-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsy Curve Steeper Ahead of Busy Day

MNI US OPEN - Lawmakers Move to Impeach South Korea President

MNI China Daily Summary: Wednesday, Dec 4

MNI ASIA MARKETS ANALYSIS: Apr Up-Revs Softens May Retail Miss

US TSY SUMMARY: Decent Action on Narrow Range Ahead Wed's FOMC

Tsys hold mildly weaker levels by Tuesday's close, holding to a narrow range in the lead-up to Wednesday's FOMC policy annc. Some early post-data chop preceded some brief action following the Tsy 20Y bond auction.

- Choppy post data trade as upward revisions (+0.9%) to Apr softened May retail sales miss ( -1.3%), PPI beat exp (+0.8%). Knee jerk reaction pushed futures near top end overnight range before rates sold off, extending session low slightly. Sources reported decent two-way trade volumes as fast$, prop accts buying 5s and 10s, bank selling 10s and 30s.

- Tsys futures pared loess after strong $24B 20Y auction re-open: drawing a high yield of 2.120% (2.286% last month) vs. 2.137% WI. Bid-to-cover 2.4 vs. 2.24 in May.

- Indirect take-up climbed to 62.07% (highest since October 2020) vs. 56.72% in May. Primary dealer take-up falls to lowest in over a year to 17.53% vs. 23.75.51% prior. Direct take-up 20.40% vs. 19.51% prior.

- Another decent day for corporate issuance with foreign banks issuing $8.8B after Mon's $9.35B.

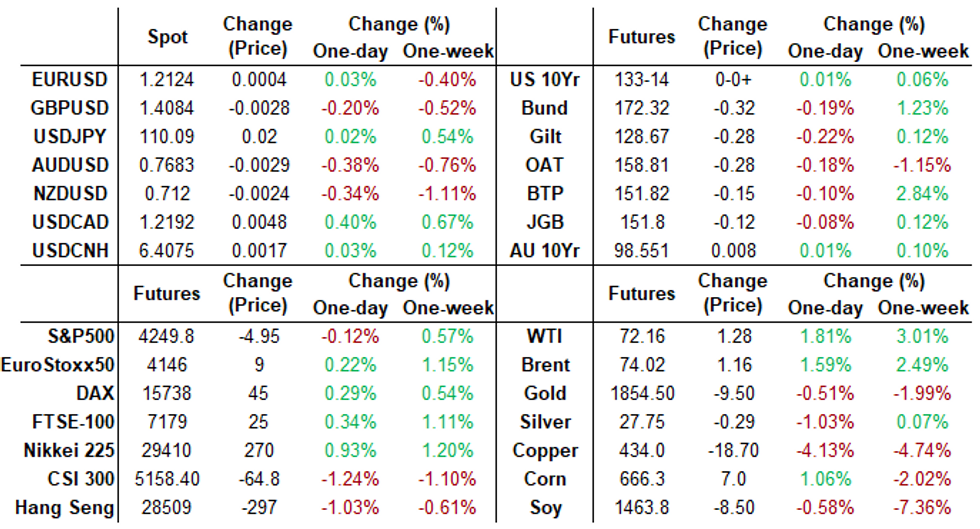

- The 2-Yr yield is up 0.8bps at 0.165%, 5-Yr is up 0.2bps at 0.7838%, 10-Yr is up 0.3bps at 1.4973%, and 30-Yr is up 1.5bps at 2.1975%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00075 at 0.05613% (+0.00075/wk)

- 1 Month +0.00712 to 0.08175% (+0.00888/wk)

- 3 Month +0.00675 to 0.12475% (+0.00588/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month +0.00225 to 0.15262% (+0.00012/wk)

- 1 Year -0.00425 to 0.23325% (-0.00613/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $58B

- Daily Overnight Bank Funding Rate: 0.04% volume: $251B

- Secured Overnight Financing Rate (SOFR): 0.01%, $877B

- Broad General Collateral Rate (BGCR): 0.01%, $367B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.335B submission

- Next scheduled purchases:

- Wed 6/16 ---- Buy-op paused for FOMC rate annc

- Thu 6/17 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/18 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -5,000 Dec 99.68 puts, 1.0

