-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Focus on Wednesday FOMC Minutes

US TSY SUMMARY: Calm Start to Week, Focus on FOMC Minutes Wednesday

Relative calm start to the week, modest volumes with TYM1 just over 1M futures by the close. Limited data for the week as a whole focus on housing related data, Markit PMIs Friday. Fed-speak book-ends the April FOMC minutes release on Wednesday.

- US Chamber of Commerce announces line-up for Tuesday-Wednesday Global Forum on Economic Recovery, includes Tsy Sec Yellen.

- While still "mostly Transitory", the Fed is keeping close eye on inflation risks. Fed VC Clarida: "my baseline view is that most of this is likely to be transitory, but we have to be attuned and attentive to the incoming data," adding he sees the economy growing 6.5%-7% this year.

- Coming into the session, flow included deal-tied selling in 3s-5s, fund and swap-tied selling in 10s, and a pick-up in Jun/Sep quarterly roll volume (first notice May 28).

- Outsized issuance spurring pick up in rate lock selling, weighing on Tsys in late trade. $7B 5pt from UnitedHealth helped push total issuance just over $18.5B/day.

- Block: FVM/WNM: both legs through the offer, but ratio close to the CME's 6:1 hedge ratio, appears to be a flattener at 1033:08ET:

- 13,022 FVM1 124-04.5, through 124-03.75 post time offer

- 2,033 WNM1 184-04, well through 183-26 post time offer

- The 2-Yr yield is up 0.4bps at 0.1511%, 5-Yr is up 1.6bps at 0.8291%, 10-Yr is up 1.2bps at 1.6403%, and 30-Yr is up 1.4bps at 2.3538%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00038 at 0.06238% (-0.00212 total last wk)

- 1 Month +0.00000 to 0.09750% (-0.00388 total last wk)

- 3 Month -0.00550 to 0.14963% (-0.00475 total last wk) ** (NEW Record Low vs. 0.15413% on 5/12)

- 6 Month -0.00113 to 0.18650% (-0.00512 total last wk)

- 1 Year -0.00138 to 0.26450% (-0.00512 total last wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $62B

- Daily Overnight Bank Funding Rate: 0.05% volume: $245B

- Secured Overnight Financing Rate (SOFR): 0.01%, $865B

- Broad General Collateral Rate (BGCR): 0.01%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $348B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.25Y, $1.401B accepted vs. $5.809B submission

- Next scheduled purchases:

- Tue 5/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 5/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, +12,000 Green Jun 92/93/95 call flys, 3.0 with additional 6,850 on screen

- +2,000 Gold Jun 80 puts, 4.0

- +10,000 Green Jul 90 puts, 6.0

- Overnight trade

- Block, +8,000 short Dec 91 puts, 3.0 vs. 99.58/0.12%

- +8,000 Jun 99.81/99.87/99.93 call flys, 2.75

- 4,500 Sep 99.87/99.93 1x2 call spds

- +3,600 short Mar 90/92 put spds 0.5 over 97 calls

- +2,300 FVQ 121.75/122.75 put spds, 10

- 5,000 TYU 134 calls, 23

- +2,000 TYM 132.25 puts, 14

- +1,500 TYN 128.5/130 put spds .5 over 133/134.5 call spds

- -1,600 TYN 129/131.5 strangles, 53

- -1,000 FVM 124/124.25 call spds .5 over FVN 124/125 call spds

- -25,000 TYN 127.5/128.5/129.5/130.5 put condors 11, unwind: paid 12 last wk

- Overnight trade

- +10,000 TYM 131/131.5 put spds, 1

- 2,000 TYM 131.5/132 put spds, 3

EGBs-GILTS CASH CLOSE: PEPP Slowdown Fears

In a soft start to the week for the European FI space, the standout move was in periphery spreads which have widened sharply in recent days.

- Spain, Portugal, Greece 10 Yr spreads traded at the widest vs Bunds since mid-2020, with the best explanation appearing to be speculation over potential ECB slowdown of PEPP purchases as soon as June. Italy widened most; notably the sovereign has a heavy issuance slate for the remainder of the year and would be unduly impacted by a slowdown in purchases.

- Gilts and Bunds were stronger early but sold off through most of the morning.

