-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS: ISM Employ Data Tempers Risk-On

US TSY SUMMARY

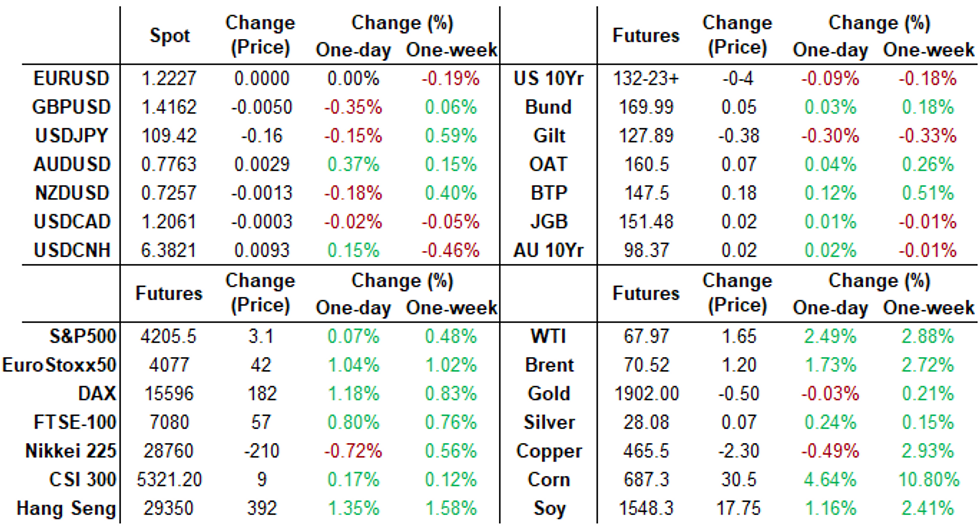

Markets returned from extended holiday weekend with a stronger risk-on tone in early trade Tuesday: Equities traded firmer after the open (ESM1 +23.0), Tsys under pressure w/10YY near middle of 1.55%-1.70% range at 1.6284%.- Rates recovered some ground after ISM employ data -- focus on drop in ISM employment index to 50.9 vs. 55.1 last month. Notable with the week's main focus on Fri's NFP (+266k prior, +650k est).

- Fed speakers did not cover any new ground. Fed Gov Brainard answered questions after speaking at Economic Club of NY event: nothing really new, boiler plate comments no late session reaction in rates or equities. Reminder, Fed media blackout starts midnight Friday.

- Interesting -- VIX had almost 3.0 range today, is +1.24 at 18.0 vs. session high of 18.53.

- Two-way overall flow with a couple waves of better selling in the long end noted early in the first and second half.

- The 2-Yr yield is up 0.6bps at 0.1466%, 5-Yr is up 0.8bps at 0.8076%, 10-Yr is up 1.9bps at 1.613%, and 30-Yr is up 1.2bps at 2.2946%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00688 at 0.05425% (+0.00138 total last wk)

- 1 Month +0.00287 to 0.08875% (-0.00575 total last wk)

- 3 Month -0.00288 to 0.12850% (-0.01562 total last wk) ** (Record Low)

- 6 Month +0.00388 to 0.17488% (-0.00775 total last wk)

- 1 Year -0.00125 to 0.24688% (-0.01150 total last wk)

- Daily Effective Fed Funds Rate: 0.05% volume: $61B

- Daily Overnight Bank Funding Rate: 0.03% volume: $219B

- Secured Overnight Financing Rate (SOFR): 0.01%, $868B

- Broad General Collateral Rate (BGCR): 0.01%, $378B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $355B

- (rate, volume levels reflect prior session)

- Tsys 2.25Y-4.5Y, $8.401B accepted vs. $32.966B submission

- Next scheduled purchases:

- Wed 6/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 6/03 1100-1120ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/04 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -3,500 Green Jul 99.12/99.25 strangles, 11.0 vs. 99.185/0.10%

