-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Early US$ Bid Spurs Strong Risk-On

US TSY SUMMARY: Risk Appetite Returns After Early US$ Bid

Early risk aversion that carried over from Monday evaporated by midmorning on the back of strong US$ buying that helped trigger strong rebound in equities and sell-off in Gold. Risk-on reprieve w/stocks higher: ESU1 +76.0 late.- Long end support completely evaporated by midmorning, Bonds leading sale to new session lows on wide ranges and heavy volumes (TYU already 2M), yld curves bear steepen after Mon's sharp bull flattening. Current 10YY at 1.2169% after falling to 1.1260% earlier (early Feb level), 30YY currently 1.8745% vs. 1.7781% low.

- Trading desks report prop and fast$ accts sold 5-10s early, steepeners in 2s and 5s vs.10 and 30s, real$ selling 30s, deal-tied selling in shorts to intermediates. Some long end buying from dealers in 30s more recently.

- Early bid: desks cited familiar risk-off drivers (virus variant spd, geo-political, peak growth/inflation in rear-view). Bonds gained after Housing Starts come out stronger than expected (1.643M vs 1.590M) while Building Permits come out weaker than expected (1.598M vs. 1.696M) - down 5.1%/month.

- Eurodollar futures: Huge selling in lead quarterly EDU1 futures: over 130,000 EDU1 sold down to 99.855-.85, small print at 99.845 (-0.020) in early trade.

- The 2-Yr yield is down 2.4bps at 0.1915%, 5-Yr is down 3.1bps at 0.6738%, 10-Yr is up 1.8bps at 1.2069%, and 30-Yr is up 4.8bps at 1.8675%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00050 at 0.08550% (-0.00025/wk)

- 1 Month +0.00375 to 0.08900% (+0.00537/wk)

- 3 Month +0.00400 to 0.13825% (+0.00400/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00100 to 0.15275% (+0.00062/wk)

- 1 Year +0.00012 to 0.24175% (-0.00038/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $67B

- Daily Overnight Bank Funding Rate: 0.08% volume: $255B

- Secured Overnight Financing Rate (SOFR): 0.05%, $888B

- Broad General Collateral Rate (BGCR): 0.05%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $337B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $2.114B submission

- Next scheduled purchases

- Wed 7/21 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 7/22 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operations

NY Fed reverse repo usage dips to $848.102B from 75 counterparties vs. $860.468B on Monday. Remains well off June 30 record high of $991.939B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- Block, +10,000 Green Sep 90/91 put spds, 3.5

- -14,000 Blue Dec 92/95 call strip, 7.0

- -3,000 Blue Dec 98.75/98.87 strangles, 39.25

- Block 10,000 Blue Aug 98.62/98.75 put strips, 9.0

- Additional 25,000 Blue Aug 98.62 puts 3.0 (adds to appr +60,000 Mon at 4.0)

- 6,500 Green Dec 99.25/99.37 call spds

- -5,000 Red Jun'23 99.25/99.50 put spds, 7.25

- Block -22,000 short Sep 99.50/99.62/99.75 put flys, 2.5

- Block 10,000 Blue Aug 98.62/98.75 call spds, 10.5

- +22,000 Green Aug 99.12 puts, 5.0 -- mostly on screen

- +6,000 Green Dec 98.62/99.00 2x1 put spds, 4.0

- Block post at 0837:00ET:

- 10,000 Green Sep 99.00/99.12 put spds 3.0 vs. Blue Sep 98.62/98.75 put spds 3.5

- Block: 10,000 Green Sep 99.00/99.12 put spds 3.0 vs. Blue Sep 98.62/98.75 put spds 3.5

- +20,000 Green Aug 99.12 puts, 5.0

- 10,000 short Dec 99.37/99.68 call over risk reversals, 0.0

- 10,000 Green Mar 100 calls

- Overnight trade

- Block: 11,400 Blue Aug 98.87/99.00/99.12 call trees, 2.5 at 0812:32ET

- 5,000 short Sep 99.37 puts

- 3,000 Green Sep 99.37/99.62 1x2 call spds

- 3,600 Green Dec 99.25/99.37 call spds

- 3,500 Blue Sep 98.37/98.50 put spds

- 2,000 Gold Sep 98.25/99.00 strangles

- Block: 20,000 Blue Sep 98.62/98.75 put spds, 3.5 at 0700-0735ET

- Block: 18,000 Green Sep 99.00/99.12 put spds, 3.5 at 0656-0738ET

- Block: 1,875 Blue Sep 98.87/99.00 4x5 call spds vs. 7,500 Blue Sep 98.50 puts, 2.0 net at 0652ET

- Block: total 20,000 Blue Aug 98.62/98.75 put strips, 9.0 from 0651-0652ET

- Block: 10,000 long Green Mar'24 99.25 calls, 29.5 at 0649:27ET

- Block: Total +42,065 Blue Sep 98.25 puts, 1.5 from 0639:14-:26, still offered, open interest 272,471 coming into the session after trading near 60k Monday as part of large sale/re-position: -25,000 Blue Sep 97.75/98.12 put spds w/Blue Sep 97.62/98.25 3x2 put spds, 3.0-2.75 total

