-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Home on the Range

US TSY SUMMARY: Narrow Range Ahead April FOMC Minutes

With the exception of early morning chop, alternately rallying after the open to session highs after weaker than anticipated April housing starts (1.569M vs. 1.702M est). Tsys sold off soon after to extend session lows -- levels moderated by 10am, trading mixed on narrow range through the close, yield curves steeper after a flatter start. Though dated, focus remains on Apr FOMC minutes out Wednesday.- Light overall volumes even with the pick-up in 5- and 10Y June/Sep rolls, TYM1 breaking 880k after the bell. FVM/FVH trades 79,800 from 18.75-19.25, 19.0 last; TYM/TYU 66,100 from 27.5 to 28.5, 28.0 last.

- Another decent session for corporate issuance at just over $12B, $30.6b since Monday. June quarterly options expire this Friday, generating some two-way hedging flows as accts squared up positions.

- The 2-Yr yield is down 0.4bps at 0.1491%, 5-Yr is down 1.8bps at 0.8178%, 10-Yr is down 0.9bps at 1.6403%, and 30-Yr is up 0.1bps at 2.3633%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00050 at 0.06288% (+0.00088/wk)

- 1 Month +0.00175 to 0.09925% (+0.00175/wk)

- 3 Month +0.00562 to 0.15525% (+0.00012/wk) ** (NEW Record Low 0.14963% on 5/17)

- 6 Month -0.00275 to 0.18375% (-0.00388/wk)

- 1 Year -0.00175 to 0.26275% (-0.00312/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $63B

- Daily Overnight Bank Funding Rate: 0.05% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.01%, $902B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $2.550B submission

- Next scheduled purchases:

- Wed 5/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

US TSYS/OVERNIGHT REPO: 5s Heating Up

Holding steady, 5s heating up slightly. Currently, T-Bills: 1M -0.0025%, 3M 0.0076%, 6M 0.0254%; Tsy General O/N Coll. 0.01%.

| Duration | Current | Old Issue |

| 2Y | -0.01% | -0.01% |

| 3Y | 0.00% | -0.01% |

| 5Y | -0.12% | -0.04% |

| 7Y | -0.05% | 0.00% |

| 10Y | -0.01% | -0.11% |

| 30Y | -0.01% | -0.08% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +30,000 Red Jun 93/96 put spds, 2.5 vs. 99.76/0.15%

- +5,000 Green Jul 88/90/91 put trees, 1.0

- +5,000 short Dec 92/95 put spds, 3.75 legs

- -3,000 short Dec 97/98 call spds, 1.5

- Overnight trade

- Block, 5,000 Red Dec 100.12/100.25 call strip, 1.0

- 4,500 Green Jun 99.43/99.56 call spds

- 3,500 Sep 99.87 calls, 1.0

- 4,000 Blue Sep 98.0/98.25 put spds vs. 98.87/99.12 call spds

- 4,000 Blue Dec 97.87/98.12 put spd vs. 98.75/99.00 call spds

- 2,700 short Dec 90/92/95 put flys

- +8,500 TYM 131.75/132.25/132.5 broken put flys, 0.0

- 3,000 FVM 124/124.25 call spds vs. FVN 124/125 call spds

- +10,000 wk4 TY 130.5/131 put spds, 6

- +5,000 FVN 122.5/123/123.5 put flys, 4

- 5,200 TYN 129.5 puts 10 over TYM 130 puts

- +1,250 TYN 130.5 puts, 23

- Overnight trade

- 5,500 TYM 132.5 calls, 8

- +1,200 USN 160/163 call spds, 10

EGBs-GILTS CASH CLOSE: Reprieve For Peripheries

Periphery EGB spreads narrowed Tuesday, reversing widening earlier in the session (though BTPs underperformed once again). Bunds and Gilts closed weaker with some bear steepening.

- UK sold GBP5.5bln of Gilts; Germany allotted E4.8bln of Schatz (lowest bid-to-cover since Mar 2020); EU syndicated E14.1bln of 8Yr/25Yr SURE.

- U.K. labour market data came in better than expected, while Eurozone 1Q flash GDP confirmed the prelim reading. BOE's Bailey said QE unwind should be operated "automatically".

