-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Time To Talk About Tapering?

US TSY SUMMARY: Thinking About Thinking of Tapering

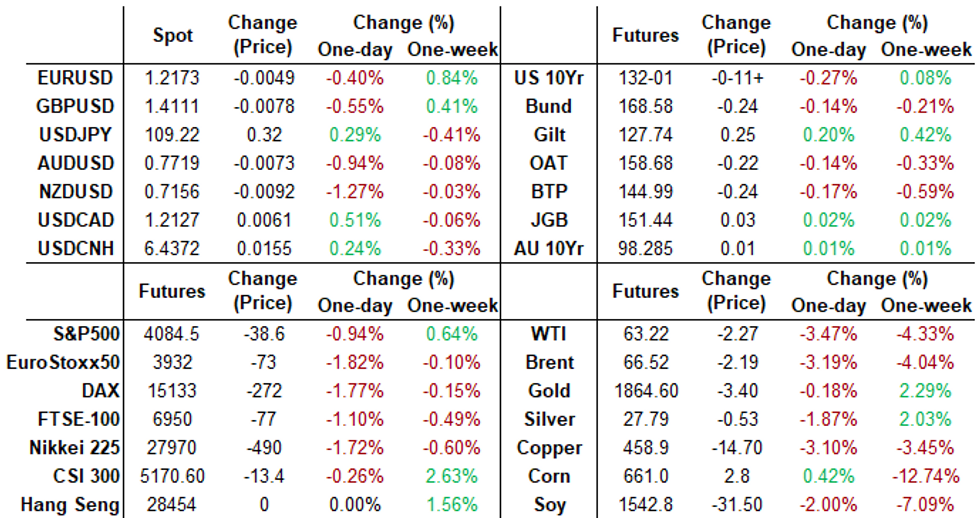

An active midweek session with a lot to unpack with several Fed speakers leading up to the April FOMC minutes release, a weak 20Y auction and a meltdown in crypto-fx that weighed heavily on tech stocks in the first half. Heavy overall volumes even without the pick-up in Jun/Sep quarterly rolling, TYM1 near 1.9M after the bell.- No data aside from the April minutes event risk, Tsys kicked off with a risk-off tone as sharp declines in crypto currencies (various reasons, but some pointed to early headlines China expressing negative opinion on digital tokens, Bitcoin ->20% last 24 hours, Ether -42% from highs), that spilled over to tech stocks and global equities in general.

- Upbeat Fed speakers tempered the bid in rates (BULLARD: U.S. HAS `BIG ECONOMIC BOOM GOING ON', Bbg) while a weak $27B 20Y Bond auction (2.286% high yld vs. 2.275% WI) spurred additional selling. Tsys extended sell-off after April FOMC minutes as it became apparent Fed is thinking about thinking of tapering as economic recovery continues.

- "Some participants mentioned upside risks around the inflation outlook that could arise if temporary factors influencing inflation turned out to be more persistent than expected."

- The 2-Yr yield is up 1bps at 0.1592%, 5-Yr is up 5bps at 0.868%, 10-Yr is up 5bps at 1.6864%, and 30-Yr is up 3.1bps at 2.3911%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00125 at 0.06163% (-0.00038/wk)

- 1 Month -0.00275 to 0.09650% (-0.00100/wk)

- 3 Month -0.00600 to 0.14925% (-0.00588/wk) ** (NEW Record Low vs. 0.14963% on 5/17)

- 6 Month -0.00012 to 0.18363% (-0.00400/wk)

- 1 Year +0.00075 to 0.26350% (-0.00238/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $63B

- Daily Overnight Bank Funding Rate: 0.05% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.01%, $888B

- Broad General Collateral Rate (BGCR): 0.01%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $15.686B submission

- Next scheduled purchases:

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

US TSYS/OVERNIGHT REPO: Holding Steady

Holding steady while bills and GC dips: T-Bills: 1M -0.0025%, 3M 0.0051%, 6M 0.0203%; Tsy General O/N Coll. 0.00%.

