-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: What a Short Strange Trip It's Been

US TSY SUMMARY: Risk-On as Stocks Make New Highs

After risk-off rout that sent 30YY to 1.7781% five month lows earlier in week, rates reversed in the second half of week as equities climbed to new all-time highs (ESU1 over 4406.0 after the FI close) had 30YY back to 1.9484% Friday after climbing to 1.9649% high Wed.- Sep 30Y futures (USU1) traded down to 163-14 by midmorning -- see-sawed to middle of session range at 164-00 by the close albeit on light summer volumes. Generally quiet -- sights set on next week's FOMC on Wed, Q2 GDP, Tsy supply (2-, 5- and 7Y notes), and a slew of equity earnings.

- Meanwhile, the statutory debt limit suspension expires Saturday, July 31. Tsy Sec Yellen in a note to Congress said "If Congress has not acted to suspend or increase the debt limit by Monday, August 2, 2021, Treasury will need to start taking certain additional extraordinary measures in order to prevent the United States from defaulting on its obligations."

- The 2-Yr yield is up 0bps at 0.2001%, 5-Yr is down 0.4bps at 0.715%, 10-Yr is up 0.5bps at 1.283%, and 30-Yr is up 0.4bps at 1.9203%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; US Gov infl-linked 0.23Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.06 | 0.04 | 0.05 |

| Credit | 0.06 | 0.12 | 0.08 |

| Govt/Credit | 0.07 | 0.1 | 0.08 |

| MBS | 0.08 | 0.07 | 0.06 |

| Aggregate | 0.07 | 0.09 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.07 |

| Iterm Credit | 0.06 | 0.1 | 0.08 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.11 | 0.1 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00325 at 0.08013% (-0.00562/wk)

- 1 Month -0.00312 to 0.08613% (+0.00250/wk)

- 3 Month +0.00363 to 0.12888% (-0.00537/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00125 to 0.15850% (+0.00637/wk)

- 1 Year -0.00262 to 0.24138% (-0.00075/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $71B

- Daily Overnight Bank Funding Rate: 0.08% volume: $255B

- Secured Overnight Financing Rate (SOFR): 0.05%, $849B

- Broad General Collateral Rate (BGCR): 0.05%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $339B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $18.151B submission

- Next scheduled purchases

- Mon 7/26 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Tue 7/27 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 7/28 No buy-operation scheduled due to FOMC

- Thu 7/29 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/30 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operations

NY Fed reverse repo usage dips to $877.251B from 76 counterparties vs. $898.197B on Thursday (compares to June 30 record high of $991.939B).

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 4,350 Dec 99.31/99.37/99.56/99.62 put condors

- +5,000 Green Mar 98.50/Blue Dec 97.75 put calendar spd, 6.5

- Block, +10,000 Green Aug 99.00/99.12 put strip, 7.0

- -7,500 Blue Dec 97.75 puts, 1.5 vs. 98.75/0.10%

- 6,100 short Dec 99.62/99.75/99.87 call flys

- +5,000 Green Sep 98.87/99.12 4x3 put spds, 16.5 vs. 99.19/0.70%

- +5,000 Blue Oct 98.25/98.50 put spds 2.5 over 99.12 calls

- Overnight trade

- 5,000 Dec 99.75 puts, 1.5

- 5,000 Green Mar 98.50 puts, 9.0

- 10,000 Green Mar 100 calls, 0.5 (adds to +28k last 2 days)

- 5,750 Blue Sep 98.00/98.25 put spds

- 3,000 Blue Sep 98.75/99.25 call spds

- 1,900 Blue Aug 98.87 calls

- 4,000 TYU 135/135.5 call spds vs. 131/132/133 put flys

- 7,300 wk5 US 168 calls, 5

- 7,000 USU 164 calls, 151

- 10,000 USU 154/155 put spds, 1

- 10,000 wk5 FV 125.5 calls, 0.5

- -2,000 TYV 127.5/139.5 strangles, 4

- total 6,000 FVU 123 puts, 4

- Overnight trade

- 5,700 TYQ 134 calls, 8

EGBs-GILTS CASH CLOSE: Peripheries Impress As ECB Hawks Explain Dissents

The German and UK curves finished a busy week on a fairly flat note, though notably yields ended well below intraday highs. Periphery spreads narrowed, with risk appetite gaining (equities stronger).

- Friday's ECB talk was all about the hawkish dissenting voices: Weidmann and Wunsch explaining why they objected to the new policy guidance.

