-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rate Liftoff? FOMC: Not There Yet

US TSY SUMMARY: Substantial Further Progress Not Yet Reached

Tsy futures are back to steady/mildly mixed in the hour after the closing bell, markets still digesting the latest FOMC policy announcement.- Rates extended session lows after the Fed kept rates and QE steady. Dip buyers quickly filled the gap with futures trading just as quickly back to pre-release levels. The statement a little hawkish as "economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings." Similarly, indicators of economic activity and employment have "continued to strengthen", rather than prior statement's simply "strengthened".

- "This is a very strong labor market," Powell stated. "If you look at the number of job openings compared to the number of unemployed, we're clearly on a path to a very strong labor market with high participation, low unemployment, high employment, wages moving up across the spectrum."

- Nevertheless, Tsys continued to see-saw higher with one desks saying there was "nothing for hawks to flap over" in the latest annc. "We have not reached substantial further progress yet," Chairman Powell stated in his Q&A session, "we see ourselves as having some ground to cover to get there".

- Tsy and Eurodollar option flow proved mixed on net, some large upside call positions unwound in both after the policy annc. The 2-Yr yield is up 0.2bps at 0.2055%, 5-Yr is up 1.9bps at 0.7175%, 10-Yr is up 0.2bps at 1.2427%, and 30-Yr is up 0.9bps at 1.9027%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; US Gov infl-linked 0.23Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.06 | 0.04 | 0.05 |

| Credit | 0.06 | 0.12 | 0.08 |

| Govt/Credit | 0.07 | 0.1 | 0.08 |

| MBS | 0.08 | 0.07 | 0.06 |

| Aggregate | 0.07 | 0.09 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.07 |

| Iterm Credit | 0.06 | 0.1 | 0.08 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.11 | 0.1 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00125 at 0.07963% (-0.00050/wk)

- 1 Month +0.00188 to 0.09200% (+0.00588/wk)

- 3 Month -0.00113 to 0.12850% (-0.00038/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00450 to 0.15400% (-0.00450/wk)

- 1 Year -0.00187 to 0.23713% (-0.00425/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $69B

- Daily Overnight Bank Funding Rate: 0.08% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $874B

- Broad General Collateral Rate (BGCR): 0.05%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- No buy-operation scheduled Wednesday due to FOMC

- Next scheduled purchases

- Thu 7/29 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/30 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operations -- Nearing Record High

NY Fed reverse repo usage climbs to $965.189B from 74 counterparties vs. $927.419B on Tuesday (compares to June 30 record high of $991.939B).

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 Green Dec 99.25/99.50 call spds, 5.5

- +4,000 EDH4 97.50/97.75 put strips, 30.5 vs. 99.005/0.28%

- Block, -12,250 Dec 99.75/99.87 2x1 put spds, 4.0 net vs. 99.815/0.30% at 1157:16ET

- Block: 10,000 Red Dec'12 99.50/99.62 put spd block on 3x4 ratio, wrong way, for 27.0-27.5 vs. 8,000 EDZ2, 99.585

- 2,000 Dec 99.68/99.75/99.81 put flys

- -3,500 short Mar 99.37/99.62 strangles, 17.0-16.75

- -2,500 Green Sep 98.62 puts, 17.5 vs. 99.195/0.32%

- -20,000 short Dec 99.687/99.75 call spds, 1.75 on legs

- +5,000 Blue Dec 98.25/98.37/98.75/98.87 put condors, 3.75 on legs

- Overnight trade

- 3,500 Green Dec 98.75/99.00 put spds

- -25,000 TYU 135.75 calls, 11

- +10,000 FVU 123.5 puts, 8

- -3,500 TYU 132.25/136.25 strangles, 17

- Overnight trade

- 1,600 TYU 131.5/132/132.25 broken put flys

- 12,000 TYU 135.5 calls, 19-22, 19 last

- 7,000 TYU 133 puts, 18

- 5,500 TYU 133.25 puts, 21

- 7,200 TYU 134 puts, 35-38

- 7,200 TYV 132 puts, 25

- 5,200 FVU 123.5 puts, 8.0-8.5

EGBs-GILTS CASH CLOSE: Gilts Underperform With Fed, EZ Inflation Awaited

Wednesday saw Gilts weaken slightly, underperfoming Bunds / EGBs which broadly firmed. Periphery spreads widened very slightly.

