-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - Equities Provide Holiday Fireworks

NOTE: Due to the U.S. Independence Day holiday, the next MNI Asia Markets Analysis will be published on Tuesday July 6.

HIGHLIGHTS:

- The June U.S. nonfarm payrolls gain of +850k beat expectations, but the unemployment rate ticked higher

- Gains in global core bonds resumed following immediate volatility on the largely positive but mixed data

- S&P futures hit all fresh all-time highs for the 6th consecutive session, going into the U.S. long weekend

US TSYS SUMMARY: Nonfarm Fireworks Only Brief Ahead Of Long Weekend

The much-anticipated June employment report provided an upside surprise on headline job gains Friday, but mixed underlying data dampened the fireworks ahead of the long holiday weekend.

- An above-consensus nonfarm payrolls gain of 850k (130k more than expected, plus higher revisions to prior) was offset by a slightly higher unemployment rate (+0.1pp to 5.9% vs 5.6% expected), as the Establishment and Household surveys appeared to tell slightly different stories.

- Either way it didn't change the macro narrative conclusively. The curve steepened slightly (5Y yields headed lower, potentially fading earlier Fed liftoff risks). Once the immediate volatility played out, TYs continued their short-trend higher, narrowing the gap with the Jun 21 high of 132-30.

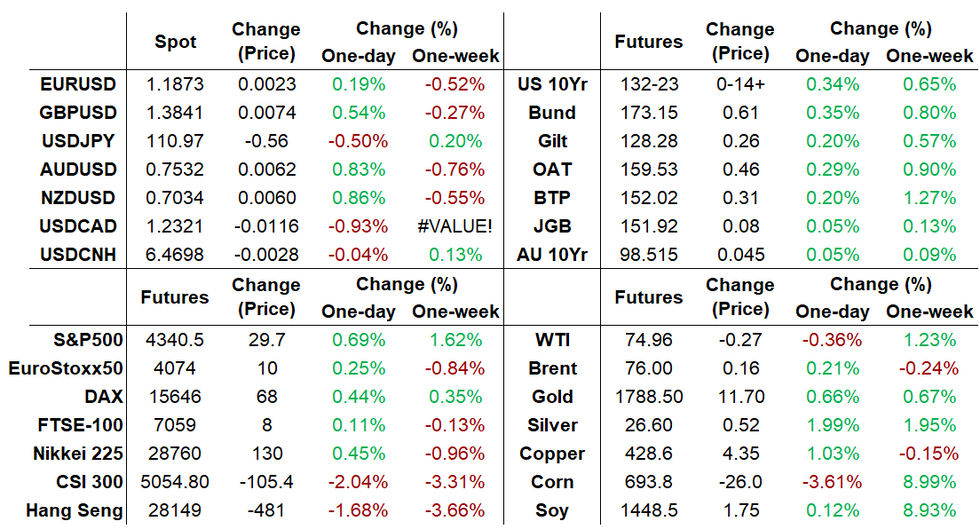

- Sep 10-Yr futures (TY) up 14.5/32 at 132-23 (L: 132-07.5 / H: 132-23.5) The 2-Yr yield is down 1.7bps at 0.2356%, 5-Yr is down 3.5bps at 0.8573%, 10-Yr is down 3.1bps at 1.4272%, and 30-Yr is down 1.9bps at 2.0417%.

- This came alongside continued gains in equities (S&P hit an ATH for the 6th straight day).

- Globex futures trade until 1700ET Friday, but CME floor closed at 1300ET and Sifma recommended cash close at 1400ET. The latter two resume Tuesday.

EGBs-GILTS CASH CLOSE: Capping A Strong Week

The German and UK curves bull flattened Friday, consolidating a strong week. Periphery spreads ended the session marginally wider but likewise capped a solid weekly performance.

- Global FI hit turbulence at 1330BST on the release of US employment data, but the report was mixed and Bunds/Gilts ended up largely unchanged.

- Little key data apart from the US payrolls, no supply, and not much meaningful central bank speak.

- We get a few ECB speakers over the weekend including Schnabel and Villeroy.

Closing yields/10-Yr Spreads To Germany:

- Germany: The 2-Yr yield is down 0.4bps at -0.671%, 5-Yr is down 1.6bps at -0.605%, 10-Yr is down 3.4bps at -0.235%, and 30-Yr is down 3.3bps at 0.273%.

- UK: The 2-Yr yield is down 1bps at 0.058%, 5-Yr is down 1.9bps at 0.318%, 10-Yr is down 2.7bps at 0.703%, and 30-Yr is down 2.1bps at 1.226%.

- Italian BTP spread up 0.3bps at 100.7bps/Spanish up 0.6bps at 60.5bps

EUROPE OPTIONS SUMMARY: Large Sterling Structures

Friday's options flow included:

- OEU1 134.00/133.50 ps, bought for 12 in 2.5k

- RXQ1 174/174.5/175c fly 1x3x2, bought for -1.5 in 1.5k

- 0LU1 99.62/99.75cs vs 3LU1 99.25/99.37cs, bought the 1yr for half in 6k

- 0LZ1 99.50^ vs 99,37p, sold the straddle at 14.25 in 33.5k

- 0LZ1 99.375p/99.75c bought for 2 & 2.5 (Bot puts/sold calls) in 30k. Delta -38%

- 2LU1 99.25/12 ps, bought for 2.25 in 3k

FOREX: Dollar Fades Post Payrolls

- Greenback strength was the order of the day ahead of June non-farm payrolls, with the dollar index trading close to 3-month highs, potentially anticipating a strong set of data.

- The USD initially traded firmer on the higher than expected headline, however, dollar optimism faded almost immediately. A strong reversal ensued, with the potential trigger being an unexpected 0.1ppts rise in the unemployment rate, taking the shine off the report.