| Duration | Current | Old Issue |

| 2Y | -0.01% | -0.01% |

| 3Y | -0.01% | -0.01% |

| 5Y | -0.10% | -0.04% |

| 7Y | -0.05% | 0.00% |

| 10Y | -0.01% | -0.10% |

| 30Y | -0.01% | -0.08% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -5,000 short Mar 90/95 3x2 put spds, 13.5 vs. 99.525/0.42%

- >18,000 Green Dec 82 puts

- +3,800 Dec 99.812 straddles, 6.5

- +7,000 Dec 98 calls, 1.0

- +10,000 short Mar 90/92 put spds, 3.75 and vs. calls:

- +5,000 short Mar 90/92 put spds .25 over 97 calls

- +5,000 Sep 99.81 puts, 1.25

- 5,600 Dec 91 puts, 0.5

- -4,000 Gold Sep 72/85 call over risk reversals, 0.5, after 10k traded overnight (+p over 1.5 db)

- -5,000 Gold Sep 75 puts, 5.0

- -1,000 Red Dec 95 straddles, 37.5

- Overnight trade

- Block, 25,000 Blue Dec 72/77 put spds, 5.5

- >-26,000 Gold Sep 75 puts, 5.5

- +10,000 Gold Sep 72/85 put over risk reversals, 1.5

- 5,000 Blue Sep 95 calls, .5

- 2,500 short Dec 90/92/95 put flys

- 4,000 Green Jun 96 calls, 0.25

- 10,000 TYM 132 puts, 10

- +3,000 TYU 129.5 puts, 37

- +3,000 TYM 131.5/132 put spds, 3 vs. 132-16/0.13%,

- +10,000 TYM 131.5/132 put spds, 4

- +4,000 TYU 133.5 calls, 31

- +4,000 TYN 130.5 puts 1 over TYQ 129.5 puts

- Overnight trade

- >+44,000 FVN 125 calls, 1.5 took out offer, 1 bid/at 2 currently

- Block, 10,000 FVN 124 calls, 10

- 10,000 USN 148 puts, 9

- 3,500 USN 161/USQ 164 call diagonal calendar

- 2,000 TYN 130/131 put spds

- 2,000 TYM 131.75/132.25 2x1 put spds

EGBs-GILTS CASH CLOSE: Core FI Yields Succumb To Safe Haven Gravity

Bund and Gilt yields succumbed to the gravity of weakening equities as Wednesday's session progressed, with yields closing well off session highs. Meanwhile periphery spreads traded in a fairly wide range, settling higher.

- In some ways it was a case of simple risk-off (with equities sharply lower amid a cryptocurrency meltdown), but short cover/profit taking helped core FI, and EGB supply ahead potentially weighed on peripheries too: Thursday sees Spain sell up to E6bln nominal and France up to E13.5bln of nominal and linkers.

- Germany allotted E3.4bln of Bund (weakest 10-year auction in terms of bid-to-cover and bid-to-offer since Mar 2020), Finland sold E3bln of 2031 RFGB via syndication. UK sold Gilts (GBP2.5bn), Portugal BTs (E1.75bn) and the EFSF (E1bln).