- Few headline / data drivers out today: the session's focus was mainly on a steadying in China/HK equities overnight following the recent rout - and of course Wednesday's pending Federal Reserve decision.

- Confidence data for France and Italy was broadly in line with expectations. Supply this morning came from Germany (Bund, EUR1.79bn).

- After the Fed this evening, attention will turn quickly to Thursday's prelim July inflation readings out of Germany and the Eurozone.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at -0.756%, 5-Yr is down 1.5bps at -0.737%, 10-Yr is down 0.9bps at -0.45%, and 30-Yr is unchanged at 0.037%.

- UK: The 2-Yr yield is up 1bps at 0.086%, 5-Yr is up 1bps at 0.281%, 10-Yr is up 1.7bps at 0.575%, and 30-Yr is up 2.3bps at 0.995%.

- Italian BTP spread up 0.2bps at 106.6bps / Spanish up 1bps at 72.3bps

OPTIONS/EUROPE SUMMARY: Largely Downside In German Bonds

Wednesday's options flow included:

- RXU1 174.5/172.5ps 1x2, bought for 16 in 1k

- RXU1 177/175cs 1x2, sold at 53.5 and 53 in 3k

- DUU1 112.30/112.20ps 1x2 bought for 2.25 in 4k

- DUU1 112.10/112.20/112.40 broken call fly, bought for -2.5 (receive) in 5k

- OEU1 135.25/135/134.75p ladder, bought for 3 in 3.5k

- OEU1 134.75p, bought for 7 in 1.25k

- ERV1 100.37p, bought for half in 10k

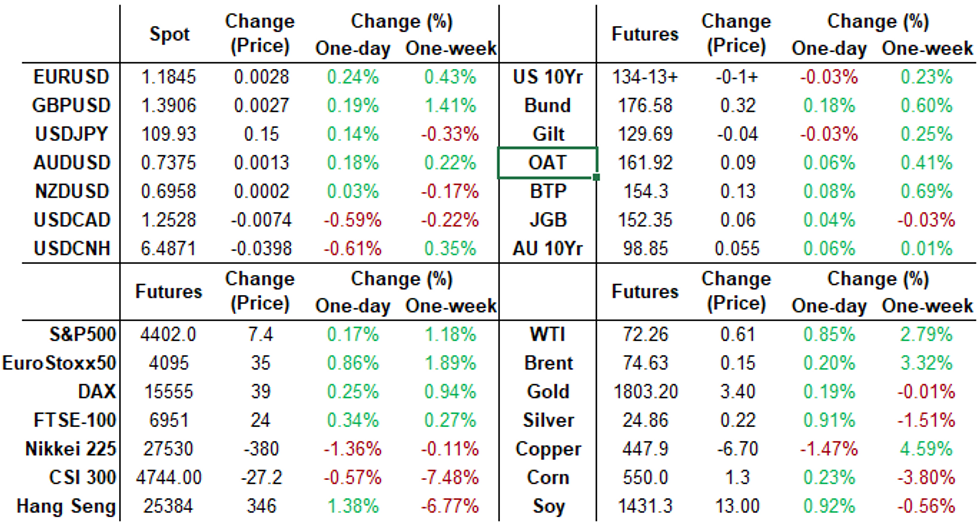

FOREX: Minor Greenback Weakness Prevails Post FOMC

- The greenback was trading marginally higher heading into the FOMC announcement. The initial reaction to the statement was a spike higher in the dollar of around 25 pips as the Fed recognised the economy has made progress on taper goals.