- Additional positioning implications heading into the US holiday weekend prompted a sharp move to fresh lows for Friday's session. The DXY is extending losses into the close (-0.37%) ending a five-day win streak for the index.

- Stronger US equities boosted risk-tied pairs with AUD, NZD and CAD all benefitting between 0.8-0.9%. Similarly, emerging market currencies performed very well with EMFX indices seen around 0.5% higher with notable reversals in MXN and ZAR both around 1.25% better off.

- EURUSD (0.17%) ends just marginally higher on the session with a large amount of option expiries around 1.1850 capping the price action. USDJPY has fallen back below the important breakout point at 111.12 after posting highs at 111.66 during European hours.

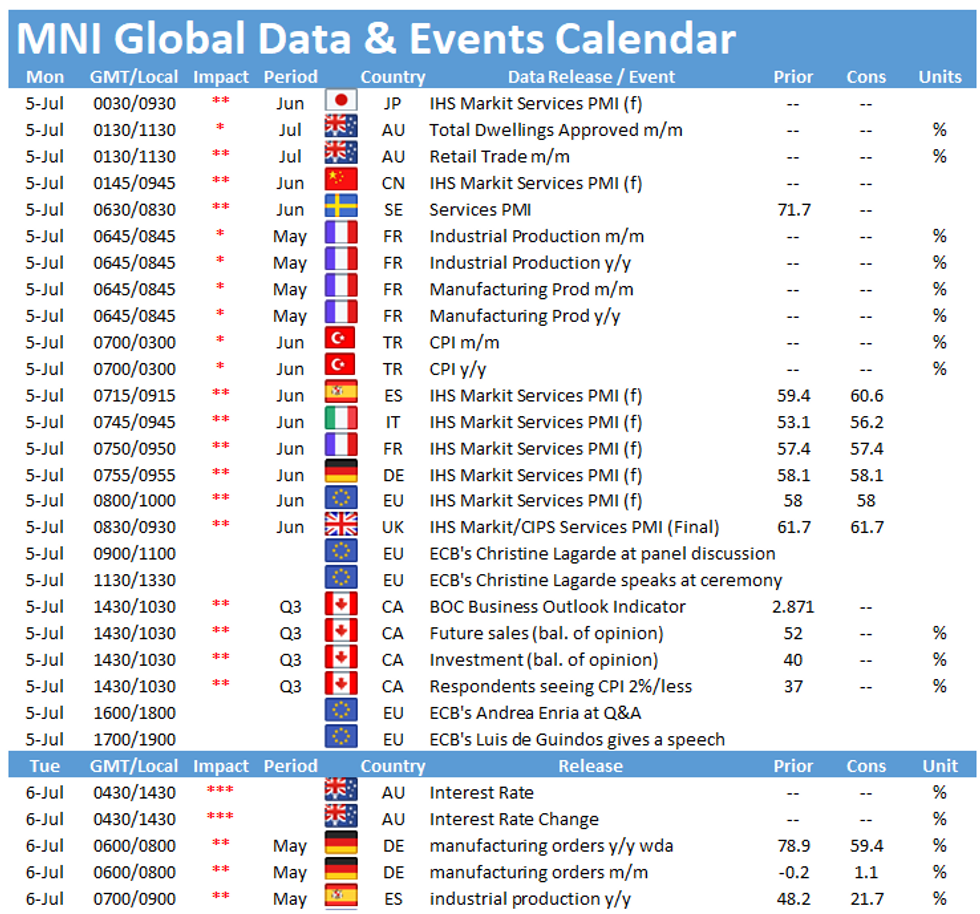

- Next week, markets will focus on the release of the FOMC minutes. Elsewhere Tuesday's RBA meeting will be of importance as well as Canadian Employment data to round of the week.

FX OPTIONS: Expiries for Jul05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-50(E1.9bln), $1.1900(E780mln)

- USD/JPY: Y110.25-28($600mln), Y111.00($829mln)

- AUD/USD: $0.7500-05(A$605mln)

- NZD/USD: $0.7025-45(N$506mln)

EQUITIES: Equities Strike New ATH for Sixth Consecutive Session

- US equity indices traded uniformly positively Friday, with the e-mini S&P cracking near-term resistance to touch new record highs following the better-than-expected payrolls headline. The index has now hit alltime highs for a sixth consecutive session.

- The US tech sector bounced back following Thursday's underperformance, with the sector as a whole rising over 1%. Communication services and consumer discretionary firms were also solid risers. Energy was a laggard, with the sector unwinding some of the week's solid gains into the Friday close.

- IBM were the worst performer in the S&P 500, slipping well over 4% on the surprise news that IBM President Whitehurst is to step down from his position.

- European stocks were more mixed, with German stocks helping drag the EuroStoxx50 into minor positive territory, while losses were sustained in Frence, Spanish and Italian markets.

COMMODITIES: WTI, Brent Edge Off Cycle Highs While OPEC+ Decision in the Balance

- Having traded solidly throughout the week, both WTI and Brent crude oil benchmarks edged off the cycle highs printed this week, with markets looking through near-term OPEC+ discord despite the decision hanging in the balance.

- Reports Thursday suggested Saudi Arabia and Russia had found common ground to ease output curbs further by an immediate 400,000bpd, with as much as 2mln bpd hitting the market at a later date. This agreement was called into question, however, with UAE refusing to proceed with the plan until their production baseline was altered.

- Gold saw support as the USD faltered following the mixed payrolls report, with the headline change in payrolls countered by a rising unemployment rate and slippage in participation. Gold traded a high of $1795.2, running into resistance ahead of the key $1,8000/oz mark.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.