- +25,000 Blue Jul 85 puts, 4.0

- +8,000 Blue Dec 72/82 put spds 3.0 over Blue Mar 71/81 put spds

- +5,000 Green Jul/Sep 86/87/88/90 put condor spd, 0.75 db/Sep over

- +10,000 Mar 100 calls, 1.0 vs. 99.815/0.10%

- +5,000 Green Jul 99.18/99.31/99.43 call flys, 4.0

- -1,000 Red Dec 96 straddles, 27.0

- +6,000 Green Aug 95/96 call spds, 0.5

- +5,000 Jun 95/96/97 put flys, 1.0

- 4,000 Gold Aug 78/80/81 1x2x2 put trees

- Overnight trade

- 10,000 Green Jul 99.31 calls

- 3,500 Blue Aug 81/82/85 broken put flys

- +4,000 TYQ 131/132 2x1 put spds, 4 vs. 132-19.5/0.05%

- +5,000 USN 160 calls, 19

- +3,250 TYQ 130 puts, 6 vs. 132-15/0.9%

- +2,000 TYQ 134/135 call spds, 7 vs. 132-18.5/0.10%

- -2,000 TYU 134 calls 5 over TYU 129/131 put spds

- +7,000 FVN 123.5/123.75 put spds, 3.5-4.0

- Overnight trade

- 5,000 TYN 133 calls, 12

- 2,000 TYN 131.5/132/132.5 put flys, 5

- +3,000 TYQ 131.5/TYU 131 put spd, 11

- +2,000 USQ 156/158 2x1 put spds, 3

EGBs-GILTS CASH CLOSE: Big NGEU Issuance Sets Bearish Tone

A huge debut 10-Yr NextGenerationEU syndication set a bearish tone for Tuesday's session, with core FI weaker in a broadly risk-on session.

- Bunds sold off as it was announced the NGEU size would be the maximum E20bln, which was double most expectations (on books >E142bln).

- Apart from that we had bond supply from the UK (Gilts, GBP7.75bn), Germany (Schatz, EUR4.068bn allotted) and Finland (RFGBs, EUR1.417bn).

- Gilts traded mixed; Periphery spreads tighter.

- UK employment / earnings data impressed; final CPIs carried no surprises.

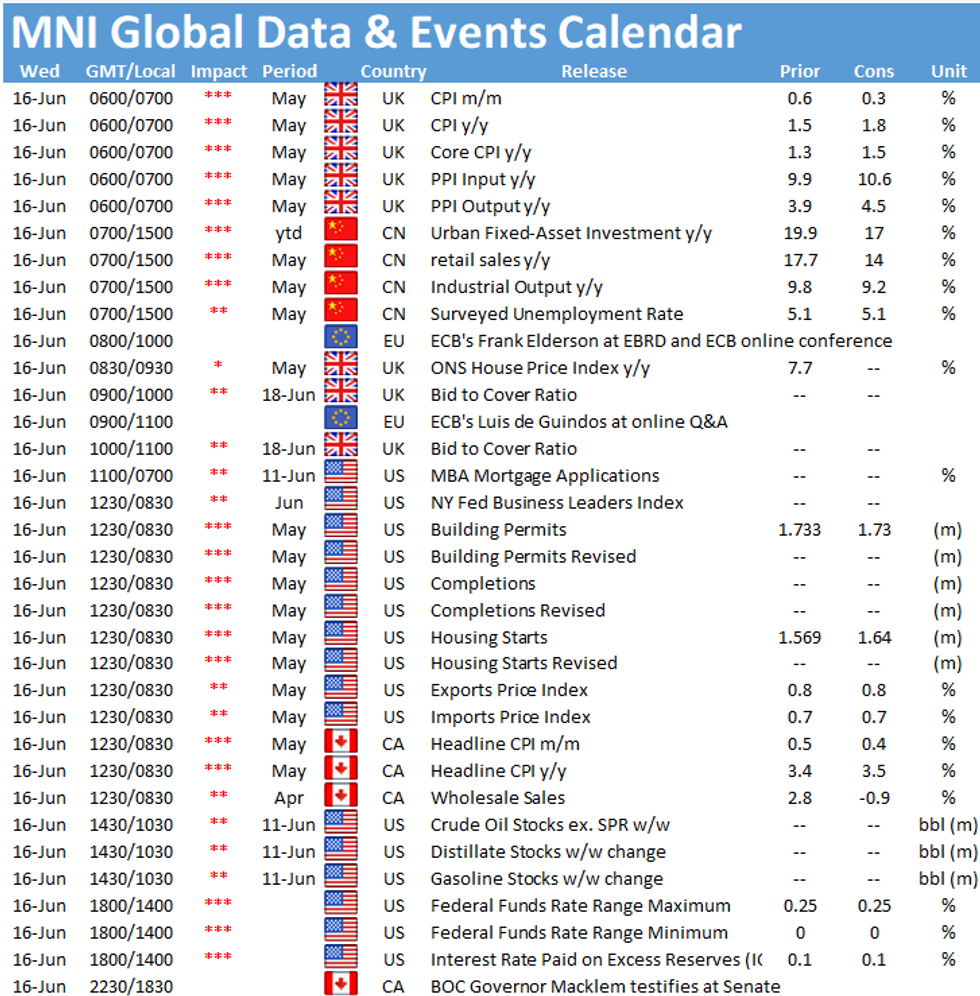

- Wednesday sees UK May inflation data, Gilt / Bund supply, and the US Fed decision.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is up 0.1bps at -0.672%, 5-Yr is up 1.2bps at -0.603%, 10-Yr is up 1.9bps at -0.232%, and 30-Yr is up 1.5bps at 0.322%.

