/Bbg Extension Estimates for US

Updated Forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; Govt inflation-linked, 0.17. Note broad decline in Govt/Credit and Intermediate credit from year ago levels, while MBS extension est surges.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.08 | 0.13 |

| Agencies | 0.05 | 0.04 | 0.03 |

| Credit | 0.06 | 0.1 | 0.2 |

| Govt/Credit | 0.08 | 0.09 | 0.17 |

| MBS | 0.25 | 0.06 | 0.05 |

| Aggregate | 0.12 | 0.08 | 0.08 |

| Long Gov/Cr | 0.06 | 0.09 | 0.06 |

| Iterm Credit | 0.08 | 0.08 | 0.2 |

| Interm Gov | 0.09 | 0.08 | 0.1 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.15 |

| High Yield | 0.1 | 0.11 | 0.08 |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +2,000 long Green Sep 75 puts, 10.5 vs. 99.065/0.12%

- 6,000 short Jul 95 puts, 1.5

- +8,000 Blue Jun 91/93/95 broken call trees, 1.0

- +2,000 Gold Jul 73/75/77 broken put flys, 4.5

- +10,000 Blue Sep 80/90 put over risk reversals -- position build >125k so far

- +5,000 Blue Jun 80/83/86 put flys, 5.5

- Overnight trade

- 1,250 short Dec 90/92/95 put flys

- 1,250 Green Sep 82/87 put spds vs. 91/92 call spds

- Block, 6,900 short Sep 91 puts, 1.0 vs. 99.615

- +2,000 TYN 128.5/130 put spds 6 over 133 calls

- -2,000 TYM 130.5/131.5 put spds, 18

- Block, 10,371 wk2 TY 130.5/131.5 2x1 put spds, 12 -- adds to 18k earlier

- Update, 7,500 TYN 134/TYM 133 call diagonal spd, 10 vs. 131-22/0.10%

- -5,000 TYN 129 puts, 21-22

- +1,000 TYN 129/TYM 131.5 put spd. 10 cr/Jun sold over

- +1,000 TYN 130 put 130/TYN 131.5 put spds, 7 cs/Jun sold over

- 18,000 wk2 TY 130.5/131.5 2x1 put spds, 9

- Overnight trade

- +16,500 TYM 131/131.75 2x1 put spds, 1

- +15,500 TYM 131.25/132 2x1 put spds, 1-3 cr

EGBs-GILTS CASH CLOSE: Weaker In Reflationary Move

Bunds and Gilts traded weaker for most of the session alongside a broader bear steepening move in core global FI, while periphery spreads were mixed.

- There wasn't a clear driver of this move, though a broader "reflation trade" theme seemed to be in play in the afternoon in the US which helped drive UK and German yields higher.

- Flash April inflation data for Germany and Spain came in above expectations. Italy sold E8.5bn of BTP/CCTeu. ECB's Lane said in an interview that he sees the EZ economy at an "inflection point".

- Reuters reported Greece plans at least 2 more bond issues this year, to raise up to E4bln.