- Initial hawkish tweaks/optimism were sold into immediately with the dollar index trading back to unchanged and then into negative territory in anticipation of Chair Powell's press conference.

- Comments relating to the labour market having 'a way to go' in the recovery kept the dollar on the backfoot for the remainder of the press conference.

- EURUSD traded through both daily extremes, initially breaching session lows through 1.1780 before retracing to the best levels since last week's ECB press conference above 1.1840. As the press conference ended, EURUSD was on the highs of the day at 1.1843 (+0.22%).

- Overall, ranges were somewhat subdued, with the most notable moves seen in CAD and CNH, both recovering around 0.6% after yesterday's sell-off. USDCNH back below yesterday's touted resistance at 6.50 may be technically significant.

- NOK also posted a strong recovery from yesterday and was a stand out performer on Wednesday, with USDNOK down 0.83%.

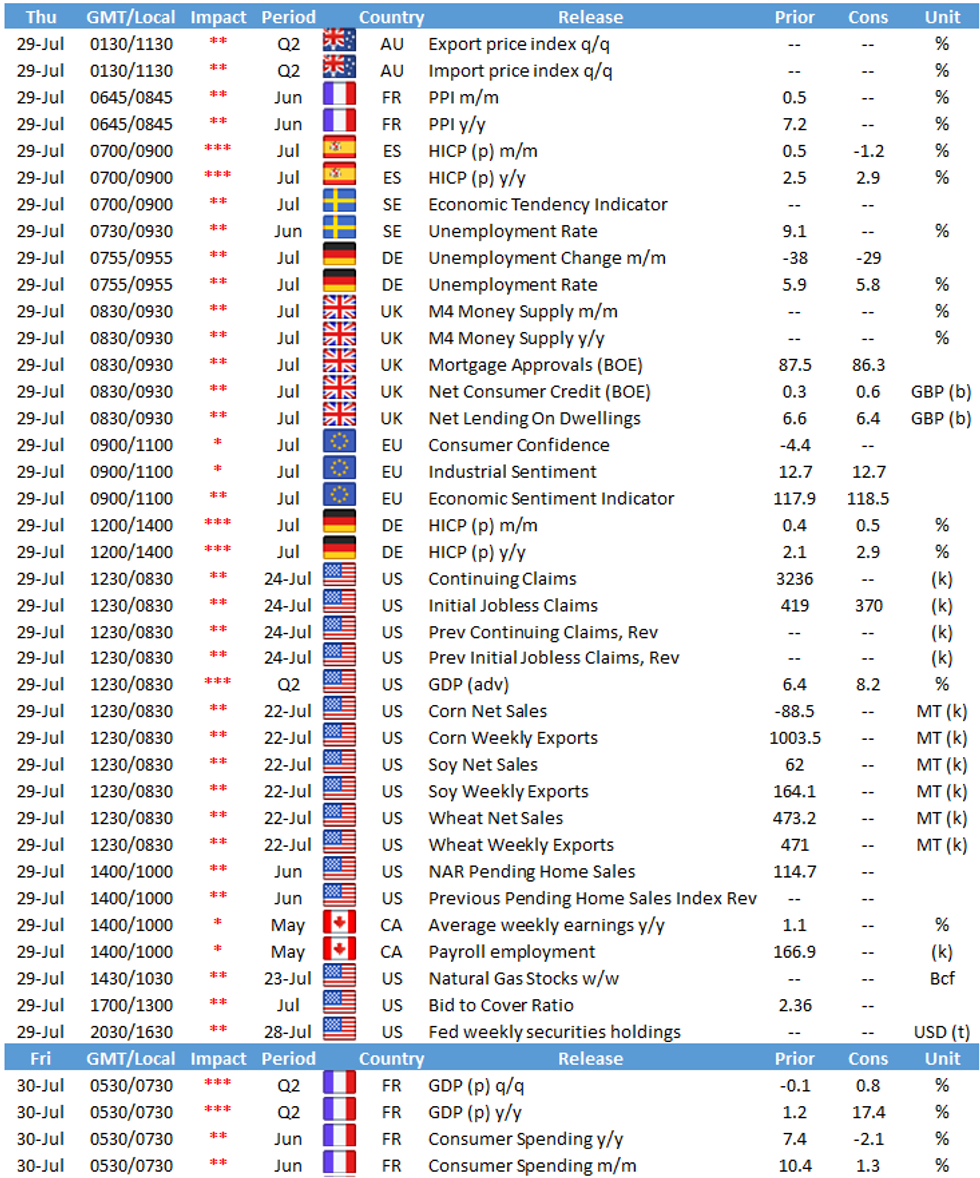

- Thursday's docket will feature German CPI and Unemployment before the ECB will publish the Monetary Policy Meeting Accounts. Tomorrow's headline data will undoubtedly be the first release of second quarter U.S. GDP, expected to rise to 8.5% Q/q.

FOREX: Expiries for Jul29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E1.3bln), $1.1850-70(E3.0bln), $1.1895-00(E750mln)

- USD/JPY: Y110.00-10($593mln), Y110.90($705mln)

- GBP/USD: $1.3750-55(Gbp539mln)

- AUD/USD: $0.7385-00(A$835mln), $0.7500(A$556mln)

- USD/CAD: C$1.2315-30($1.0bln), C$1.2445-55($540mln)

- USD/CNY: Cny6.4000($1.2bln), Cny6.4500($500mln), Cny6.4615($1.3bln), Cny6.5000($945mln)

PIPELINE: Jefferies 7Y Priced

- Date $MM Issuer (Priced *, Launch #)

- 07/28 $1B *Jefferies 7NC3 5%a

- 07/28 $600M *Triton Int 2Y +65

- $5.45B Priced Tuesday, $12.8B/wk

- 07/27 $1.6B *American Express perp NC5 3.55%

- 07/27 $1.2B *Air Canada 5NC 3.875%

- 07/27 $1B *Bank of Nova Scotia 3Y +32

- 07/27 $1B *Capital One Fncl Corp 11NC10 +112

