-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Dollar Continues Gaining Ground

MNI ASIA MARKETS ANALYSIS - Dollar Continues Gaining Ground

HIGHLIGHTS

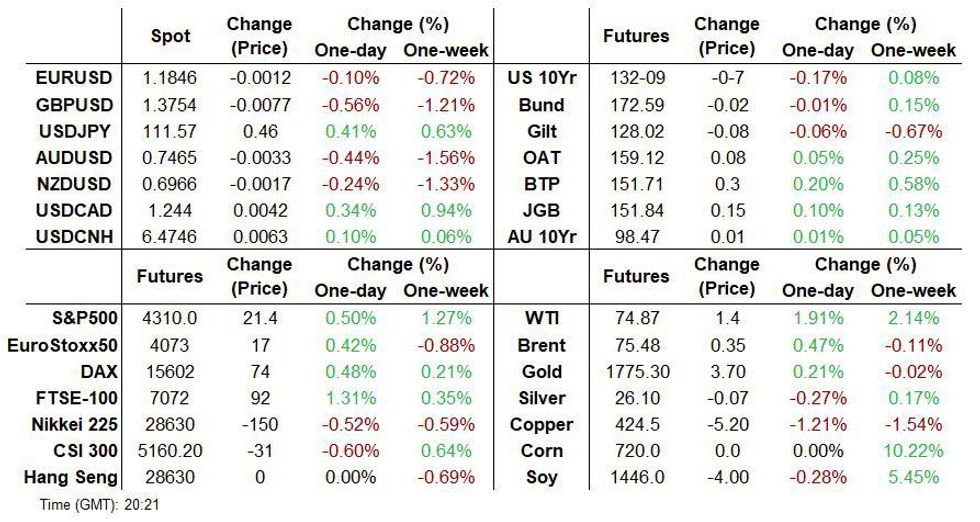

- The dollar continues to gain ground while the UST curve has marginally flattened during the session

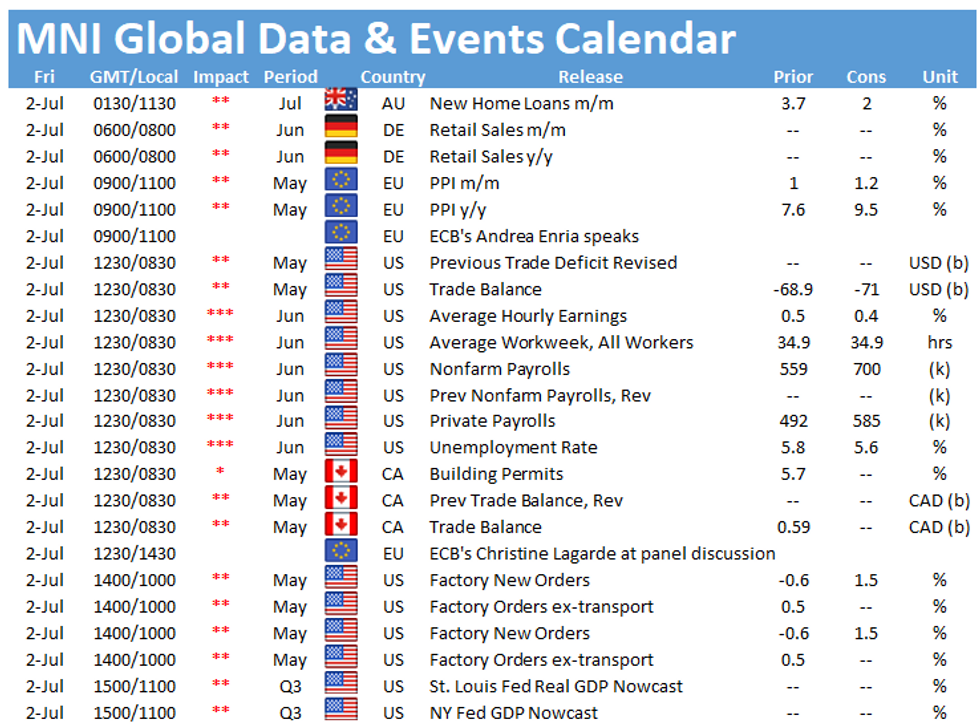

- Following today's jobless claims data and ISM manufacturing update, focus shifts to payrolls tomorrow

- UK Chancellor of the Exchequer Rishi Sunak unveiled post-Brexit reform measures for the City of London

US TSYS SUMMARY: Marginal UST Curve Flattening; Focus Tomorrow Shifts To Payrolls

The UST curve has flattened slightly on the day as a result of the short end trading a touch weaker and long-end yields inching lower. Following a brief rally around the time of the initial claims data, USTs are now back to the middle of the day's range.