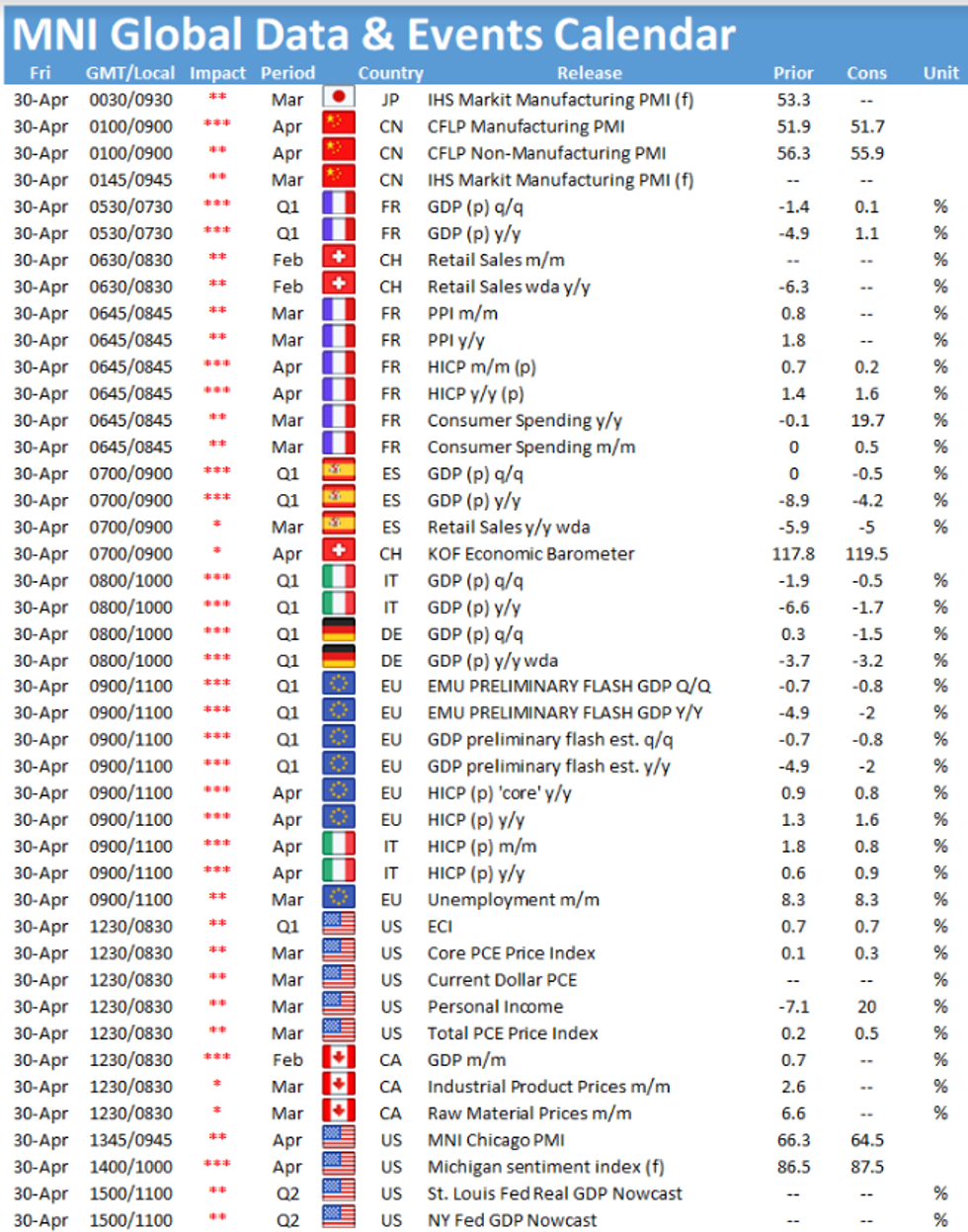

- Friday sees a busy data calendar, including prelim Q1 GDP and Apr inflation for multiple countries.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.7bps at -0.678%, 5-Yr is up 2.2bps at -0.562%, 10-Yr is up 3.8bps at -0.193%, and 30-Yr is up 4.9bps at 0.36%.

- UK: The 2-Yr yield is up 1.9bps at 0.078%, 5-Yr is up 3.1bps at 0.387%, 10-Yr is up 4.6bps at 0.843%, and 30-Yr is up 3.6bps at 1.347%.

- Italian BTP spread up 0.4bps at 110.6bps / Spanish up 0.4bps at 66.8bps

OPTIONS/EUROPE SUMMARY: Large Stg Put Structures Steal The Show

Thursday's options flow included:

- RXM1 171/172cs, sold at 25 in 1.25k

- RXN1 170.5/168.5ps 1x1.5, bought for 33 in 1k

- RXN1 170/168ps 1x2, bought for 13 in 1k

- RXN1 171/169ps vs 173/175cs, bought the ps for 3 in 1.5k

- RXU1 172.5/170ps 1x1.5, bought for 50.5 in 1k

- RXM1 172.50c, bought for 7 in 5k

- OEM1 134.5/134ps, bought for 9 in 2k

- OEQ1/OEU1 133/135 RR strip, bought the puts for 10 in 1k

- 3RZ1 100/99.87/99.75/99.62p condor, bought for 1.75 in 1k

- 0LM1 99.62/75/12/25 broken c condor, sold at 9 in 6k

- 2LM1 99.50c, bought for 4 in 4k

- 3LM1 99.50/99.25/99.00/98.75 put condor sold down to 17.25 in 30k (v 99.135)

- 3LU1 98.875/98.625 put spread sold at 5 in 45k (v 99.08). Market contact notes: originally bought for 3.75 and 4

