-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Yields Slip on Early Geopol Angst

US TSY SUMMARY: Yields Slip on Early Geopolitical Angst

Tsy yields kicked off August weaker, 10-day lows by midday Monday before retracing appr a third of the move in quiet second half trade.- Tsys opened bid, trading steadily higher into noon amid unwinds of late Fri sales. Desks also cited a pick-up in geopolitical risk on Iranian Press TV headlines that the country will "give a strong and crushing response to any measures against its interests and national security" (not unusual rhetoric from Iran and oil prices traded broadly weaker).

- Meanwhile: RUSSIA SAYS THE UNITED STATES HAS ASKED 24 OF ITS DIPLOMATS WHOSE U.S. VISAS ARE EXPIRING TO LEAVE THE COUNTRY BY SEPT. 3 - TASS. Whatever the reason, stocks traded weaker underscoring the first half risk-off tone on lighter volume.

- No market react to late hawkish comments from Fed Gov Waller interview on CNBC: "HE COULD BE READY TO MAKE TAPER ANNOUNCEMENT BY SEPT" while the Fed "COULD TAPER AT A FASTER PACE THAN LAST TIME".

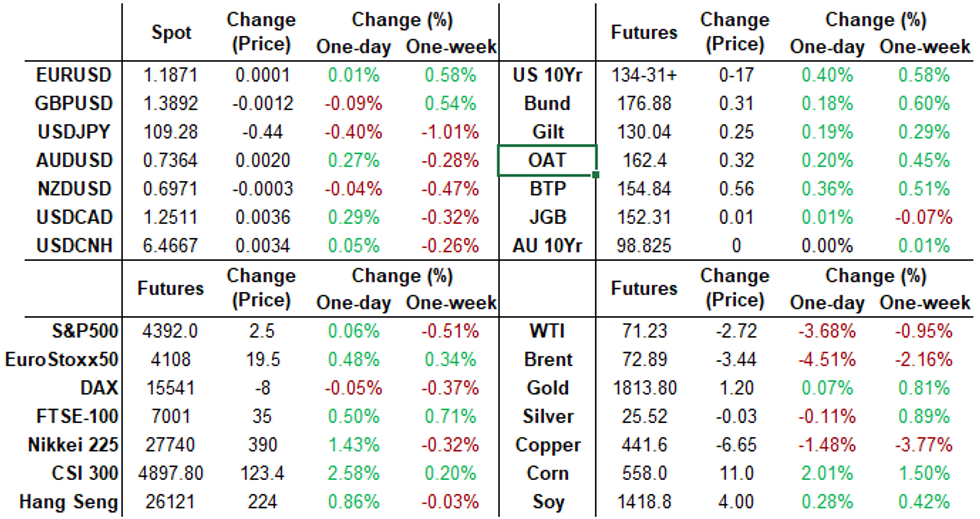

- The 2-Yr yield is down 1bps at 0.1741%, 5-Yr is down 4bps at 0.6505%, 10-Yr is down 5bps at 1.1723%, and 30-Yr is down 4.1bps at 1.851%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00262 at 0.07950% (-0.00325 total last wk)

- 1 Month -0.00087 to 0.08963% (+0.00438 total last wk)

- 3 Month +0.00600 to 0.12375% (-0.01113 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00350 to 0.15663% (-0.00538 total last wk)

- 1 Year -0.00275 to 0.23238% (-0.00625 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $61B

- Daily Overnight Bank Funding Rate: 0.06% volume: $215B

- Secured Overnight Financing Rate (SOFR): 0.05%, $903B

- Broad General Collateral Rate (BGCR): 0.05%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.922B submission