- +9,300 FVQ 124.5/124.75 call spds vs. FVQ 123.75/124.25 put spds 0.0 net

- 10,000 FVU 123/123.5 call spds

- -10,000 TYU 132/133.5/134.5/135.5 put condors, 17

- +5,312 TYU 132/134 3x2 put spds, 37

- +5,000 TYU 132/134 3x2 put spds, 37 vs. 135-04/0.32%

- +7,500 TYU 134/136.5 call spds, 1-7/64

- +5,600 FVU 125 calls 1 over FVU 123.25/124.25 put spds

- -2,500 wk5 TY 133.5 puts, 6 earlier

- Overnight trade

- 4,000 FVU 124.5 calls, 23

- 5,000 TYU 137 calls, 8

- 2,500 TYU 136.5 calls, 13

EGBs-GILTS CASH CLOSE: Afternoon Reversal

German cash yields ended Tuesday's session lower, but well off the session's lowest levels, while UK yields fully reversed higher after a late afternoon correction.

- Among the notable moves: Schatz closed 2+bps lower, back to Feb levels - one of the biggest single-day moves of the past year. 10Y Gilts traded in a 6.8bp range (briefly setting a fresh post-Feb low 0.497% before closing at 0.564%).

- Tough to pin the moves on fundamentals - some giveback was inevitable given the magnitude of the yield drop, particularly as U.S. stocks rallied hard in the afternoon, forcing a reconsideration of the risk-off/economic slowdown narrative (however brief).

- Periphery spreads finished well off wides, with BTP 10s even tightening.

- Attention turns to the ECB meeting Thursday (our preview went out today).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at -0.714%, 5-Yr is down 3.2bps at -0.688%, 10-Yr is down 2.4bps at -0.41%, and 30-Yr is down 3bps at 0.058%.

- UK: The 2-Yr yield is up 1.2bps at 0.093%, 5-Yr is up 0.6bps at 0.282%, 10-Yr is up 0.4bps at 0.564%, and 30-Yr is down 2.1bps at 1.01%.

- Italian BTP spread down 0.3bps at 109.6bps / Spanish up 0.8bps at 67.1bps

OPTIONS/EUROPE SUMMARY: Big Bund Put Buying

Tuesday's options flow included:

- RXU1 166.5p, bought for 1 in 13.5k

- RXU1 175.5/173ps, bought for 51 and 52 in 22.5k

- RXU1 176/176.5/177c fly vs 177.5/180cs sold the fly at 30 in 1.3k

- OEU1 134.25/134/133.75p ladder, bought for 1 in 3k

- DUU1 112.20/112.10/112.00p fly, bought for 2 in 1.25k

- ERZ1 100.50/10.62cs 1x2, bought for 3.75 in 5k

- 3RU1/3RZ1 100.25/37cs spread, bought the Sep for 0.25 in 3k

- 0LU1 99.62c vs 2LU1 99.50c, bought the 1yr for -0.5 (receive) in 5k

- 0LV1 99.62/50/25 broken put fly bought for 1.5 in 2k

- 2LU1 99.375/99.25/99.125 put fly bought for 1.75 in 10k

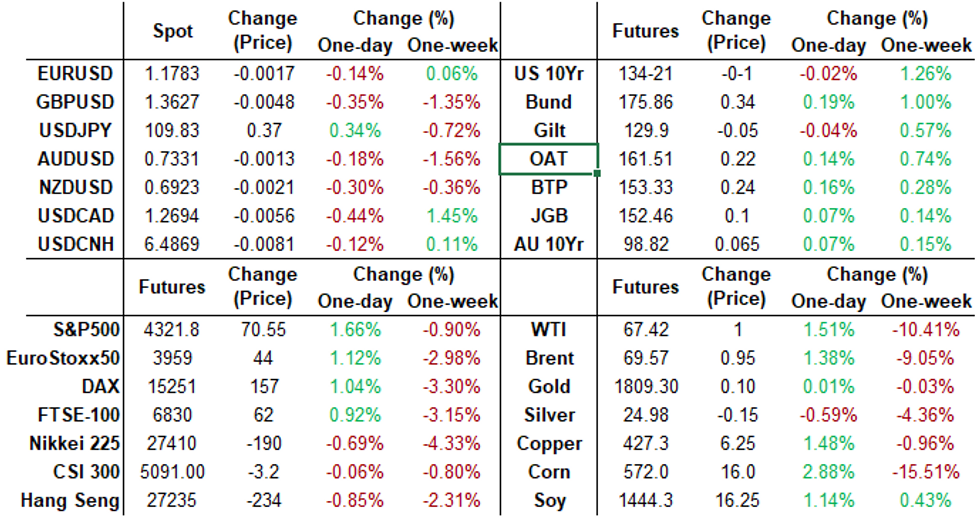

FOREX: Risk Bounce Stifles JPY Momentum, CAD Recovers

- An extension of Monday's late bounce in global equity indices aided USDJPY back up to just shy of the 110 mark on Tuesday.