- +20,000 Dec 100/100.12 call spds, 0.5 vs. 99.84/0.10%

- -3,000 Green Jun 93/95 strangles, 39.5

- +4,000 short Sep 95 puts, 1.5

- +5,000 Blue Jul/Aug 80/90 put over risk reversal strips, 1.0 total

- Overnight trade

- Block, +5,000 short Dec 91/95 3x2 put spds, 7.5, more on screen

- +1,750 Blue Jul 87/88 2x3 call spds, 3.0

- +4,500 FVU 123.25 puts, 24.5

- +7,000 USN 168.5 calls, 2

- -1,000 TYN TYN 131.5 straddles, 108

- -10,000 wk1 TY 131 puts, 4 vs. 131-21.5/0.16%

- -4,000 TYN 132.5 calls, 14

- +5,000 FVQ 122.75/123.25 put spds, 7

- -5,400 TYU 129.5/133.5 strangles, 50, still offered

- +3,000 TYN 131.5 puts, 30-31

- +2,000 TYN 131.75 straddles, 108

- Overnight trade

- +4,000 TYU 126/128 put spds, 8

EGBs-GILTS CASH CLOSE: Poor Start To A Short Week For Gilts

A poor, bear steepening start to a shortened week for Gilts, with Bunds weakening slightly and periphery spreads tighter Tuesday.

- Gilts bear steepened on the return to trading after the long weekend. They were underpinned early in part by 3rd COVID wave concern, but underperformed in the afternoon following a poor long-dated APF (offer-to-cover 2.78x).

- Heavy Eurex future roll volumes (around half of front-month volume was spread related).

- The morning's data put the focus on strong activity and inflationary pressures, including strong Italian and Spanish PMIs, Italy Q1 GDP revised from contraction to expansion, and 2.0% Y/Y flash Eurozone inflation. Germany sold E0.8bln of linkers.

- On Wednesday, UK sells GBP4.75bln of Gilts; Germany sells E4bln of Bobl.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is up 0.3bps at -0.659%, 5-Yr is up 0.3bps at -0.564%, 10-Yr is up 0.9bps at -0.178%, and 30-Yr is up 1.5bps at 0.382%.

- UK: The 2-Yr yield is up 0.7bps at 0.07%, 5-Yr is up 1.7bps at 0.359%, 10-Yr is up 3.1bps at 0.826%, and 30-Yr is up 4.1bps at 1.345%.

- Italian BTP spread down 1.7bps at 107.9bps/ Spanish spread down 0.3bps at 64.7bps

OPTIONS/EUROPE SUMMARY: Put Fly Buying In German Contracts

Tuesday's options flow included:

- DUU1 112.30/112.20/112 broken p fly, bought for 2 in 2.5k (underlying Sep is 112.15)

- RXN1 169.5/168.5/167.5p fly, bought for 6 in 1k

- 0LZ1 99.62/99.37/99.12p fly vs 99.87c, bought the fly for 3 in 2k

- 3LU1 99.12/99.00/98.87/98.75p condor vs 99.50/99.62cs, bought the condor for 1.25 in 1k

FOREX: USDCAD New 6-Year Lows, Bounces Ahead of 1.20 Support

- Buoyant commodities helped lift the Canadian dollar to six-year highs against the greenback on Tuesday. USDCAD printed a fresh low at 1.2007, however, the psychological 1.20 support barrier proved a step too far. The pair squeezed 0.5% as the US dollar regained some poise in the latter half of the session.

- In similar fashion GBPUSD managed to break to new 2021 highs with 1.4250 capping the price action during European trade. Sterling proceeded to be the worst performing G10 currency, losing 0.4% as of writing. A lack of follow through after the February high was breached left fresh longs susceptible to an unwind, which was prompted by a small miss in the manufacturing PMI data as well as fresh Covid concerns.

- Media speculation is escalating that the final stage of unwinding COVID-19 restrictions in England could be delayed from the intended date of 21 June due to a rise in new infections and a very small uptick in hospitalisations from the virus.

- China FX is softer for a second session by around 0.2%, snapping the extended winning streak that pressured USD/CNY to its lowest levels since 2018. Markets continue to react to the PBoC's policy tweak on Monday, in which they raised the FX RRR to 7% from 5%.

- Despite the statement on Monday morning, the DTCC has tracked close to $7bln in USD/CNY options trades, the bulk of which have been USD/CNY puts (with an average strike of 6.3845). USD/CNY put strikes at 6.25 and 6.30 have also garnered significant focus, with close to $1.5bln in notional trading across both strikes.

- Broadly the US dollar has lacked direction following the US holiday, exactly unchanged on the day. The better performers include the Swedish Krona and the Australian Dollar, lifted by the strong commodity complex.