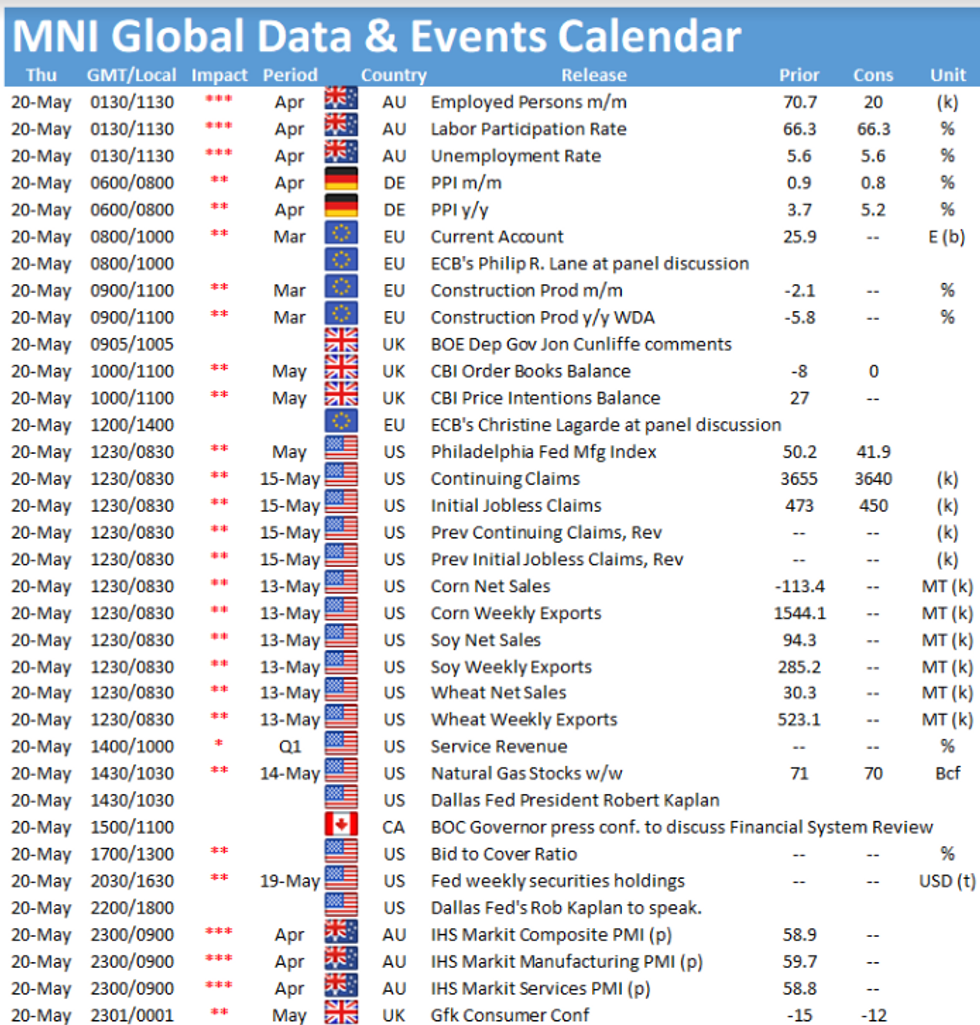

- Apart from EGB supply, main items on Thursday's calendar are ECB speakers (incl Lane, Lagarde, and Villeroy).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.3bps at -0.647%, 5-Yr is down 0.1bps at -0.506%, 10-Yr is down 0.7bps at -0.11%, and 30-Yr is down 1.7bps at 0.447%.

- UK: The 2-Yr yield is down 1.3bps at 0.075%, 5-Yr is down 1.1bps at 0.374%, 10-Yr is down 2bps at 0.848%, and 30-Yr is down 1.9bps at 1.398%.

- Italian BTP spread up 1.7bps at 122.8bps/ Spanish spread up 1.3bps at 71.8bps

OPTIONS/EUROPE SUMMARY: Large Bund Condor; Stg Rate Hike Play

Wednesday's options flow included:

- RXN1 169.50/168.50/167.50/166.50p condor, bought for 24 in 35k

- 2LV1 99.00/98.75/98.62 broken put fly, bought for 2.5 in 2.5k (Eyeing rate hike in end of 2023)

- 3LU1 98.62/98.37/98.25 broken put fly, bought for 1.75 in 2.5k

- 3LU1 99.00/98.875/98.75p fly, bought for 1.25 in 5k

FOREX SUMMARY: FOMC Taper Mention Prompts Greenback Strength

- The US Dollar surged as the FOMC minutes suggested officials noted more recovery progress would open door to taper debate.