- Flash July PMI data were mixed, while still pointing to a sustained expansion in economic activity. Germany surprised higher, France was a touch weaker than expected and the UK posted a significant miss. Earlier, UK retail sales figures were broadly better than expected.

- The German PMI beat sent Bunds much lower initially, but the move soon reversed.

- After hours Friday sees ratings reviews: Moody's on Cyprus and DBRS on EFSF, ESM.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.6bps at -0.726%, 5-Yr is down 0.2bps at -0.704%, 10-Yr is up 0.6bps at -0.42%, and 30-Yr is up 0.8bps at 0.061%.

- UK: The 2-Yr yield is up 1bps at 0.079%, 5-Yr is up 1.3bps at 0.279%, 10-Yr is up 1.8bps at 0.584%, and 30-Yr is up 0.3bps at 1.005%.

- Italian BTP spread down 2.5bps at 103.8bps / Spanish down 2.1bps at 69.1bps

OPTIONS/EUROPE SUMMARY: Vol Trades En Vogue Post-ECB

Friday's options flow included:

- DUU1 112.20^, bought for 11.5 in 4k

- DUU1 112.30^ sold at 9 and 8.5 in 10k

- DUU1 112.20/10ps 1x2, bought for 0.75 in 4k

- ERM3 100.37/100.50cs 1x2, bought for half and 0.75 in 11k total

- 2RZ1 100.25/100ps 1x1.5, bought for 1.25 in 2k

- 3RZ1 100.25^ bought for 15.75 in 5.5k. Appears adding to position (bought yesterday just before ECB decision for 17.75)

- 2LZ1 call 99.625 (cov 99.335/17d) vs 3LZ1 99.625 call (cov 99.22/12d), sells the green at 0.5 in 17.5k

- 3LZ1 99.25/99.00/98.12 broken p fly, bought for 1.5 in 1k

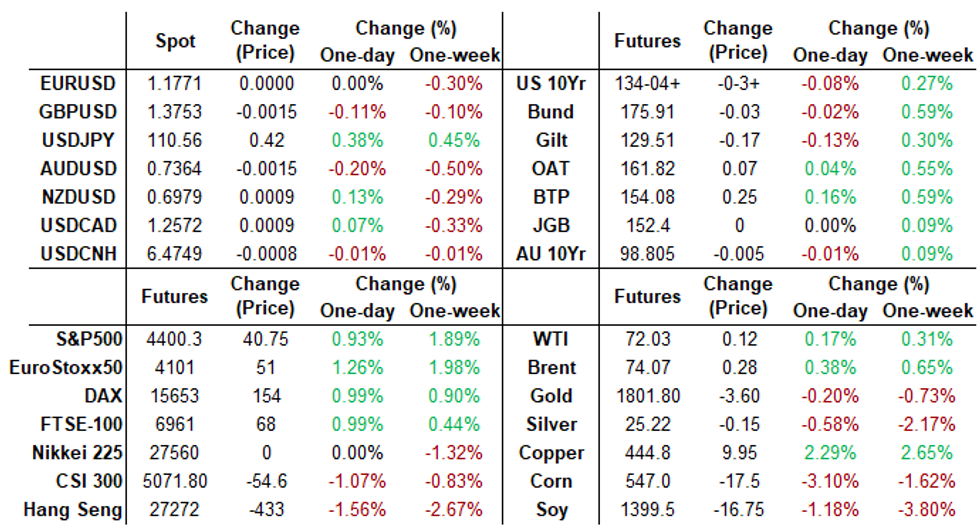

FOREX: JPY Weakness Continues As Equities Extend Recovery

- G10 FX held extremely narrow ranges on Friday as markets continued to recover from Monday's bout of risk-off sentiment that prompted a volatile burst for currency markets to start the week.

- The Japanese Yen posted the biggest retreat in the final session of the week, with USDJPY (+0.35) edging higher above 110.50. Spot trades just shy of the July 14 highs at 110.70 which is considered firm resistance following the recent bearish technical developments for the pair.

- The New Zealand Dollar was a relative outperformer, marginally firming +0.14%, whereas small losses were exhibited in GBP, AUD and CAD resulting in the dollar index a touch higher on the day.

- The biggest move came in the South African Rand (-1.03%) following an extension of yesterday's weakness after the central bank meeting. The statement included a reduction of 2021 growth and 2022 average CPI forecasts, weighing on ZAR.