- Next scheduled purchases

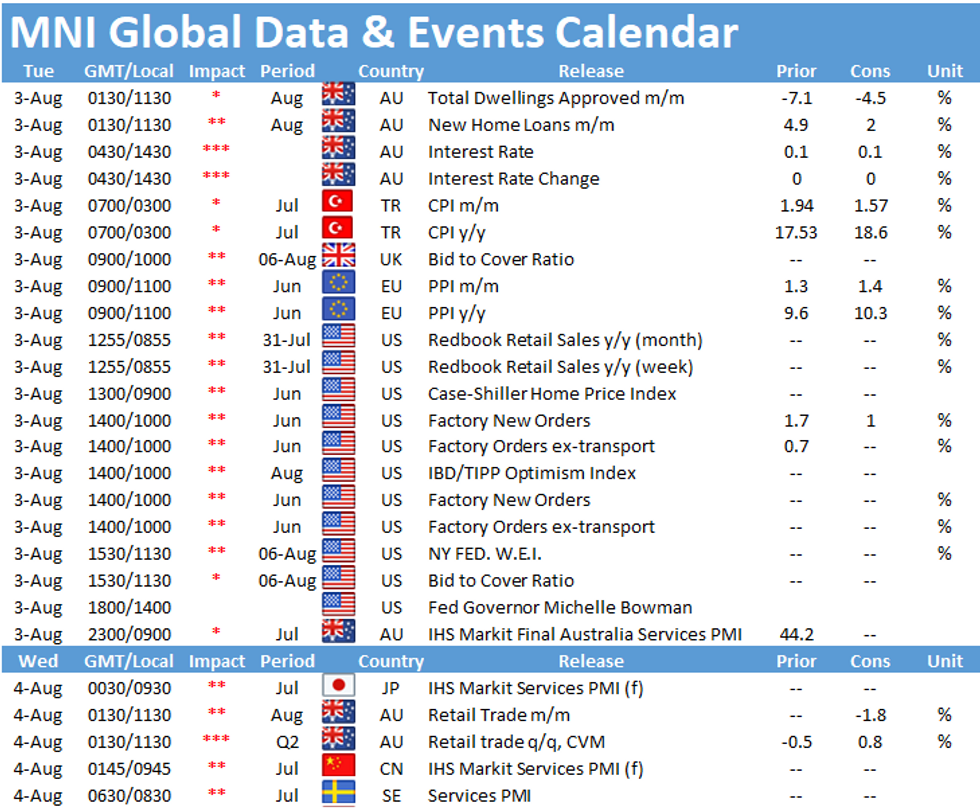

- Tue 8/03 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 8/04 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Thu 8/05 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 8/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

FED: Reverse Repo Operations -- Back Below $1T

NY Fed reverse repo usage recedes to $921.317B from 70 counterparties vs. last Friday's new record high of $1.039.394B (compares to prior record high of $991.939B on June 30).

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -7,000 Red Dec'22 99.25 puts, 6.5

- 20,000 short Sep 99.62/99.68 put spds,

- +16,000 Dec 99.81/99.87/99.93 call trees, 2.75 vs. 99.845/0.08%

- Overnight trade

- 4,900 Jun 100.06 calls, 0.5

- 3,000 Dec 100 calls, 0.25

- +2,000 USU/USV 169/171 call spd spd, 0.0, Oct over

- +10,000 TYU 131.5/132.5 put spds, 3

- +10,000 FVU 124/124.25 put spds, 4

- BLOCK, 8,654 TYX 132 puts, 29

- Overnight trade

- 13,500 TYU 133 puts, 10-13

- 7,800 TYU 132.5 puts

- 4,200 FVU 124 puts, 9-10

EGBs-GILTS CASH CLOSE: Strong Rally As Growth Fears Re-Emerge

European FI enjoyed a very strong start to the week/month, with bull flattening in the UK and German curves, and periphery spreads flattening.

- A fairly subdued morning with modest weakness gave way to increasing strength as the session went on, with Italy and Spain PMIs disappointing, and later, the US Manufacturing ISM pointing to inflation and activity slowing.

- As we entered the cash close, gains in FI were accelerating, as equities began to pare substantial gains made earlier in the session. No particular trigger seen, but potentially geopolitical (Iran rumblings) and general growth risks.

- Notably, German 30Y yields fell below 0% for the first time since February.

- A quiet slate Tuesday, Austria and the UK sell bonds.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at -0.775%, 5-Yr is down 1.3bps at -0.755%, 10-Yr is down 2.6bps at -0.487%, and 30-Yr is down 3.1bps at -0.011%.

- UK: The 2-Yr yield is down 2.6bps at 0.034%, 5-Yr is down 4.1bps at 0.225%, 10-Yr is down 4.4bps at 0.521%, and 30-Yr is down 3.6bps at 0.958%.

