-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI ASIA MARKETS ANALYSIS: Post-FOMC Sale, Powell Downplay DOTS

TSY SUMMARY: Hawkish Take on Steady FOMC, IOER Adjust, Rising DOTS

Futures broadly weaker across the strip as markets take measure of tone from latest FOMC policy annc as hawkish to one degree or another with an eye toward late 2023.- "FOMC forecasts for economic growth have been revised up since our March summary economic projections, even so the recovery is incomplete and risks to the economic outlook remain."

- Aside from a technical adjustment in IOER to 0.15%, Powell said the Fed is "continuing to increase our holdings of treasury securities by at least 80 billion per month, and of agency mortgage backed securities by at least 40 billion per month, until substantial further progress has been made toward our maximum employment and price stability goals."

- Several waves of selling saw Eurodollar and Tsy futures ratchet lower through the initial statement, then the Fed chair's press-conference. Futures did bounce off lows as Chairman Powell reiterated effects of inflation in near term remain uncertain, but likely transitory, will fade over time and any liftoff will be well telegraphed.

- Powell did downplay the DOTS as "not a great forecaster of future rate moves" and need to be taken with a "big grain of salt". Any future lift-off will remain "outcome based and not time based."

- Large sell-blocks noted in 5Y futures, -15k from 123-19.5 to -17.75 before trading down to 123-07.5 low. Yield curves mixed with longer pares flatter after the bell.

- The 2-Yr yield is up 4.2bps at 0.2052%, 5-Yr is up 11.3bps at 0.8938%, 10-Yr is up 8.3bps at 1.5754%, and 30-Yr is up 1bps at 2.1968%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00063 at 0.05550% (+0.00012/wk)

- 1 Month +0.00075 to 0.08250% (+0.00963/wk)

- 3 Month -0.00025 to 0.12450% (+0.00562/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month -0.00075 to 0.15188% (-0.00063/wk)

- 1 Year +0.00125 to 0.23450% (-0.00488/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $60B

- Daily Overnight Bank Funding Rate: 0.04% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.01%, $905B

- Broad General Collateral Rate (BGCR): 0.01%, $381B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $355B

- (rate, volume levels reflect prior session)

- Wed 6/16 ---- Buy-op paused for FOMC rate annc

- Next scheduled purchases:

- Thu 6/17 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/18 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, +10,170 Gold Sep 75 puts, 4.0 adds to 3.5 buy earlier:

- +10,000 Gold Sep 75 puts, 3.5

- +20,000 Dec 99.81/99.87/99.93 1x1x2 call trees, 0.75-1.0

- +10,000 short Mar 92/93/95/96 put condors, 2.5

- Block, +15,000 Blue Sep 81/82/85 broken put flys, 4.5 vs. 98.64/0.10%

- -4,000 Blue Mar 80/85/90 iron flys, 35.5

- +5,000 short Sep 96/97 strangles, 5.5 vs. 99.715/0.10%

- -11,000 Sep 99.93/100.0 call strip, 0.75, total -15k total between screen/pit, pre-post NY open

- +7,000 TYQ 131.5 straddles 128

- +5,000 USN 158 puts, 31

- +15,000 TYN 132.5 calls from 25-27

- +2,000 TYN 132.25/133 strangles, 26

- +5,000 wk3 TY 132.25 puts, 9

- +3,000 wk3 TY 132/132.25 2x1 put spds, 4

- +2,000 wk3 TY 130.25 puts, cab-7

- +2,000 FVU 123.5/124/124.5 call trees, 5

- -1,000 FVN 124 straddles, 25.5

- +1,750 USN 152/153/154 put fly, 1

- +5,000 TYQ 131 puts, 12

- +1,000 TYN 132.25/133 put over risk reversals, 2

- +3,000 wk3 FV 124 calls 8-8.5

EGBs-GILTS CASH CLOSE: UK Breakevens Shrug Off High Inflation Data

The UK and German curves bull flattened Wednesday with periphery spreads slightly wider, ahead of the US Federal Reserve decision after hours.

- UK inflation data came out on the high side (2.1% Y/Y in May vs 1.8% consensus), but breakevens actually headed lower over the day after the initial jump (in a move similar to the US inflation data shockers in Apr and May).

- Bond supply came from the UK (Gilts, GBP2.5bn) and Germany (Bunds, EUR4.085bn allotted). Italy also conducted a tap issuance for specialists (E1.5B total).