- UK: The 2-Yr yield is up 0.9bps at 0.08%, 5-Yr is up 1.7bps at 0.331%, 10-Yr is up 1.7bps at 0.758%, and 30-Yr is down 0.2bps at 1.276%.

- Italian BTP spread down 1bps at 102bps / Spanish spread down 0.3bps at 64.1bps

OPTIONS/EUROPE SUMMARY: Large Aug Bund Call Structures

Tuesday's options flow included:

- DUU1 112.20/112.10 1x2 put spread bought for 1 in 3.75k

- RXN1/U1 171.00 put calendar bought for 63 in 2.5k (bought Sep)

- RXN1 172.50 call bought for 58.5 in 5k

- RXQ1 171.00/172.50/174.00 1x1.5x1 call fly bought for 87.5 in 2k (2k x 3k x2k)

- RXQ1 174.00/175.00 1x2 call spread bought for 5 in 25k vs RXN1 171.00 put sold at 6.5 in 8.5k

- RXU1 171.00/170.00/169.00 put fly bought for 8.5 in 1k

- 3RU1 100.125/99.875/99.75 put ladder bought for 1.75 in 5k (v 100.235)

- 0LZ1 99.625^ bought for 18.25 in 2k

- 2LU1 99.375/99.50 ^^ sold at 12.25 in 2k

FOREX: Softer US Equities Prompt Risk-Tied Currencies To Fade

- With major US equity indices edging lower, risk tied currencies lost ground while major pairs remained broadly unchanged.

- Losses were concentrated in AUD, NZD and CAD, all retreating by around 0.4%.

- EURUSD and USDJPY were little changed from Monday's close and due to their weighting, the DXY held an extremely tight range during the US session on Tuesday. The Bloomberg dollar index, however, strengthened 0.2%, aided by a broad sell-off in emerging market FX.

- Despite the gains in oil, USDCAD continued it's gradual bounce off 1.20 support and matched key resistance at 1.2203 today. For bulls, clearance of 1.2203, would instead signal a short-term technical base and the potential for a stronger corrective bounce.

- GBPUSD briefly broke through most recent lows around 1.4070, prompting a quick bout of selling which brought the pair down to lows of 1.4034, just below key support at the 50-day EMA at 1.4039. The dip ran into solid demand and a quick 50 pip recovery ensued.

- Both the UK and Canada will release their respective CPI data tomorrow.

- The focus, however, is undoubtedly on tomorrow's Fed meeting, where Chair Powell will likely make it clear that the FOMC is not yet ready to move any further than just talking about reducing asset purchases.

FOREX/Expiries for Jun16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2115-20(E1.1bln-EUR puts), $1.2200(E551mln)

- USD/JPY: Y109.15-25($660mln), Y109.70-75($885mln), Y110.00-05($530mln), Y110.25-30($530mln)

PIPELINE: CIBC, Toyota Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/15 $2.5B #CIBC $1.25B 2Y +30, $500M 2Y FRN SOFR +34, $750M 5Y +50

- 06/15 $2.25B #Macquarie Group $950M 6.25NC5.25 +85, $300M 6.25NC5.25 FRN SOFR+92, $1B 11NC10 +120

- 06/15 $1.8B #Toyota Motor Cr $850M 3Y +20, $350M 3Y FRN SOFR+26, $600M 5Y +35

- 06/15 $1B #ANZ Bank of New Zealand 5Y +50

- 06/15 $750M #Crown Castle Int 10Y +103

- 06/15 $500M #Kommunalbanken 2Y +0

- 06/15 $Benchmark Rep of Turkey 5Y Sukuk 5.25%a

COMMODITIES: WTI Extends Winning Streak, RSI Flashes Overbought

- WTI cemented 14 consecutive sessions of higher highs Tuesday, with the front-month contract creeping higher to touch a new cycle best of $72.03/bbl. The persistent rally has now pushed the WTI RSI into overbought territory, which may suggest the rally could decelerate going forward, although momentum remains in tact for now.

- Both Brent and WTI saw support off the back of reports that Iran had completed the production of over 100kg of 20% enriched uranium, directly running against US sanctions agreements and lessening the likelihood of a return to international energy markets for Iranian crude supply.

EQUITIES: Stocks Sour in Pre-Fed Trade

- US equity markets traded lower Tuesday, with all three major US indices in the red ahead of the much-anticipated Fed meetings on Wednesday. Equity futures got off to a solid start, but began to ebb lower following the opening bell to chew through the late Monday gains.

- Real estate and materials names were the poorest performers, with consumer discretionary and communication services not far behind. Energy and industrials were among the session's only gaining sectors, although financials drew some support from the steeper US yield curve.

- The VIX managed to pick up further off the Monday low, with the index showing just back above 17 points. This still remains well below the 2021 average of circa 21 points.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.