- Italian BTP spread down 2.4bps at 105.8bps / Spanish down 0.9bps at 72bps

OPTIONS/EUROPE SUMMARY: Big Bund Put Spread Trades

Monday's options flow included:

- RXU1 175/174ps, trades again for 15 and 16 (bought) in 13k

- RXV1 172.5/171.5/170.5p fly, bought for 9.5 in 1.5k

- DUU1 112.20/112 ps, bought for 0.5 in 2k

- ERH3 100.37/100.25ps vs 100.50/100.62cs 1x2, sold the ps at 0.75 in 4k

- 0LX1 99.62/99.50/99.25p ladder, bought for 4.75 in 4k

FOREX: Broad JPY Strength As Equities Give Up Gains

- The Japanese Yen firmed to start the week as US equity indices gave back earlier gains and risk sentiment soured, evident by the large move lower in crude futures.

- The European session had been characterised by a slightly softer greenback. USDJPY (-0.42%) extended this weakness, resting just 20 pips shy of the July lows of 109.07.

- The Canadian dollar traded heavily with the oil move, however G10FX lacked any momentum in a lacklustre Monday session. CADJPY had the most notable swing, retreating 0.7%.

- Despite the souring sentiment, potentially fuelled by an uptick in geopolitical risk stemming from headlines concerning Iran and Russia, there were significant moves higher for some emerging market currencies. USDTRY and USDZAR both receded over 1% while the Brazilian Real advanced 1.35%, retracing a good portion of Friday's move lower.

- Additionally, the Australian Dollar was resilient, rising 0.3% to $0.7365. This comes ahead of the RBA rate decision/statement due overnight where markets will likely see the RBA reneging on its previously outlined tapering move before it goes into play.

- The trend outlook is unchanged and bearish for AUDUSD. This follows the recent breach of a channel base drawn from the Feb 25 high, signalling potential for 0.7235 next, a 1.236 projection of the Feb 25 - Apr 1 - May 10 price swing. On the upside, initial resistance is at 0.7429, Jul 19 high.

- Spanish unemployment due tomorrow before US factory orders. Then Fed Gov Bowman due to deliver opening remarks at a webinar hosted by the Board of Governors of the Federal Reserve System.

FX/Expiries for Aug03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-55($1.4bln), $1.1880-00(E1.0bln), $1.2000(E868mln)

- USD/JPY: Y110.00($775mln)

- USD/CAD: C$1.2480($1.2bln)

- USD/CNY: Cny6.4780($1bln), Cny6.5000($1.3bln)

PIPELINE: $3.75B Credit Suisse Launched, 5Y FRN Dropped

- Date $MM Issuer (Priced *, Launch #)

- 08/02 $3.75B #Credit Suisse $1.4B 2Y +35, $600M 2Y FRN/SOFR+38, $1.75B 5Y +65

- 08/02 $2.5B #Honeywell Int $1B 5.5Y +45, $1.5B 10Y +60

- 08/02 $1.25B Charter Comm 12.5NC6.5 4.375%a

- 08/02 $2B Sirius XM Radio 5NC2, 10NC5

- 08/02 $620M #Rwanda 10Y 5.5%

- Later in week

- 08/03 $Benchmark Bank of China 2Y FRN

EQUITIES: Equities Take on Water Following London Close

- Possibly some geopolitical risk starting to be reflected in equities prices over the past ten minutes or so - timing doesn't quite match up, but looks like weakness in equities after the London close may have accelerated on Iranian Press TV headlines that the country will "give a strong and crushing response to any measures against its interests and national security" - although not unexpected from Tehran. Latest Russia-US headline could also be contributing.

- Nonetheless, worth noting the oil price slippage today, with both Brent and WTI off sharply (both benchmarks off around 4%) which wouldn't suggest an uptick in geopolitical risk.

- Volumes still a touch light, with contracts crossing in the E-mini S&P below recent averages for this time of day. Energy and materials again the poorest performing names in the S&P 500 so far.

COMMODITIES: Oil Mean Reverts, With WTI Gravitating to 50-dma

- Oil benchmarks were in retreat Monday, with the active WTI and Brent futures contracts off 4% despite a relatively sanguine currency market. WTI futures were mean reverting, with prices gravitating towards the 50-dma at $70.55/bbl.

- Macro data may have added some weight, with China's manufacturing PMI and the US ISM manufacturing release came in below expectations. This, twinned with OPEC's recent supply deal weighed on energy markets across US hours.

- Gold has faded off last week's highs, but remains in recovery mode after printing 1790.0 in mid-July. The outlook is bullish and the recent pullback was considered corrective. Price still needs to clear $1834.1, Jul 15 high to confirm a resumption of the bull cycle. This would open $1853.3, a Fibonacci retracement. Support to watch is $1790.0, Jul 23 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.