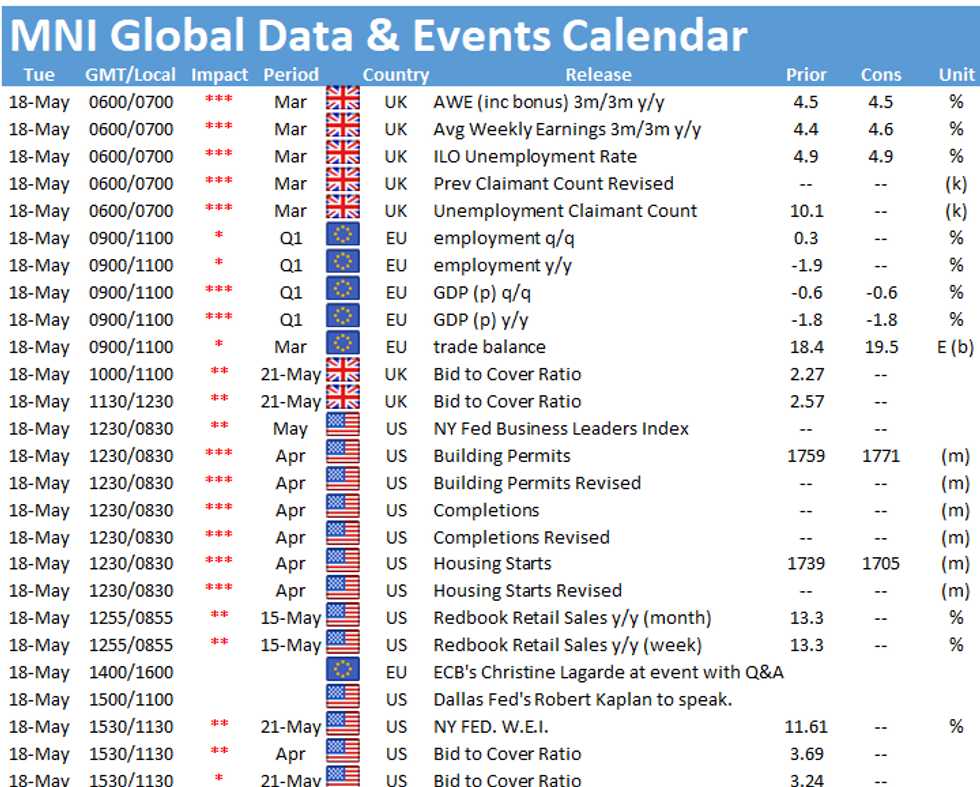

- Tuesday sees UK labor market data and flash Eurozone Q1 GDP. Appearances by ECB's Villeroy, and BOE's Bailey, Broadbent and Ramsden. UK sells GBP5.5bln in Gilts, Germany E6bln Schatz; EU syndicates dual-tranche SURE (MNI est size E11-15bln).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.1bps at -0.655%, 5-Yr is up 1bps at -0.51%, 10-Yr is up 1.4bps at -0.115%, and 30-Yr is up 1.2bps at 0.446%.

- UK: The 2-Yr yield is up 0.4bps at 0.084%, 5-Yr is up 0.6bps at 0.386%, 10-Yr is up 0.8bps at 0.865%, and 30-Yr is up 0.4bps at 1.401%.

- Italian BTP spread up 2bps at 122bps / Spanish spread up 1.6bps at 73bps

OPTIONS/EUROPE SUMMARY: Big Sterling Call Fly And Euribor Par Put Seller

Monday's options flow included:

- RXN1 169/168ps, bought for 25 in 16.75k (underlying Sep is 170.25)

- ERU1 100p sold at cab in 52.75k

- 0LZ1 99.75/99.87/100c fly, sold at 1.5 in 50k total

- 2LU1 99.62/99.37ps, bought for 15.75 in 4k (ref 99.385, -34 del)

- 3LM1 99.00/98.75/98.62p flay bought for 1.5 in 2k

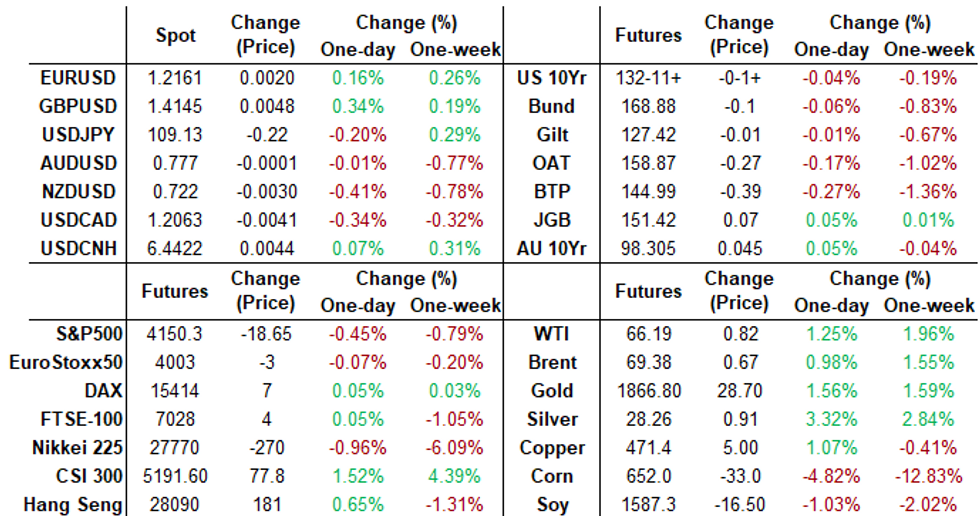

FOREX: Dollar Index Edges Lower As Commodities Continue Ascent

- G10 FX held fairly tight ranges on Monday with little news or data to spark currency volatility.

