-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Hawks Resume Message, Mkts Cautious

US TSY SUMMARY: Mkts Discount More Hawkish Fed-Speak

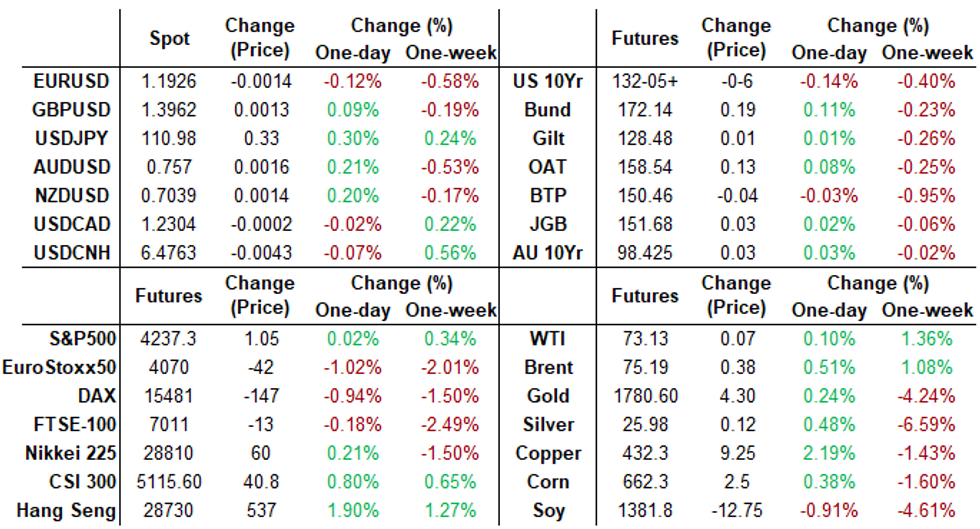

Inside range session with Tsys trading modestly weaker after the bell, yield curves marginally mixed, equities mostly firmer (ESU1 +4.0 at 4240.0). Decent volumes on two-way positioning flow ahead Thursday's heavy economic data release schedule and continued Fed-speak.- Hawkish rhetoric returns with side of salt: after Atlanta Fed Pres Bostic called for two hikes in 2022 and two more in 2023 earlier today, Dallas Fed Pres Kaplan sees first rate hike in 2022 followed soon after by taper. Why the salt? Markets discounted either slow to react to Kaplan comments after the bell, or are seriously discounting the message as rates hold off session lows.

- Other political headlines also discounted: Sens' Romney and Tester see infrastructure deal as soon as today.

- The $61B 5Y note (91282CCJ8) auction tailed slightly: .02bp: high yield of 0.904% vs. 0.902% WI. Bid-to-cover 2.36x just over 5 month average of 2.35x. Indirects take-up declines to 57.62% vs. last month's 64.35% (prior high of 66.22% in August 2020); direct bidder take-up surged to 18.09% vs. 14.87% last month and 5M avg of 15.48%; primary dealer take-up: 24.29% just shy of the 5-month average of 24.88%.

- The 2-Yr yield is up 3.8bps at 0.2661%, 5-Yr is up 2.8bps at 0.8829%, 10-Yr is up 2.7bps at 1.4903%, and 30-Yr is up 3bps at 2.1158%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00013 at 0.08525% (+0.00475/wk)

- 1 Month +0.00075 to 0.09150% (+0.00050/wk)

- 3 Month +0.01350 to 0.14725% (+0.01238/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month -0.00125 to 0.15938% (+0.00313/wk)

- 1 Year -0.00213 to 0.24350% (+0.00338/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $70B

- Daily Overnight Bank Funding Rate: 0.08% volume: $261B

- Secured Overnight Financing Rate (SOFR): 0.05%, $888B

- Broad General Collateral Rate (BGCR): 0.05%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $333B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $15.933B submission

- Next scheduled purchases:

- Thu 6/24 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/25 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Repo and Reverse Repo Operations, Another Record High

NY Fed reverse repo usage makes another new record high of $813.573B from 73 counterparties. Compares to Tue's record of $791.605B -- continued knock-on effect of FOMC's IOER technical adjustment to 0.15% from 0.10%.