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at -0.677%, 5-Yr is down 1.6bps at -0.619%, 10-Yr is down 1.8bps at -0.25%, and 30-Yr is down 1.7bps at 0.305%.

- UK: The 2-Yr yield is down 0.3bps at 0.077%, 5-Yr is down 0.6bps at 0.325%, 10-Yr is down 1.9bps at 0.739%, and 30-Yr is down 1.9bps at 1.257%.

- Italian BTP spread up 0.8bps at 102.8bps/ Spanish spread up 0.6bps at 64.7bps

OPTIONS/EUROPE SUMMARY: Stg Straddle Buying Continues

Wednesday's options flow included:

- RXN1 170.50p, bought for 3 in 2k

- DUN1 112.20/112.10/112.00/111.90p condor, bought for 3.5 in 1.5k

- 3RZ1 100.25/100/99.75p fly, sold at 5.75 in 5k

- 0LZ1 99.625^ bought for 18.5 in 7k total. Was bought for 18.25 yesterday

- 2LU1 99.37/99.25/99.12p fly, bought for 1.75 in 3.5k

- 2LZ1 9937/9912ps 1x1.5 vs 99.62c, bought the ps for 1.75 in 3k

- SFIM2 (SONIA) 99.80/99.70ps bought for -1 tick in 2.5k

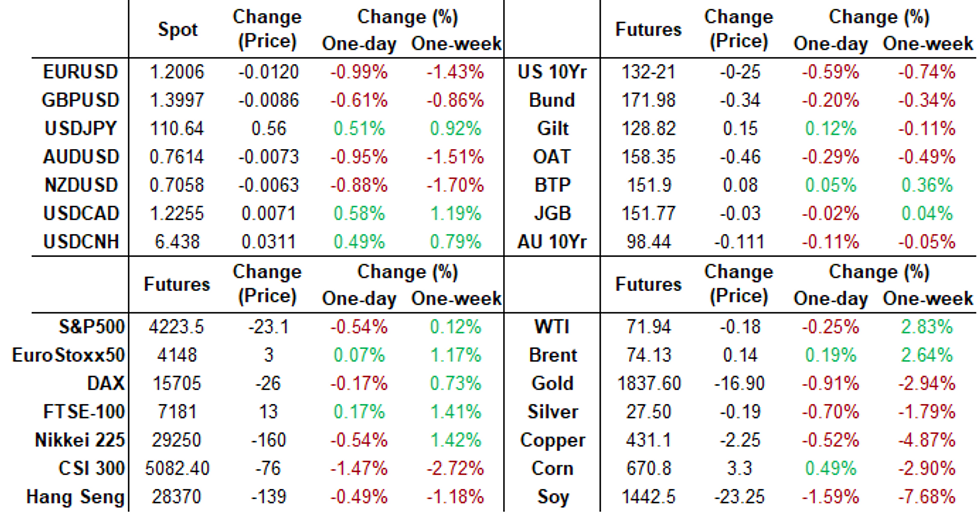

FOREX: Dollar On The Charge

- The greenback rallied sharply on the back of FOMC decision, with markets immediately focusing on the median dot pointing to two hikes by the end of 2023. This was more hawkish than expected, with traders also eyeing the hike to the RRP rates and IOER, as well as 7 dots now favouring rate liftoff by end-2022, up from 4 previously.

- The greenback surge unsurprisingly put most major pairs under pressure, with the likes of EUR/USD, GBP/USD and USD/JPY all breaking out of their recent ranges.

- The USD Index rallied to touch new June highs, showing above the 100-dma in the process.

- NOK was the G10 laggard, with the currency slipping ahead of Thursday's Norges Bank rate decision. The bank are expected to bring forward their projections for the first NB hike to September.