- Last yields: 2-year 0.2527%, 5-year 0.8926%. 10-year 1.4663%, 30-year 2.0728%

- TYU1 trades at 132-10+, having sat inside a relatively tight range during the day (L: 132-06 / H: 132-15).

- Initial jobless claims came in at 364k vs 388k consensus, while the ISM manufacturing print was a touch below expectations at 60.6 vs 60.9 while pointing to still solid expansion.

- Focus tomorrow shifts to payrolls with consensus looking for a print of 716k.

EGBs-GILTS CASH CLOSE: Steepening Fades Slightly On Afternoon Mini-Rally

The Gilt and Bund curves bear steepened slightly Thursday, though came off steepest levels amid an afternoon mini-rally in longer-duration core European FI.

- After tracking US Tsys closely throughout most of the session, Bunds decoupled in the last 1.5 hours of cash trade, retaining the move lower in yields as Tsy yields rebounded to session highs.

- Periphery spreads compressed, with Italy 10s touching 100bps vs Germany.

- BoE's Bailey added little new in his Mansion House speech today.

- Data throughout the session brought little impact in either direction (Italy Mfg PMI in line, Spain beat), with focus still firmly on Friday's US nonfarm payrolls release.

- Little data or supply, but multiple ECB speakers, including Lagarde.

Closing Yields / 10-Y Spread to Germany:

- Germany: The 2-Yr yield is down 0.5bps at -0.667%, 5-Yr is down 0.1bps at -0.589%, 10-Yr is up 0.6bps at -0.201%, and 30-Yr is up 1.6bps at 0.306%.

- UK: The 2-Yr yield is up 0.5bps at 0.068%, 5-Yr is up 0.5bps at 0.337%, 10-Yr is up 1.4bps at 0.73%, and 30-Yr is up 1.3bps at 1.247%.

- Italian BTP spread down 2.2bps at 100.4bps / Spanish spread down 2bps at 59.9bps

EUROPE OPTION FLOW SUMMARY: Plenty Of August Bund Puts

Thursday's options flow included:

- RXQ1 169.5/168.5ps, bought for 3 in 1.5k

- RXQ1 171.50/171/170.50p fly 1x3x2, bought for -3 (receive) in 1.5k

- RXQ1 171.50/171.00ps bought for 10 in 2k

- RXQ1 172.00/171.00 1x2 put spread bought for 7.5 in 1.3k

- 0LU1 99.37p, bought for 0.75 in 17.5k

- 0LZ1 99.75/00 cs, bought for 1 in 6k

- 3LZ1 98.75p, bought for 5 in 5k

FOREX: Dollar Strength Prevails, JPY Out Of Favour

- The dollar index (+0.16%) is likely to post a 5-day winning streak as markets appear optimistic regarding the upcoming June non-farm payrolls data, with the whisper number at a slightly more bullish 800k, vs. 720k estimates.

- USDJPY broke some strong technical resistance through 111.12 overnight and very supportive action throughout Thursday ensued. Approaching the close, USDJPY is on the highs around 1.1165, up 0.5% on the day.

- Interest has been building in topside USD strikes, most notably at Y111.75 in USD/JPY, at which over $2bln in call options are due to expire at the post-NFP NY cut. This would narrow the gap with key resistance at the 112.23 Feb 20, 2020 high.

- Initially, EURUSD bounced from noted Fibonacci retracement support at 1.1837 with a fairly swift rally back to 1.1884, showing relative outperformance. However, with dollar momentum growing throughout the US session, the lows are being approached once more. A positive surprise from tomorrow's data may prompt a sustained break that would open 1.1704, Mar 31 low and a key support.

- Elsewhere both GBP and AUD retreated by 0.5%, with slightly smaller losses seen for CAD (-0.35) and NZD (-0.26%). Emerging market currencies bore the brunt of the dollar strength with both ZAR and BRL down well over 1%.