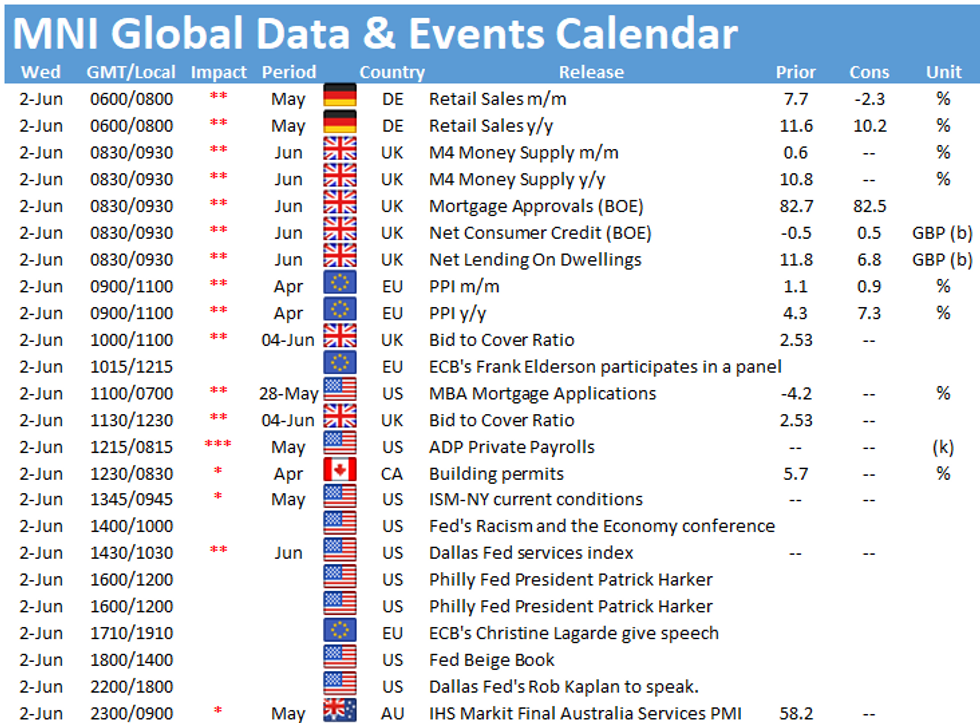

- Wednesday's docket includes Australian GDP, German Retail Sales and Spanish Unemployment before a quiet US session headlined by the Fed's Beige Book.

FX OPTIONS/Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-05(E800mln), $1.2400-10(E550mln)

- USD/JPY: Y111.25($500mln)

- AUD/USD: $0.7710-15(E667mln), $0.7740-50(A$1.2bln-AUD puts)

- AUD/JPY: Y83.15(A$943mln-AUD puts)

- NZD/USD: $0.7200-20(N$1.5bln-NZD puts)

- USD/CNY: Cny6.38($760mln), Cny6.40($926mln)

PIPELINE: $3B TD Launched, 5Y FRN Dropped

- Date $MM Issuer (Priced *, Launch #)

- 06/01 $3B #TD Bank $900M 2Y +18, $800M 2Y FRN SOFR +22, $1.3B 5Y +40

- 06/01 $800M #Pacific Gas & Electric 7Y +180

- 06/01 $500M #MetLife 3Y +28

- 06/01 $Benchmark Vodafone 60NC5.25 3.87%a, 60NC10 4.5%a, 60NC30 5.5%a

- Expected later in the week:

- 06/02 $Benchmark ADB 3Y +0, 7Y +12a

COMMODITIES: WTI Unable to Sustain Gains Above $68

- Both WTI and Brent crude futures were better bid Tuesday, with markets focusing on drifting odds of any nuclear deal being struck with Iran.

- Late Monday, IAEA inspectors circulated a number of written reports suggesting Iran were far less willing to address their nuclear programme than initially believed - thereby dropping the likelihood of a near term supply deal with Tehran.

- This helped boost WTI to trade at $68.87/bbl, but markets were unable to sustain the rally, with prices edging lower into the close and briefly back below $67.50/bbl.

- OPEC headlines drove markets lower, with the monthly meeting committing to higher output in July, but stopped short of any pre-commitments beyond that.

EQUITIES: Early Gains Evaporate to Put Stocks at Flat

- The E-mini S&P traded well throughout European hours, with the index rallying to touch 4,230.00 alongside the cash open. This sentiment soon reversed, however, with prices slipping back to unchanged just after the London close.

- The ISM Manufacturing release added some weight, with particular attention paid to the unimpressive employment sub-component, which fell back to the lowest levels since November last year. This raises focus on Friday's payrolls release, with markets on watch for any further slowdown in job gains.

- In the US, healthcare led losses, countering more modest gains in real estate and financials. Energy and materials were the day's hotspot, buoyed by new cycle highs in WTI crude futures.

- The VIX bounced as equities edged off the week's highs, bouncing off a multi-month low printed yesterday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.