MONTH-END EXTENSION: PRELIMINARY Barclays/Bbg Extension Estimates for US

PRELIMINARY forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.01Y; US Gov infl-linked -0.4Y.

| Indices | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.11 | 0.04 | 0.06 |

| Credit | 0.05 | 0.12 | 0.09 |

| Govt/Credit | 0.07 | 0.10 | 0.09 |

| MBS | 0.11 | 0.06 | 0.08 |

| Aggregate | 0.08 | 0.09 | 0.09 |

| Long Gov/Cr | 0.07 | 0.09 | 0.12 |

| Iterm Credit | 0.07 | 0.10 | 0.10 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.09 | 0.08 |

| High Yield | 0.07 | 0.11 | 0.09 |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +12,500 Dec 90 puts, cab

- +2,000 short Mar 97 straddles, 34.0

- -2,000 Blue Jul 85/86 strangles, 11.5

- +5,000 Green Oct 82/85 3x2 put spds, 3.0

- +5,000 Green Sep 87 put, 4.5 vs. 99.015/0.10%

- -4,000 Blue Jul 85 straddles, 18.5

- -4,000 Green Aug 90/91 strangles, 14.0

- Overnight trade

- 1,000 Green Sep 98.68/98.81/99.06 2x3x1 put flys

- 1,000 Green Oct 98.56/98.68/98.93 2x3x1 put flys

- -10,000 FVN 123/123.25 call spds, 13.5

- BLOCK, -9,999 FVQ 123.5 calls, 16

- 5,000 FVU 121.25/122 2x1 put spds

- +1,000 USQ 160 calls, 129

- +1,000 TYQ 132 puts, 29

- Overnight trade

- 10,000 TYN 131 puts, 1

- +3,000 TYN 132 puts, 3

- 2,000 FVU 125/125.75 call spds

EGBs-GILTS CASH CLOSE: Mixed Curves Post-PMIs, Pre-BoE

Bunds and Gilts traded mostly stronger Wednesday though curves were mixed, with equities retreating, and the Bank of England decision awaited Thursday.

- The German curve bull flattened to 10-Yrs, while the UK short-end outperformed. Periphery spreads widened slightly.

- Flash Jun PMI data was mixed, with France and the UK disappointing, and Germany beating expectations. Global core FI ticked higher on a US PMI miss in the afternoon.

- UK sold GBP0.4bln in linkers; Germany allotted E2.06bln of Bund; Slovenia syndicated E1bln of sustainable 10Y.