- Overall, the dollar index edged out a small win of 0.1% in a mixed day for G10 FX.

- CAD (+0.4%) was the clear outperformer after yesterday's onslaught. USDCAD retraced back to 1.27 having printed a high above 1.28 during Monday's session. CADJPY had a strong squeeze higher after matching/bouncing from the April lows of 85.43. A late recovery in oil prices kept the Canadian dollar on the front foot.

- Most other G10 currencies lost ground to the greenback, with GBP and NZD retreating around 0.35%. The GBPUSD outlook remains bearish with moving average studies pointing south. What appears a clear breach of 1.3669 should reinforce bearish conditions and pave the way for an extension of the bear cycle. 1.3579, a Fibonacci retracement was briefly probed, support below here is 1.3567, the February lows.

- The greenback strengthened just ahead of the WMR fix, but the moves appeared to be more closely following the uptick in both equity markets and Treasury yields seen just beforehand.

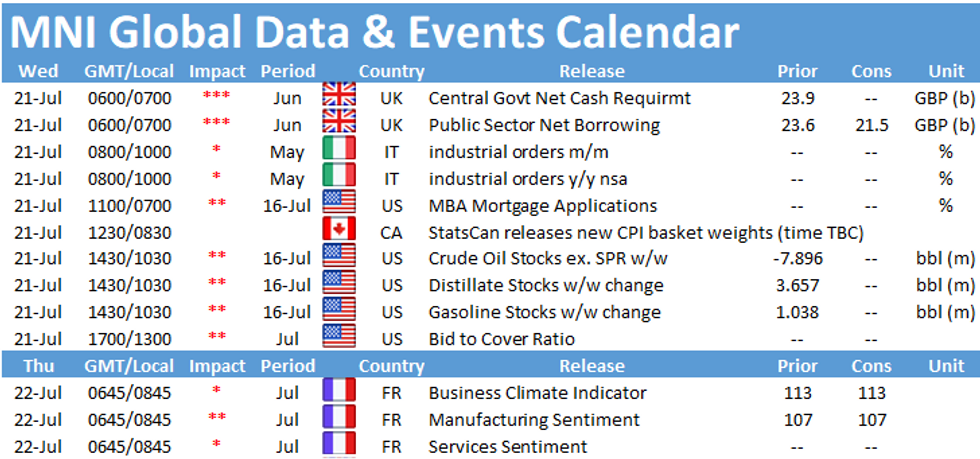

- Australian retail sales and BOJ minutes headline the overnight docket before US crude oil inventories in the latter stages of Wednesday. As a reminder the July ECB statement/press conference is on Thursday.

FOREX/Expiries for Jul21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E1.3bln), $1.1835-50(E1.1bln), $1.1900(E1.1bln)

- USD/JPY: Y110.00-15($947mln), Y110.50($820mln)

- AUD/USD: $0.7400(A$857mln)

PIPELINE: $6B VMware 5Pt Jumbo Launched; BoNY Mellon Guidance Updated

- Date $MM Issuer (Priced *, Launch #)

- 07/20 $6B #VMware $1B 2Y +45, $1.25B 3NC1 +65, $1.5B 5Y +75, $750M 7Y +90, $1.5B 10Y +100

- 07/20 $1.25B #Wells Fargo 5Y 4.25%

- 07/20 $650M #Blackstone Secured Lending Fund +5Y +168

- 07/20 $500M #MidAmerican Energy WNG 31Y green bond +85

- 07/20 $Benchmark Bank of NY Mellon +5Y +40a, 10Y +60a

- 07/20 $Benchmark CPPIB Capital 5Y FRN/SOFR +25a

EQUITIES: Stocks Bounce, But Recovery Needs Legs

- Global equity markets extended the late Monday bounce, with the e-mini S&P adding close to 100 points from the week's lows to briefly show above the Monday high. The bounce was built on outperformance in financials and industrials names, with a re-steepening of the US Treasury yield curve helping nurse banks off their weakness on Monday.

- Strong earnings from the likes of HCA Healthcare and Dover Corp underpinned the recovery, with only around 25 of the 500 names in the S&P 500 lower on the day.

- The bounce in stocks worked against the VIX's rise this week, bringing the index back under 20 points after trading north of 25 yesterday.

- This price action was mimicked across continental Europe, which saw mainland indices rally with outperformance in French, Spanish and Swiss names.

COMMODITIES: WTI, Brent Stage Tepid Bounce

- Both major crude benchmarks headed into the close higher, but gains were shy of 1% and dwarfed by the sharp downtick on Monday. New macro drivers were few and far between, but the stabilisation in equities will have helped underpin.

- Gains were most notable across the front-end of the WTI futures curve, steepening the curve out to Dec-23.

- Focus Wednesday turns to the weekly DoE crude oil inventories, in which markets see a draw of close to 4mln barrels in crude stocks for the week ending July 16th.

- Gold oscillated inside a range, with spot capped by the 200-dma at $1824.5, while markets never really gained sufficient momentum to test the lower-end of the recent range. This keeps the technical picture unchanged, with eyes on key near-term support of the Jul 12 low at $1791.7.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.