FX OPTIONS: Expiries for Jul02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750(E1.0bln), $1.1820-25(E1.5bln-EUR puts), $1.1850-55(E2.6bln), $1.1865-66(E1.1bln), $1.1895-1.1900(E2.0bln), $1.1940-50(E3.9bln), $1.2025-35(E543mln)

- USD/JPY: Y109.35-50($1.2bln), Y109.75($650mln), Y110.20-25($656mln), Y110.70-80($1.8bln), Y111.00($2.0bln), Y111.40-50($2.0bln-USD calls), Y111.75($1.9bln-USD calls)

- EUR/JPY: Y132.00-20(E582mln)

- AUD/USD: $0.7495-00(E514mln), $0.7625(A$593mln)

- USD/CAD: C$1.2250($988mln), C$1.2300($730mln), C$1.2325($855mln), C$1.2500-15($830mln)

- USD/CNY: Cny6.32($1.6bln-USD puts), Cny6.40($950mln), Cny6.45($875mln)

Price Signal Summary - USD Extends Gains

- In the equity space, S&P E-minis maintain a bullish theme and today, has traded above the 4300.00 handle today. This opens 4322.15, 0.764 projection of Mar 25 - May 10 - 13 price swing. EUROSTOXX 50 futures focus is on a key technical pattern from Jun 18 - a bearish engulfing candle - that continues to warn of a short-term top in the trend. A break of 4015.00, Jun 21 low would reinforce the importance of the engulfing line and signal scope for a deeper pullback potentially below 4000.00 towards 3914.00, May 20 low.

- In FX, the USD remains firm and has resumed its uptrend. The EURUSD support is under pressure. The focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. A break would open 1.1795, Apr 6 low. GBPUSD is trading below 1.3787, Jun 21 low. A clear break would signal scope for weakness towards 1.3717, Apr 16 low. USDJPY is trading higher and has cleared 111.30, the Mar 26, 2020 high. The focus turns to 111.71/73, Mar 24, 2020 high and 1.0% 10-dma envelope.

- On the commodity front, the yellow metal broke lower Tuesday and cleared support at $1761.1, Jun 18 low. The break confirms a resumption of the downtrend that started Jun 1 and note the move has also confirmed a bear flag that developed during the most recent consolidation phase. The focus is on $1733.5, 76.4% retracement of the Mar 8 - Jun 1 rally. Resistance is at $1795.0, Jun 23 high. The Oil market trend condition remains bullish and pullbacks are considered corrective. Brent (U1) focus is $76.42, 1.236 projection of Mar 23 - May 18 - May 21 price swing. Support lies at $72.94, the 20-day EMA. WTI (Q1) sights are set on $75.01, 1.382 projection of Mar 23 - May 18 - May 21 price swing. Watch support at $71.35, the 20-day EMA.

- Within FI, Bund futures key short-term directional triggers are; support at 171.67, Jun 22 low and resistance at 173.16, Jun 11 high. Key support in Gilt futures is unchanged at 126.70, Jun 3 low and marks an important pivot level. The key resistance is at 128.39, Jun 11 high.

EQUITIES: Stocks on Firmer Footing as ES1 Cements Five-Day Winning Streak

- The e-mini S&P extended its winning streak Thursday, cementing a fifth consecutive session of new all-time highs. This pushes the high watermark up to 4305.75, helping the S&P500 cash outperform both the tech-led NASDAQ and the Dow Jones Industrial Average.

- Gains in the US came as energy firms rallied further - the energy sector as a whole was higher by over 2% as oil benchmarks rallied sharply and the Brent premium over WTI contracted. Market moves were in response to an OPEC+ deal that sees 400,000bpd return to the market initially, before output curbs ease further in the subsequent months.

- The tech sector was the underperformer, with semiconductor names the hardest hit.

- European trade was uniformly positive, with Spain's IBEX-35 and UK's FTSE-100 outperforming, higher by 1.3% apiece.

COMMODITIES: WTI, Brent Surge as OPEC+ Opt to Drip Feed

- Thursday's OPEC+ meeting took market focus, with oil prepped for an uptick in output of between 500k - 1mln bpd as soon as August, but the group opted to adopt a far more gradual approach, with 400,000bpd hitting the market in August, followed by a far more gradual return to capacity.

- This helped support oil benchmarks, with WTI and Brent crude futures rallying over 2% apiece and hitting new cycle highs in the process.

- The WTI-Brent contracted sharply, with the group's decision to commit to an eventual restoration of as much as 2mln bpd of lost output contrasting with less flexible shale production / US supply.

- Focus Friday turns to the June jobs report, with markets expecting an improvement in jobs added to 720k.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.