- The Dollar index rise marks the seventh weekly gain over the past 9 weeks, likely to post the second highest close for 2021. The year's highs reside at 93.44 and become the next logical reference point for the index.

- EURUSD closes less than 20 pips above the week's lows of 1.1752. Despite underwhelming markets, the first ECB meeting since the strategy review marked a slight dovish shift. Markets will place focus on the 1.1704 April lows which may potentially trigger a deeper pullback for the pair.

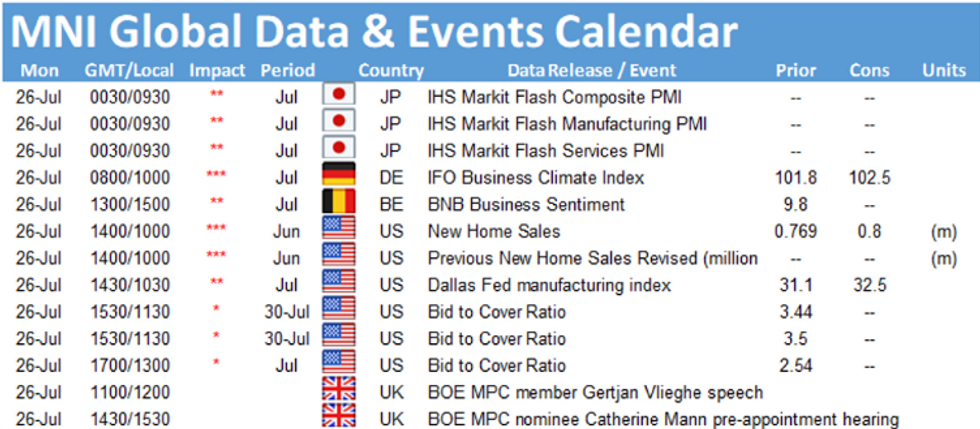

- A fairly quiet start to kick off next week with Monday featuring German IFO data and a speech from Bank of England's Vlieghe on demographics, debt, and distribution of income.

FOREX/Expiries for Jul26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-55(E667mln), $1.1830(E622mln), $1.1860(E584mln)

- USD/JPY: Y111.50($510mln)

- GBP/USD: $1.3895-00(Gbp561mln)

- AUD/USD: $0.7330-35(A$555mln)

- USD/CAD: C$1.2570-75($542mln), C$1.2690-00($595mln)

PIPELINE: $3.75B Chile 3Pt Lead Thu's Issuance

- Date $MM Issuer (Priced *, Launch #)

- 07/23 No new issuance Friday after $30.65B priced Mon-Thu

- $9.45B Priced Thursday

- 07/22 $3.75B *Rep of Chile $2.25B 12Y +130, $1B 20Y +130, $500M 40Y +140

- 07/22 $2.3B *DirecTV 6NC2 5.875%

- 07/22 $2B *JP Morgan PerpNC5 4.2%

- 07/22 $900M *World Bank 2031 tap FRN/SOFR +34

- 07/22 $500M *Ukraine 6.876% 2029 Tap 6.3%

EQUITIES: Equites Build on Recent Rally, Strike Alltime Highs

- Despite Monday's pullback, the equity rally from the week's low has been impressive. The e-mini S&P has added over 175 points from the Monday low, pushing the index to new alltime highs to touch 4,400.

- A solid showing from communication services and consumer staples were behind the drive higher, with solid outperformance in social media names (Facebook, Twitter, Alphabet) on the back of solid Snap and Twitter earnings.

- European indices gained in sympathy, with notable outperformance in French and Italian markets.

- Earnings season will be key for the sustainability of the rally, with close to 50% of the S&P 500 by market cap due to report in the coming week. Highlights include tech titans Apple, Amazon, Microsoft, Alphabet, Tesla, Facebook and more.

COMMODITIES: Oil Holds Close to Highs, Recovery Secured

- WTI and Brent crude futures closed broadly flat on the day, holding the week's solid gains and the 10% rally from the Monday low. Stocks continue to trade well, with US futures markets hitting new alltime highs and providing a healthy tailwind for oil benchmarks.

- Oil supermajors earnings in the coming week will be closely eyed, with reports from ExxonMobil, ConocoPhillips among others due.

- Gold and silver both trade in minor negative territory, with silver underperformance prompting a modest correction higher in the gold/silver ratio. The measure hit multi-month highs of 72.9 earlier this week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.