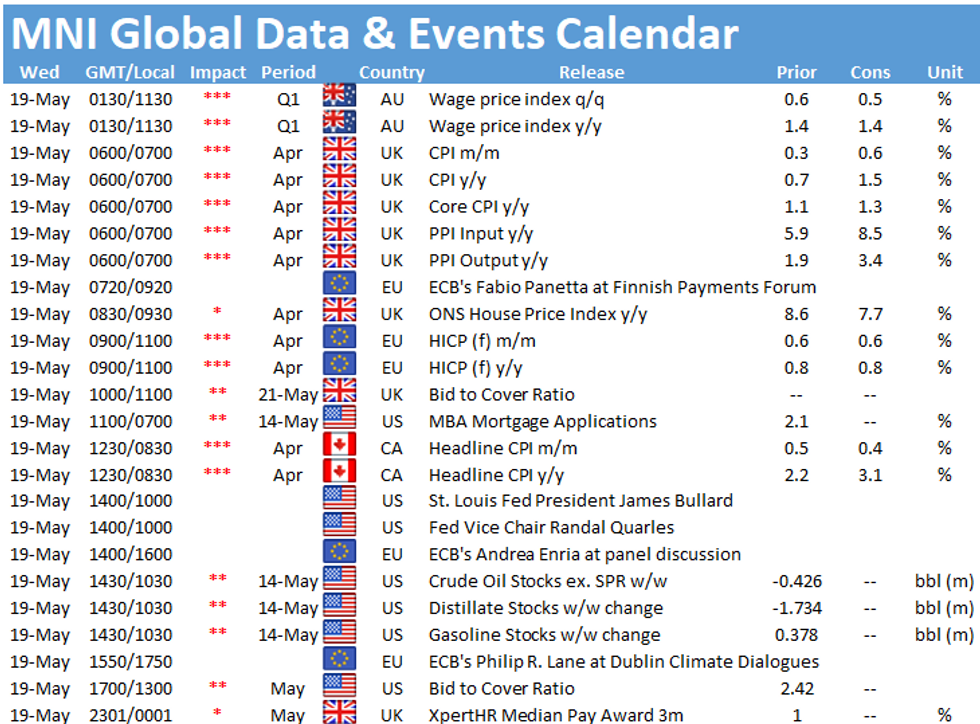

- Looking ahead to Wednesday, data includes UK Apr inflation. In supply, UK sells GBP2.5bln of Gilt, Germany E4bln of Bund, and EFSF E1bln. Speakers include ECB's Panetta, Rehn, de Cos, and Lane, while ECB also publishes its Financial Stability Review.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.1bps at -0.644%, 5-Yr is up 0.5bps at -0.505%, 10-Yr is up 1.2bps at -0.103%, and 30-Yr is up 1.8bps at 0.464%.

- UK: The 2-Yr yield is up 0.4bps at 0.088%, 5-Yr is down 0.1bps at 0.385%, 10-Yr is up 0.3bps at 0.868%, and 30-Yr is up 1.6bps at 1.417%.

- Italian BTP spread down 0.9bps at 121.1bps / Spanish spread down 2.5bps at 70.5bps

OPTIONS/EUROPE SUMMARY: Sterling Put Flies And Way OTM Bund Puts

Tuesday's options flow included:

- OEN1 133.50/133.25/133p fly, bought for 3 in 1k

- RXN1 162p, bought for 1 in 2.75k

- RXN1 169/168.50/168p fly, bought for 3 in 2k

- RXQ1 161p, bought for 2 in 7.4k

- 0LZ1 99.62/99.50/99.25broken p ladder, bought for 2 in 8k

- 3LU1 98.62/98.37/98.25p fly, bought for 1.75 in 7k total

- 3LU1 99.62/99.37/99.25p fly, bought for 1.75 in 5.5k

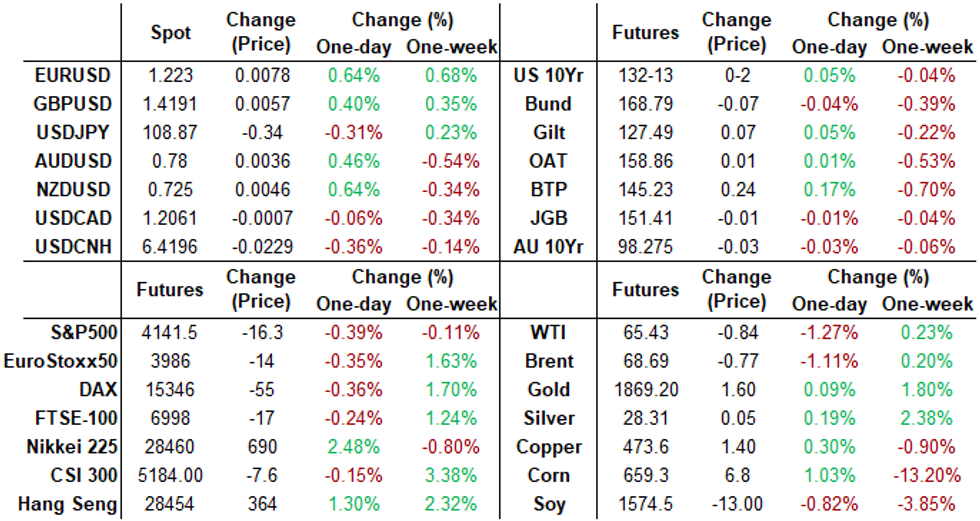

FOREX SUMMARY: USD Weakness Prevails Despite Commodities Turnaround

- A softer greenback had largely been attributed to further commodity strength and positive risk sentiment early on Tuesday, particularly benefitting the antipodeans, rallying close to 1%.