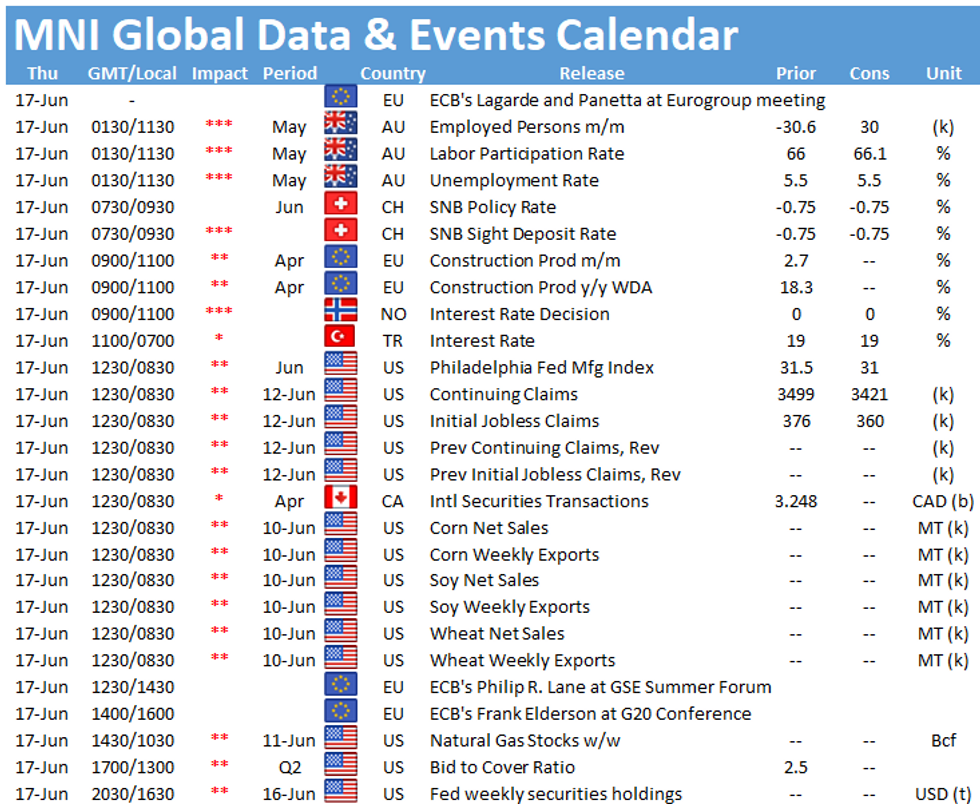

- Focus Thursday turns to Australian jobs report, final Eurozone CPI data, weekly jobless claims data and the latest Philly Fed release. Rate decisions are due from the Swiss, Norwegian, Indonesian and Turkish central banks, all of which are expected to keep rates unchanged.

FOREX/Expiries for Jun17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1985-05(E1.3bln), $1.2045-50(E1.0bln), $1.2085-00(E1.0bln), $1.2190-00(E1.1bln), $1.2220-35(E3.6bln-EUR puts), $1.2300(E1.9bln-EUR puts)

- USD/JPY: Y108.65-75($886mln), Y109.10-20($878mln), Y109.35-50($586mln), Y110.20-25($1.2bln-USD puts), Y110.50($885mln)

- AUD/USD: $0.7715-30(A$629mln), $0.7800(A$521mln)

- NZD/USD: $0.7250(N$920mln)

- USD/CAD: C$1.2065-70($1.0bln-USD puts)

PIPELINE: FOMC Sidelines Issuers

- Date $MM Issuer (Priced *, Launch #)

- 06/16 $2B #Lundin Energy Finance $1B each: 5Y +115, 10Y +155

- 06/16 $750M #Wipro 5Y +80

COMMODITIES: WTI Edges Off Highs Post-Fed, But Extends Winning Streak Nonetheless

- WTI and Brent crude futures traded mixed Wednesday, with WTI edging off new cycle highs following a more hawkish-than-expected FOMC rate decision. A sooner and steeper rate liftoff firmly strengthened the dollar, dragging WTI off the earlier highs.

- This countered any support WTI may have received from a much sharper draw in crude reserves in the week's DoE crude inventories.

- Despite weakness into the close, WTI managed to extend the recent winning streak, with Wednesday marking the 15th consecutive session of higher highs - a sequence that hasn't occurred in the contract's history. The second longest winning streak was 13 sessions in 1987.

EQUITIES: Stocks Recover Fed-Induced Slip

- Wall Street fell sharply in the immediate response to the Fed decision, with the e-mini S&P shedding over 35 points in the immediate response to hit 4,200.75. These losses proved temporary, with stocks rallying sharply off the lows and steering clear of any test of the key support at the 4,172.4 50-dma.

- Bank stocks were the key beneficiary of the FOMC, with a steeper and sooner return to rate liftoff steepening the Treasury and working in favour of banks. Utilities and consumer staples were the hardest hit.

- European indices were more mixed, with Germany's DAX and Spain's IBEX-35 lagging, while the UK FTSE-100 and France's CAC-40 outperformed - albeit only slightly.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.