- 07/27 $650M *First American Fncl 10Y +120, upsized from $500M

EQUITIES: Stocks Welcome Powell's Commitment to Clarity

- Markets initially reacted negatively to the Fed rate decision, with stocks sinking in response to the Fed's acknowledgement of progress toward their policy goals. The e-mini S&P sank to session lows of 4377.50 before markets reversed course and rallied on Powell's commitment to providing advance notice and clarity before any QE taper.

- Energy and communication services names led the late rally, with earnings reports also a solid contributor. The likes of Alphabet and Facebook outperformed on earnings, while Twitter rallied on news of the addition of a shopfront for user profiles.

- US-listed Chinese firms rallied for the first session in five, with the NASDAQ Golden Dragon Index higher by 10% into the close as Chinese authorities looked to soothe markets by convening local investment bank heads to allay fears on the recent market volatility.

COMMODITIES: Gold, Silver Benefit From Fed Market Swings

- The market's initial response to the Fed rate decision was hawkish, with traders eyeing the statement's acknowledgement that the economy is making progress toward policy goals. This boosted the greenback, placing precious metals and gold in particular under pressure.

- Sentiment soon reversed, however, as the Fed chair struck a dovish tone in the subsequent press conference, reinforcing the message that communication will change and markets will receive advance notice ahead of any taper.

- This prompted a near $15 turnaround in gold, which rose back toward the overnight highs ahead of the Wednesday close.

- Oil benchmarks saw similar price action, with WTI and Brent crude both closing in positive territory. Oil received further support from the weekly DoE inventories report, with the headline crude stockpile seeing a draw of 4mln barrels over the week, close to double market expectations.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.