- A notable reversal in the commodity complex, led by a sharp move lower in oil prices, halted the momentum of dollar depreciation.

- However, tight ranges during the US session in G10 FX has meant the Dollar Index (DXY) is set to close at its lowest level since early January this year, down 0.42% on the day.

- As expected with its large weighting in the index, EUR joins Aussie and Kiwi as the largest beneficiaries with EURUSD (+0.63%) pressing on towards the February highs of 1.2243.

- In a continuation of recent technical breakouts, GBPUSD breached 1.42 and is within touching distance of the year's high at 1.4237. USDCAD also reached the lowest level since May 2015. Fresh lows of 1.2013 were posted before the oil move brought the pair back to ~1.2050.

- UK and Canadian inflation data headline Wednesday's docket before markets turn their attention to the FOMC minutes later in the session.

FX OPTIONS: Expiries for May19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E1.2bln), $1.2150(E1.5bln-EUR puts), $1.2170-80(E695mln), $1.2200(E498mln)

- USD/JPY: Y108.00-10($712mln), Y108.90-109.00($844mln), Y109.50($905mln-USD puts)

- AUD/USD: $0.7857-80(A$545mln)

- USD/MXN: Mxn19.40($500mln)

- Larger option expiry pipeline

- EUR/USD: May20 $1.2045-55(E1.1bln-EUR puts), $1.2160-75(E1.8bln-EUR puts); May21 $1.2150-70(E1.5bln)

- USD/JPY: May20 Y108.00-11($1.2bln-USD puts); May25 Y107.50-60($1.1bln)

- GBP/USD: May20 $1.3990-1.4020(Gbp1.1bln)

- AUD/USD: May20 $0.7760-80(A$1.55bln); May24 $0.7710-25(A$1.0bln-AUD puts)

- USD/CAD: May27 C$1.2195-1.2205($1.4bln)

- USD/MXN: May28 Mxn19.75($1.3bln-USD puts)

PIPELINE: Charter Communications Launched, Outpaces World Bank

- Date $MM Issuer (Priced *, Launch #)

- 05/18 $2.8B #Charter Communications $1.4B 30Y +177, $1.4B 40Y +202

- 05/18 $2.5B *World Bank 5Y +2

- 05/18 $1.5B #Cox Communications $800M 10Y +100, $700M 30Y +125

- 05/18 $1.25B #Federation des Caisses Desjardins du Quebec (CCDJ) $750M 3Y +38, $500M 3Y FRN SOFR+43

- 05/18 $1B *Caisse de depot et placement du Québec (CDPQ) 5Y +10

- 05/18 $1B #Societe Generale PNC5 4.75%

- 05/18 $1B #Microchip WNG 3Y +65

- 05/18 $1B #DNB Bank 6NC5 +72

- 05/18 $Benchmark Caisse d'Amortissement de la Dette Sociale (CADES) 3Y +4

EQUITIES

Key late session market levels:

- DJIA down 108.01 points (-0.31%) at 34216.81

- S&P E-Mini Future down 14.5 points (-0.35%) at 4142.75

- Nasdaq down 5.2 points (0%) at 13373.74

European bourses closing levels:

- EuroStoxx 50 down 1.5 points (-0.04%) at 4005.34

- FTSE 100 up 1.39 points (0.02%) at 7034.24

- German DAX down 10.04 points (-0.07%) at 15386.58

- French CAC 40 down 13.68 points (-0.21%) at 6353.67

COMMODITIES: Iran Deal Headlines Prompt Sharp Oil Sell-Off

- Initial risk on during the overnight session and early European hours spurred oil Benchmarks to print fresh recent highs.

- WTI breached $67 and Brent crude futures broke above $70, the highest level seen since 2018. Potential technical rejections could be to blame for the pullback, dragging the commodity complex into the red as New York sat down.

- However, the price action gained momentum throughout the US morning and headlines regarding the Iran nuclear Talks exacerbated the move lower:

- Initially, reports stemmed from Mikhail Ulyanov, Russia's representative at the United Nations' International Atomic Energy Agency, claiming a breakthrough in the talks. Oil initially extended losses on the report to fall as much as 3.1% in London, before regaining some ground as Ulyanov rebutted the claims.

- The senior Russian diplomat did however talk of significant progress being made. A return to the 2015 deal is likely to mean that the U.S. will reinstate sanctions waivers for purchases of Iranian crude, raising the prospect of more supply coming to the market. Both WTI and Brent sit down over 1% for Wednesday, approaching the close.

- Precious metals closed broadly unchanged on the day amid countering factors of the weaker dollar and the turnaround in commodities. We highlight our latest technical piece for bullion: https://marketnews.com/gold-bulls-continue-to-shine

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.