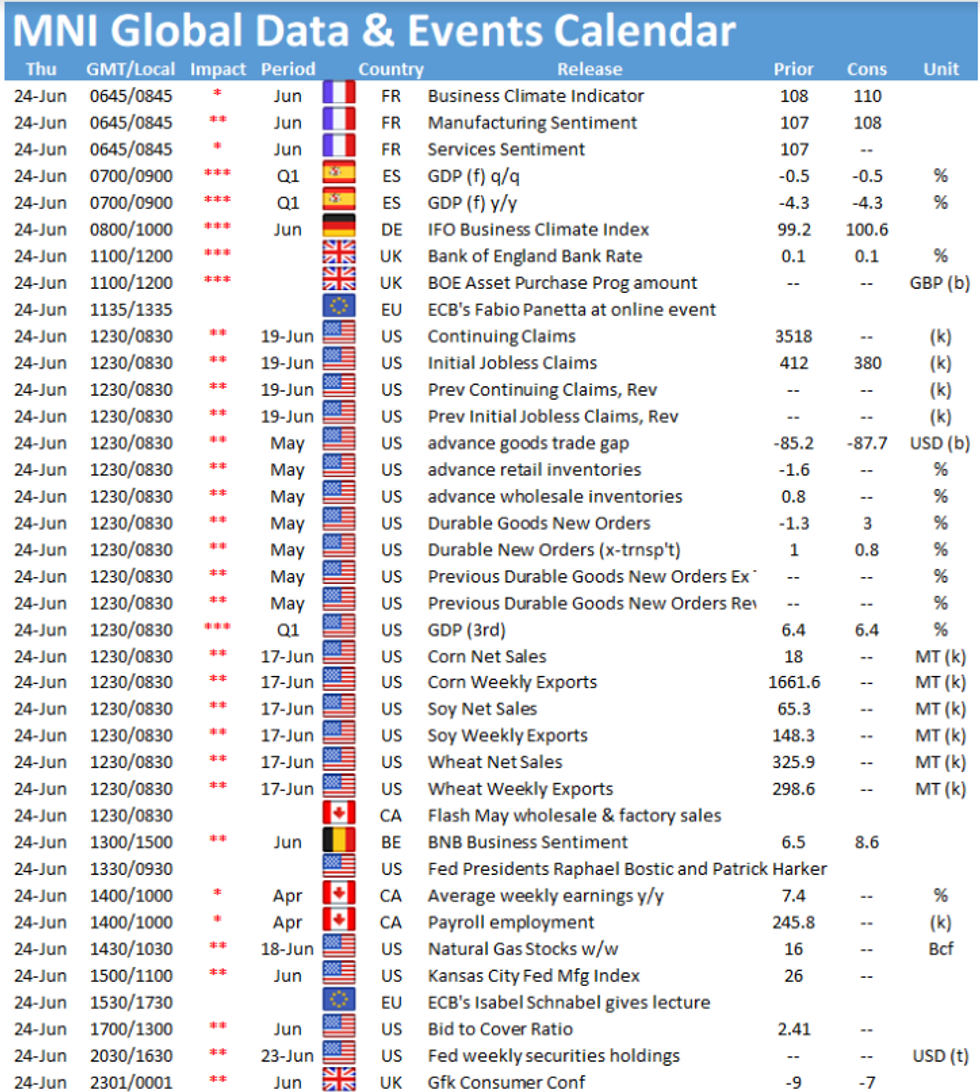

- Looking ahead to Thursday, we get the BoE decision - our preview went out today. We also get some confidence data (France; German IFO). No supply scheduled for Thursday, though today Italy announced a syndication for Apr-29 CCTeu.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.6bps at -0.653%, 5-Yr is down 1.2bps at -0.568%, 10-Yr is down 1.4bps at -0.178%, and 30-Yr is down 0.9bps at 0.308%.

- UK: The 2-Yr yield is down 1.9bps at 0.089%, 5-Yr is down 0.5bps at 0.384%, 10-Yr is unchanged at 0.78%, and 30-Yr is up 1.3bps at 1.28%.

- Italian BTP spread up 1.1bps at 107.3bps / Spanish spread up 0.3bps at 62.8bps

OPTIONS/EUROPE SUMMARY: Large Put Spreads In Rates

Wednesday's options flow included:

- RXN1 172c, bought for 27/30 in 2k

- DUU1 112.10/20/30c fly vs 112.00/90 ps, bought the fly for 1.25 and 1.5 in 5k

- OEU1 133/135 RR, sold the put at half in 2k

- ERZ1 100.37/25 ps, sold at 0.25 in 20k

- 0LU1 99.375/99.25 p1x1.25 bought for 1 in 10k

- 2LZ1 9925^ bought for 30 in 5.25k total

- 2LZ1 99.37c vs 3LZ1 99.25c, bought the 2yr for -0.75 (receive) in 5k

- 2LU1 99.75/99.37ps, sold at 31.75 in 5k

- 2LZ1 99.12/98.87ps, bought for 6 in 10k

- 3LZ1 99.00/98.62ps 1x1.5, bought for 6.75 in 15k

- 3LZ1 99.37p, sold at 34.75 in 7.5k

FOREX: JPY Continues Downward Trajectory

- USDJPY extended its winning streak on Wednesday, trading to the highest level since March 2020, triggering some volatile price action in the pair.