- Before the release of the minutes, the cryptocurrency rout had kept the USD in marginal positive territory, however, with US yields surging back close to the May highs, the dollar is extending its reprieve following 3 consecutive days of declines.

- The greenback strengthened across the board with EURUSD initially moving roughly 35 pips plumbing fresh session lows through 1.2190 to 1.2174. New highs for the USD against AUD, JPY, GBP, NZD, CAD, CNH and CHF.

- Initial weakness in equities particularly made antipodeans suffer and the extension of US yields has enhanced the move lower. AUD and NZD are the biggest losers against the dollar, shedding 1% and 1.32% respectively.

- On the downside for EURUSD, key short-term support is being approached at 1.2052, May 13 low. The outlook remains technically bullish following last week's recovery.

- The focus overnight turns to Australian employment data as well as the Annual NZ budget release. Tomorrow in the US, markets will await Philly Fed and Jobless Claims, before the Bank of Canada's Macklem is due to give a press conference.

FX OPTIONS: OPTIONS: Expiries for May20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2045-55(E1.1bln-EUR puts), $1.2100-10(E594mln), $1.2160-75(E1.8bln-EUR puts), $1.2215-35(E668mln-EUR puts)

- USD/JPY: Y108.00-11($1.2bln-USD puts), Y108.65-75($718mln-USD puts), Y109.00-10($636mln), Y110.00($522mln)

- GBP/USD: $1.3990-1.4020(Gbp1.1bln)

- USD/CHF: Chf0.9000($607mln-USD puts), Chf0.9034-35($646mln-USD puts), Chf0.9160($500mln-USD puts), Chf0.9295-0.9300($952mln-USD puts)

- AUD/USD: $0.7760-70(A$1.0bln-AUD puts), $0.7775-85(A$973mln)

- USD/MXN: Mxn19.88($980mln);

- EUR/USD: May21 $1.2150-70(E1.7bln-EUR puts)

- USD/JPY: May25 Y107.50-60($1.1bln); May28 Y110.00($1.34bln-USD puts)

- EUR/CHF: May28 Chf1.1000(E930mln-EUR puts)

- AUD/USD: May24 $0.7710-25(A$1.1bln-AUD puts)

- USD/CAD: May27 C$1.2195-1.2205($1.4bln)

- USD/MXN: May21 Mxn19.90($980mln-USD puts); May28 Mxn19.75($1.3bln-USD puts)

PIPELINE: $1B Kommuninvest 2Y Priced

Otherwise limited issuance on day after $34B in first two days of week

- Date $MM Issuer (Priced *, Launch #)

- 05/19 $1B *Kommuninvest WNG 2Y +1

- 05/18 $2.8B *Charter Communications $1.4B 30Y +177, $1.4B 40Y +202

- 05/18 $2.5B *World Bank 5Y +2

- 05/18 $2B *Square $1B 5Y 2.75%, $1B 10Y 3.5%

- 05/18 $1.5B *Cox Communications $800M 10Y +100, $700M 30Y +125

- 05/18 $1.4B *Tenet 8NC3 4.25%

- 05/18 $1.25B *Federation des Caisses Desjardins du Quebec (CCDJ) $750M 3Y +38, $500M 3Y FRN SOFR+43

- 05/18 $1B *Caisse de depot et placement du Québec (CDPQ) 5Y +10

- 05/18 $1B *Societe Generale PNC5 4.75%

- 05/18 $1B *Microchip WNG 3Y +65

- 05/18 $1B *DNB Bank 6NC5 +72

EQUITIES

- DJIA down 381.21 points (-1.12%) at 33678.48

- S&P E-Mini Future down 37.25 points (-0.9%) at 4086.25

- Nasdaq down 82.6 points (-0.6%) at 13220.12

COMMODITIES

- WTI Crude Oil (front-month) down $2.32 (-3.54%) at $63.17

- Gold is down $6.35 (-0.34%) at $1863.90

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.