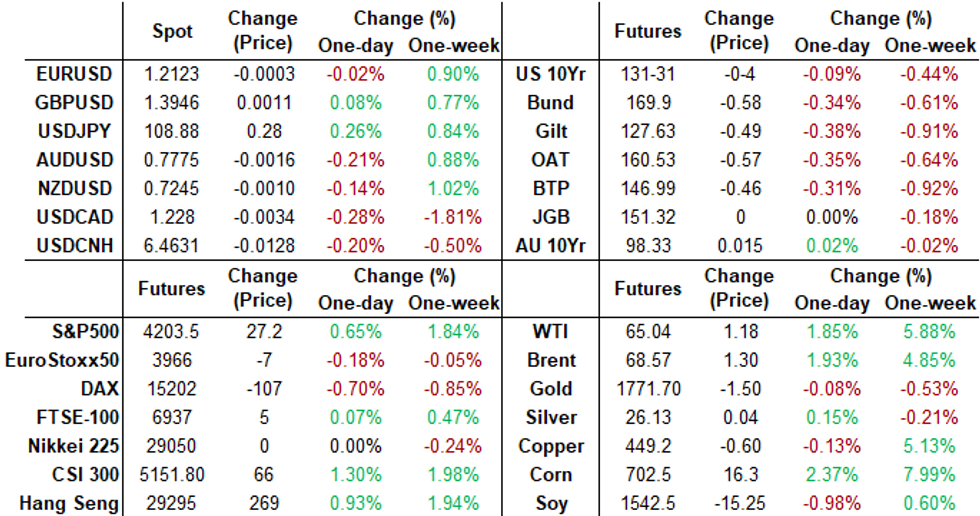

FOREX: CAD Continues to Pressure New Cycle Highs

- CAD continued to press higher Thursday, putting USD/CAD at new cycle lows for a second consecutive session. The break of 1.2365, Mar 18 low confirms a resumption of the underlying downtrend that has been in place since March 2020. MA studies remain in a bear mode reinforcing current trend conditions, with firmer oil prices also lending a hand.

- Having tested the level on several occasions Thursday, USD/JPY finally managed to show above the week's best levels of 109.08 before a turnaround in equity market sentiment undermined the bullish argument and dragged the pair back below Y109 ahead of the US close.

- CAD, USD were the strongest Thursday, with AUD, SEK and NOK among the poorest performers.

- Focus Friday turns to Japanese industrial production, Chinese PMI data for April and prelim GDPs from Germany, Italy and the Eurozone. In the US, March PCE, the MNI Chicago Business Barometer and Canadian GDP data crosses. Speakers include Fed's Kaplan.

FX OPTIONS: Expiries for Apr30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950-60(E687mln), $1.2030(E734mln), $1.2050-65(E749mln), $1.2075(E676mln), $1.2100(E1.9bln-EUR puts), $1.2125(E546mln), $1.2150(E937mln)

- USD/JPY: Y108.50($837mln), Y109.25-30($715mln)

- GBP/USD: $1.3900(Gbp671mln)

- EUR/GBP: Gbp0.8600(E776mln)

- USD/CAD: C$1.2400($990mln-USD puts)

- USD/MXN: Mxn19.50($1.46bln)

PIPELINE: Development Bank of Kazakhstan Dual Tranche Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/29 $2B CSC Holdings $1.5B 10.5NC5.5, $00M 10.

- 04/29 $500M #Development Bank of Kazakhstan 10Y 3.0% (US$ leg also launched with KZT100B 5Y at 11% yld)

- 04/?? $2.96B Allied Universal 7NC3 fix/FRN, 8NC3 sometime next week

- 04/?? $Benchmark Abu Dhabi Ports 10Y

EQUITIES: Markets Edge Off All Time Highs, Putting Weight Through Futures

- Equity markets looked to close lower Thursday, despite a resolutely positive start to the session. Initially, US futures traded perkily, reaching new all time highs as firm trade in the likes of Apple and Facebook after their earnings reports buoyed indices.

- This effect faded upon the opening bell, however, with sizeable sell orders (likely profit-taking) knocking back the S&P 500. Support from the likes of Apple and Facebook reversed, with both stocks coming off their best levels in cash trade and, in the case of Apple, entering negative territory.

- At one point, the NYSE Tick Index showed sell orders in the largest numbers of stock in around a month.

- Across Europe, indices generally closed lower, but losses were more marginal. The UK's FTSE-100 slipped 0.03% while Germany's DAX underperformed most others to drop 0.9%.

COMMODITIES: Oil Extends Weekly Gains, Copper Breaches $10,000

- Crude benchmarks rallied throughout the European session to their best levels since mid-March. As New York sat down, a sell-off in US treasuries halted the momentum, however both WTI and Brent futures have advanced ~1.75% on Thursday, posting a third consecutive day of gains.

- The renewed optimism has largely been attributed to the stronger outlook for global demand following the OPEC+ meeting and the modest upgrade to the FOMC statement's interpretation of the risk outlook.

- US yields were on the march again and as the US dollar recouped session losses, precious metals retreated. Spot gold had an aggressive move lower from $1,780 to lows of $1,756.23 coinciding with the US 10-yr yield breaching 1.68%. Losses were pared into the close, however, bullion resides 0.75% lower on Thursday at $1,768.50 an ounce.

- A close below support at $1763.4, the 50-day EMA would be a technically bearish signal to what remains a bullish outlook overall.

- Copper briefly touched above $10,000-a-metric-ton. The psychological milestone was enough to prompt a quick reversal and prices are currently 0.4% lower for Thursday's session.

- Interestingly, analysts note that speculative positioning is not back to record highs which could suggest further gains are in the pipeline. Focus going forward will be on its all-time high of $10,124, which it hit in February 2011.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.