- As the 2021 highs and the technical bull trigger were broken through 110.97, a flurry of demand prompted a 111.10 print. However, a lack of follow through prompted a sharp reversal in fortune with no headlines behind the move.

- The JPY lurch higher coincided with sizeable spike in JPY futs volumes, with just shy of 2,000 contracts changing hands inside 60 seconds at 1236BST/0736ET, roughly $225mln cash equivalent. USDJPY retreated back to the overnight highs of 110.66 which acted as firm support. The pair spent the majority of the session grinding back towards the 111 mark, continuing to benefit the crosses (notably AUDJPY & NZDJPY +0.57%).

- The dollar index remains unchanged from Tuesday's close. Initial weakness saw fresh lows for the week just above 91.50, however, a small bounce throughout the US session capped G10 FX volatility.

- German IFO on Thursday morning precedes the Bank of England decision/statement where the most notable risk is if another MPC member joins Haldane in voting for a reduction to the QE target. MNI deem this risk to be low.

- Thursday's US session sees a good amount of data on the docket, headlined by the final Q1 GDP reading as well as initial jobless claims.

FX-OPTIONS/Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.8bln), $1.1840-50(E1.0bln), $1.1900-10(E1.1bln), $1.1920-25(E1.8bln), $1.1945-50(E713mln), $1.1975(E640mln), $1.2000-20(E1.1bln)

- USD/JPY: Y109.50($658mln), Y109.95-110.00($2.1bln), Y110.25-30($663mln), Y110.50($602mln), Y110.65-75($1.3bln-USD puts), Y111.20-30($1.8bln), Y111.75($1.4bln)

- GBP/USD: $1.3895-00(Gbp798mln), $1.4000(Gbp686mln)

- EUR/JPY: Y132.00(E556mln)

- AUD/USD: $0.7750-70(A$1.25bln)

- USD/CAD: C$1.2900($1.4bln)

- USD/CNY: Cny6.40($1bln)

PIPELINE: Banco Santander, BNP Paribas, NatWest Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/23 $1.5B #Banco Santander 3NC2 +45

- 06/23 $1B #BNP Paribas 6NC5 +80

- 06/23 $750M *Turk Eximbank 5Y 5.875%

- 06/23 $750M #NatWest WNG PerpNC10.5 4.6%

- 06/23 $500M #Welltower +7Y +85

- 06/23 $500M Nemak 10Y 3.75%a

- 06/23 $Benchmark Fidelity National Fncl 5Y +90a

- 06/23 $Benchmark Rep of Panama 10Y +200a, 29Y tap +170a

EQUITIES: Path of Least Resistance for Stocks Remains Higher

- Stocks traded either side of unchanged Wednesday, with the rally from the Fed inspired lows stalling at the day's high. Nonetheless, the path of least resistance remains higher, after the e-mini S&P recovered from 4126.75, the Jun 21 low. The 50-day EMA is proving to be a reliable trend indicator and continues to successfully identify where demand interest in this contract lies, once a corrective cycle is underway.

- Strength in US consumer discretionary, financials and energy names was countered by weakness in utilities, healthcare and consumer staples.

- The picture was more negative across Europe, which saw the EuroStoxx50 shed 1.1%, while the UK's FTSE-100 was spared the bulk of the losses to drop 0.2% at the close.

COMMODITIES: WTI, Brent Top Out at New Highs

- Oil markets continue to trend higher and both Brent and WTI appear comfortable above $70.00/bbl. A bullish sequence of higher highs and higher lows remains intact and moving average studies are in a bull mode reinforcing the current bull trend conditions and market sentiment.

- This shifts focus to the upcoming OPEC+ meeting in Vienna next week. The group's delegates meet on July 1st, with recent reports suggesting the group could up daily output by a further 500,000bpd - still a relatively small move given the IEA's forecast that Q4 oil demand will hit multi-year highs of 100mln bpd in Q4.

- Gold and silver traded in minor positive territory, with moderate dollar weakness and a stall in equities underpinning precious metals.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.