- However, the bias throughout the US session has certainly been to sell dollars as gold surged and the Dollar Index edged back towards the worst levels since the US CPI release on 12 May, currently down 0.15% at 90.18.

- GBPUSD gained 0.3% to trade at 1.4140 after posting the highest weekly close since mid-February last week. Sterling was supported by the UK confirming the next stage of the easing of restrictions. The rate has cleared a number of resistance levels, reinforcing a positive theme with sights set on the key resistance at 1.4237, Feb 24 high.

- Similar gains were seen for the Canadian dollar as USDCAD begins to re-approach the major pivot chart point at 1.2062. CAD was likely buoyed by the advance in the commodity space, notably oil prices rallying around 1.5%.

- NZDUSD (0.7216) was led higher throughout the US session in line with greenback weakness, however, kiwi remains the standout underperformer (-0.43%) on Monday having traded as low as 0.7182 overnight. Our Asia desk cited reports of leverage fund selling interest, unwinding some of last Friday's rally.

- Tuesday's schedule includes RBA minutes, UK employment and Eurozone GDP. Also, expect comments from BOE officials due to testify as well as SNB/FED members participating in an online conference hosted by the Federal Reserve Bank of Atlanta.

FX OPTIONS: Expiries for May18 NY cut 1000ET (Source DTCC)

- AUD/USD: $0.7750(A$1.0bln)

- NZD/USD: $0.7260-70(N$1.4bln-NZD puts)

- USD/CAD: C$1.1945($887mln), C$1.2410-15($1.3bln)

- USD/MXN: Mxn19.82($600mln), Mxn19.90($595mln)

------------------------ - Larger option expiry pipeline

- EUR/USD: May19 $1.2150(E1.5bln-EUR puts); May20 $1.2045-55(E1.1bln-EUR puts), $1.2160-75(E1.8bln-EUR puts)

- USD/JPY: May19 Y109.50-70($1.2bln-USD puts); May20 Y108.00-10($1.2bln-USD puts)

- GBP/USD: May20 $1.3990-1.4020(Gbp1.1bln)

PIPELINE: $7B UnitedHealth 5Pt Jumbo Launched

UNH outpaces last years issuance, pushed Monday's high-grade issuance just over $18.5B.

- Date $MM Issuer (Priced *, Launch #)

- 05/17 $7B #UnitedHealth 3NC1 +25, 5Y +35, 10Y +65, 20Y +80, 30Y +90. A yr ago, almost to the day, UNH issued $5B in 5 tranches on May 13, 20: $500M 5Y +100, $1.25B 10Y +145, $1B 20Y +160, $1.25B 30Y +170, $1B 40Y +190

- 05/17 $5B #HSBC $2B 4NC3 +65, $3B 11NC10 +117

- 05/17 $2.5B #Union Pacific $850M 10Y +73, $1B 20Y +93, $650M 40Y+120

- 05/17 $1.25B National Australia Bank (NAB) 10Y +135

- 05/17 $1.2B #Air Lease 5Y +120

- 05/17 $1B #Nordea 3Y +30

- 05/17 $600B #CNH Industrial 5Y +78

- 05/18 $Benchmark Caisse d'Amortissement de la Dette Sociale (CADES) 3Y +4a

- 05/18 $Benchmark Caisse de depot et placement du Québec (CDPQ) 5Y +12a

- 05/18 $Benchmark World Bank 5Y +2a

- 05/?? $2B Square $1B 5Y, $1B 10Y

COMMODITIES: Commodities Outperforming Equities As Inflationary Pressures Intensify

- In the past cycle, the constant liquidity injections from central banks to support the economy have led to a significant outperformance of US equities relative to commodities.

- However, an increasing amount of investors have turned bullish on commodities in recent months as inflationary pressures keep intensifying and the constant unconventional monetary policy interventions from the Fed to protect the global economy from falling into a deflationary depression are likely to significantly weaken the US Dollar in the medium to long run.

- The chart below shows the dynamics of the ratio of US equities (SP500) relative to commodities (CRY(B) index) in the past 100 years.

- We can notice that after diverging significantly in the past 10 years from its LT average, commodities have been outperforming equities in the past year.

- Hence, if we assume that the ratio follows a mean-reversion process in the long run, commodities should continue to outperform US equities for a while.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.